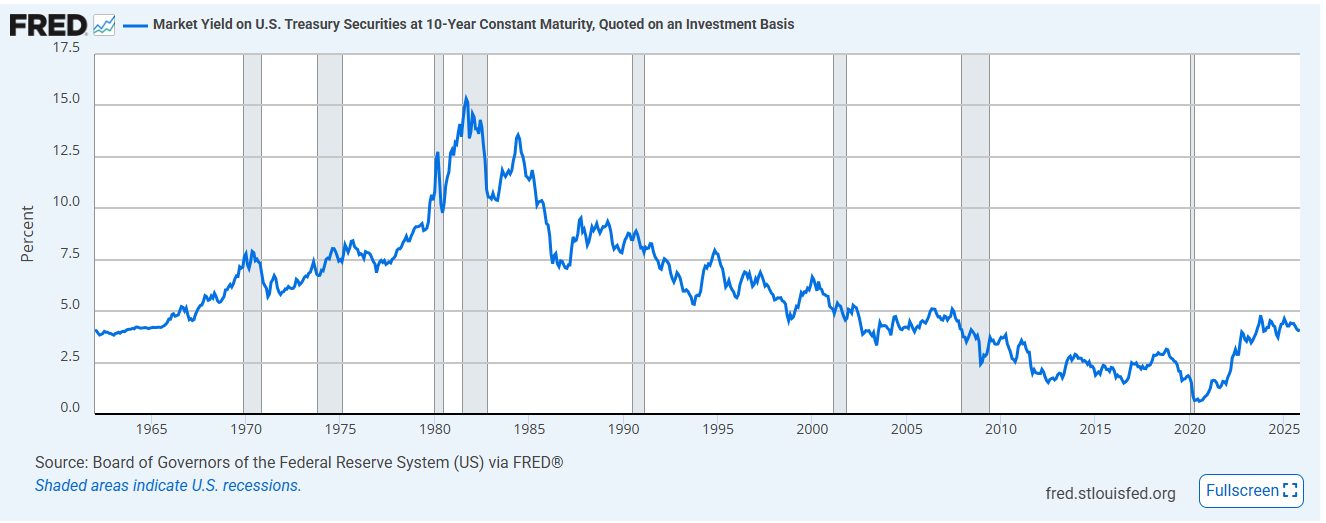

Whatever I commit to, I try and commit to until you reach a natural end. I learnt how markets worked in the 1990s and 2000s, which is an era I would call the pro-capital era. And I committed this theory until 2021, when it became clear we were entering a new era. This was an era that was good for bonds, as many of the free market policies were deflationary. Long dated bond yields began falling from 1980 onwards and kept falling. In my view 2020 market the end of this era, and we are now in an era of rising capital costs.

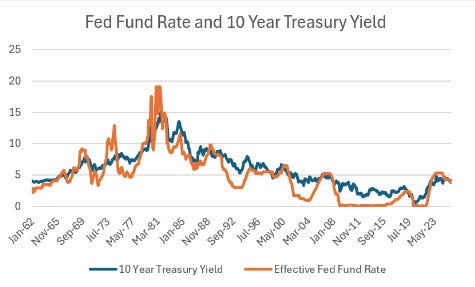

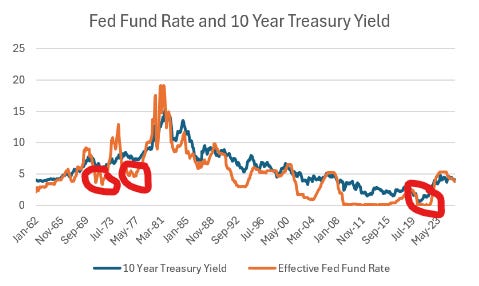

One of the most effective signals to short in the 1980 to 2020 era was when the Fed Fund Rate was above the 10 year yield, known as inverted yield curve.

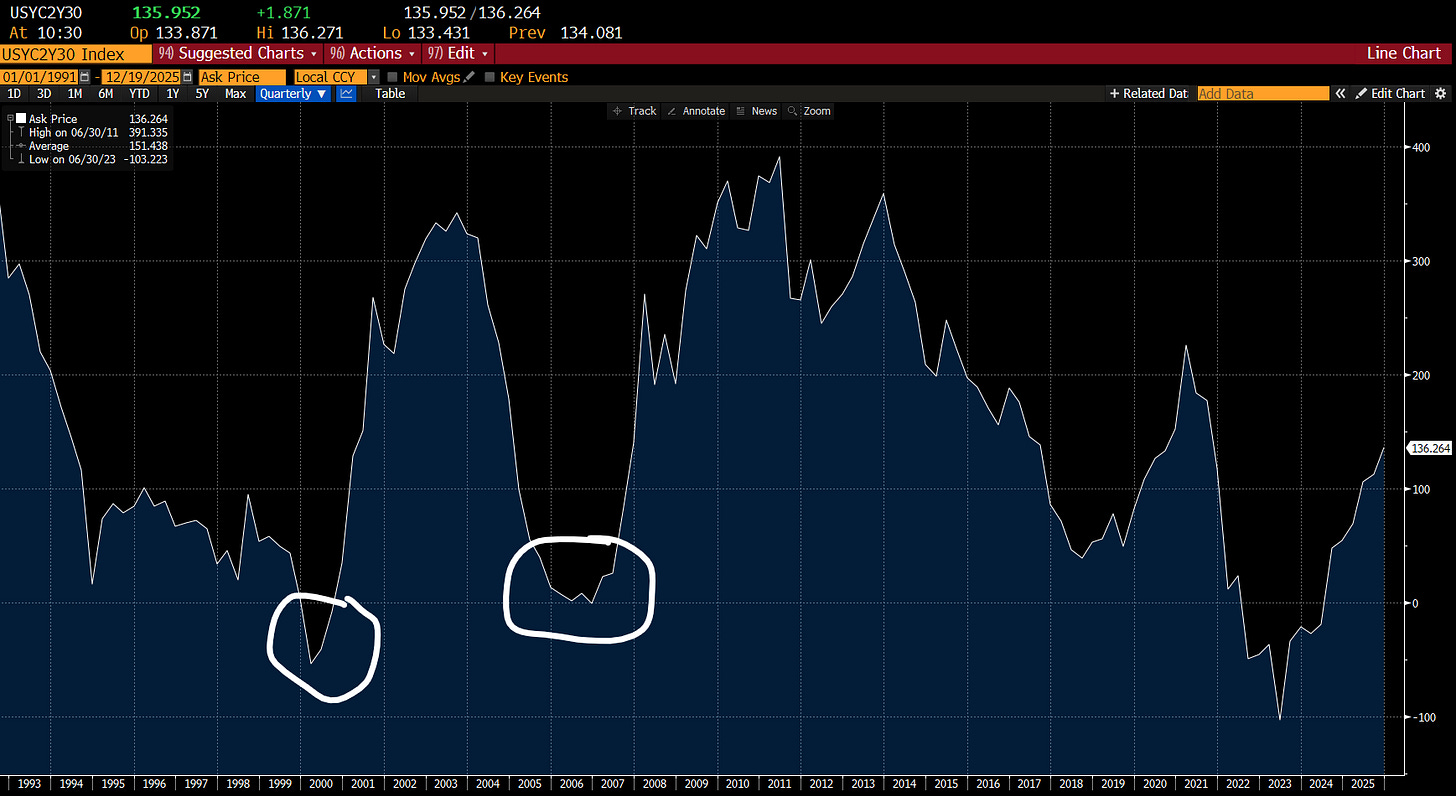

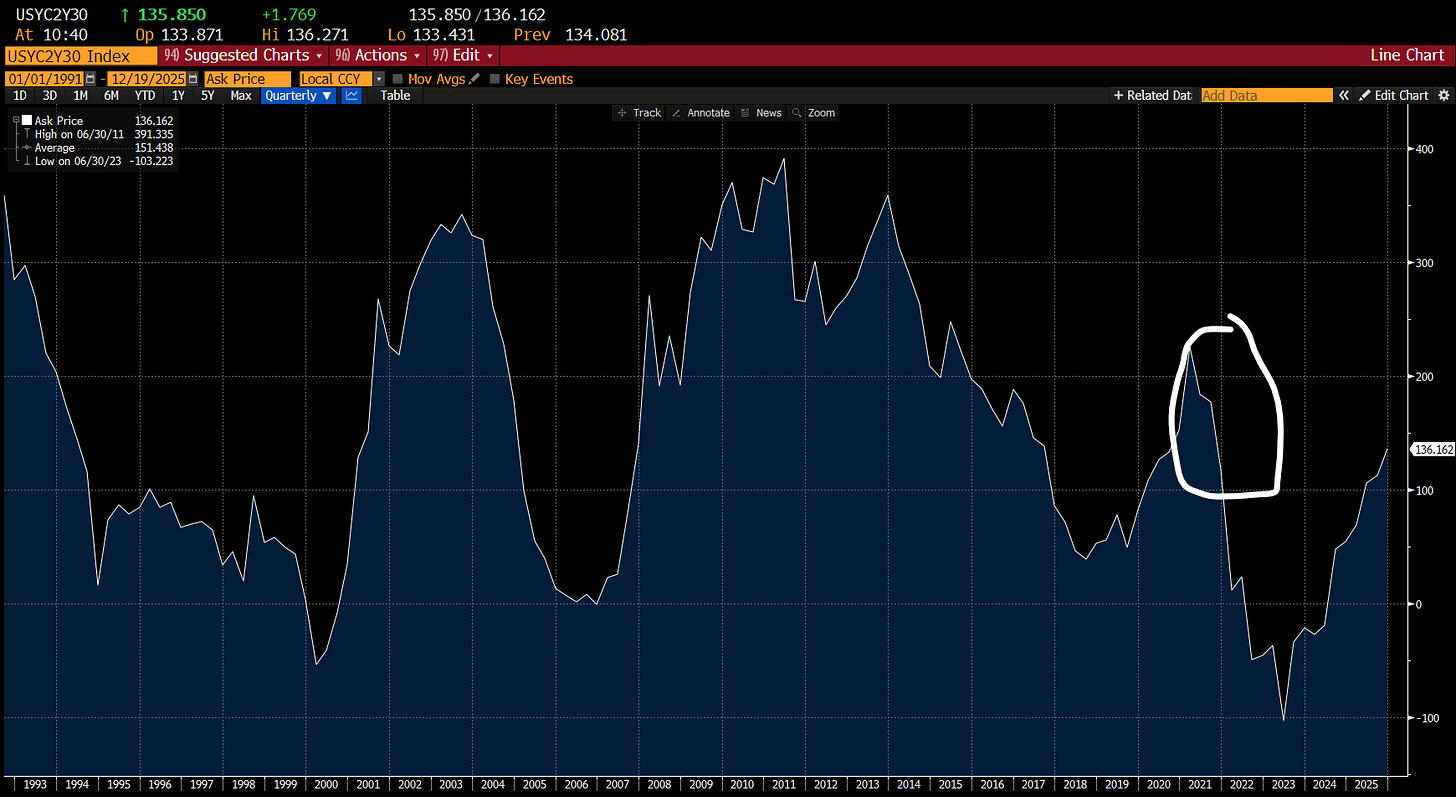

Generally speaking, investors would tend to get bullish as the Fed cut rates, and the yield curve steepened, as it happening today. Below is the 2/30 curve, which sent bearish signals in 1999 and 2007.

I see things differently. For me, we were in a deflationary era, which is what the long bull market in bonds, and ever falling yields was telling us from 1980 to 2020. We are now in an era of rising yields, for political reasons that I have expounded on at length on this website, and for me most closely resembles the 1950s, 1960s and 1970s. In this era, the time to get bearish was not after the Fed raised rates, but after the Fed had cut rates. Why? Well the long term bonds are telling you interest rates are going higher, and the time of peak bullishness is when Fed Fund rate is too low compared to long term yields. In essence, the Fed (and most other central banks) have their forecasts on interest rates and inflation completely wrong, and the bond market is correct. At the old age of 51, I would take the bond market over the Fed forecast every day of the week, and twice on Sunday. The time to get bearish is not when the Fed is TOO HAWKISH, the time to get bearish is when the Fed is TOO DOVISH.

I prefer looking at the 30 year Treasury, as it is far less influenced by the Fed. 2022 was the last big down year for equities. That was preceded by a heavy steepening in the curve.

Whenever I do anything, I like to commit to it. And it does seem like time to commit. I am also encourage by too other market signals. Japanese 30 year bond yield is at new cycle highs. And the BOJ plans to raise rates, while the Fed is talking of cutting - very odd.

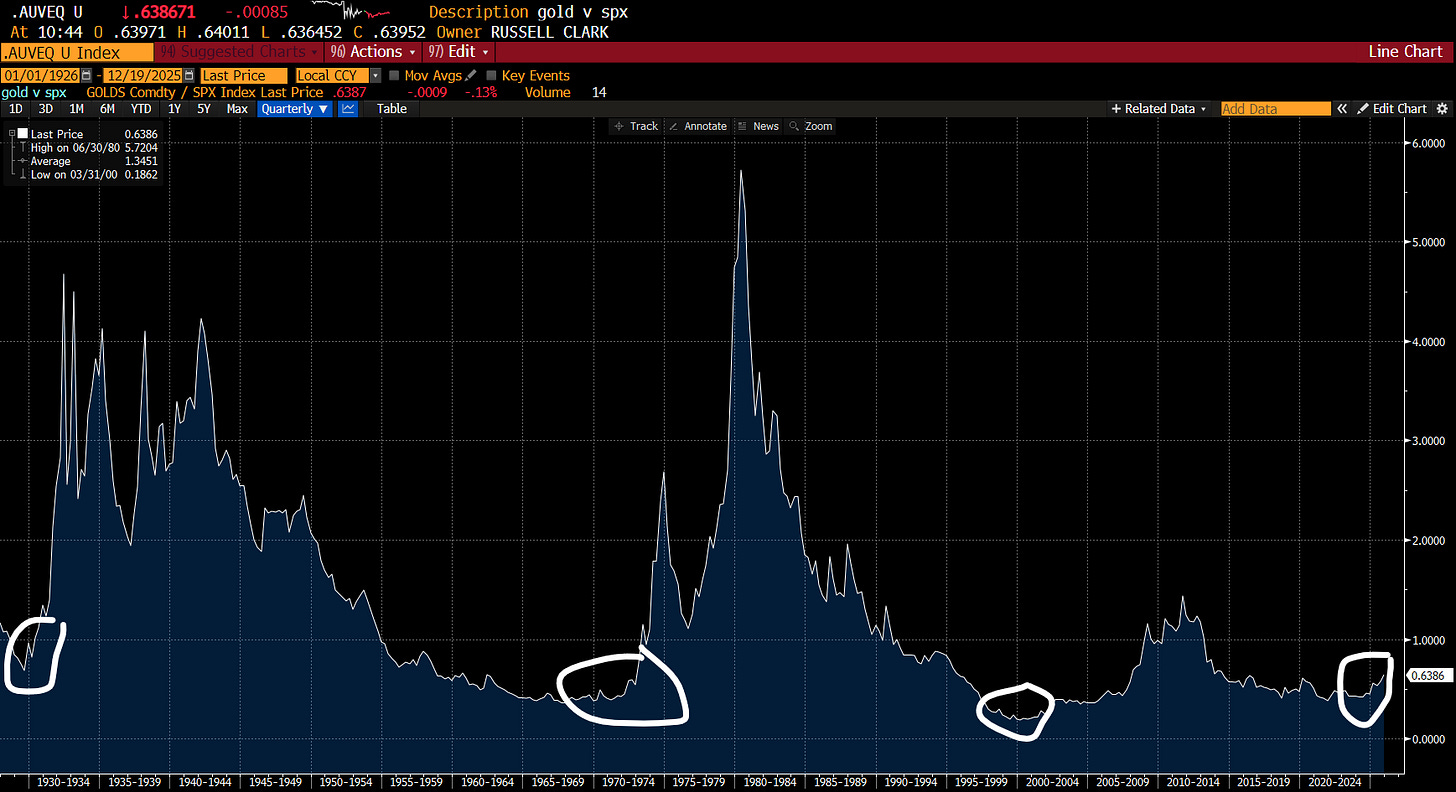

Also gold has touched a new high versus the S&P 500. This tends to be a bearish signal.

Finally, I have been doing this job a long time. I think people are coming around to my way of thinking, but they won’t really believe it until they see it. My job is to believe before seeing. I believe, and I have the short book in place. Now its time for us all to see - one way or another. My next few posts will be more thought pieces than market pieces, I hope you enjoy. Season Greetings to you all.