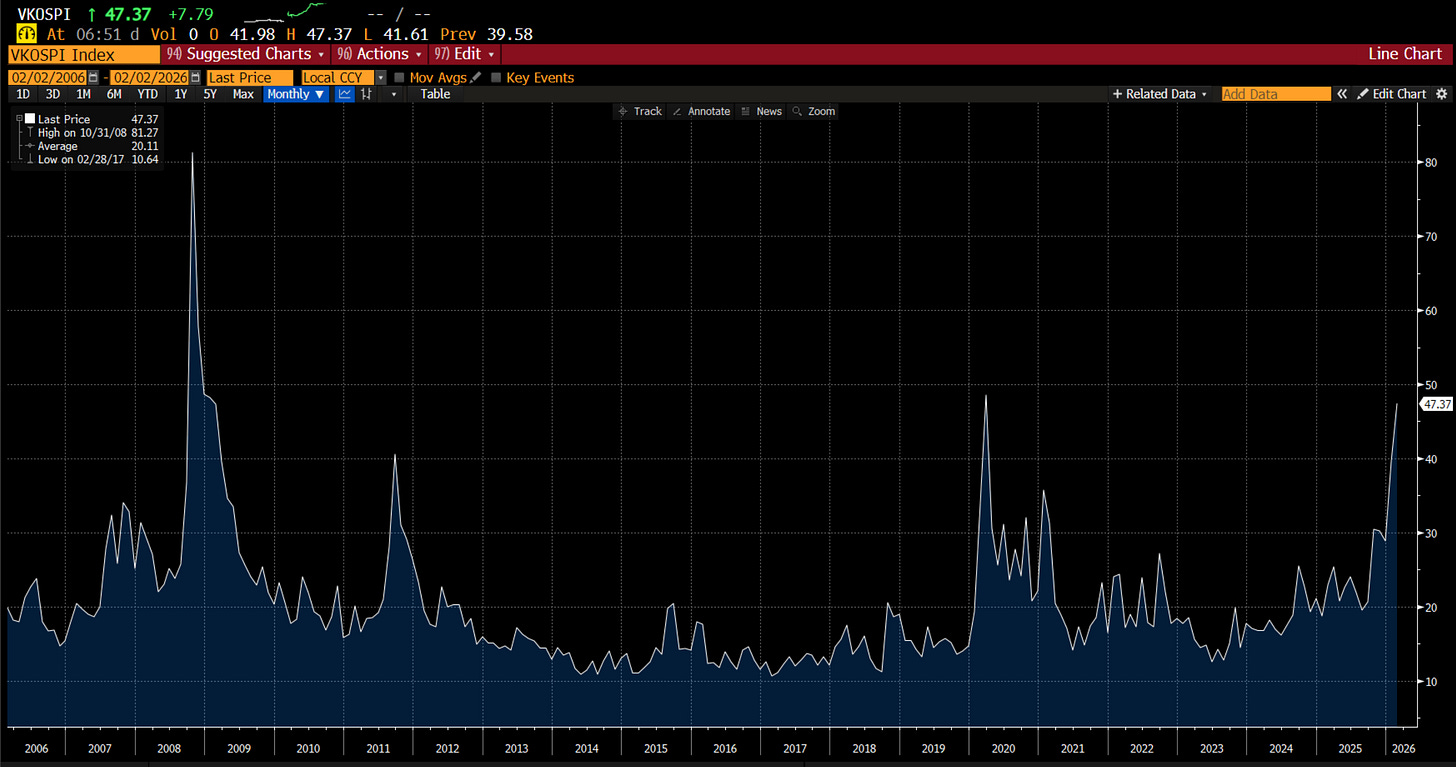

Korean VIX is not your father’s VIX. Typically, VIX spikes when markets are falling - as people then rush to buy insurance. This was the case in 2008 , 2011 and 2020. If I was told KOSPI VIX was 47, I assume the market had fallen apart.

The truth however is that the Kospi 200 (which is used to price VIX) has more than doubled over the past 6,7 months.

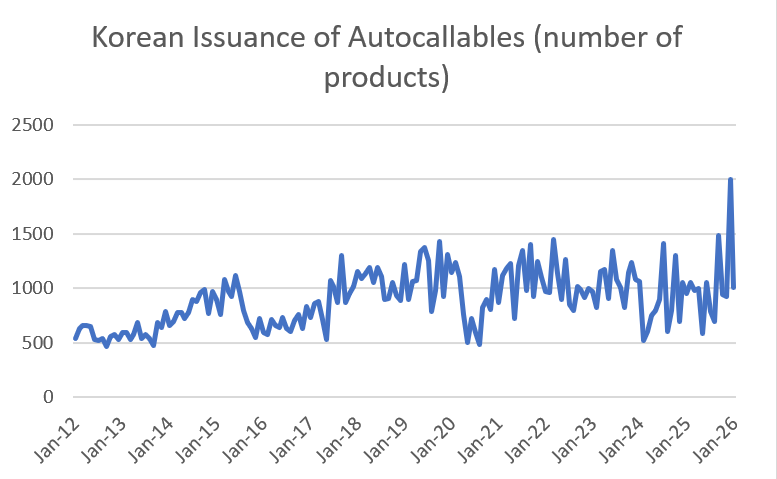

If the market is going up, then why is the KOSPI VIX so high? The most likely answer is autocallables, a product that Koreans love. In the flat equity market and low interest rate environment that has existed since 2010 in Korea, investors have tried to juice returns with autocallables (structured products) that generate a yield by selling volatility. Its a retail product that packages up the premium from selling insurance on the market and turns into “yield” product. I have written about it many times, so please see an old note for more details. It is not hard to find the reason for the Kospi 200 surging. Looking at a Kospi 200 ETF - you can see two stocks make up more than 50% of the index. Samsung Electronics and SK Hynix.

Both these companies make memory chips, and both have surged over the last few months. Samsung in particular has been pulled out of a particularly long funk.

SK Hynix is on another planet.

The weird thing about these autocallables is that they work best in a flat market. If markets go too high or too low, they have to be reset. With the Kospi continually hitting new highs, these long term sellers of volatility are constantly getting knocked out, which has meant that “supply” of volatility is reduced, and spot VIX has to rise. In December there was record issuance, probably driven by resetting of knocked out autocallables.

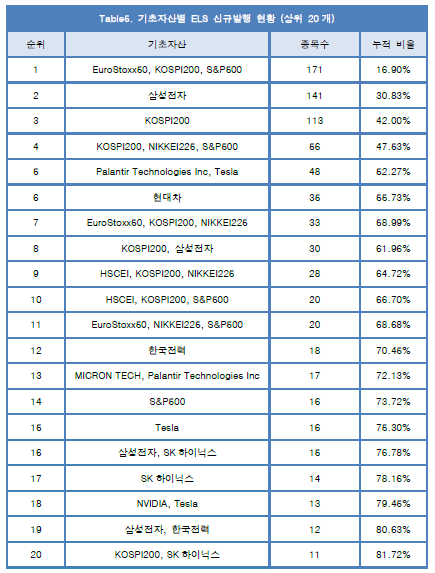

The thing is that Korean do not just sell volatility on the Kopsi200, they sell it on just about anything. Below is a list of popular underlyers No 2 is Samsung Electronics. No 6 is Hyundai Motors. But Eurostoxx 60, Nikkei and S&P 500 are popular too.

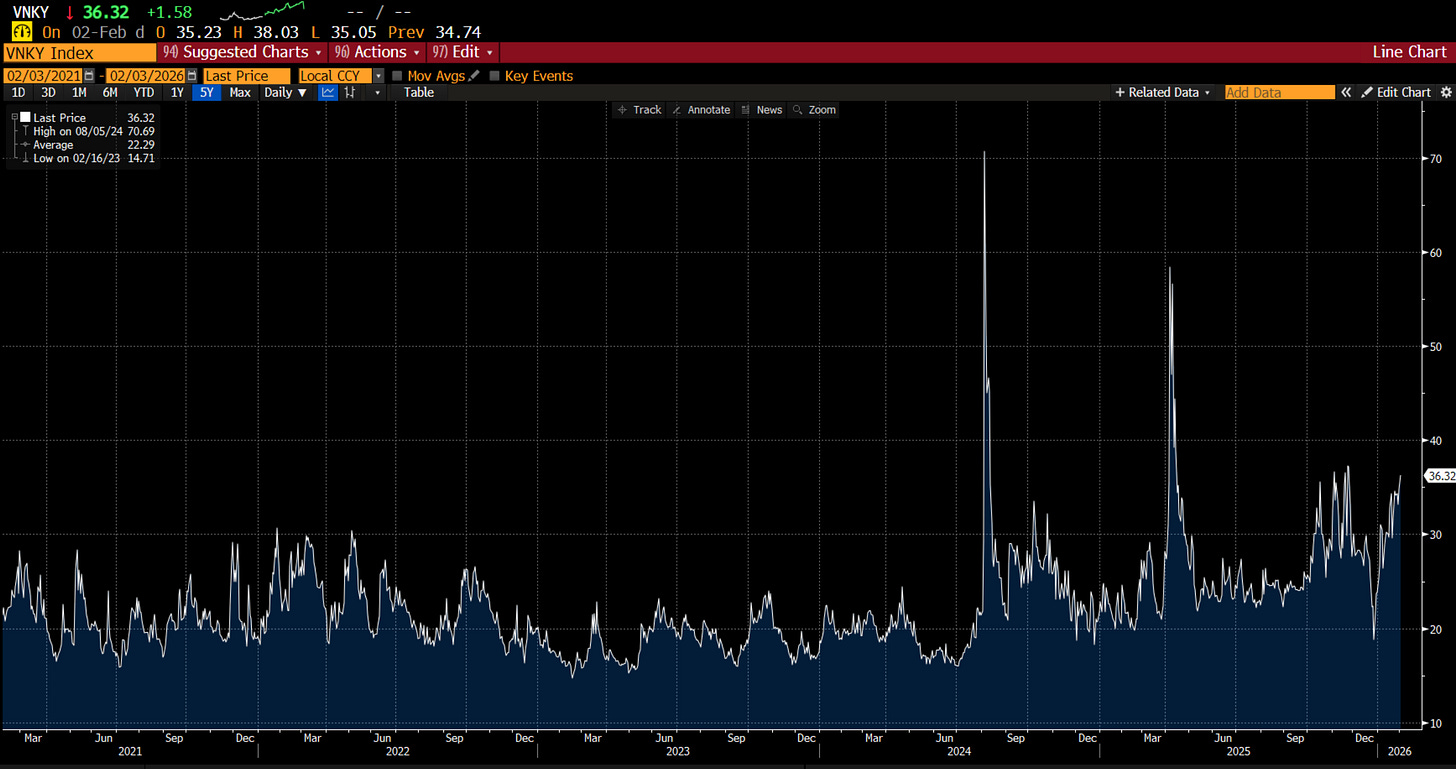

While Eurostoxx and S&P 500 VIX is well behaved, Nikkei VIX has spiked recently.

But like the Kospi, Nikkei is at highs, and used to spike on a falling market, not rising market.

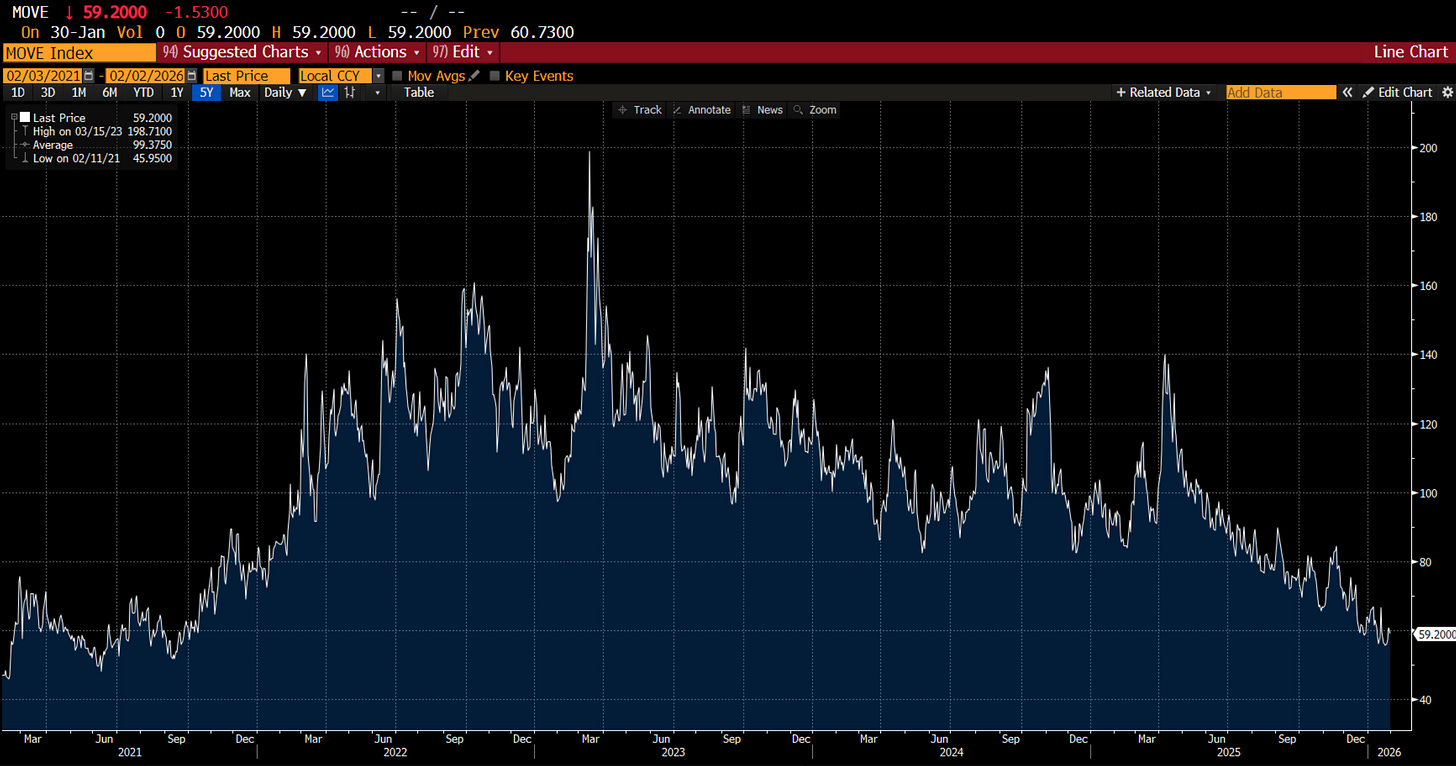

What to make of all this? Well for vol targeting funds, they must be getting very weird signals. They normally sell when volatility rises, and buy as it goes lower, but in Korea and Japan, that strategy would now be badly lagging the market. I also wonder what it does to VIX if there was a sell off now. Volatility is already expensive - does it get more so? My guess is that CTA and trend following funds are positioned in very weird ways - which means the chance that the market does weird things is elevated. I also see the MOVE Index at lows, even as the JGB market continues to be weak.

If January was crazy, the signs are we will see more odd months in 2026. Buckle up.