I have like gold as a part of a pair trade - long gold short long dated treasuries, or GLD/TLT (using the ETFs codes that capture this trade). GLD/TLT has been a great trade, but I am old enough to know that nothing lasts forever, so have to wonder if we are near the end on this trade?

I did manage to create a very long term GLD/TLT charts, which suggest we still have a ways to go.

Clearly, GLD/TLT is a “debasement” trade of some sort. But if this is working, why isn’t Bitcoin working? Bitcoin is basically back to levels first seen when in 2024, and before Trump basically “decriminalised” crypto.

As I wrote a few months ago, Bitcoin worked best when people were “bearish” on it. The problem is that despite the absolute “beasting” that Michael Saylor’s Strategy has taken recently, short interest is subdued. No one wants to short it. Bad bad sign.

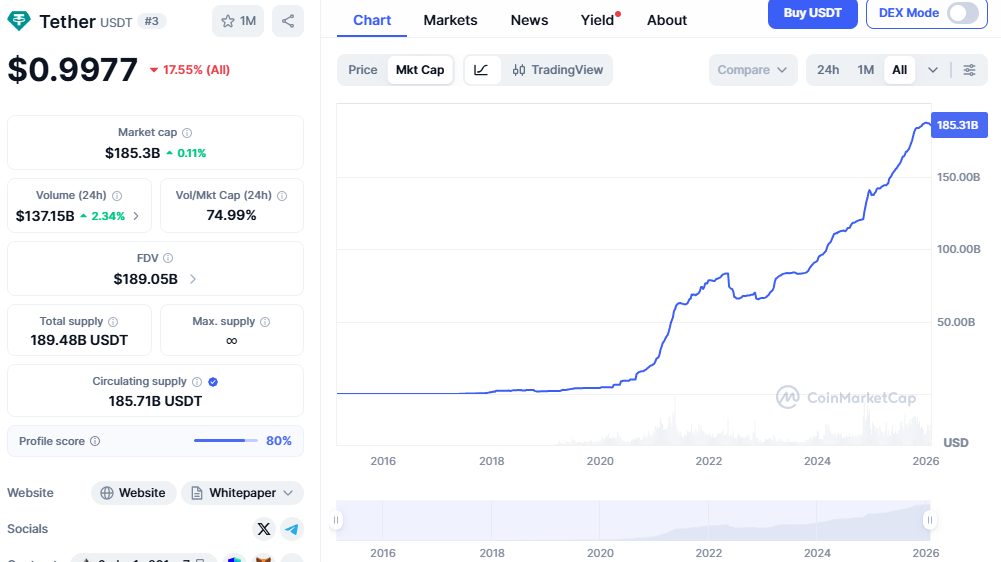

I have not wanted to short Bitcoin, because I look at Tether as a liquidity guide to Bitcoin. Tether market cap has continued to climb - suggesting liquidity is not a problem.

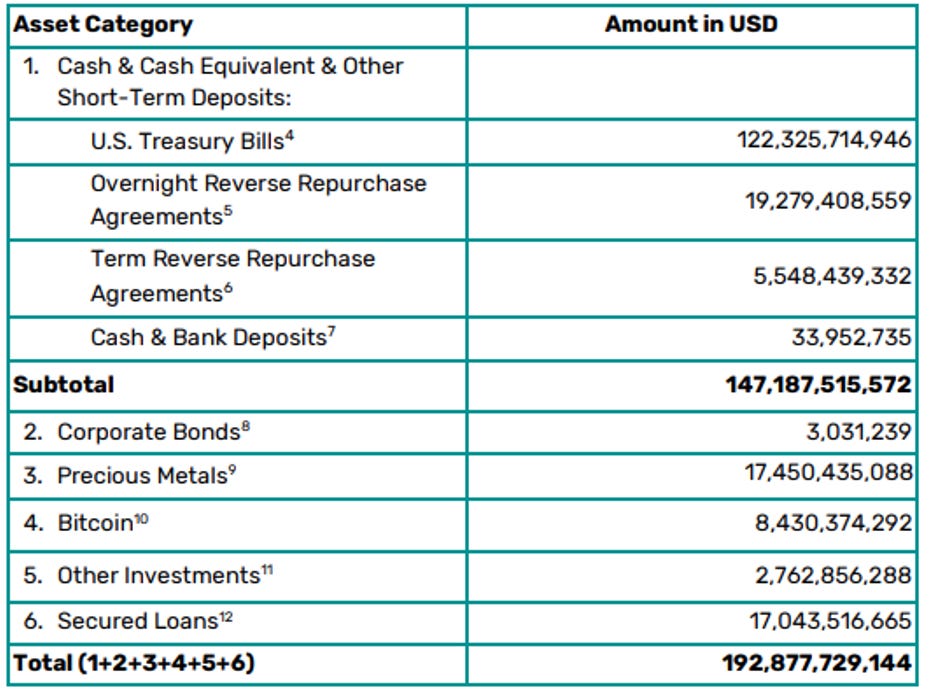

However, it has come to my attention that Tether is better described as a gold bug than a hodler. As of the 31 December 2025, Tether held USD 17.4 billion of gold, compared to USD8.4 billion of Bitcoin. Reserve breakdown is below.

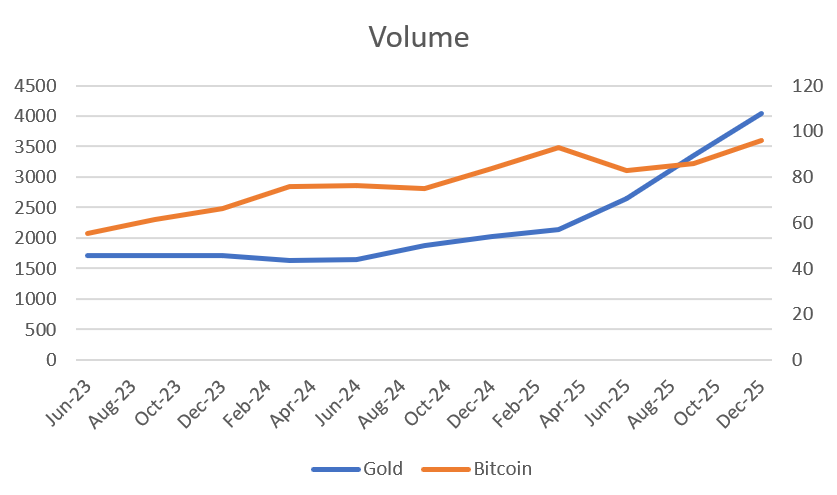

For my own interest, I tried to tease out the movement in volume in Bitcoin and Gold holdings at Tether over time. It is curious to see that the stablecoin allocation to precious (read gold) has increased substantially in 2025, while bitcoin has been largely flat. Trying to adjust for price changes - I think they invested USD 5bn into gold in 2025. They now have over twice as much in gold than they do in bitcoin. In Mid 2024, the value of the bitcoin holding was larger than gold, so its quite a turn around.

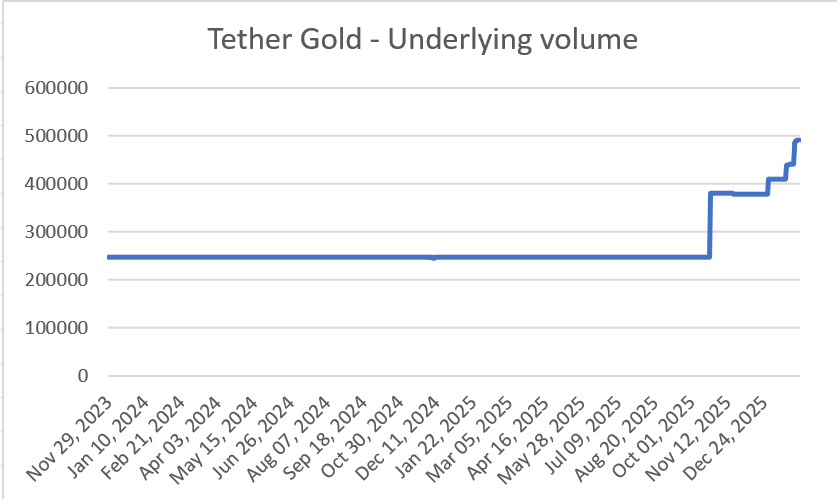

Tether also have a gold stable coin Tether Gold - I read this as Crypto Gold ETF. Its current market cap is USD 2.4bn, so pales in comparison to GLD US with USD 172bn of market cap. But we can see that they have doubled their ownership of gold in 2025.

I suspect Michael Saylor is on the phone to the guys at Tether pounding the table to sell some gold and buy bitcoin. Especially as the word on the street is that the Strategies average entry point into Bitcoin is $76,052 - or above current price of $70,687 or so.

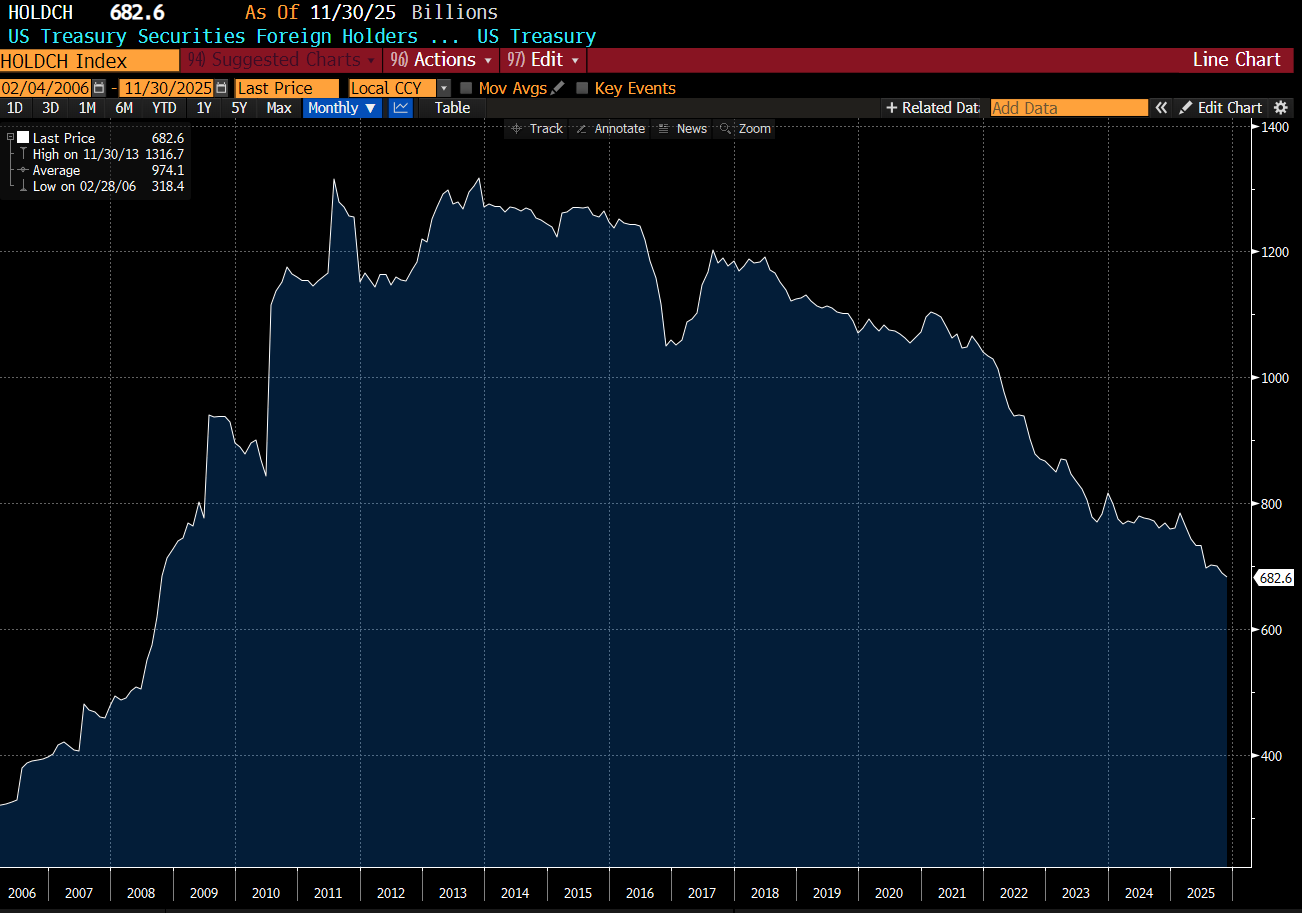

The problem with Bitcoin, as far as I can tell, is its transparency. Ever since Russia’s access to it’s foreign reserves were frozen, foreign reserve holders have to think hard about where they put their money. And as China has by far the biggest trade surplus, its their views that dominate the most. And they do not like Bitcoin. In fact the problem for China is that they have excess US treasuries and not enough gold.

The other thing is that President Trump in his ardour to “make a deal” has slapped tariffs on friends and foes alike. Not just China, but democracies like Brazil and India probably are keen to get rid of their treasuries as well. It is this “switching” that drives gold demand I think. I have seen a number of charts saying that gold holdings are now worth more than Treasury holdings. This one looks at all official holdings.

Looking at the above, the old powers of the US, Germany, Italy and France are around 70% of reserves. So may be we are getting close? Or if I just look at China, it needs another 4,000 tonnes to get to a holding commensurate with its GDP, which is about USD 700m of buying. If I had to guess a number - maybe US 10,000 for gold?

The problem here is that I think it suits China greatly to see the gold price surge. It adds to a narrative of the US being a power in decline. And they still have USD 680bn of treasuries to get rid off.

As well as trying to figure out what to do with annual trade surplus of US1.2 trillion.

Of course there is one answer to all of this. And that is to MAKE TREASURIES GREAT AGAIN. MTGA would require the Fed to raise interest rates to at least 7% and the for the US fiscal deficit to be reduced from spending cuts - or pretty much what Reagan and Volker did in 1980. This is possible of course, as anything in politics is possible, but I would say unlikely. The politics of the world, makes me think gold keeps outperforming bitcoin. Strangely Tether seems to agree. Sorry Michael Saylor - you chose the wrong debasement trade.