I hate making money from being long gold. When I was bearish China back in the day, and running net short, a lot of my investors were also long gold. I told them it was a bad idea, but they held on to their gold and gold miners and got smoked. They were not quite Smeagol/Gollum - but they were close. Here I am “Smeagolling” my way to making money. I have been long gold as part of a pair trade of short US treasuries for years - the basic driver being that the Chinese/Indians/Brazilians etc would never by a US treasury for their foreign currency reserves again, and crypto was still untouchable, which only left gold. Of course, if the US got serious about monetary policy (like putting interest rates to 7% or so), then gold would suffer, so I have been long gold, short long dated treasuries. It has been good.

I am often asked about the other precious metals, and I would say, I don’t know if central banks are buying silver/platinum etc - so I would rather stick to gold. The problem is that as the chart above shows, we have moved a long way now. Are we done? Are we all Gollum grasping at gold ring as we fall into the lava of Mount Doom? Well lets start with the bearish parts first. Total ETF holdings are back to relatively high levels. Being long gold from 2022 to 2024, falling ETF holdings offered a lot of comfort. No more.

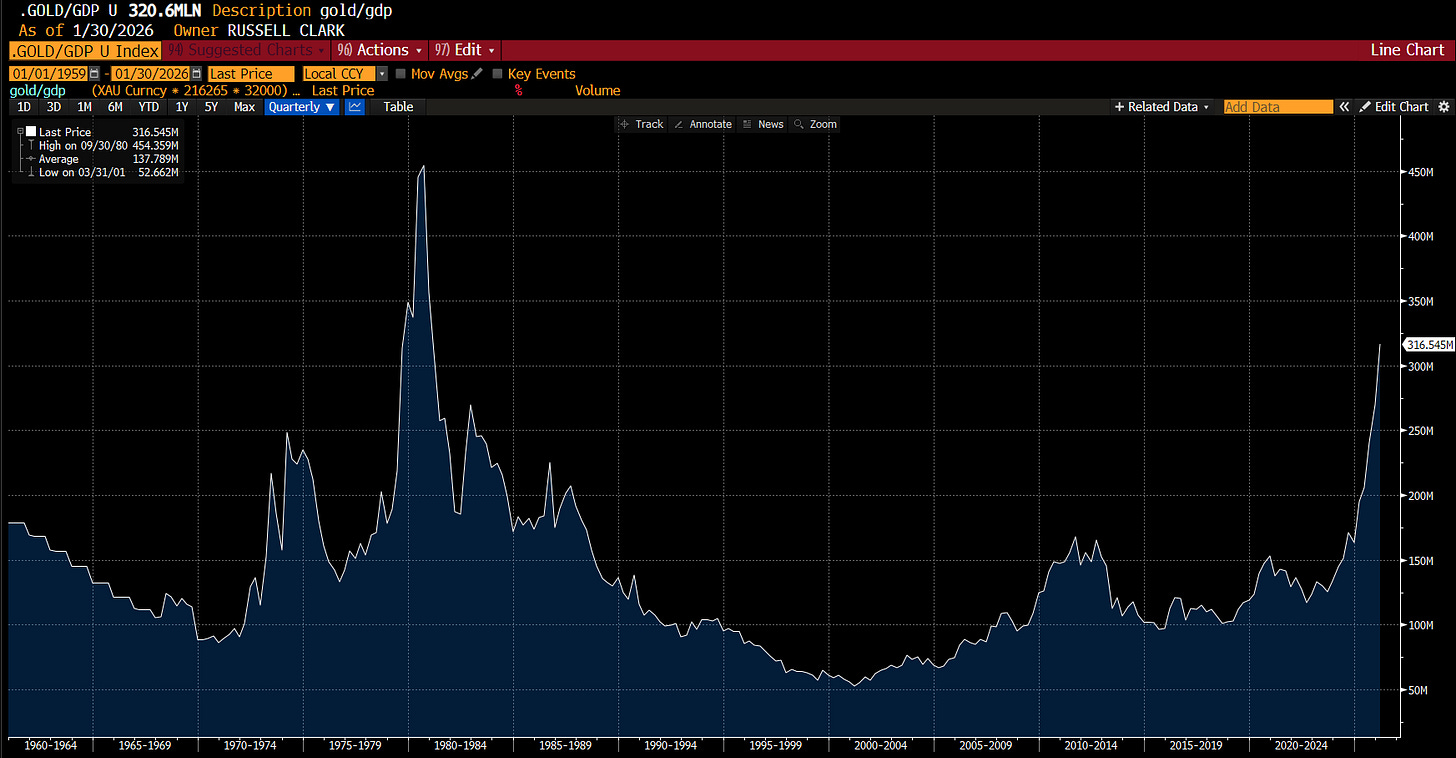

Surging gold has pushed the market capitalisation of gold to USD 35 trillion. As gold supply does not increase that much - this is just telling you the price has moved a long way.

We can normalise this to GDP, as we start getting into a scarier chart.

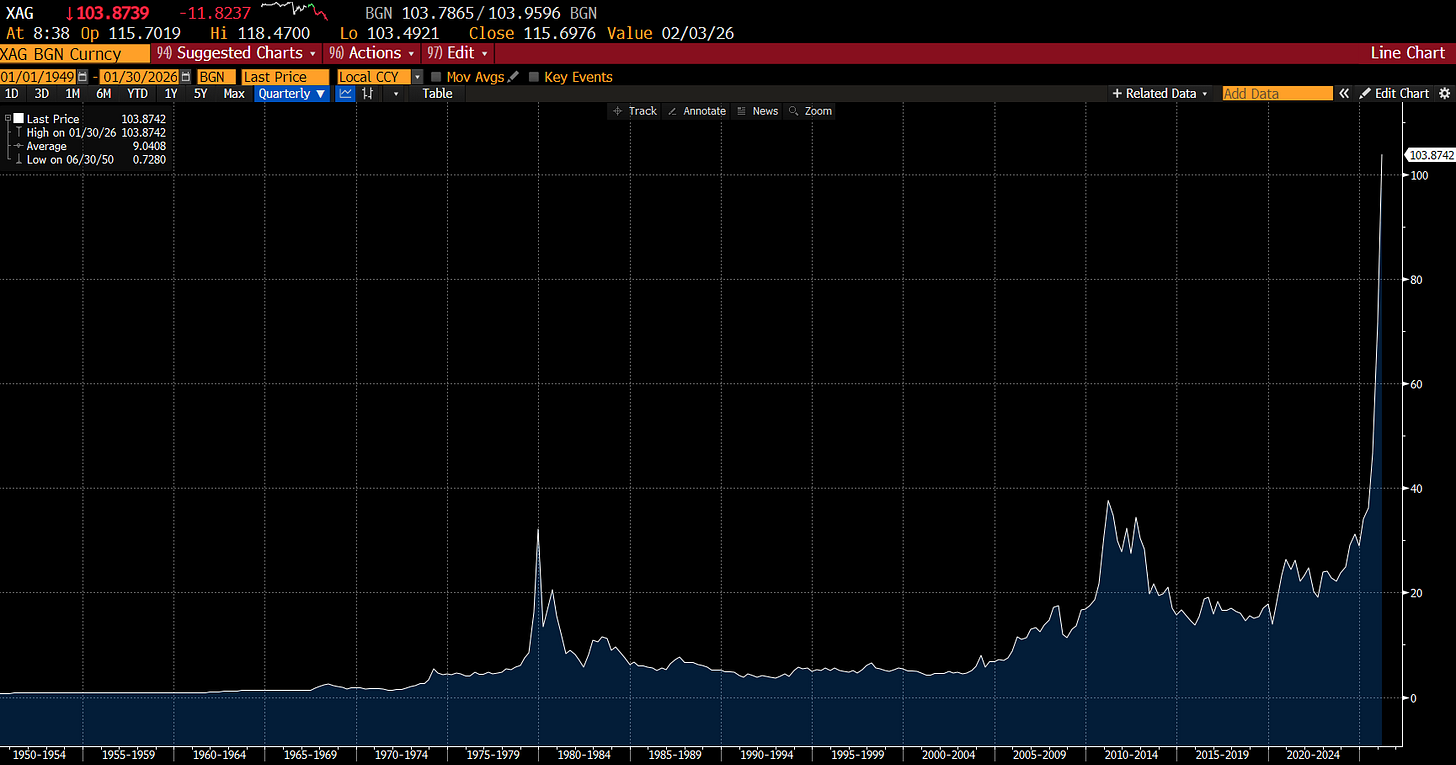

Adding to the unease is that silver, which is equivalent of golds sleazier young brother is cashing in on the boom. When silver has spiked, we are near the end historically.

Finally, we have gold dedicated funds and Substack writers doing victory laps - which is hubris inviting nemesis, if I have ever seen it. So these are all bad signs. What are the good signs then?