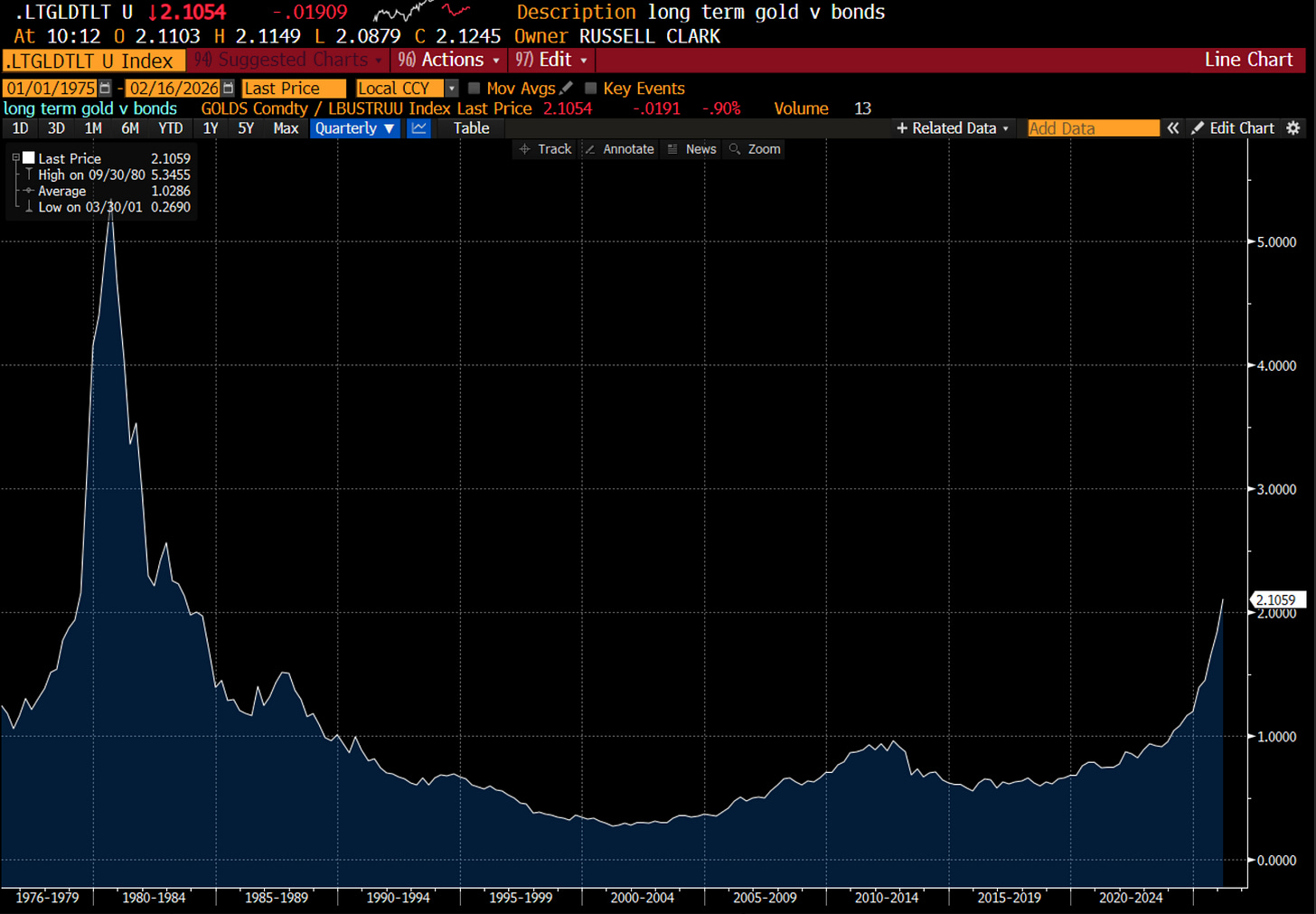

As mentioned in my last post, Eurohedge nominations often happen at inflection points in the market for me. So the recent nomination, has made me nervous that my theory that we are in a world of rising cost of capital could be played out, and it is back to deflation trades. On top of this, an investor I respect wrote to me to say he was going short QQQ, Long ZROZ (QQQ is the Nasdaq 100 ETF, and ZROZ is an aggressive long dated Treasury ETF). Further more, the Blind Squirrel is going long Africa. My first boss back in 2000 told me that when people buy Africa, we are getting near the top. So my anxiety is compounded. The biggest risk I think at the moment, is that I am not wrong, but we have a huge counter trend rally. First of all, we have to recognise that GLD/TLT has had a big move.

It has to be said in recent times, the vast majority of the move above has come from GLD being strong, and not TLT being weak. I was expecting weakness in TLT, but my friend who is shorting QQQ and going long ZROZ, says no one is positioned for a bond rally.