Markets are efficient. I know that there are thousand Substacks claiming the opposite, how everything is a bubble, and we are moments away from collapse. But the fact is that markets are very good at pricing in information in a logical and timely way.

The inevitable comeback to the above statement will then be, if markets are efficient, then why did we have the dot com bubble, or the GFC or the Eurocrisis or any other financial crisis that we care to name. The simple reason is that markets move in such a way to generate a reaction. Commodity prices surge to generate an increase in supply, and fall to generate a fall in supply. This is easy to understand for most people. But markets will also reduce to cost of credit to generate credit, and increase the cost of credit to reduce the supply. Exchange rates will decline to bring trade and other flows back into line. In other words there is action and reaction. Reaction tends to be called a crisis.

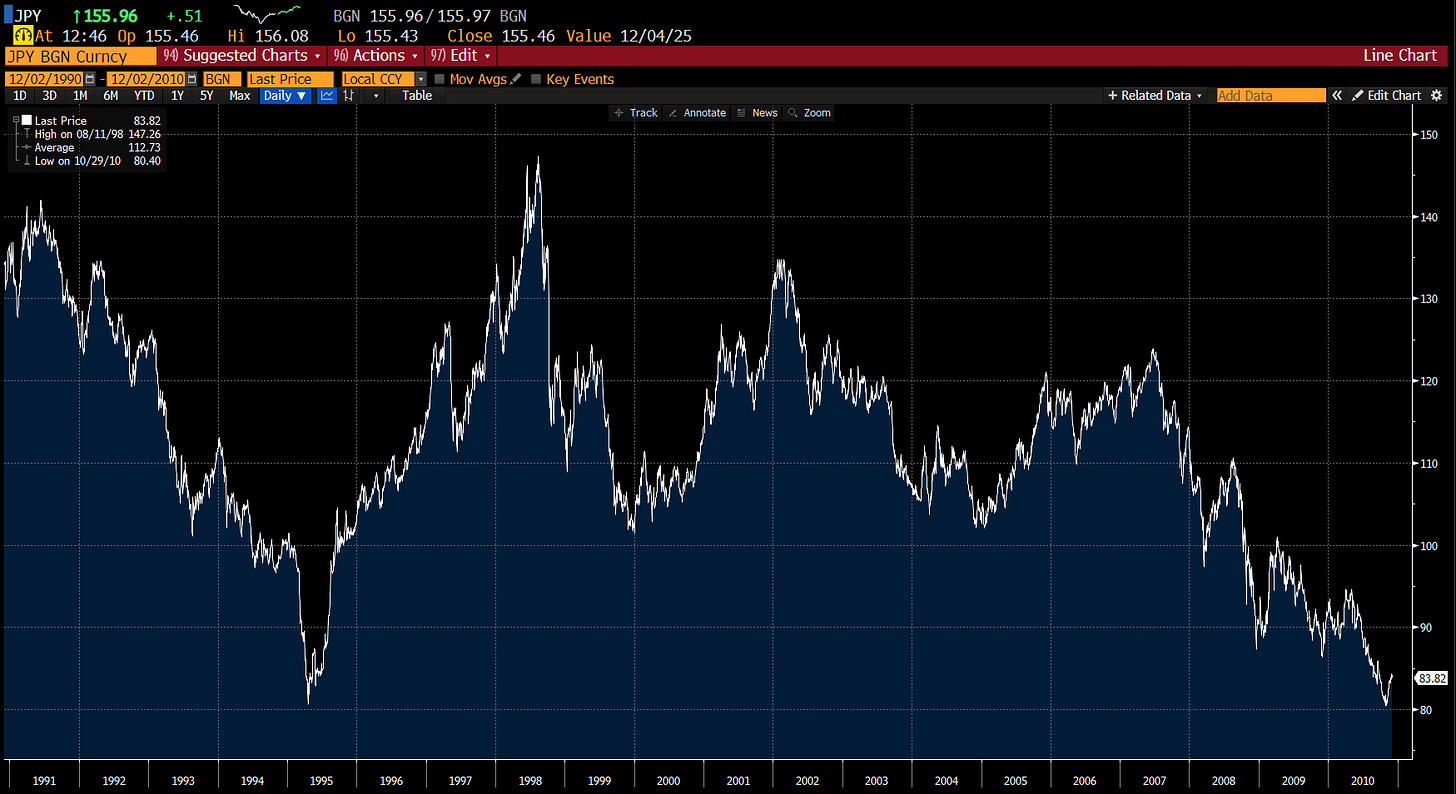

Perhaps my favourite example of this is the Yen in 1990s and 2000s. As Japan entered a deflationary credit contraction cycle, the authorities did their best to generate an inflation cycle by devaluing the Yen. A surge in Yen value in 1995, put huge pressure on the Japanese economy, and the BOJ pushed interest rates to zero, and was able to devalue the Yen versus the USD dollar - going from 80 to 145.

If the action was Yen devaluation, then the reaction was Korean Won (and Asian currencies in general) devaluation. Japan was not only a large investor in Korea, it was a near competitor in autos, semiconductors, ship building and machinery. The weak Yen, eventually forced Korea to devalue, and was a catalyst for the Asian financial crisis - action and reaction. Yen weakness from 2004 to 2007 led to Korean won again devaluing in 2008. The Won weakness tended to be much more abrupt than Yen weakness - probably reflecting the greater use of USD financing in Korea.

If you look at the cross rate between Yen and Won, you can see the difficulty either nation has in sustaining a competitive exchange rate, against each other.

The problem is that when trading the “reaction” that is Korean Won will devalue back against the Japanese Yen, the cost of doing that directly is expensive. Pre Asian financial crisis, it cost you 25%. Pre GFC, the carry was 5%, but the Won also appreciated some 50% against the Yen. That is the cost of shorting was extremely high, and would have a substantial cost before you made gains.

However, using equities you could reduce the cost of taking a view on the currency. The trick was to look at the “exporters” to Korea, not at Korean companies themselves. As mentioned, Japan was a key exporter to Korea, and competitor. When Korea devalued, you could short Japanese banks. The Topix bank index fell 70% during both Korean devaluations. The other huge benefit from this was that the profits from shorting were in a currency that was appreciating in real terms.

The other option is to short American Deposit Receipts (ADR) or Global Deposit Receipts (GDR) - these are USD listings that track the performance of foreign stocks. There are a few Asian ADRs, but ADRs really work well for Latin America, Mexico and Russia. Brazil is a good example. Typically the Brazilian Real devalues against the US dollar, but during the commodity super cycle it appreciated in value, generating large carry gains.

But shorting the Brazilian Real is always expensive. Interest rates are mainly above 10%.

But companies like Telefonica Brazil (VIV US), with a large tradable American Deposit Receipt (ADR) give you a leverage trade on Brazilian Real weakness with local currency revenues, and US debt and capex. That is weakness in the Brazilian Real feeds directly through on the movement of the stock AND weakness the profits of the company. Again your profits are in the hard currency of the US dollar in this case. The cost of shorting would typically be 3% annually, against maybe 12 -13% for shorting the currency directly. Similar analysis and strategy could be employed with all of Latin America, Mexico and Russia.

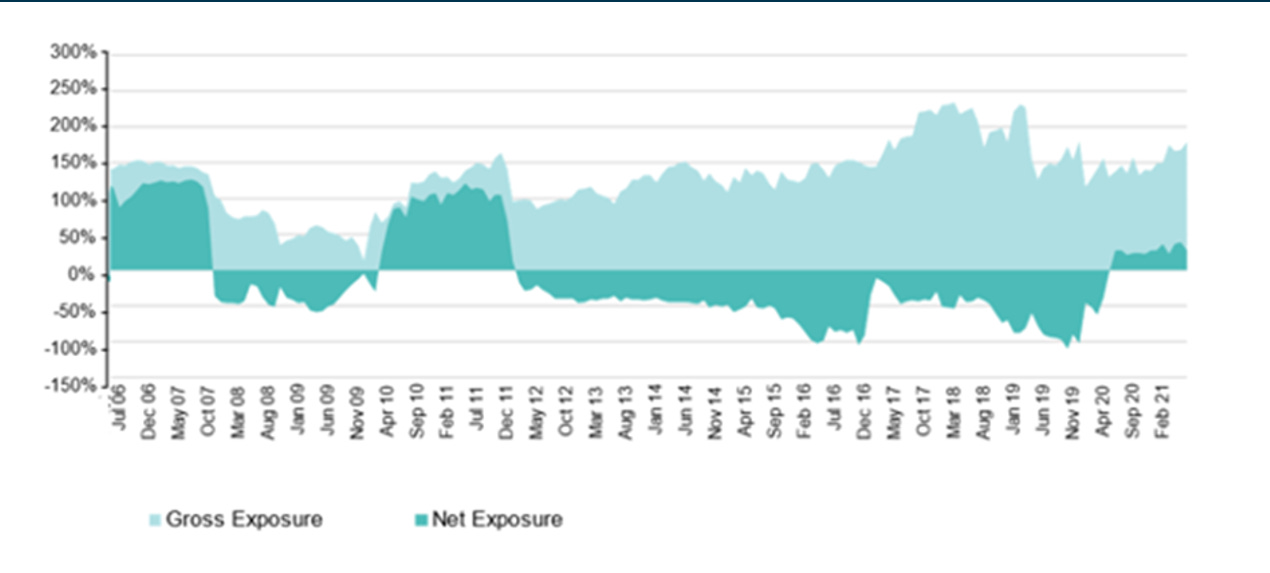

What I really liked about using equities as a cheap way to short currencies was that I really did not care that much what the company did - I just knew when a currency crisis hit, everything would fall. So when you could see USD strength coming, you could ramp up the short book massively. If you ever wondered why I was called the “most bearish fund manager in the world”, you need to understand that I was looking at currencies to guide me. From 2002 to 2008, the US dollar had been on a weakening bias, but from 2009 onwards, I was a dollar bull.

Which led me to basically run short from 2011 onwards. . Below was the gross and net I used to run. When I thought China was going to devalue, I was mega bearish - but China has seemingly been able to avoid a large devaluation, even with extreme Yen weakness.

The problem I have had since 2016, is that the currencies has stopped trending in predictable ways. I think we are in a new world, where currency crisis is not the predictable “reaction”. But oddly, I think we can use equities as a cheap way to arbitrage the future crisis I see - but that will be for another post - and behind the paywall.