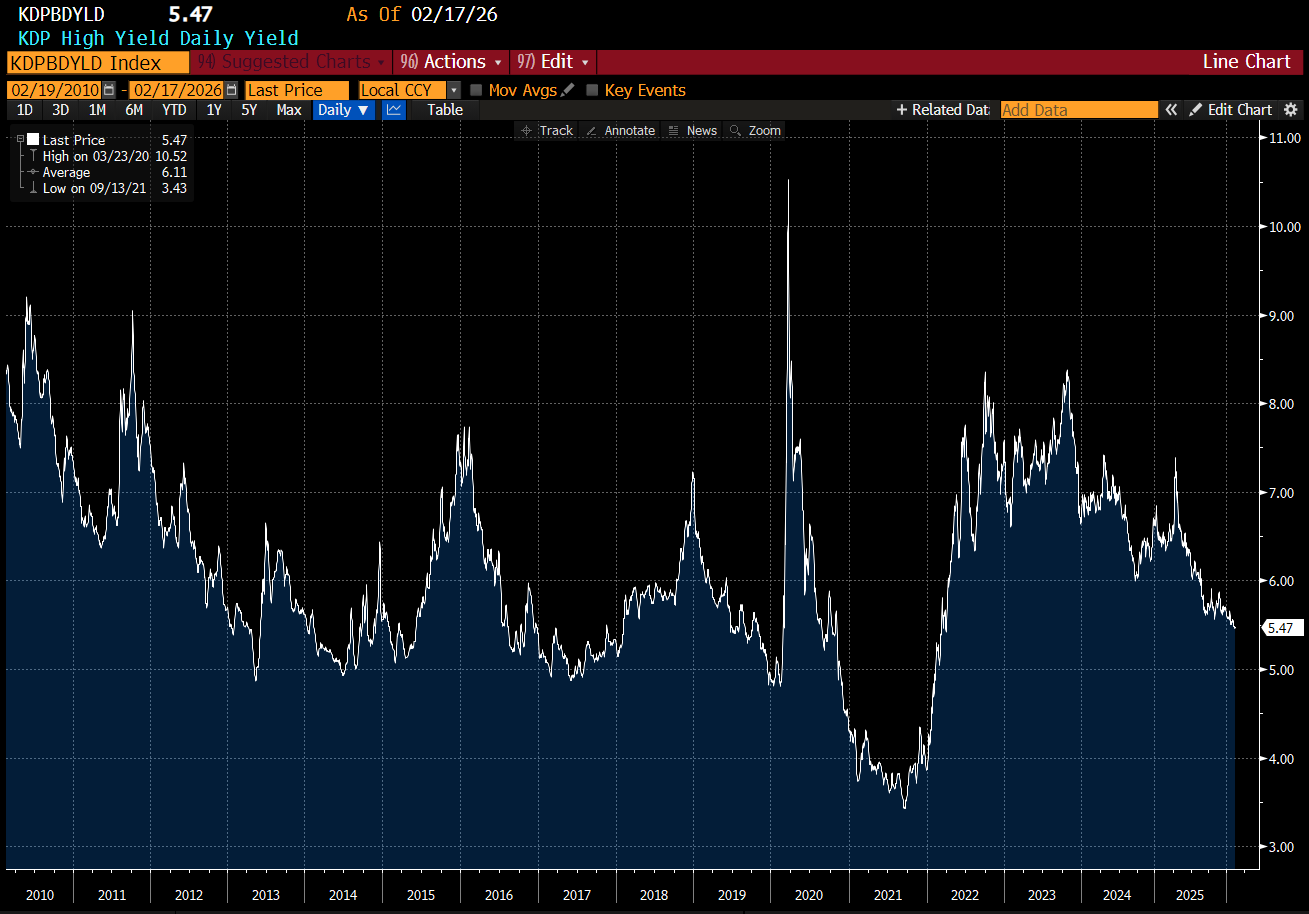

I have been bearish on private equity, partly because they stopped returning cash to investors even though markets are at all time highs, and partly because I thought the cost of capital rising would be bad for them. For corporates, cost of capital has not really risen. Over the last couple of years, high yield costs have fallen quite a lot.

Despite falling capital costs, private equity stocks have been pretty weak. KKR is representative.

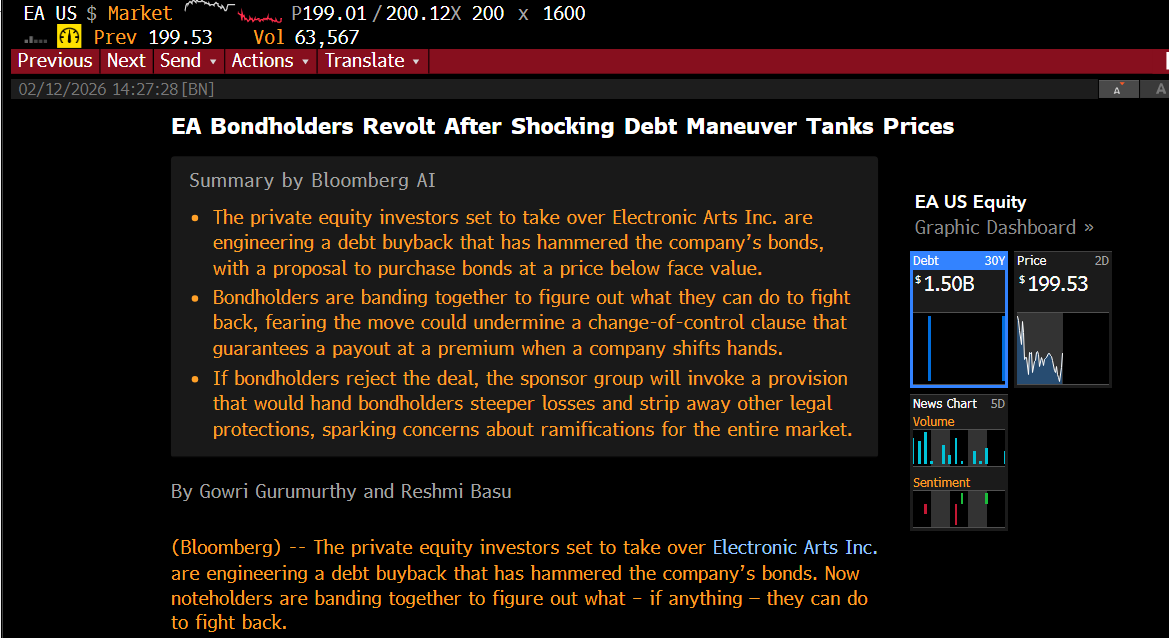

So what is going on? Well partly, the market has been radically reassessing the credit worthiness of software investments. Like with all things private equity - its not that transparent, but we know there are problems out there. We have had shenanigans in EA bonds, with private equity investors trying to shaft debt holders. Since this purchase, games and software stocks have been hammered.

So is there anyway to judge if private equity really is in trouble with its software exposure? I think there is.