I am bearish bonds, and I have built a portfolio around the idea that we will have rising inflation, rising yields and a rising cost of capital. The fund has had a good move last year, and a good move this year. So the question that has to be asked, is it done?

Firstly, in my experience, Eurohedge awards can mark the end of a trade. It has certainly been the case the three times I have been nominated before. This is a point of discomfort.

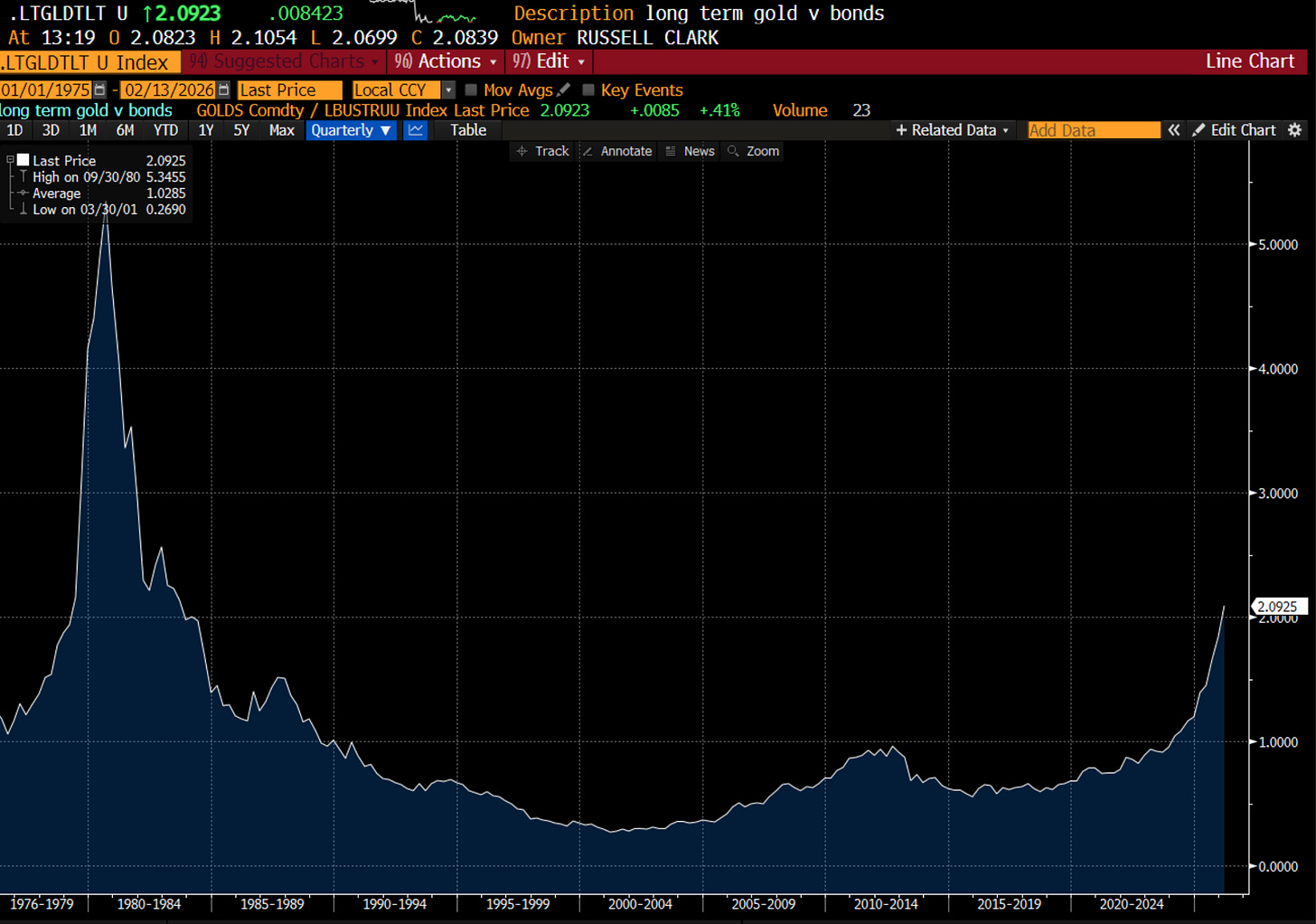

Secondly, the flagship trades for this fund HAVE done well. GLD/TLT has been good.

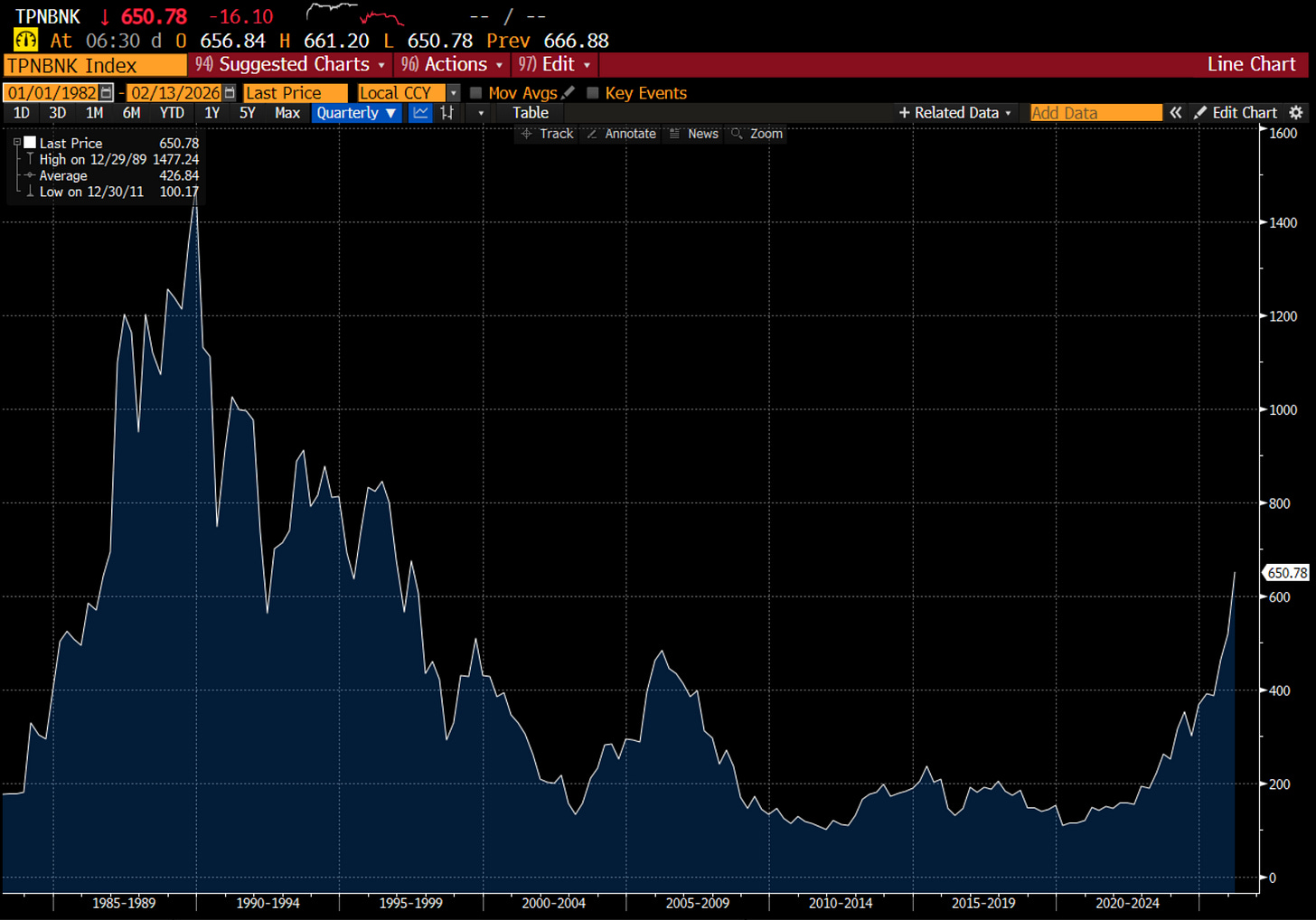

And Japanese Banks HAVE been good.

So lets sit down, and look at some of the reasons we could think the inflation trade could be over.