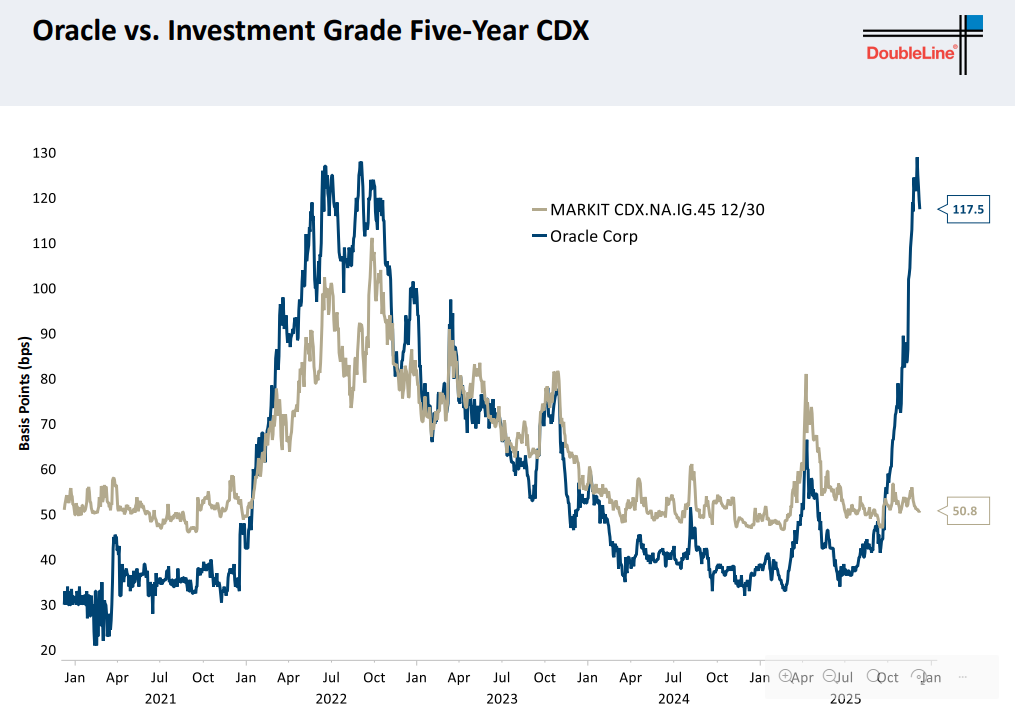

I see a lot of chat about getting bearish on AI - with exhibit A being Oracle CDS. Borrowing from a Doubleline presentation, you can see the interesting price action in Oracle CDS relative to the market.

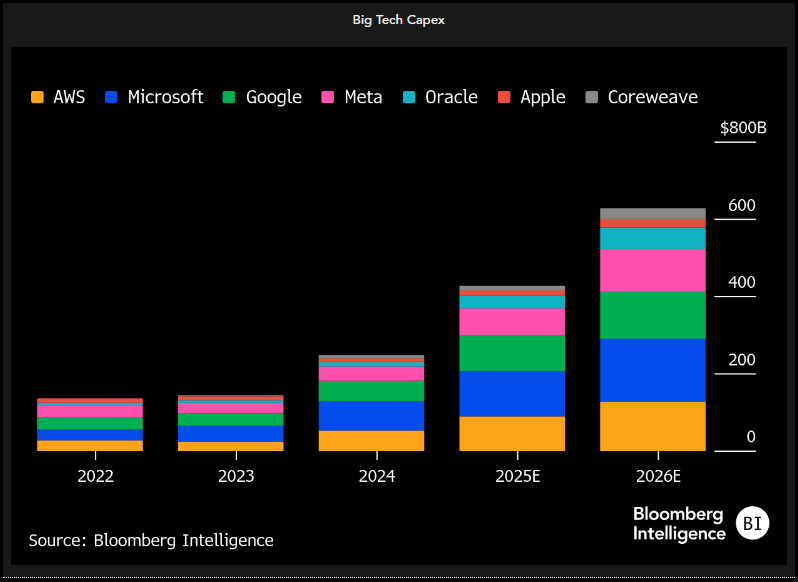

But as can be seen above, the market is sceptical more of Oracle’s financing plan, rather than AI itself. Huge capex, that will be much larger than cashflow implies heavy borrowing. Heavy capex can certainly point to a top in the market, but it is not the capex itself that is a problem.

Capex is only a problem if it leads to over supply and falling prices. The problem with being bearish on AI was that Nvidia, TSMC and ASML had basically cornered the market in high end semiconductor market, which meant the idea of falling pricing causing a bear market seemed relatively unlikely. True, there was a scare when DeepSeek was launched earlier this year, but as we can see with the the share price of Nvidia, the market went straight back to assuming strong pricing for their GPUs.

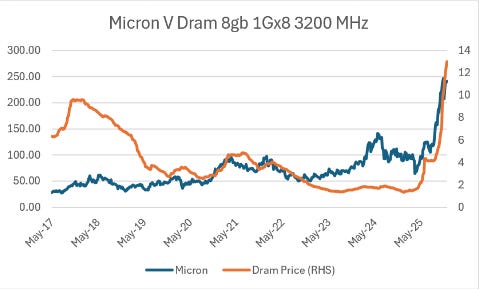

With the market transitioning from CPUs to GPUs, it was very hard to tell what the right “price” for a GPU could be. It is a bit like asking what the right price for a Birkin bag should be. For me, I think it should be much lower - but then again I am not the target market. But recently, the AI mania has upended a much more transparent market - DRAM. DRAM is memory that is used in most products. It has been a commoditised product - and given the normally constant improvements in yield from DRAM producers, the price tends to fall over time. For me, the second-hand pricing for GPUs is not transparent, but the pricing of DRAM is. As you can see below, DRAM pricing tends to be volatile, but this year we can seen it surge to prices not seen for a decade. This is highly unusual.

As this is a standardised chip, that first came into production years ago, arguments about hitting the limits of shrinking transistors does not really hold. Here, we can plainly see that demand is out stripping supply. In previous periods of excess demand, it becomes common for customers to overorder as they know they will not a full allocation. When demand slows, they then need to cut orders radically, leading to the volatility you see. Typically, the shares of DRAM producers tend to weaken BEFORE pricing falls.

Looking at Micron over the last year - if you are a brave soul, you could argue it is time to short. Personally, I would like to see the 200 MDA stop moving higher before thinking about taking this on.

The other problem with shorting AI is that you are not seeing any real weakness in the “hyper scalers”. If we suddenly saw some financial distress in Microsoft, Google, Amazon or Meta, then the case for shorting would hold more water. With maybe the exception of Meta, Mag 7 share prices are not suggesting problems.

Maybe things will change in the new year - but for me, I think being patient on the “AI is a bubble trade” makes sense.