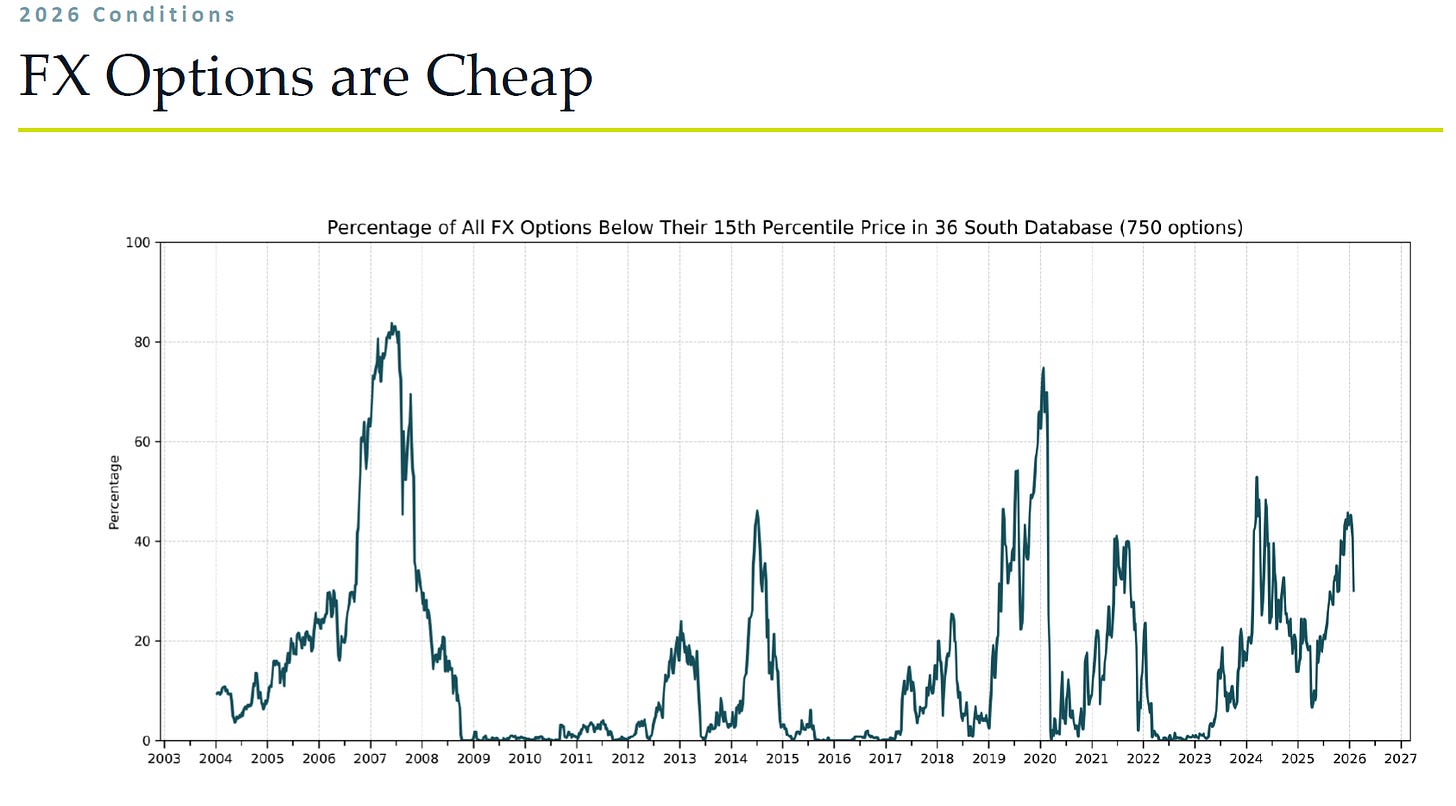

During my formative years in finance, I learnt to be a “currency first” investor. Basically, I noticed most equity fund managers tended to get currency risk totally wrong, so if I got that right - I should outperform. It has taken a few years to shake off this “currency first” mentality. But I was going through some slides from my friends at 36 South (full disclosure, I am their landlord in London - but I was friends with their head of trading George Adcock, before they became tenants), and was reminded that if I was still a currency first fund manager, I would probably be shitting the bed at the moment. First of all, most currency options are trading cheaply. This implies people are not worried about big moves, just at they were in 2007, 2014 or 2020. (If you would like to see these slides - they are available on Youtube. Link is here.)

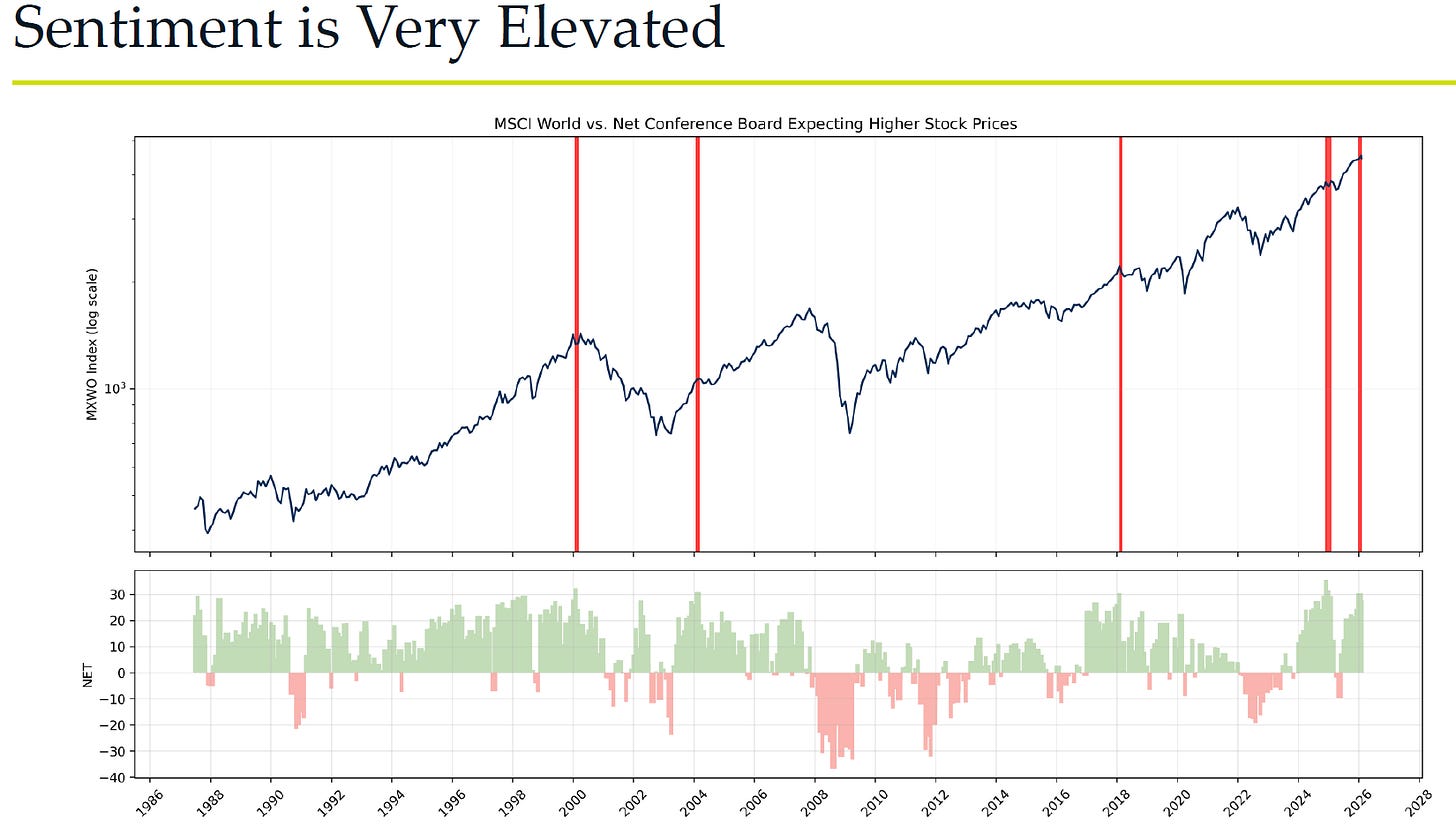

People are also bullish.

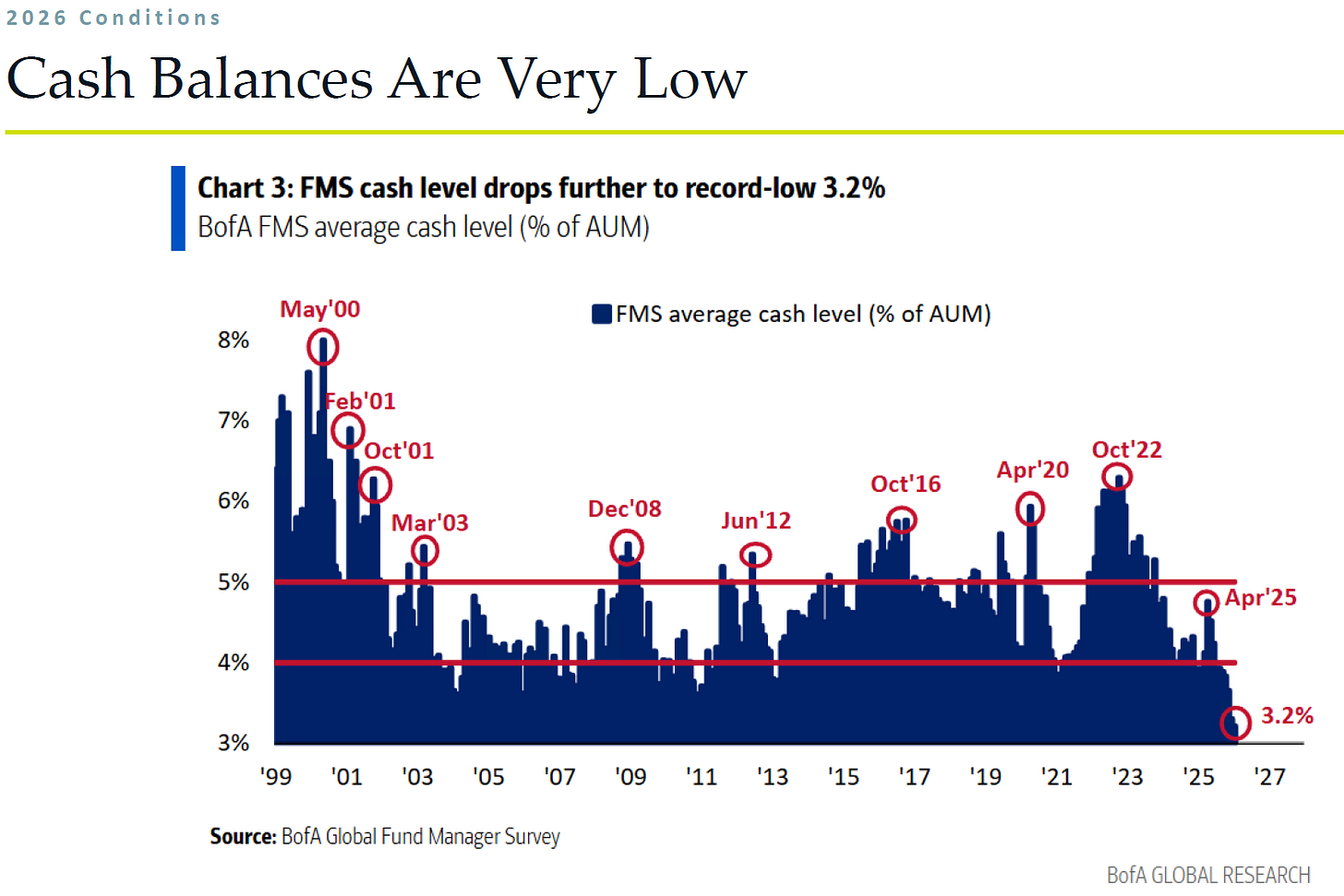

And cash balances are very low.

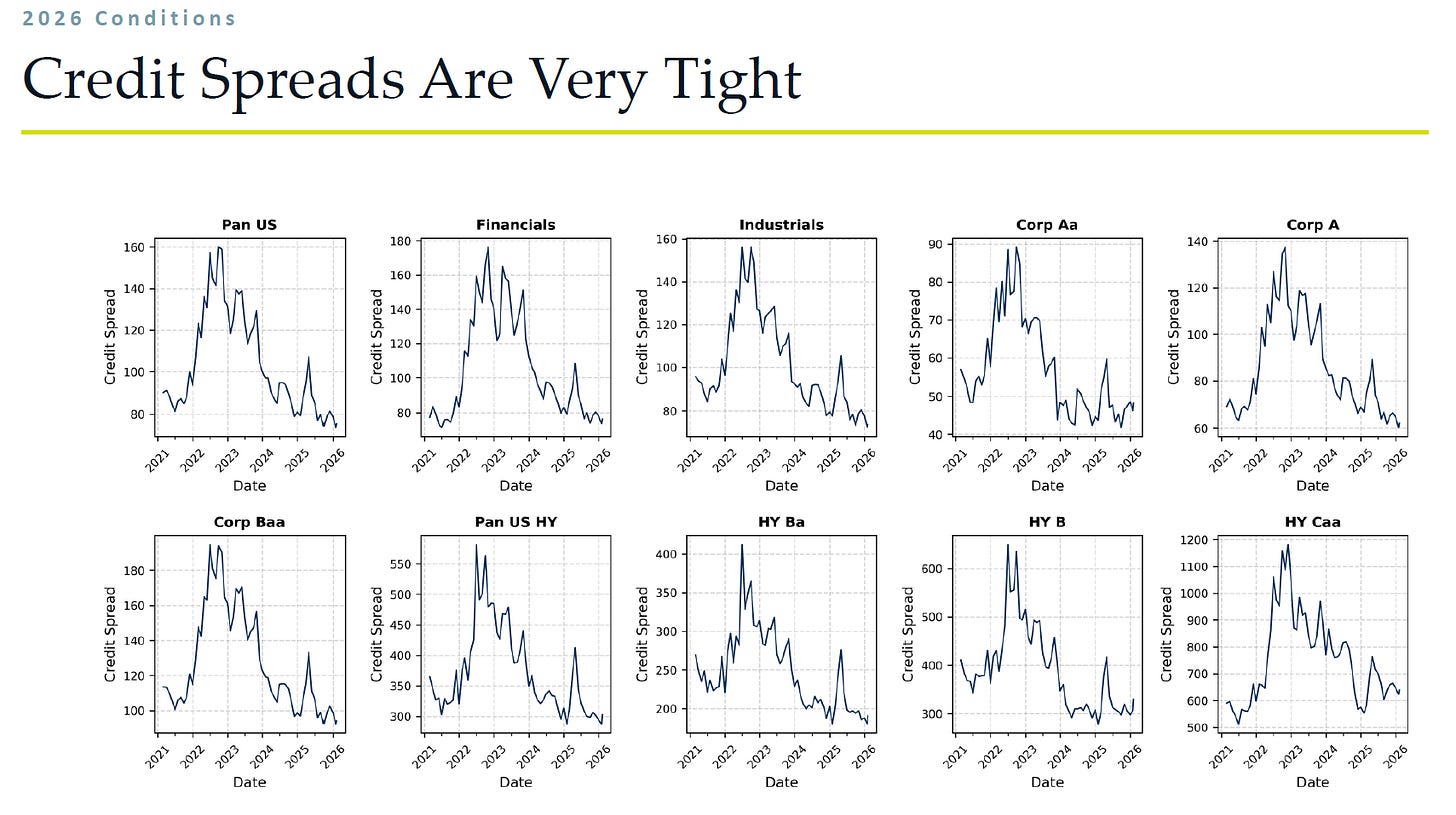

And credit spreads are tight across the board.

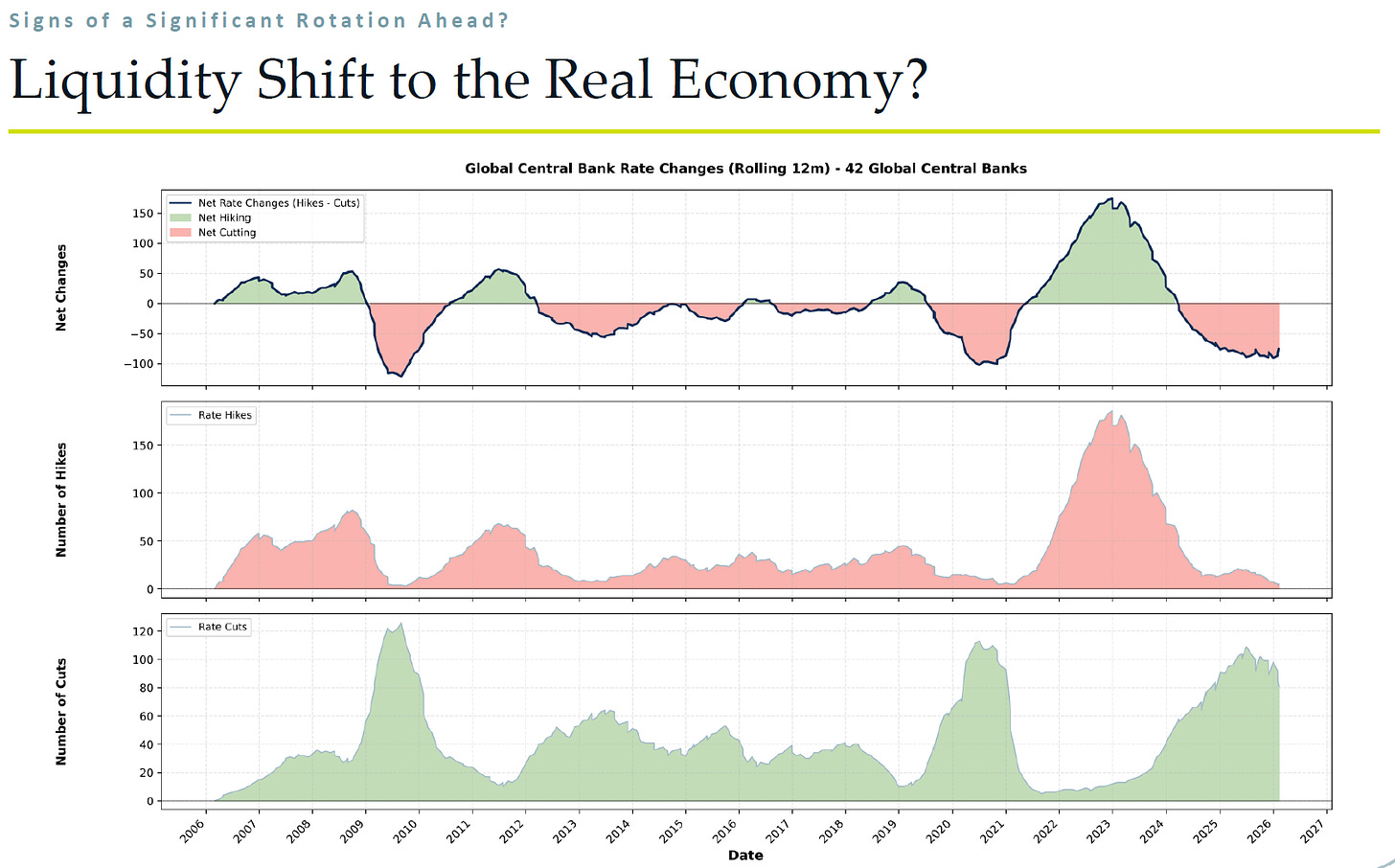

One graph I liked a lot showed that we are probably at peak dovishness when it comes to central banks. Looking at the top table, the only way seems to be up from here.

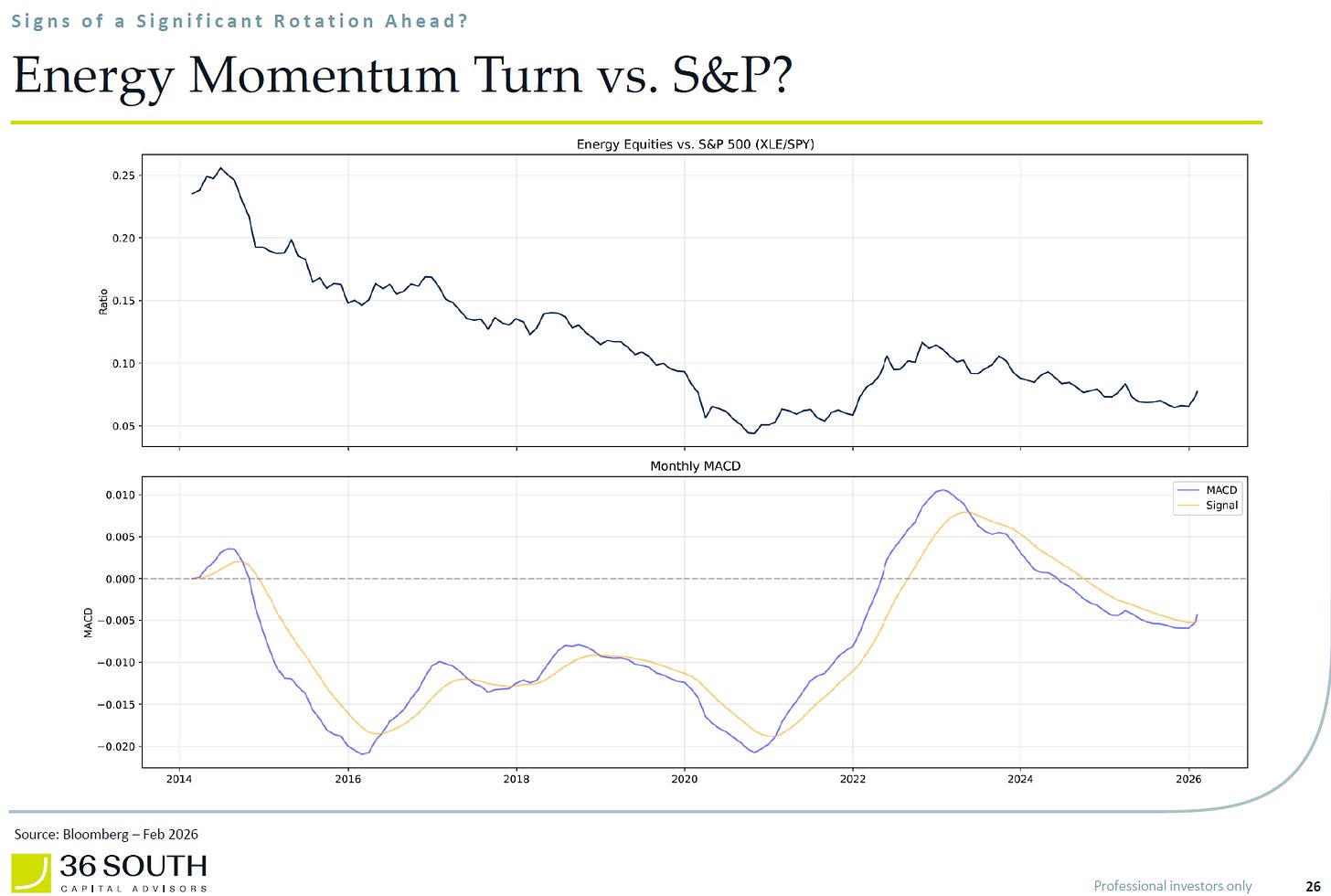

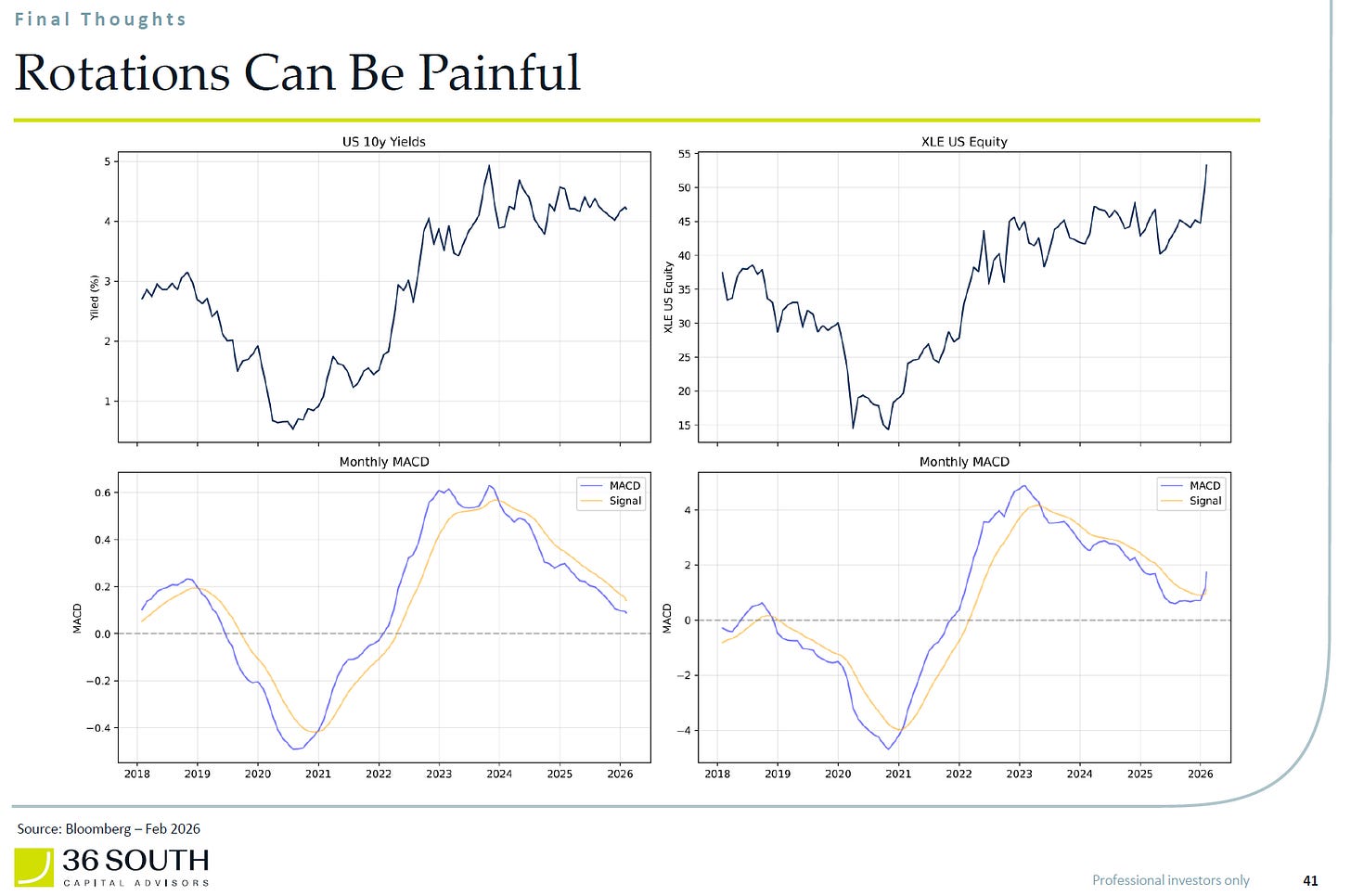

And something I have seen many people flag - energy sector is threatening to turn.

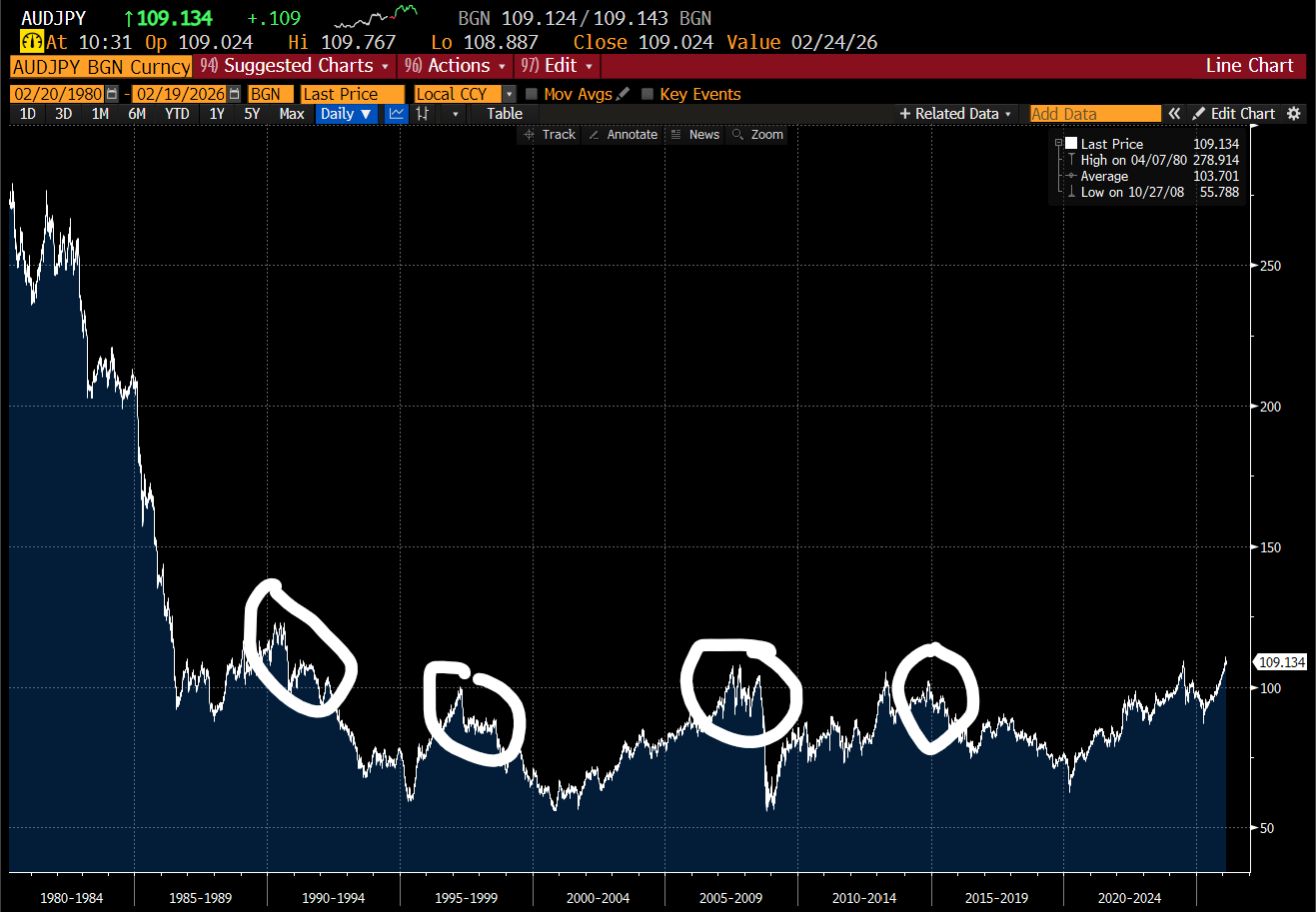

From a currency perspective, cross rates like AUDJPY are at levels that would make me worry.

What to make of all this? Well in a free market world, currency led investing works well. But in a government dominated market, currencies are not “free”, and growth is fiscal spend dominated. The question is working out which regime we are in. I still like JGBs as a signal - and even though the 10 year is not above recent highs, it still seems to be speaking to inflation - or a fiscal dominated growth environment.

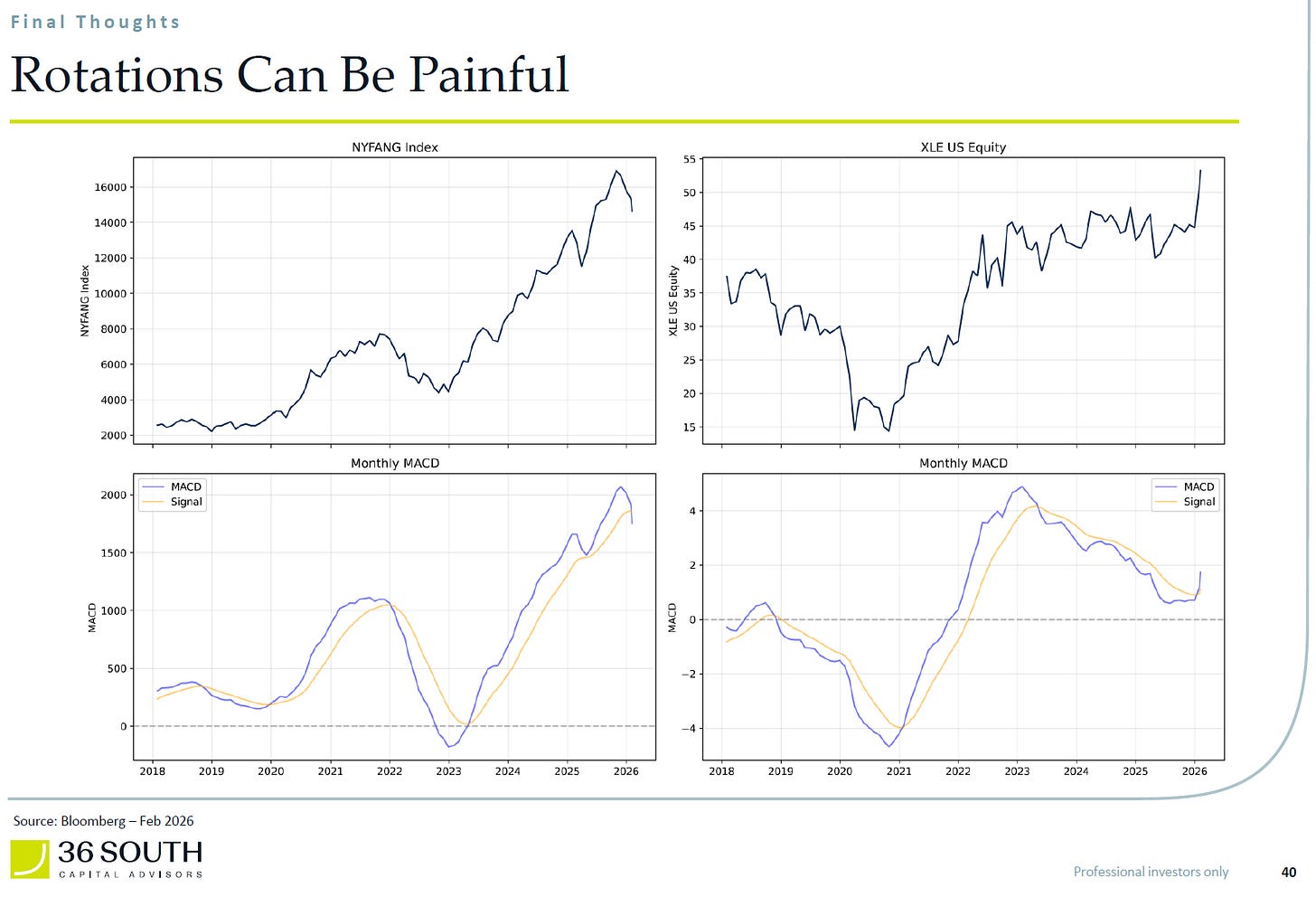

So what is the bear p@rn then? Well in the final 36 South charts, rather than a bear market, they talk of rotation. Below is signalling short tech, long energy.

And this one is signalling short bonds and long energy.

In currency first regimes, I liked to think about second order affects of currency moves. To me, and looking at 36 South charts, in a fiscal first regime, we should think about second order effects of bond moves. Thankfully, I am already positioned for it.