I am surprised by this. Performance has been good - but not that good. My nomination probably comes from maybe not that many funds launched last year or I have a great sharp ratio having not had a down month last year. Two other funds have been nominated.

Hunters Moon website says they specialise in financial stocks - so should have done well. Orgueil is run by former colleagues at Horseman, Stephen Roberts and Patric Slama. They had a good year. My only chance of winning will be a superior Sharpe Ratio. More on that later.

I have a long history with Eurohedge. My first fund - the Horseman Emerging Market Opportunity fund was also nominated and won best new fund for 2007 with an 80% return over 15 months (it launched late 2006) and can only be described as concentrated beta rocket. Beta gets a bad rap… but sometimes you want it.

The award ceremony was held in February 2008 and by that time, I had sold my beta rocket positions and started shorting some of them. I remember listening to the other EM fund managers that had won awards saying it was lucky January numbers were not included as many were down hard after big years in 2007.

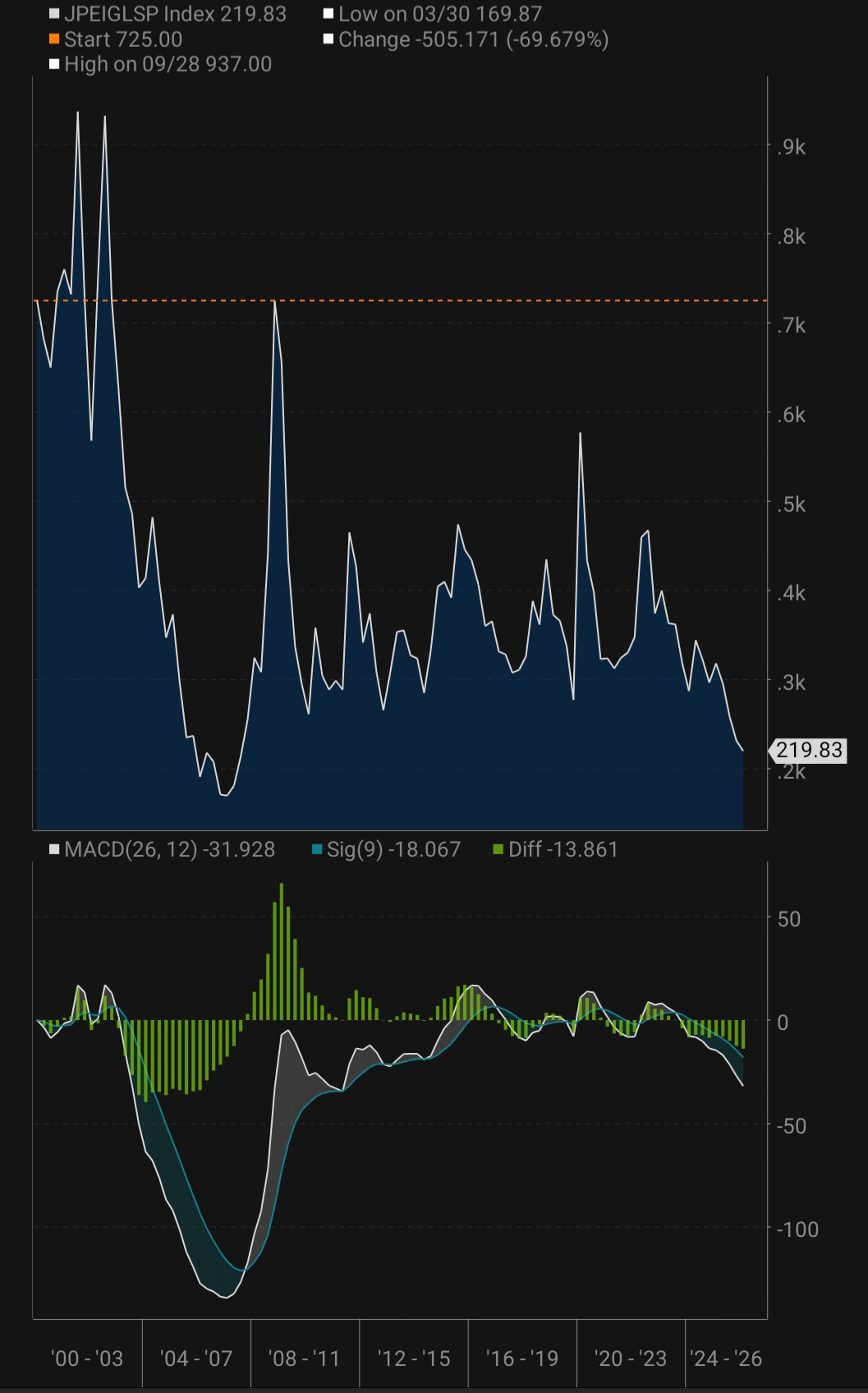

As it turned out 2008 was a very hard year for EM funds. People were very long EM in 2008 and when the credit market froze, the dollar soared and EM credit spreads blew out. 50% losses where common. I had gone short and made 15% that year - and was one of three emerging markets funds that made money that year. I won the Eurohedge award for best Emerging Market fund for 2008.

If I had followed my strategy of reversing positions at the end of the year I would have made a fortune and would probably still be running that fund and writing this from my own private island. But it was not meant to be.

That year, I took over the Horseman Global Fund. And with a lot of work got it nominated for best long/short fund in 2015, only to lose to another fund on Sharpe Ratio. What's the deal with the Sharpe Ratio? To win a Eurohedge award you need the best performance - but cannot do it with leverage. So if your Sharpe Ratio is much lower than other nominated funds you won’t win. I feel like the Sharpe Ratio tells you more about the underlying volatility of your markets rather than the skill of the manager… but rules are rules.

Does being nominated for Eurohedge mean anything? Like above - should I be reversing my positions? Short gold and long treasuries - a depression trade again? Probably not - but there are a couple of similarities to 2008. First corporate bonds spreads are at very tight levels - just like in 2007.

Also EM bond spreads are also at very tight levels.

For me January and February 2026 performance has been so far so good. But if commodity prices continue to rise - the risk is inflation returns and bonds sell off - and its 2008 or 2022 all over again.

Anyway - thank you Eurohedge for the nomination. And this time, if I win, I will stop my mate from putting the trophy down his kilt at the drinks after ceremony. Good times.