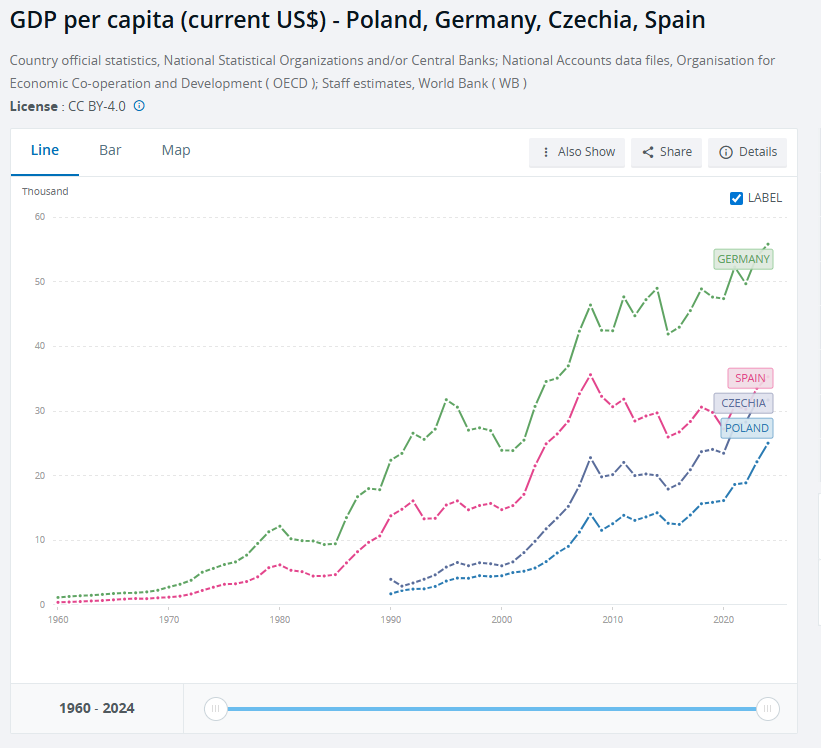

For decades, the road map to economic success was pretty clear. Reduce tariffs, allow the free movement of capital, enforce the rule of law, and have governments run balanced budgets to get inflation and interest rates down. The pinnacle of this type of economic management was the EU and its enlargement process - where it would allow European nations to join the EU if they met all of these requirements. At least in the early stages, these economic policies were a stunning success. First with nations like Spain and then central European nations like Czech Republic and Poland seeing there GDP per capita rising rapidly in the 2000s.

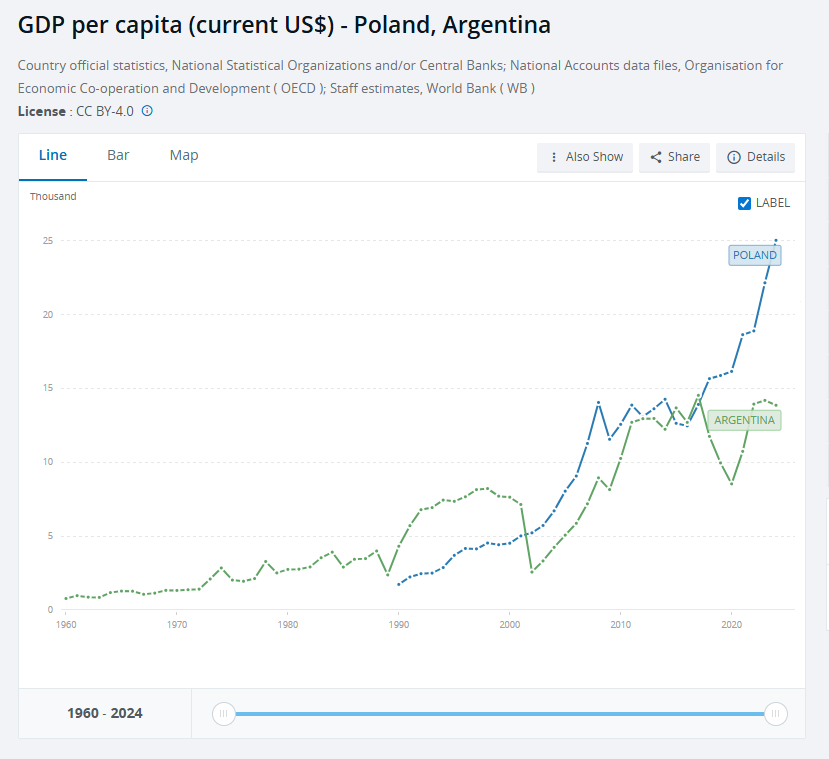

Argentina did try and follow Washington consensus in the 1990s, which saw its GDP per capita rise, but from 2000 onwards, it has been run very differently. Over that period, Poland has seen its GDP per capita overtake Argentina.

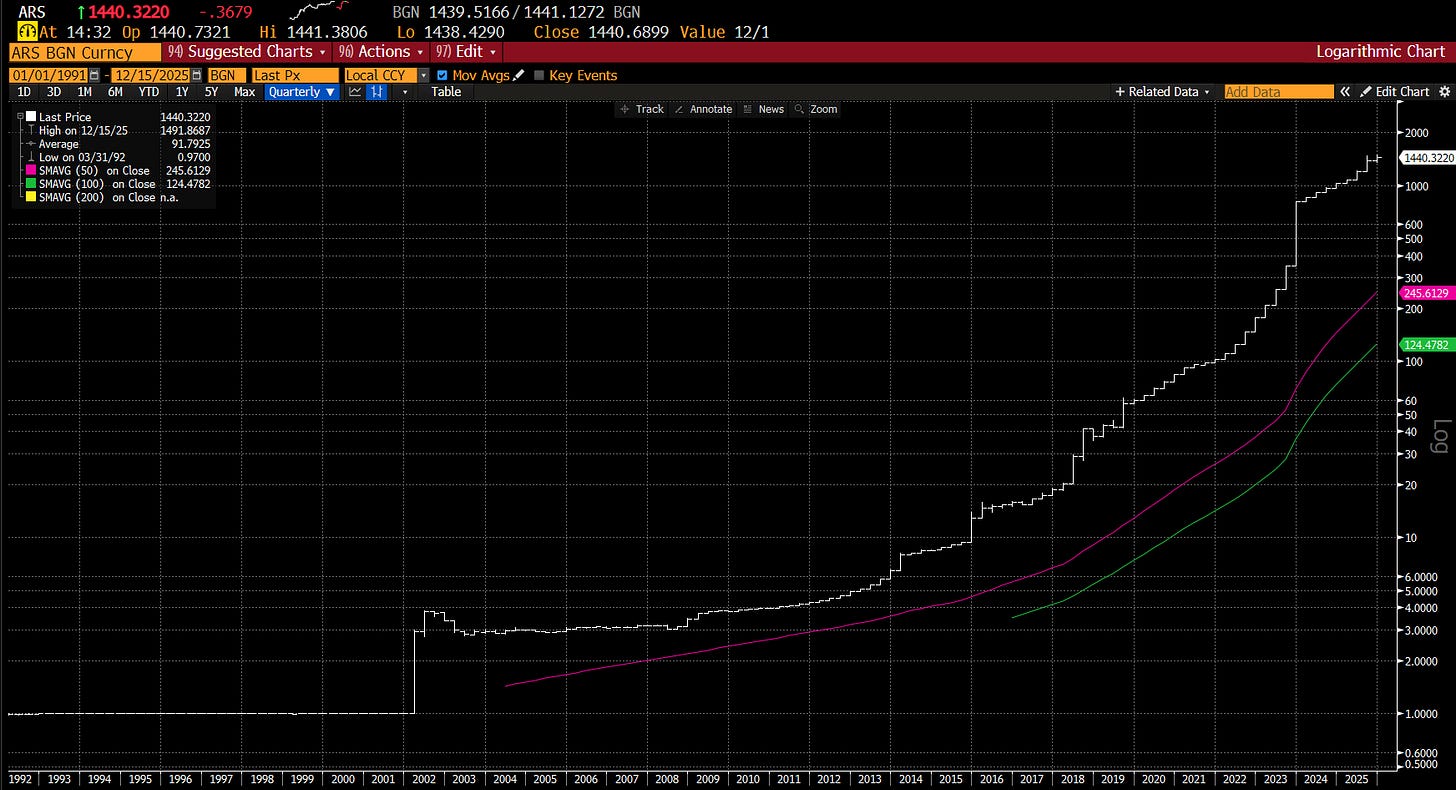

The Washington consensus policies worked so well, it became almost axiomatic that they were needed to prosper. Nations like Argentina, that went down a more populist route from 2000 onwards saw the economies weaken, and most clearly saw their currencies weaken dramatically. The Argentine peso is below - shown in log scale.

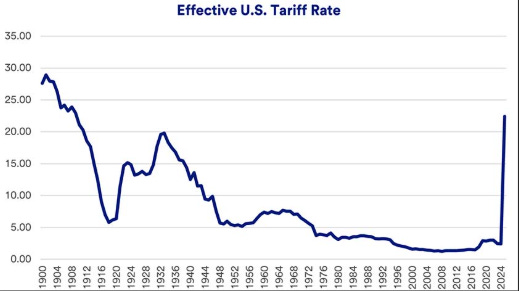

For macro economist observers like myself, the Trump administration economic policies seem closer to Argentinian in the 2000s than Washington consensus. First of all is the love of tariffs. Tariffs naturally lend to inefficient and allocation of assets and inflation.

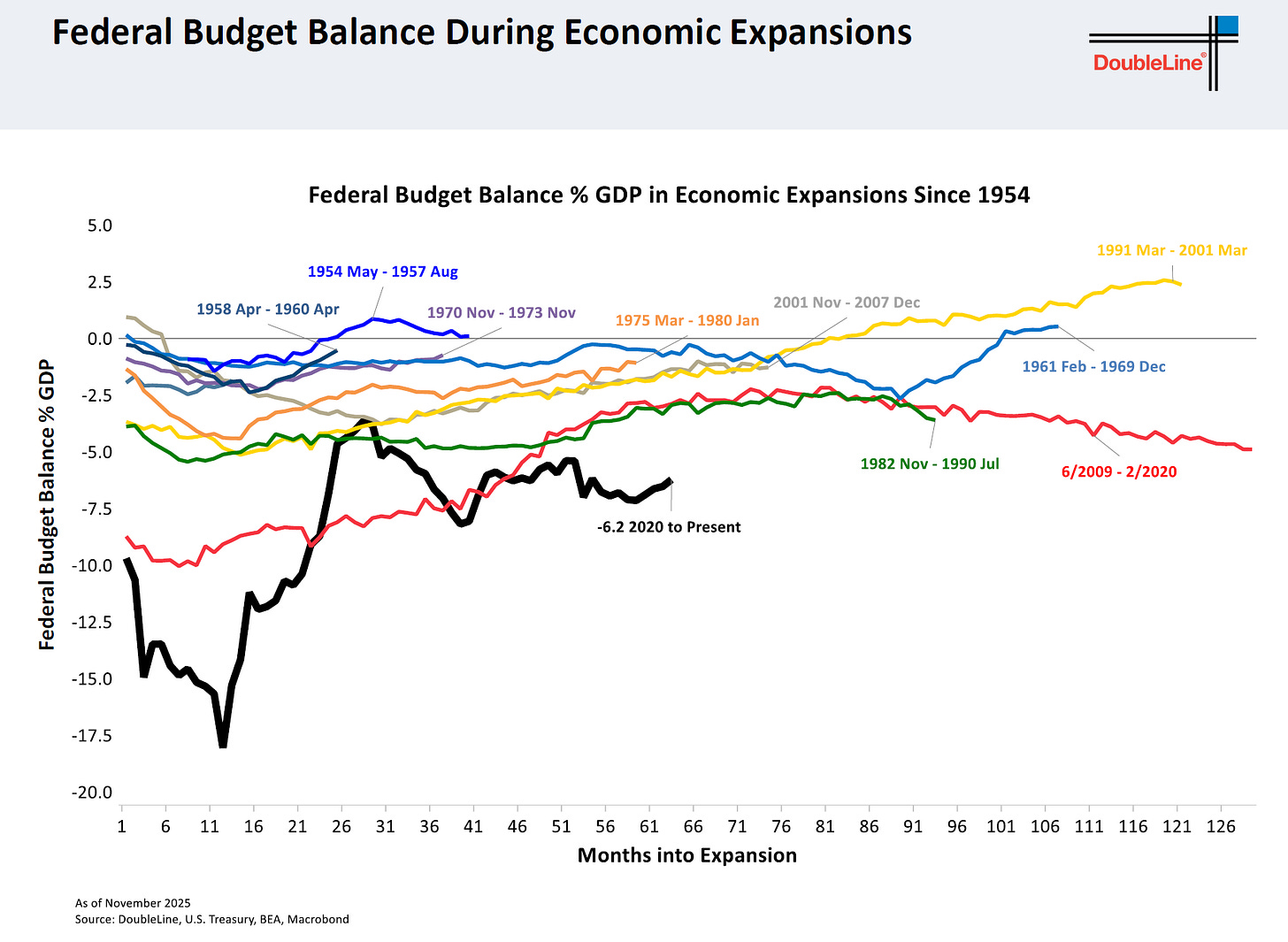

An inability to balance budgets is also very Argentinian. We also see much larger fiscal deficits, but this is not confined to the US. A good Doubleline chart shows the change.

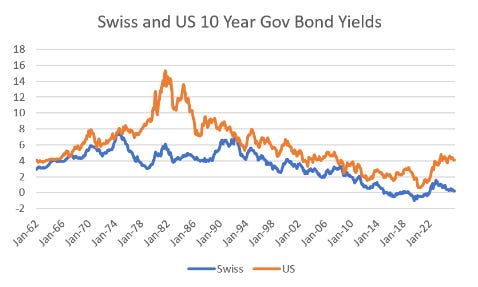

The question then is why does the US not suffer from leaving the Washington consensus? Can the US just do whatever it wants? I think to answer this question, we have to ask why did the Washington Consensus policies worked in the first place? One clear outcome from adopting these policies is lower interest rates. Before Poland joined the EU, its government bonds use to yield 12%, and then fell to 6%.

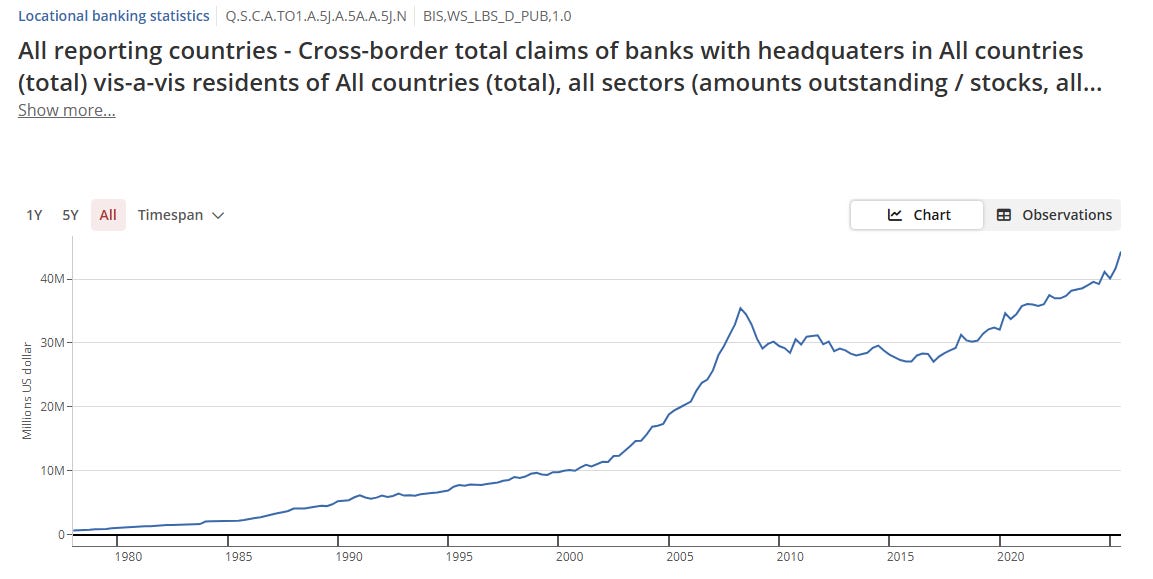

So Washington Consensus policies drove lower interest rates, which then drove credit expansion. Looking at BIS data, we can see that the credit expansion nature of growth seemingly ended with the GFC, but has rebounded somewhat since 2016.

What I am arguing is that we should see the cost of credit in the US rise, as it moves away from the Washington consensus. There are some signs of this. Switzerland runs a balanced budget, and has generally refrained from tariffs. We can see just like in the 1970s, the cost of borrowing between US and Switzerland is beginning to widen.

We have also seen gold outperform treasuries by the most significant amount since the 1970s.

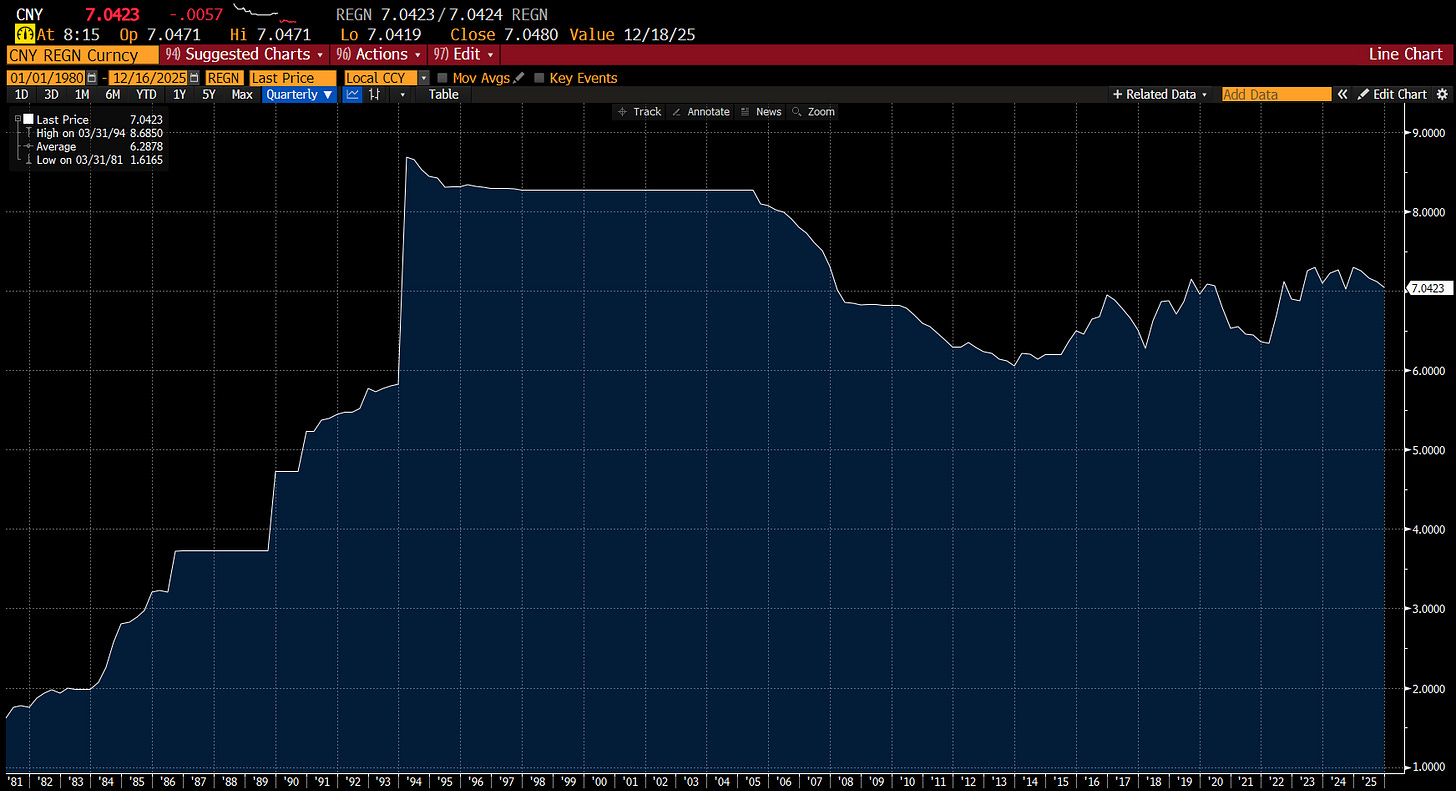

Despite these signs of weakness, the general theme remains one of American dominance. What could change that? Well US dollar weakness would definitely begin to cause some angst in my view. And politically speaking (and we live in a political world), US dollar weakness against the Chinese Yuan would be the most likely event to cause political change.

With the current surge in Chinese trade balance, a Chinese Yuan appreciation cannot be ruled out.

If this is the case, then President Trump will become the latest politician to achieve the exact opposite of his stated aims. Time will tell.