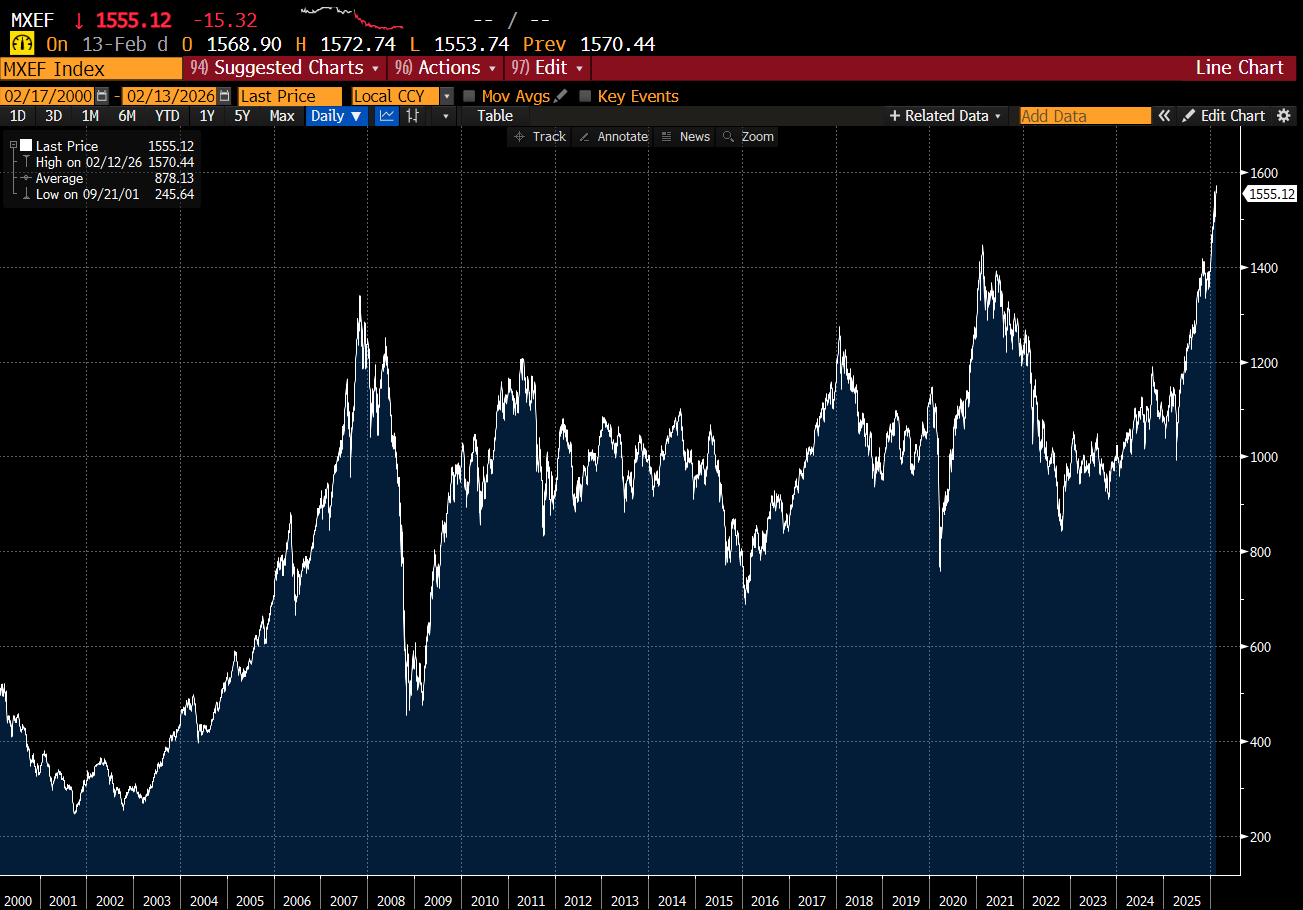

The reason I was known at the most bearish fund manager on the planet back in the day, was that I ran the emerging market bull market all the way up from 2002 to 2007, and was pretty sure emerging markets were going to be a huge waste of time going forward. This view was correct as MSCI Emerging Markets has only recently surpassed the highs of 2007nearly 20 year later. Are Emerging Markets worth chasing from here?

Back in 2007, MSCI Emerging Markets were dominated by banks, commodity stocks and mobile phone stocks. Today, the top five stocks are tech related, with TSMC being by far the biggest constituent. While back in the day emerging markets may have offered some diversification benefit - these days you are making the same bet you are with US stocks - which does reduce the attraction.

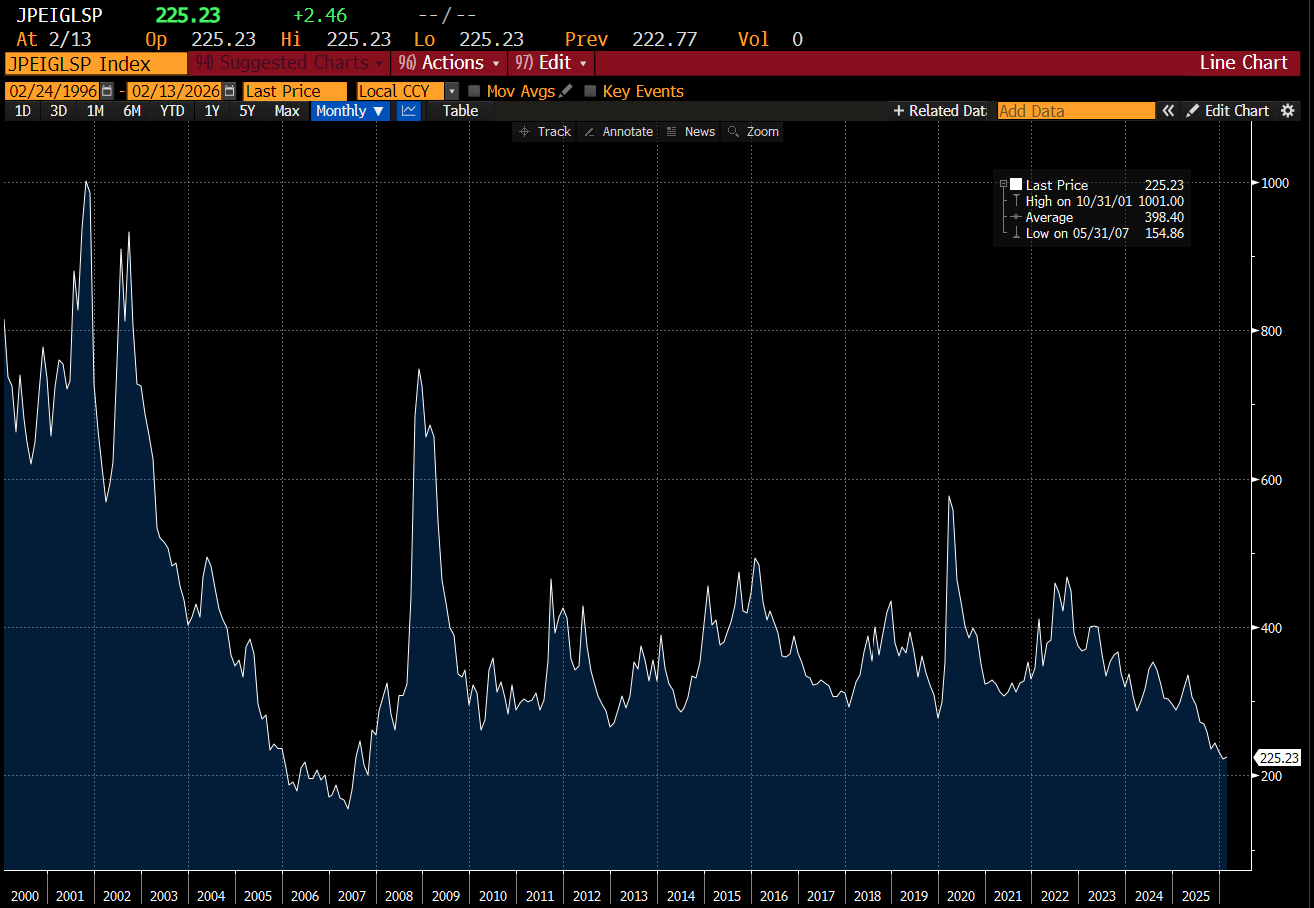

The boom in emerging markets from 2002 to 2007 was also driven by spread compression. The Asian Financial Crisis of 1998, the Argentinian and Brazil devaluation crisis of 2001 and 2002 had caused investors to shun EM debt - by 2002, you were getting 8% over treasuries, which fell to 1.5% spread in 2007. Today, EM spread is 2.25% - outside of 2007 the tightest spread I have ever seen.

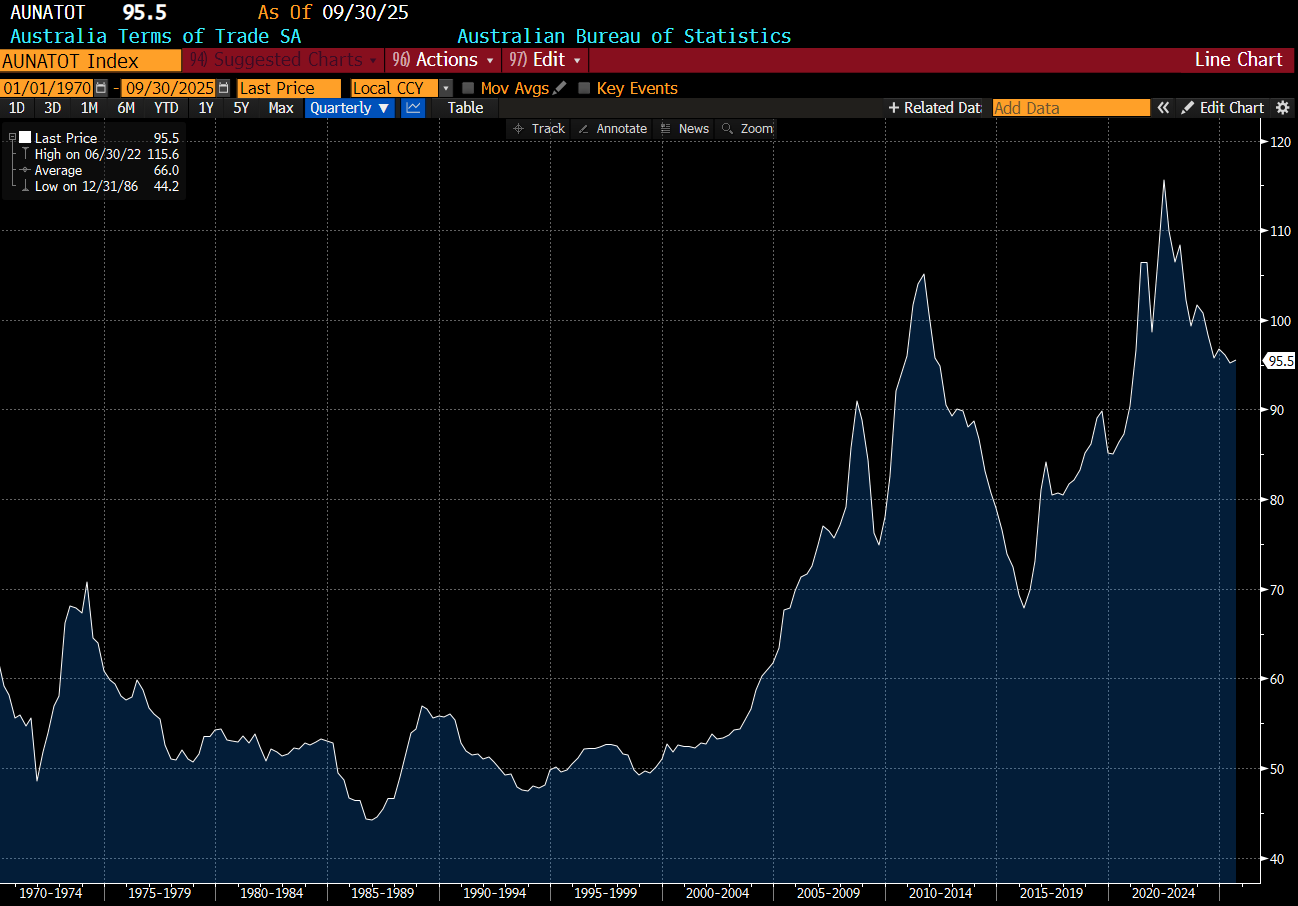

Some parts of the commodity cycle has boomed but it is extremely narrow. If we look at the Australian Terms Of Trade - we can see very little recent improvement.

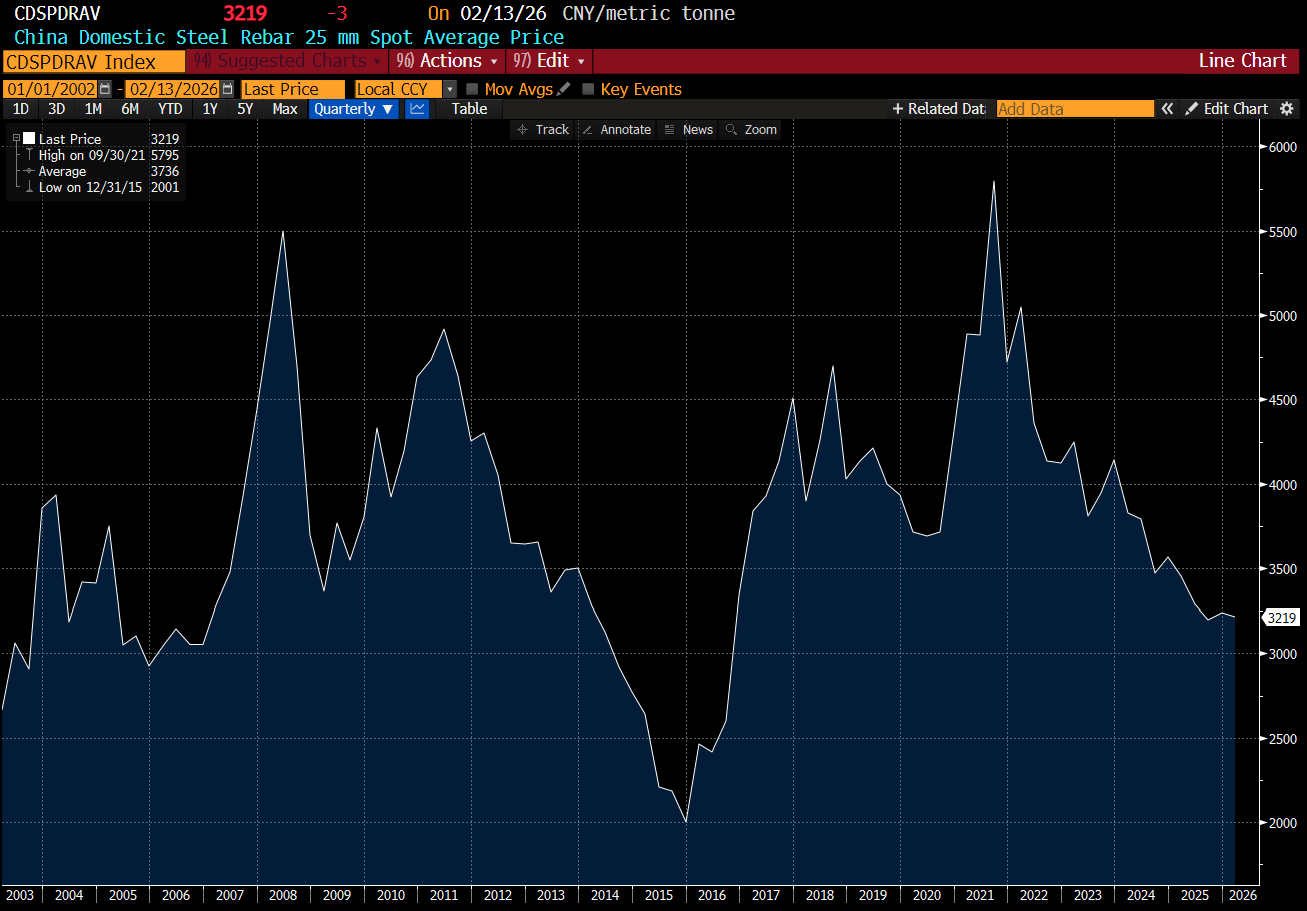

While we are all aware of the boom in precious metals, major industrial commodities are still very weak. Chinese steel prices, which was a great proxy for Chinese commodity demand remain at prices first seen in 2003.

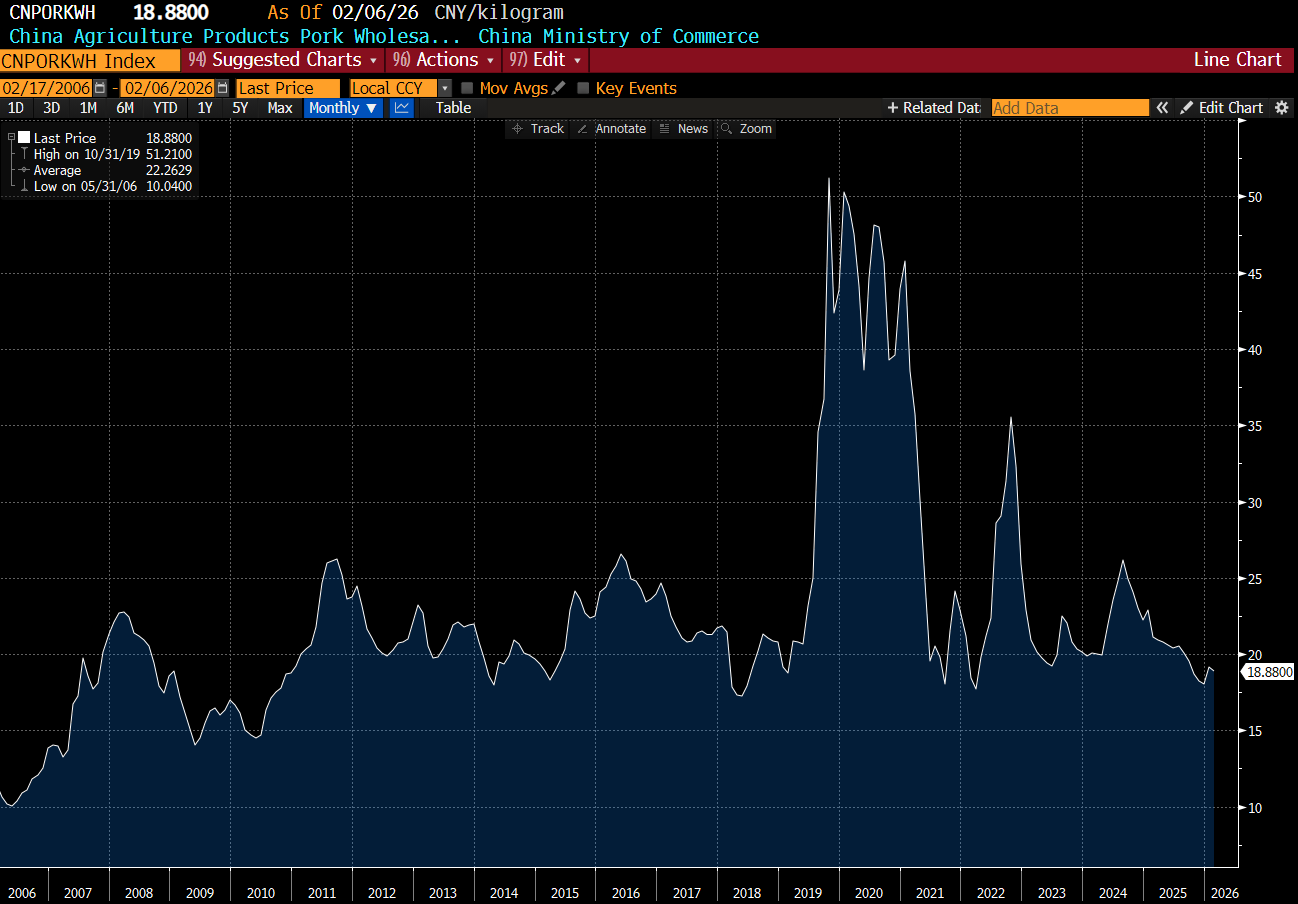

Chinese pork prices which drive surging agricultural commodity prices in 2021/2 remain at levels first seen in 2007.

On the currency side, the appreciation of the Chinese Yuan recently does make a positive background for EM assets.

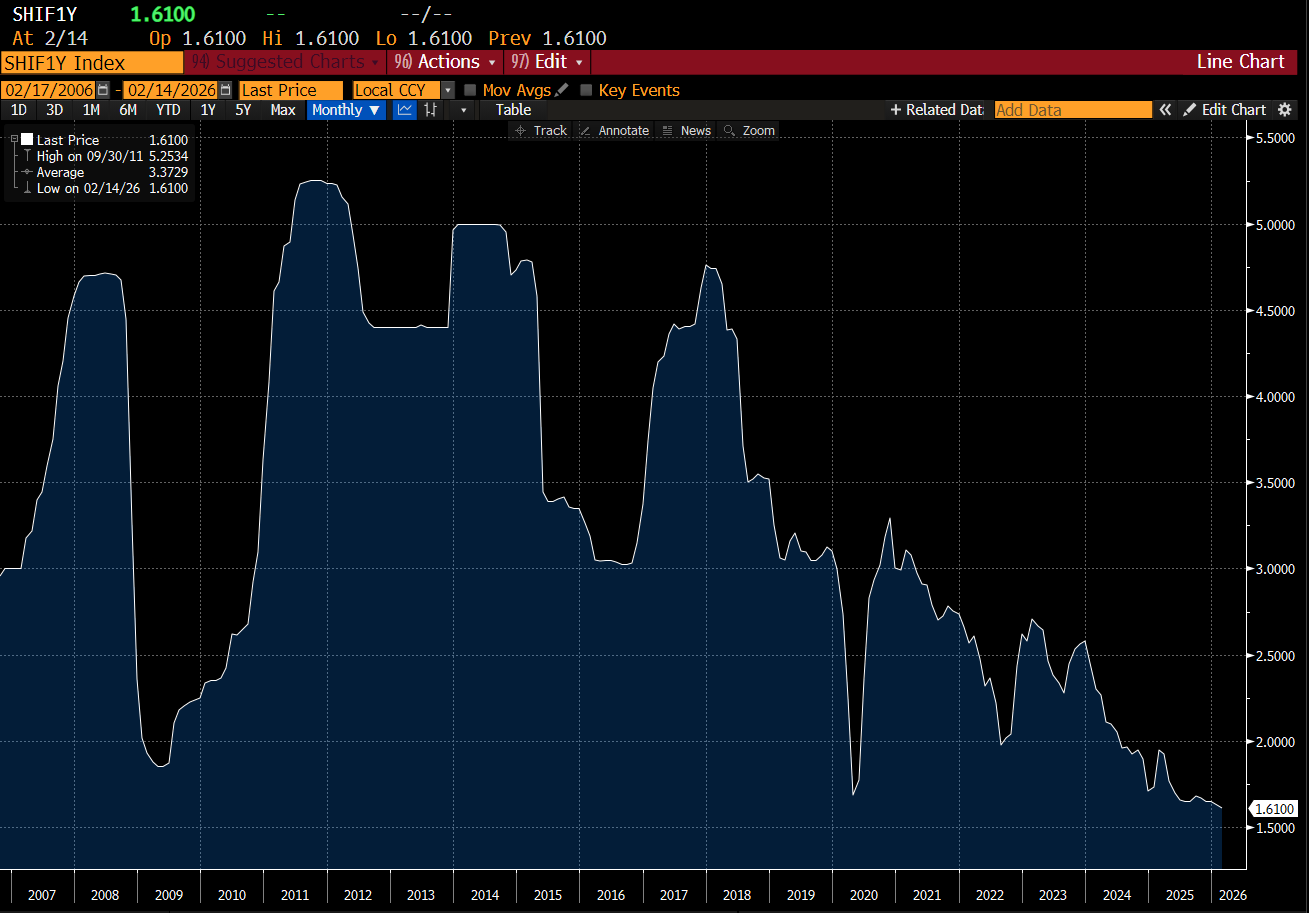

But Chinese interest rates are not sending a confirming message. 12m SHIFOR remains at lows.

Also old currency pairs that have moved with commodity cycles before are back at levels that suggest caution. AUD/JPY is at levels seen before the Asian Financial Crisis, the GFC and China devaluation scare.

Long Emerging Markets does not seem like a slam dunk trade to me. But if you like the argument that AI is shifting spend from software to hardware, then long EM versus S&P 500 makes sense - but that is very different to a traditional emerging market bull market.