I have thought fast food restaurant chains were a short for a while now. Basically three reasons:

1 - Rising costs, particularly labour would put pressure on profitability.

2 - Rising interest rates would pressurise indebted franchisees, leading to profitability problems for the franchisors

3 - Ozempic and other weight loss drugs were reducing demand from “big eaters”.

I am still bearish on fast food chains, but I happened to come across this note by Brevarthan Research on UK listed Dominos and Greggs. Its a good note, so I am now recommending his substack, and have become a paid subscriber. Both stocks have been poor over the last year or so. I am not short them as they are popular shorts. I could go into my history of popular shorts, but it still too early in the morning for me to recount short squeezes like Volkswagen in 2008. Just to say, popular shorts often work, but when they don’t, the really don’t work. So I avoid them.

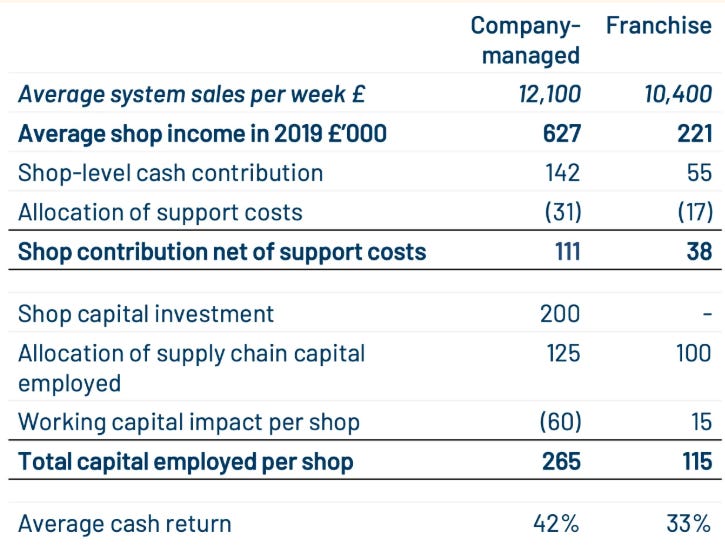

I happen to quite like Greggs as a chain. Unlike other chains like KFC or McDonalds, Greggs is still very affordable. Stealing shamelessly from his post, he shows the profitability split on franchised versus owned stores.

If you look at the above, the franchisees has to invest these days around £260k to own a Greggs franchise. In 2019, a 10 year UK gilt yield 1%, today they yield 5%. In other words, the interest cost of being a franchisee has risen dramtically.

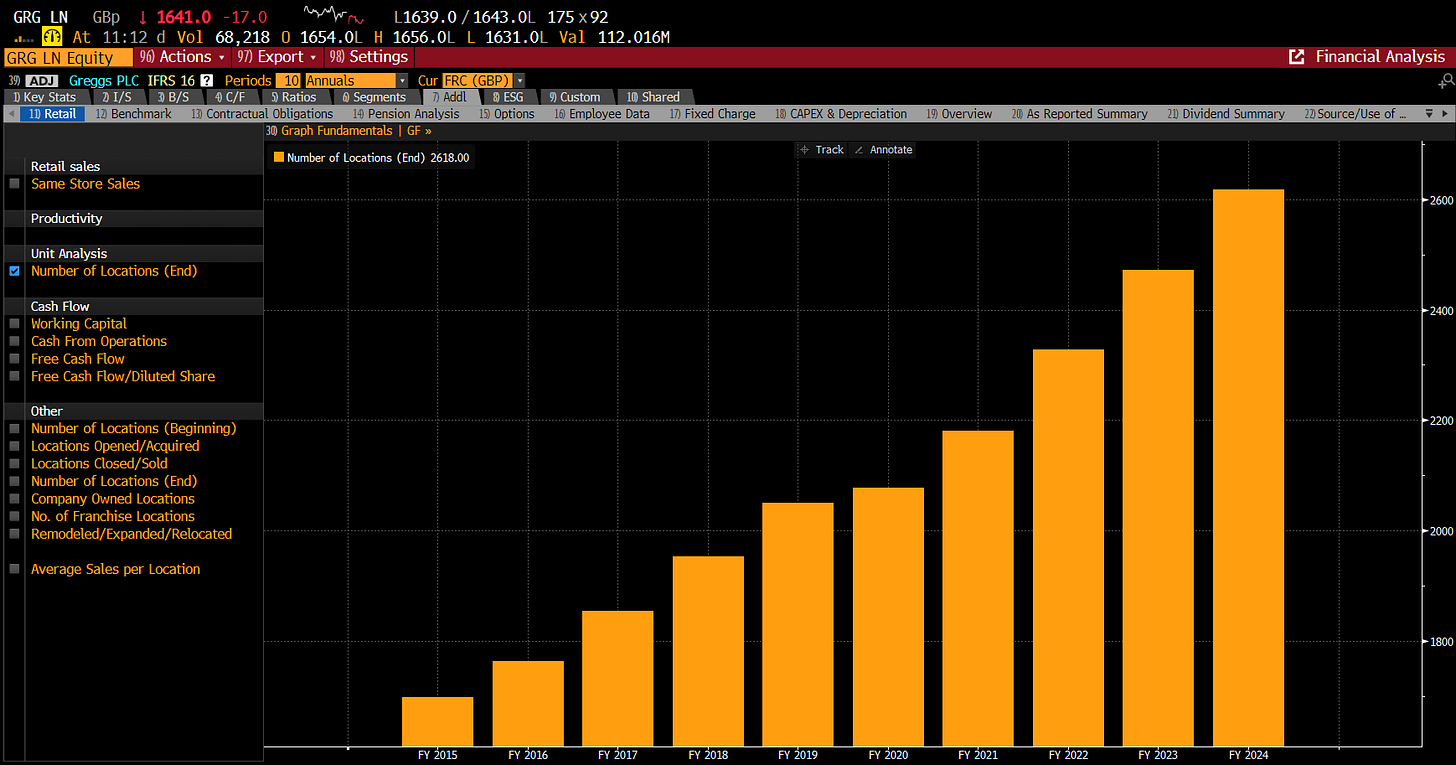

Greggs is still growing its store base, but as can be seen above, the market is not sure this is profitable growth.

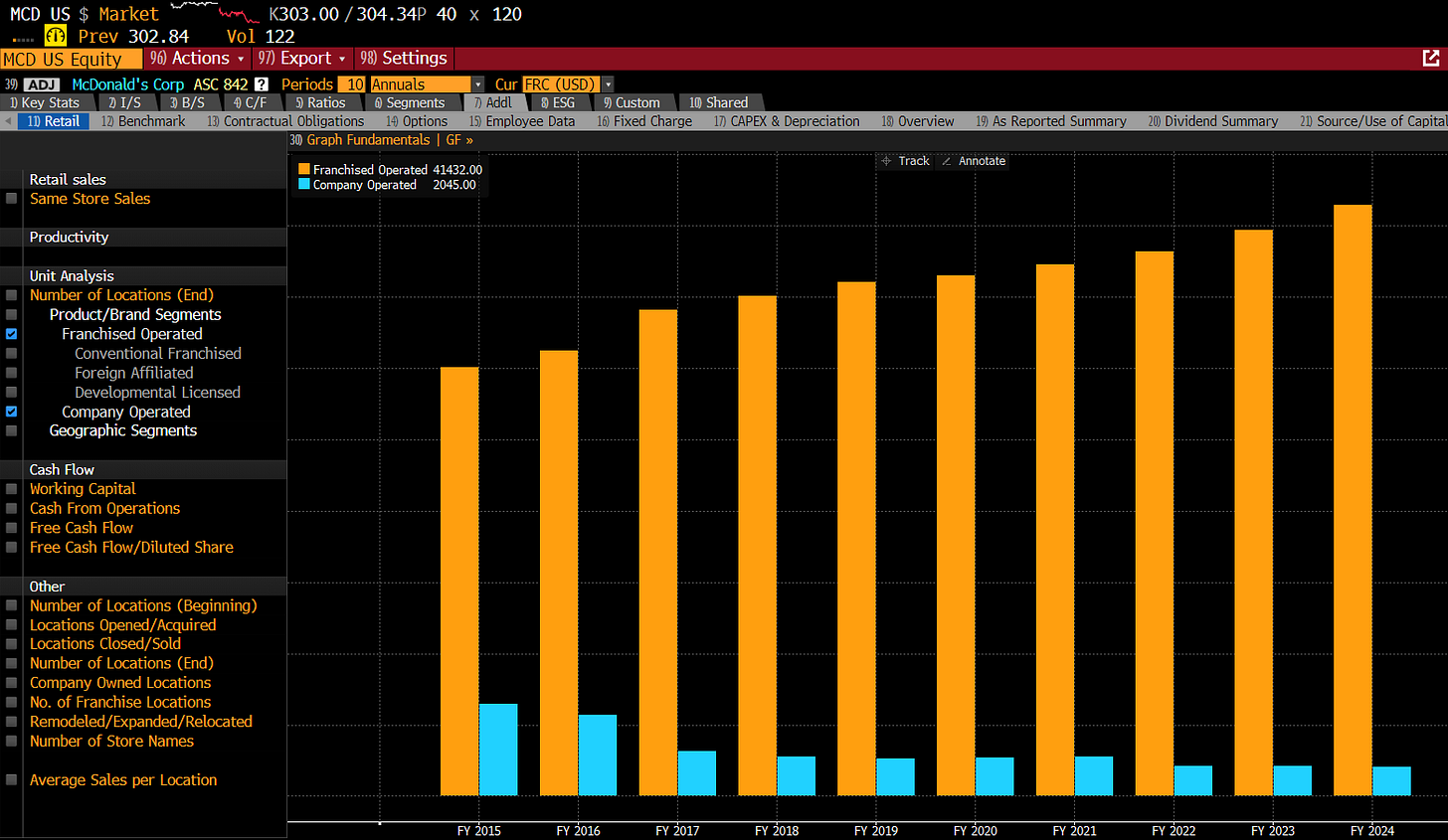

McDonalds and other big chains have realised that running a restaurant these days is just not that profitable, so have been dumping restaurants on franchisees as quickly as they can.

Big restaurant chains remind of me US banks in 2007. Selling a product to investors that is probably not going to make money. So far, with employment holding up, for the big chains, everything is just about holding together, but if a recession does hit, I suspect a lot of franchisees to go to the wall. Junk food business indeed.