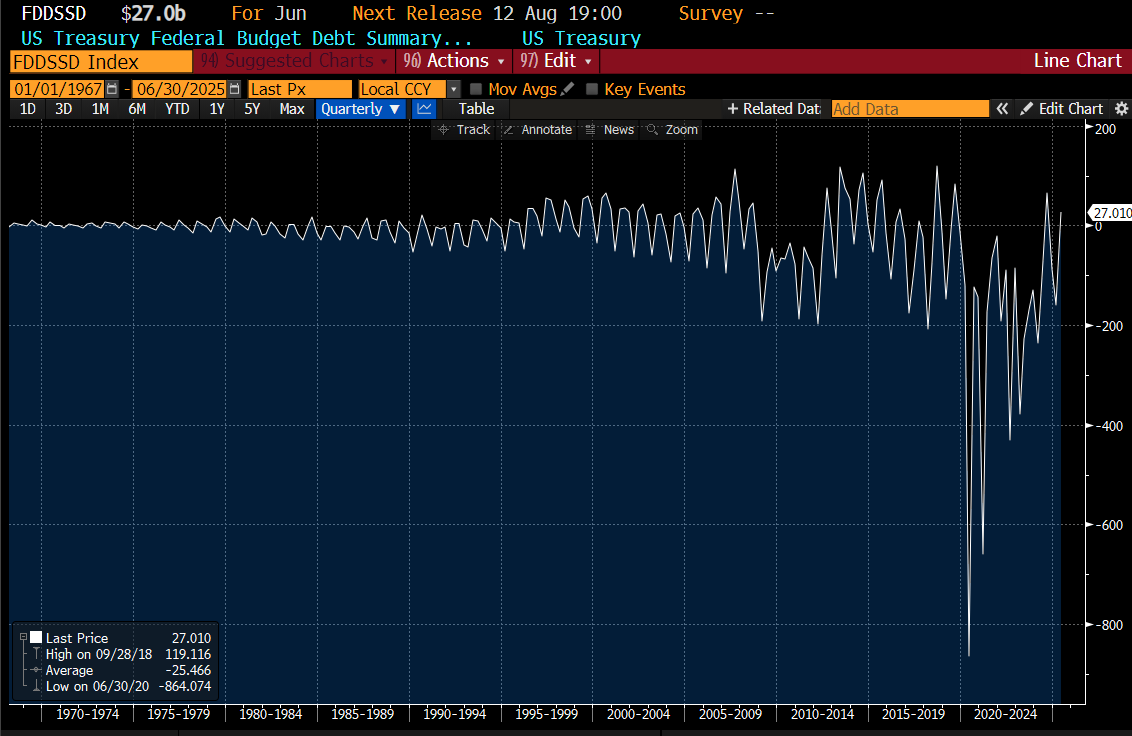

Generally speaking the US government fiscal position has looked terrible. On a 12 month rolling basis, for the last 15 years despite full employment and record asset prices, revenue to the US government has never looked close to meeting outlays.

Which has fuelled an ever large amount of federal debt to GDP. Inflation, and soaring stock markets have usually led to falling debt levels, but in this case, it continues to climb.

President Trump has eschewed obvious options like taxing private equity, or progressive taxation for DOGE and tariffs. Neither seemed remotely likely to balancing the budget. But when we look at the monthly summary, June saw a 27bn surplus, compared to 71bn deficit in June of last year - a close to USD 100bn improvement.

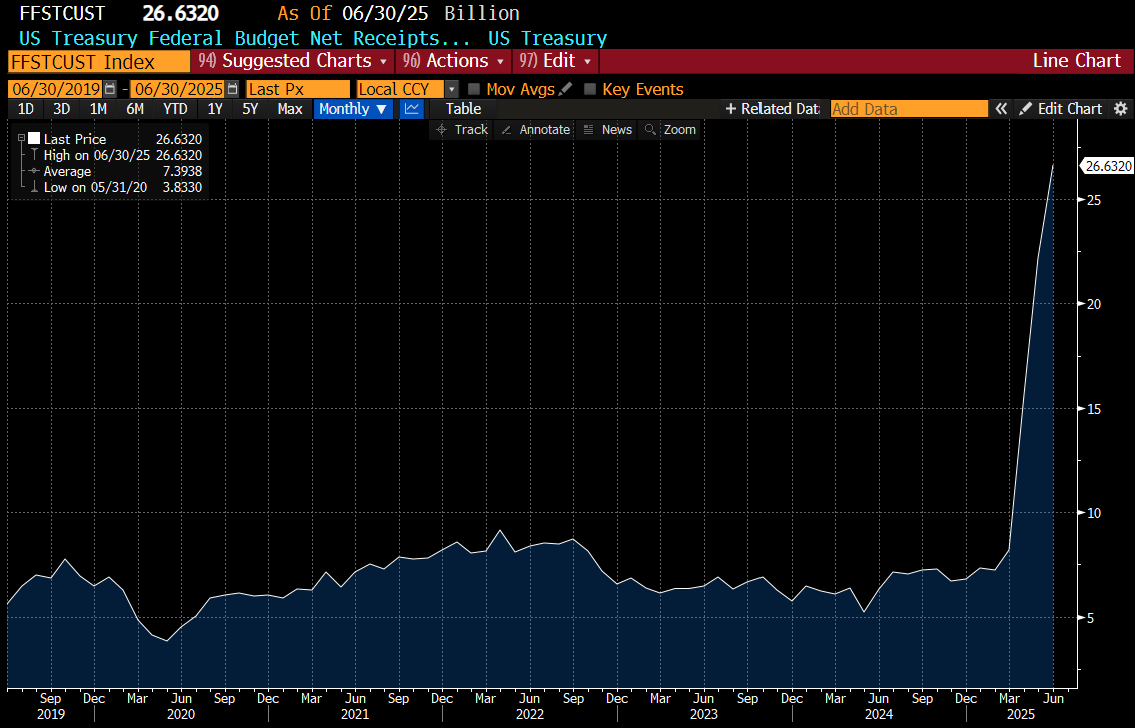

Outlays in June fell by USD 40bn compared to last year. I am struggling to find where that fall comes from. All the major items show continued growth in spending. Revenue was up an impressive USD 60bn compared to June of last year. The vast majority was from higher individual income tax. Corporate tax take was down, but custom duties was up USD 20bn from a year ago.

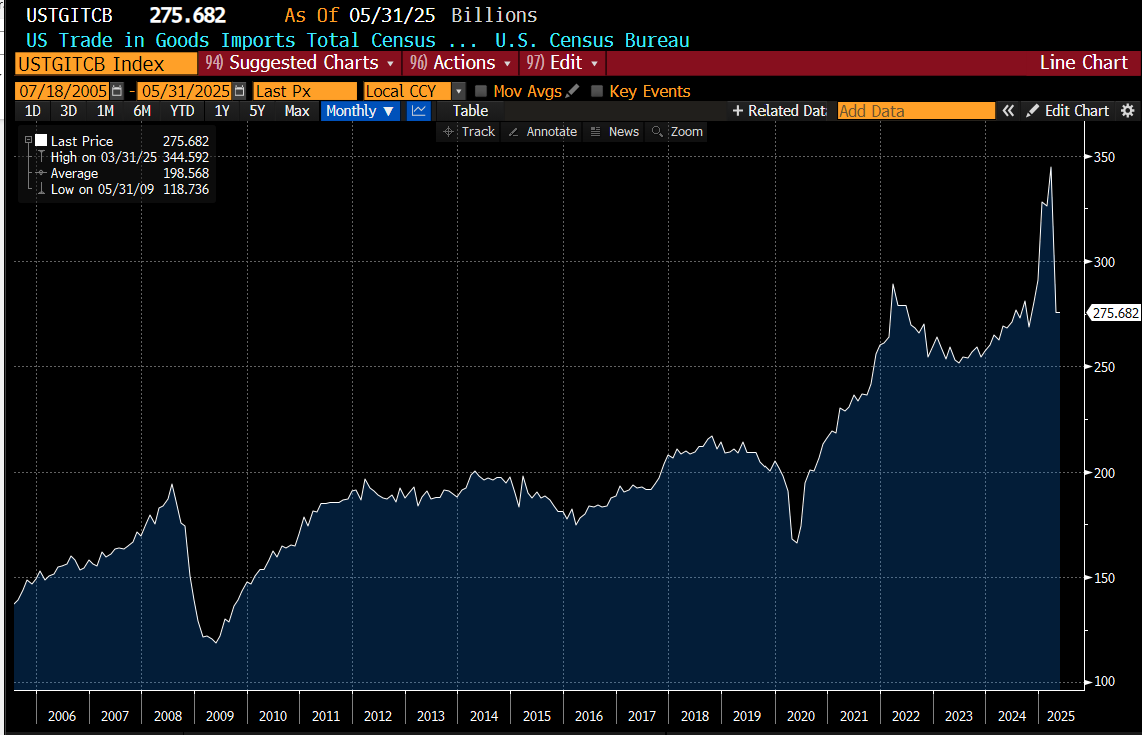

How high could this number go? Well the US is importing around USD250bn a month steady state, so we can simplify and say there was an effective 10% tariff in June.

President Trump throws around a lot of number on tariffs. I am going to “guestimate” that maybe he can get to 30% tariffs before you get real substitution (buying US made rather than imports). This would give a USD75bn monthly bump to revenue. Lets also assume it causes a 15% bump in wages, so income taxes also rise by 15%. That would add another 30bn to tax revenue. USD 100bn increase in monthly revenue to the government is nothing to be sniffed at. Cutting expenses is hard, as the short lived DOGE seemed to prove. One option Trump wants to explore is cutting the net interest expense. This has ballooned from around USD 15bn a month to USD 80bn a month.

If the Federal Reserve could cut rates back to 1 or 1.5% and get monthly net interest spend back to USD 20bn a month, that would also help. What happens with 30% tariffs and 1% Fed Fund Rate? An increase of USD 100bn in revenue (custom duties and higher wages driving higher income take), and 1% Fed Fund Rate would give 60bn cut in expenditure. 160bn a month, over 12 months would be close to USD 2 trillion, which is pretty much exactly what the Federal Government Budget gap.

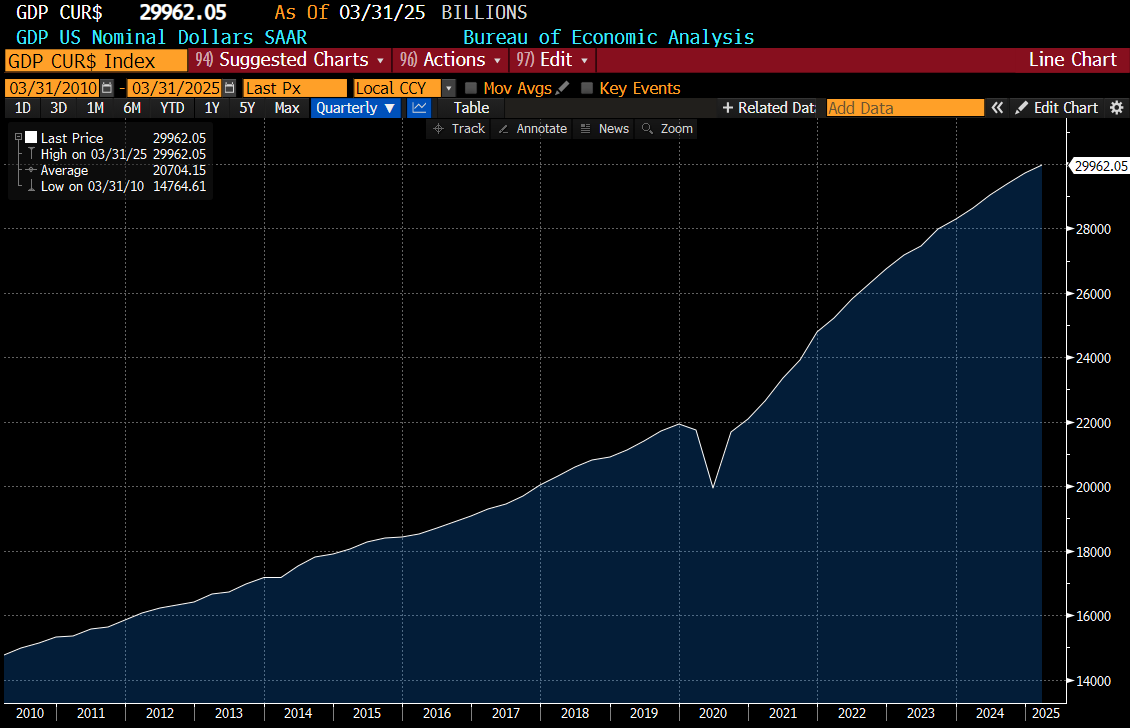

I assume 15% wages increase and 30% tariffs and 1% interest rates would be pretty inflationary, so maybe US GDP grows by another 25% in the next 4 years. (It has grown 50% in the last 5). This would give USD 37.5trillion GDP, up from USD 30 trillion today.

Assuming the budget gap is fixed then the debt pile should not need to grow anymore, something that last happened in 1999/2000. If that was the case, then government debt to GDP would fall to 85% of GDP, and potentially lower if inflation is higher.

We have already seen something similar in Greece, where decent tax collection combined with inflation has reduced debt levels substantially.

All of this seemed fanciful a few months ago when Trump first announced his tariffs - slumping markets pointed to recession and falling tax collection - but with markets bouncing and asset prices surging, maybe it is doable.