I, like almost everyone else it seems, thought the Trump Presidency would be extremely good for crypto assets. Certainly, when Trump won for the second time we saw a surge in the crypto space, but it has been pretty poor since then.

The bullishness that President Trump created for Bitcoin in some ways has created problems for Bitcoin. For years the market has tended to be very bearish on Bitcoin. If we look at the short interest of Strategy (previously Microstrategy), it used to be 35% of shares outstanding. As explained previously, when a share is shorted, it creates huge illiquidity in the underlying, as the owner of the share cannot sell until it is recalled, and the short seller can only buy.

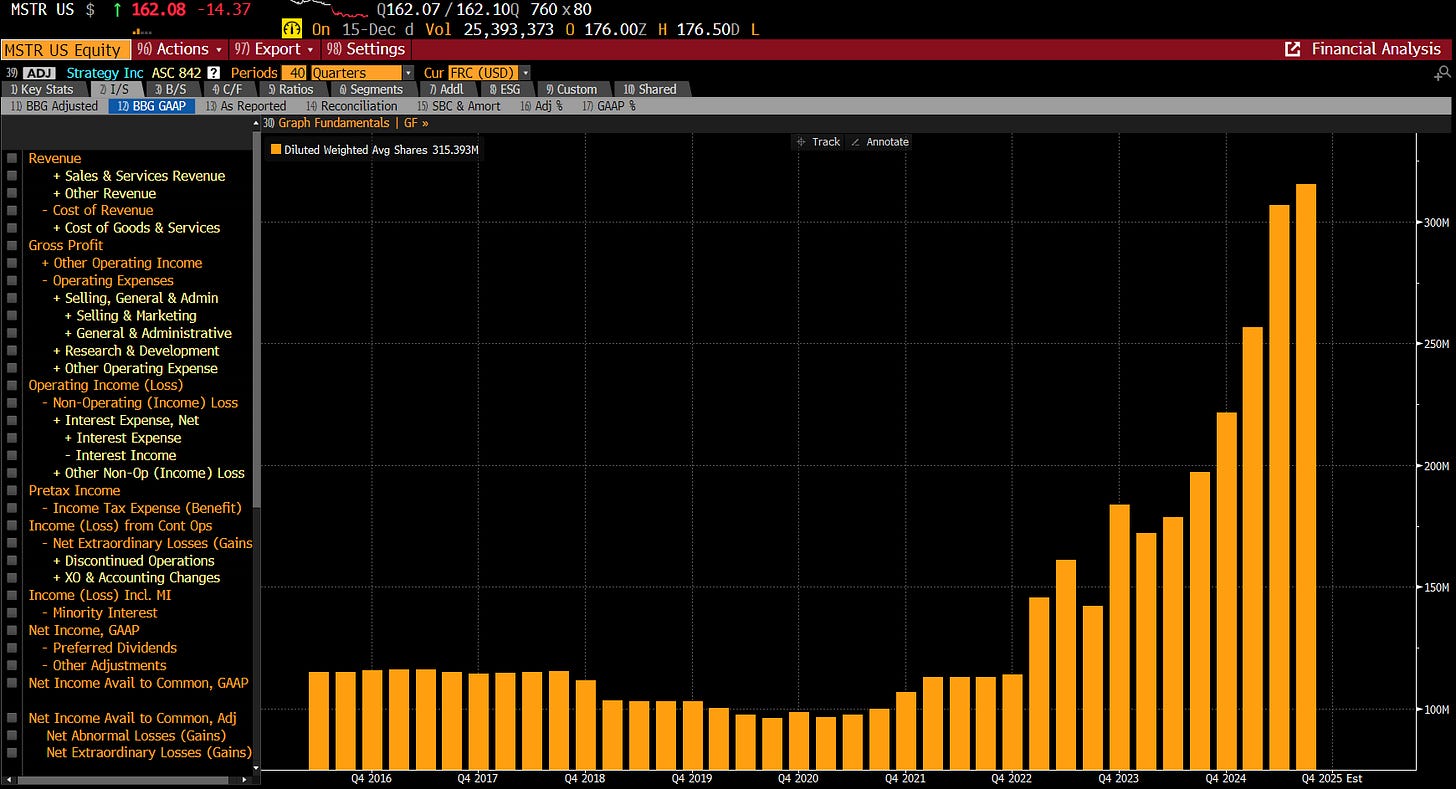

What that meant in practice was that Strategy would trade at a premium to its NAV, and was incentivised to issue shares to buy more Bitcoin. This is something that Michael Saylor did with gusto. Shares outstanding rose from less than 100m in 2020 to over 300m today.

Unfortunately, with relatively little short interest, Strategy now trades below NAV, making issuing shares to buy Bitcoin a value destructive trade. Or in a weird way, bullishness has reduced demand for Bitcoin.

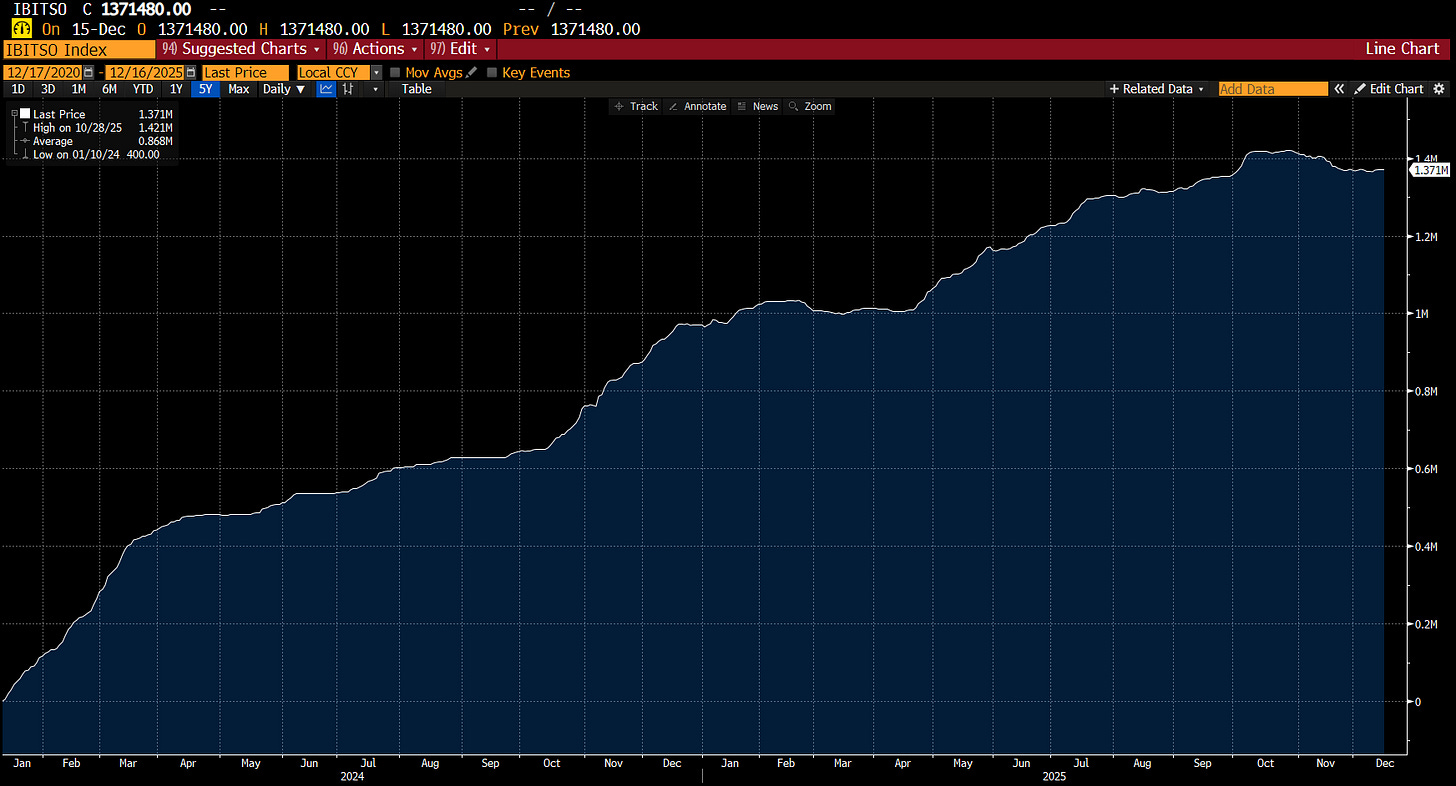

The other big problem for Bitcoin, was that is used to be difficult to monetise or even hedge your holding. This is not the case anymore. IBIT US, is a large US ETF that allows you to short sell. It also allows you to buy and sell at anytime. Until recently, it only saw inflows.

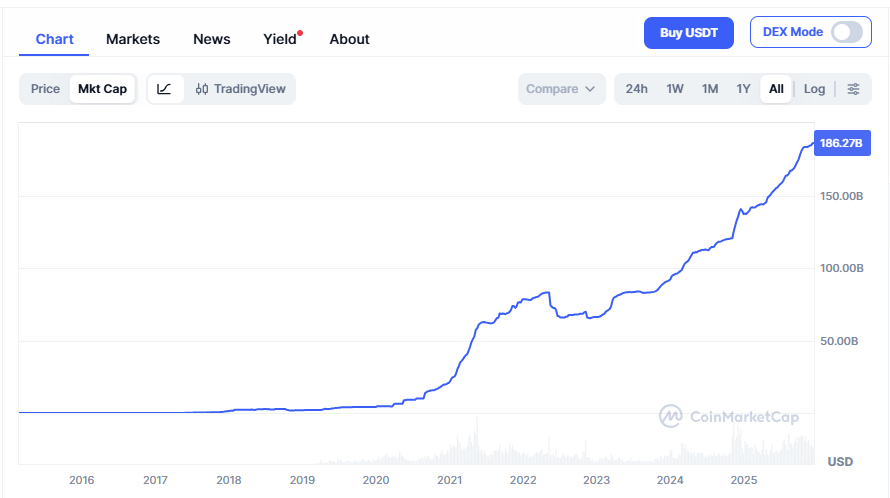

In essence, what I am saying is that the structure of Bitcoin until recently only allowed inflows. Previous volatility in Bitcoin probably came from leveraged players getting margin calls, but now volatility in Bitcoin comes from normal two way markets. For me, I generally look at the market capitalisation of Tether to get an idea of liquidity in the crypto space. This continues to rise.

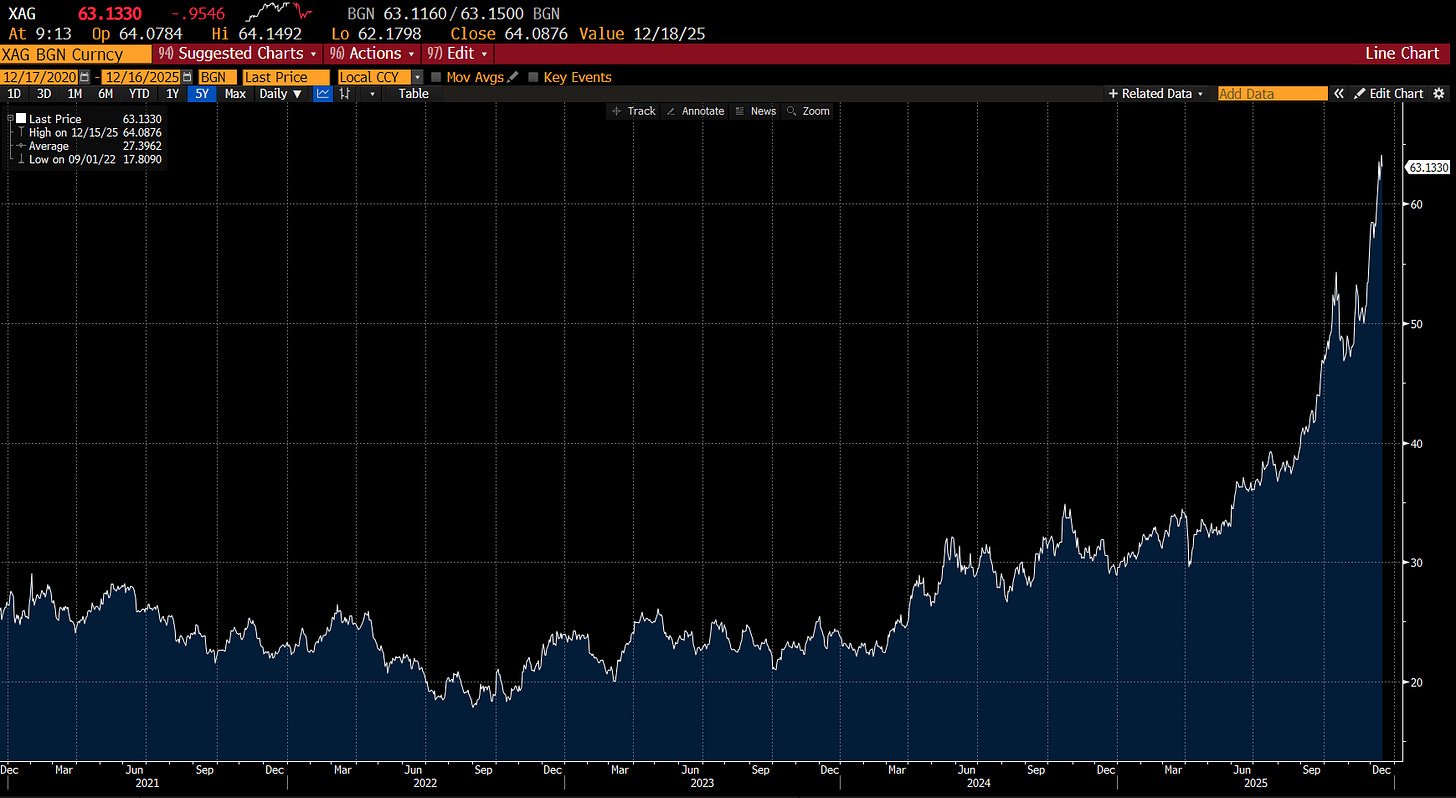

And if I look at silver, it is hard not to argue we are still in a speculative, dollar debasement era.

But here is the problem. Strategy has fallen 64% from its peak this year. When I check the borrow cost, it is still GC (i.e. very cheap).

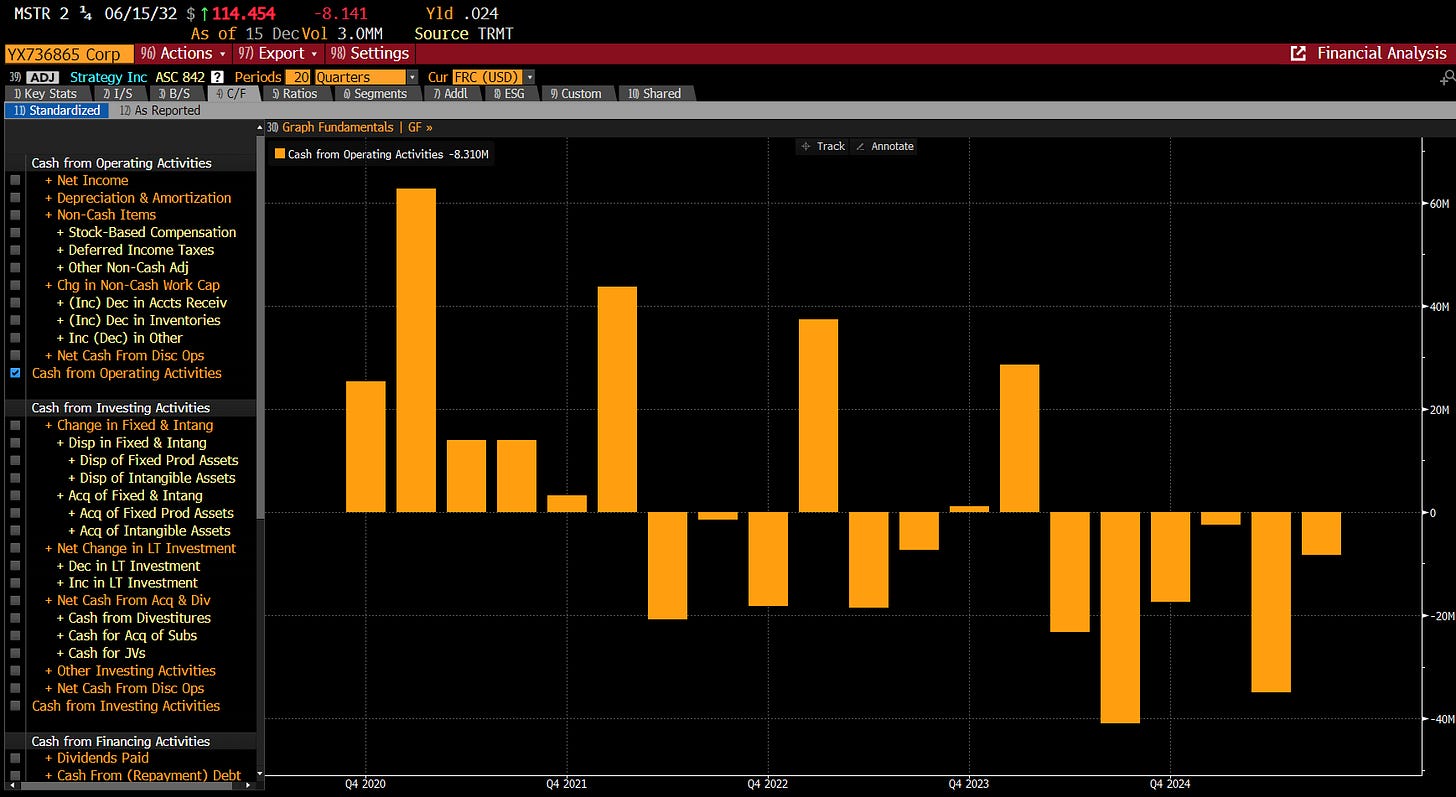

And its software business no longer generates cash.

And here is the problem. When Strategy traded above its NAV, it made sense to sell equity to buy bitcoin. But now it is trading below NAV, it would make sense to sell Bitcoin to buy back shares (in theory you are buying Bitcoin at a discount).

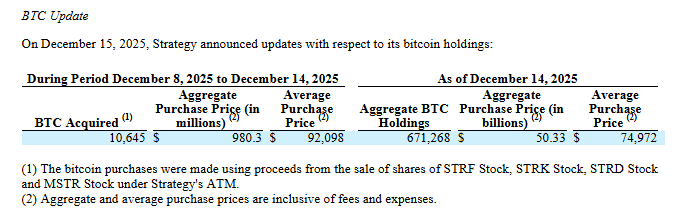

In the most recent filing, it reported buying more Bitcoin.

To get excited about Bitcoin, I think I need to see either rational actions from Saylor (buying his own shares would be buying Bitcoin at a discount here), or much more bearishness in the market (spiking short borrowing cost for Strategy, liquidation of IBIT or perhaps liquidation of Tether). We have not seen enough bearishness to get excited about Bitcoin in my view.