I have been pushing the GLD/TLT trade for a while. It has been good, even if GLD has been doing most of the work lately.

If we are going back to a 1970s style stagflation market, then we still have more to go - although we would be transitioning from a value trade to a momentum trade I think.

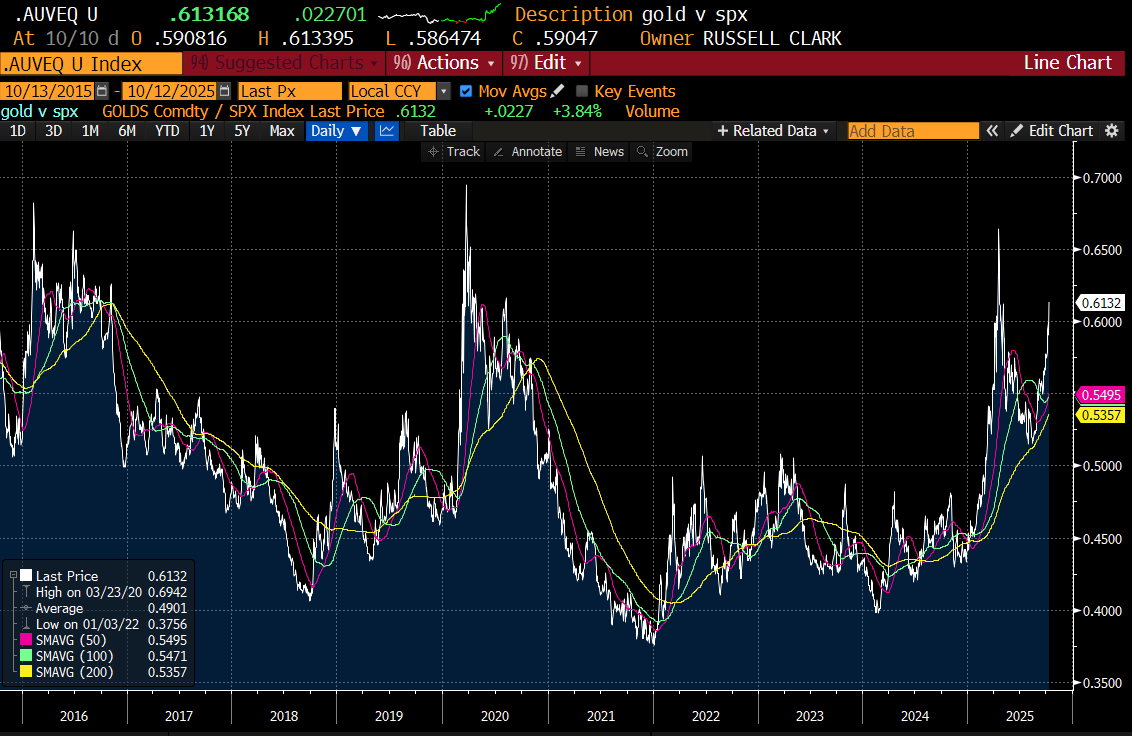

But this year has seen a turn in GLD/SPX, which is now starting to look like it is being confirmed. Over the last 10 years, there has been a few false dawns on this trade. 2016 and 2020 both looked like potential breakdowns in the S&P 500, but this time GLD/SPX bounced hard of the 200 MDA.

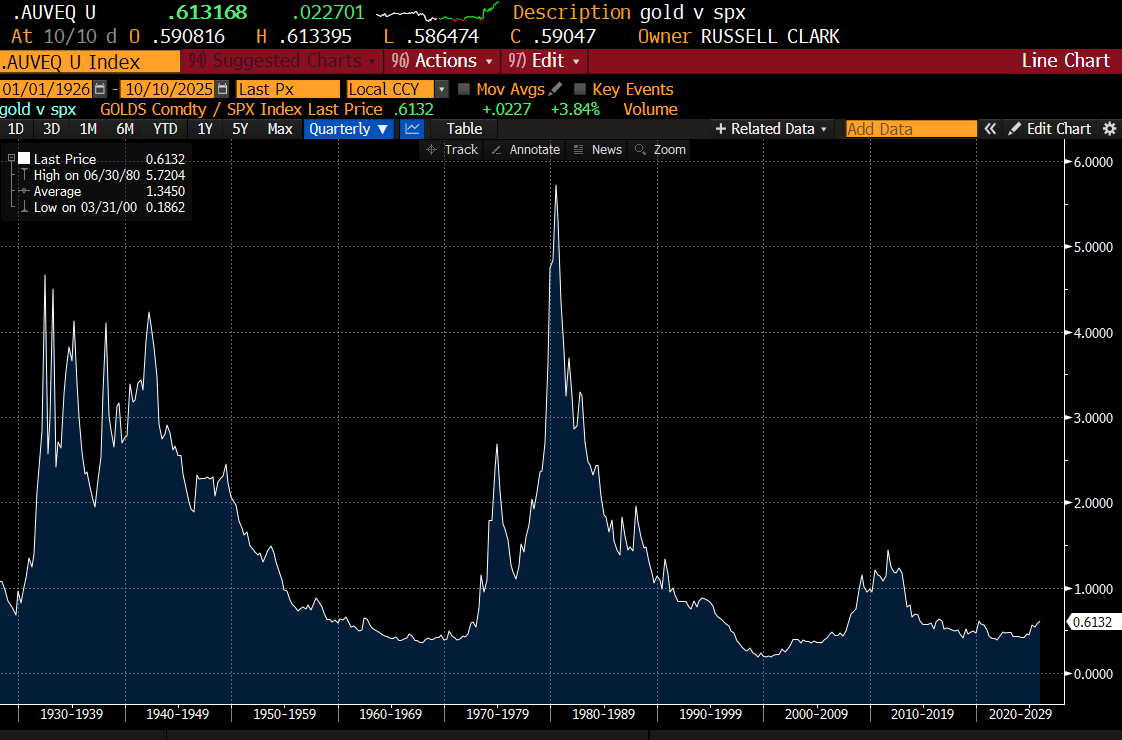

On a long term graph, a GLD/SPX move it really only at the foothills. That is a more a value trade than a momentum trade.

SPX has really been driven by the combination of extremely low credit spreads, despite fiscal laxity in the US. As a rule, I never short equity indices as by design, they are meant to go up. So a long GLD/short SPX trade implies shorting more US listed stocks.