I am generally an upbeat guy, but this morning I woke up and felt down for some reason. When I feel down, I don’t try and cheer myself up, I lean into it, I wallow until I hate it so much, I drive myself to live again. I feel like writing about death and loss, so I shall write on bonds. And as I write, and wallow, I shall listen to sad songs. First up is “Richter: On The Nature Of Daylight” .

I should note, my downbeat mood does not come from markets or my strategy. GLD/TLT has been wonderful. If you have not looked at GLD/TLT, I provide a long term graph here.

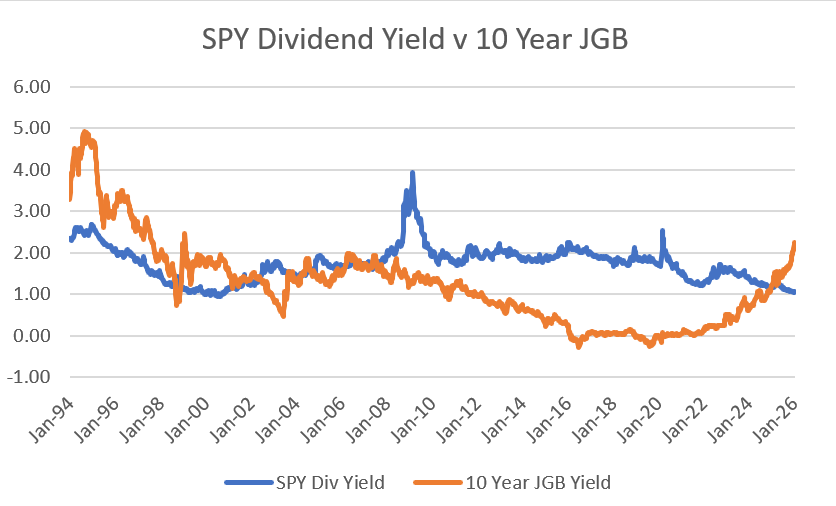

The question, I think, everyone wants an answer to, is why has the sell off in JGB yields not had a greater effect on the US. I look at this graph, and ponder this myself (I have now changed music to It’s Quiet Uptown from Hamilton)

I do have some thoughts on this. When I look at the GLD/TLT graph, there are three distinct periods of gold outperformance - 1970s, 2000s and now. For me, the 1970s and now are pretty easy to explain. US (and global) government was “pro-labour” which was an era of rising wages and costs. Good for gold, but bad for bonds. The problem is that 2000 to 2010 was the golden age of globalisation, and yet gold outperformed treasuries. My first thought was that this was driven purely by rising Asian wages (or weak US dollar - different sides of the same coin). We can use the Chinese Yuan as a proxy for Asia in this case.

The problem with this analysis is that the Chinese Yuan has been weak, and so have most other major Asian currencies. Korean Won, Indian Rupee, Japanese Yen are either at all time lows, or decade lows against the US Dollar. Or in other words, if you showed me how well GLD/TLT has done, I would have assumed the US dollar would be in the toilet. But its not. (I have changed music to Merry Christmas Mr Lawrence - its a sign my mood is lifting. I spent most of Covid learning to play this). In fact, as predicted many times, long Yen has become the new Widowmaker trade. Bonds and currencies have changed - buy why and how?

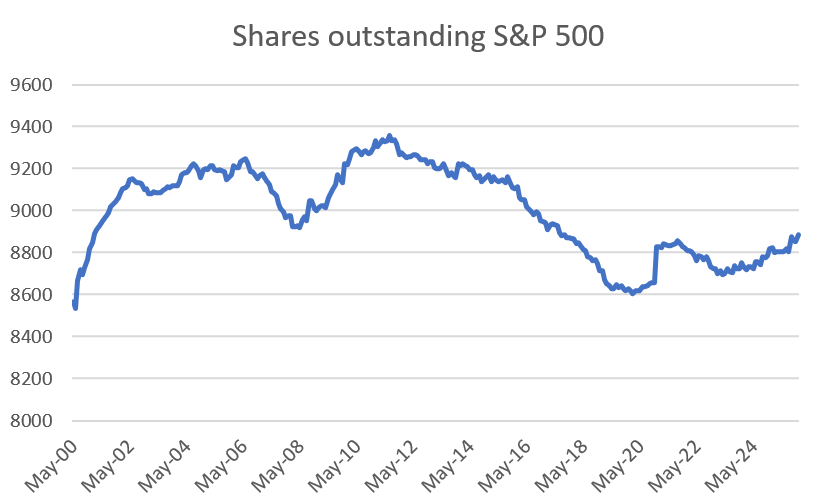

I think the simple answer is the market is signalling lack of investment everywhere. For a world where the US is not willing to play peacemaker, everyone now has to beef up defence, and secure supply chains. The deflationary influence of technology has looked to have ended, which I blame not on Moore’s law, but on the relentless consolidation of tech companies, and the relentless focus on returning capital to share holders through share buybacks. For the US, which had for years outsourced manufacturing to emerging markets, this made sense, but as we can see, raising equity from the stock market is beginning to return to the S&P 500. However we are still a long way from what we saw in the 2000s.

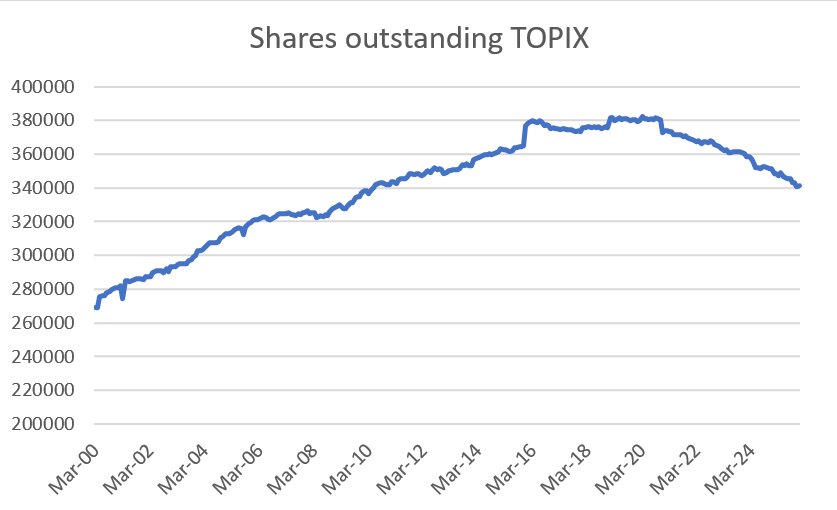

Japan, which has tried to maintain a manufacturing base, also has been focusing more on share holder return in recent years than investing - as we can see from the now falling share count of the Topix.

What is so interesting about this graph, its that 30 Year JGBs also bottomed as shares outstanding started to fall.

And at the same time, the Yen became reliably weak.

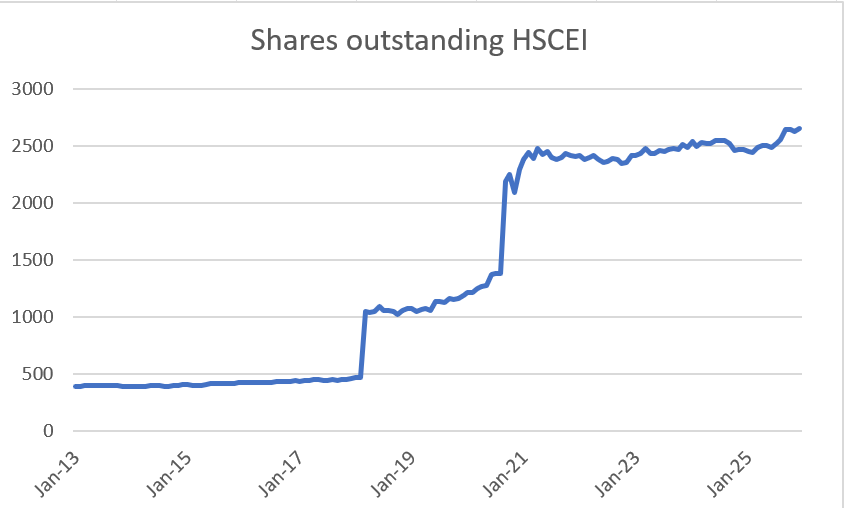

Everywhere I look in the Western World, the markets are crying out for more investment, and sending price signals to encourage this investment. And yet, corporates demur. There is only one country that has maintained investment necessary for the modern world, China. It has developed it military, and spent to develop its tech industry (and avoided the consolidation we see in US tech). This probably explains why the Chinese bond market is closer to lows than highs.

The Chinese never really caught the buyback bug.

Why are bond yields rising? Because corporate investment now lags behind needs greatly - leading to surging prices. And this also explains the move in GLD/TLT we saw from 2000 to 2010, at the time, we had underinvested for the needs of an industrialising China. Now are underinvesting for period of military and technological confrontation. Equities understand this - bond investors are deluding themselves. The really bad news for bond investors is the longer corporates keep capex low and prices high, the greater the catch back in wages and inflation will be. I still target 10% on the US 30 year treasury.

As I finish writing this note - I am listening to Skyfall by Adele. The lyrics are strangely apposite for a song about Bond…

This is the end

Hold Your Breathe And Count To Ten