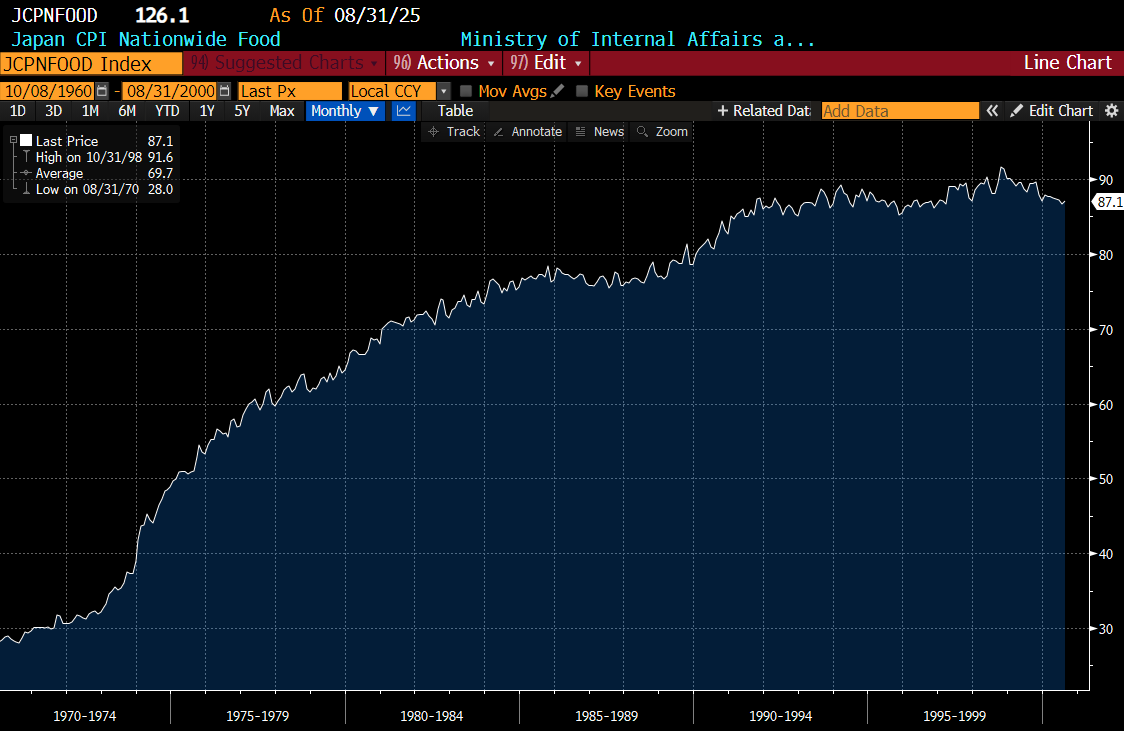

In the pro-capital/pro-free trade era from 1980 to 2000, we learnt that the Yen was a hard currency. For all the fiat/debasement traders, out there, Japan was a true widowmaker market. With rising debt levels, and a fiscal deficit, and a central bank putting interest rates to zero, you would have assumed gold in Yen terms would have soared at least during the 1990s. You would have been wrong. The gold price in Yen terms fall back to 1971 levels by 2000.

The other mistake that investors made was that they assume bond yields would sell off in Japan. The classis widowmaker trade was short JGBs. As we should all know, this was a massively wrong. JGB yields kept falling, and even when negative on occasions.

And this was not your average retailer they got Yen and JGBs wrong. It was Nobel laureates and head traders and big banks and hedge funds. What did they get wrong? For me it was always Yen. While the BOJ was always desperate to get Yen weak, the government, under pressure from the US, was never too keen to intervene in foreign exchange markets. The Japanese government was committed to free markets, or at least convincing the US government it was committed to free markets. With no inflation in Japan, this meant the Yen would always need to appreciate.

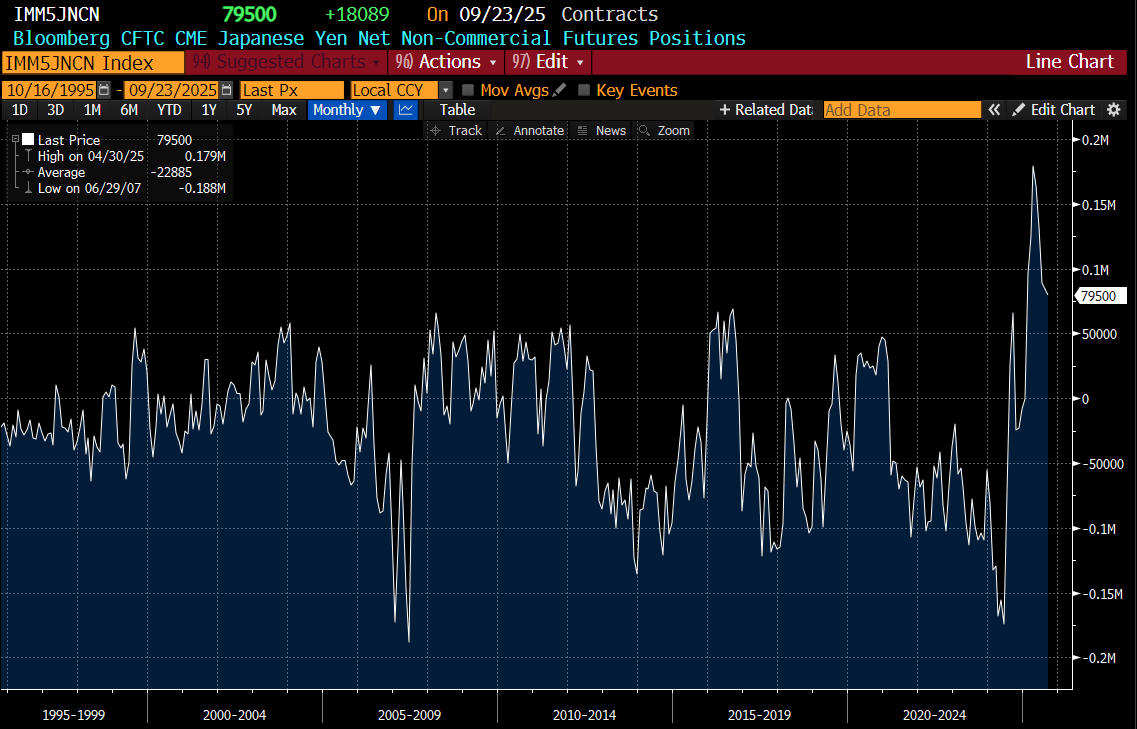

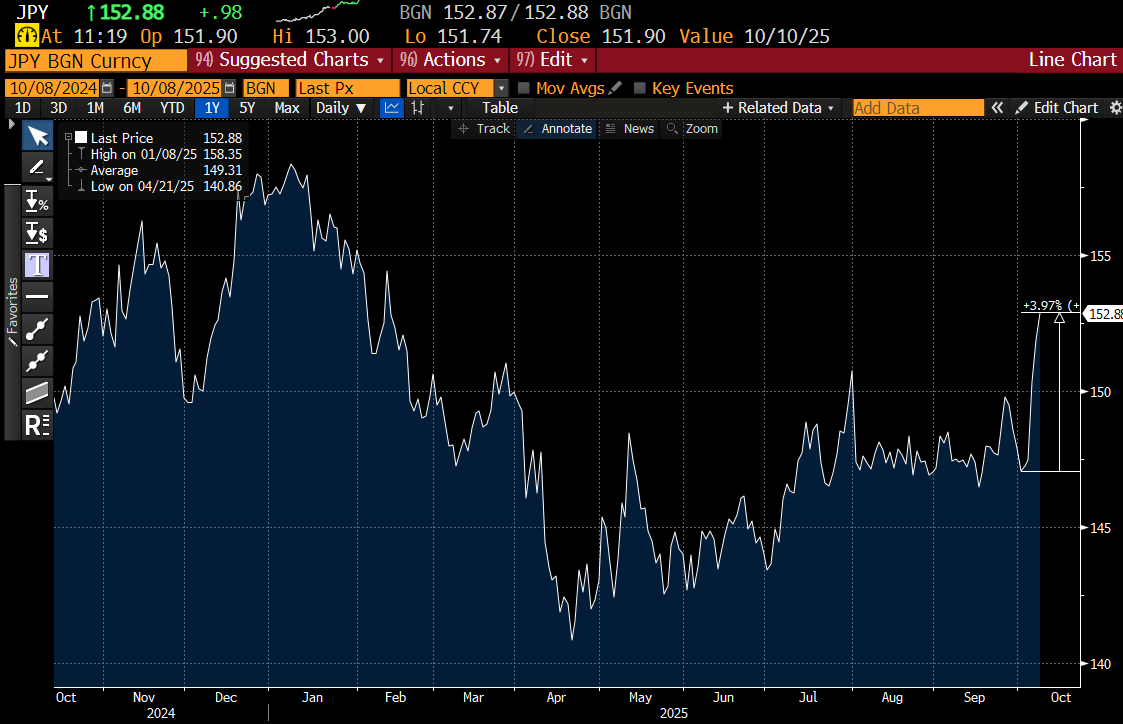

But free markets are not longer. And the BOJ and the Government LOVE a weak Yen, and crucially, the US does not seem that bothered. Probably the move to tariffs makes it hard for the US to preach free market philosophy to its trade partners. This is what makes the Yen so hard to read. It is very cheap, but there is no political consensus that is should strengthen. Despite this, macro managers are repeating the mistake they made with JGBs. They keep expecting yen to appreciate, so early this year were the longest ever in Yen (according to CFTC data).

Their bullishness has been “rewarded” with a chunky 4% sell off in recent days, and a full 9% sell off from peaks in April.

Gold in Yen terms does indeed look parabolic now.

In an interesting twist, the BOJ wants to raise rates, while the incoming LDP leader Takaichi is keen on them not raising rates. When would Japan want a strong yen again? My guess is when the US and/or China put pressure on them to stop. But I also think the Chinese take some measure of pleasure from seeing the Yen weaken.

As I have been writing for a while, macro investors could rely on economics to justify positions from 1980 to 2010s, because political consensus was to allow markets to price everything. In a political world, long yen is a widowmaker trade, and old school macro traders look foolish. The big question is when does the politics change again, and the dogmatic debasement traders look bad again? Its happened before, so I am pretty sure it will happen again. Could be tomorrow, could be after I die. But all I know is to keep an eye on politics.