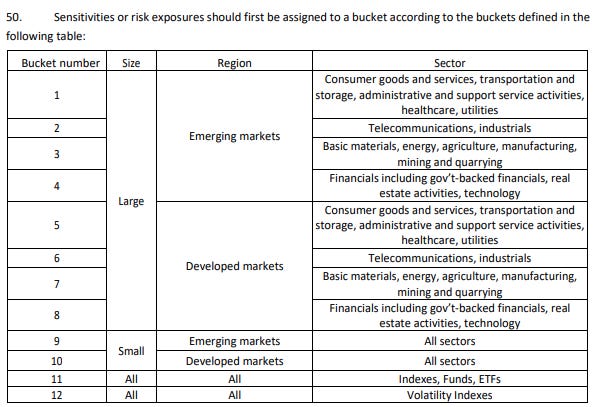

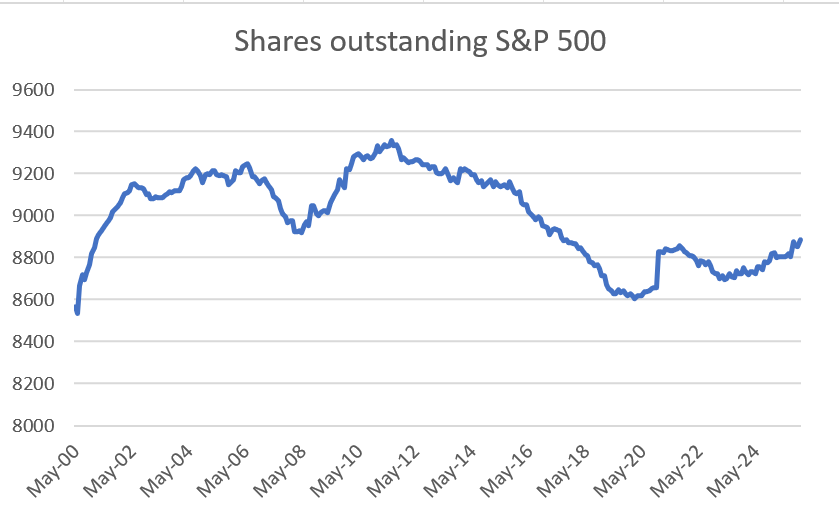

Passive investing gets a lot of heat. The Economist has a recent article talking about the potentially distorting features of passive investing. I also know that Michael W. Green has written about the problems with passive on multiple occasions. Don’t get me wrong, I think there are some big problem with index and passive investing. One of them fits in with my personal “bete noire” of clearinghouses. ISDA-SIMM set out model risk weightings for equities as priced by clearinghouses. Indexes (sic), Funds and ETFs have a weighting of 17, nearly half the weighting of an individual stock. This naturally drives financial firms to passive investing over individual stock investing, and creates a distortion bias.

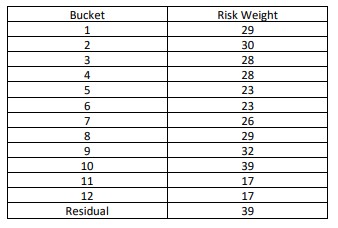

But this just tells me clearinghouses are bad at pricing risk - which I already knew, and which has been proven over and over again. The real criticism levelled against passive is that is causes markets to be mispriced. On many measure, US equities do look overpriced. Take this one which I like which compares S&P 500 dividend yield to JGB yields.

Or US net worth to GDP, which has broken well above its long term trend.

Part of the criticism of passive comes from active managers who are looking for someone to blame for their underperformance. Implicitly they are saying current pricing is crazy, and its been driven by flows to passive. If market was priced by active managers, then it would be much more reasonable. Maybe this is true, but maybe not.

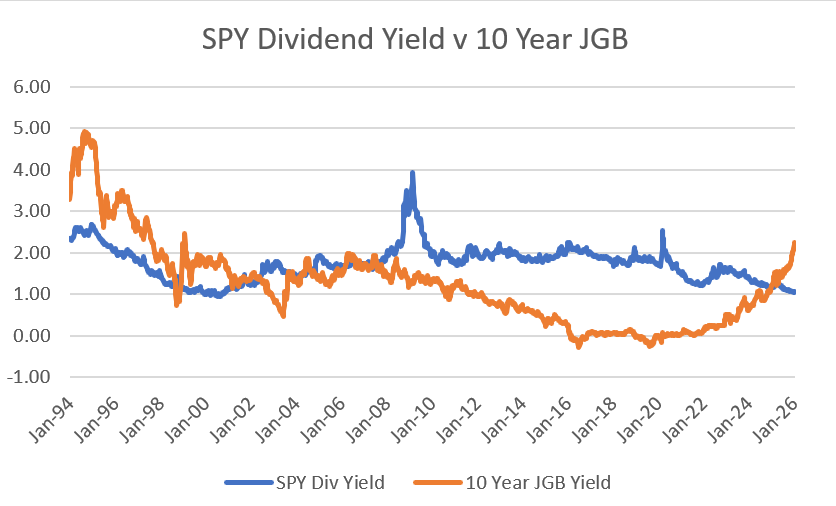

From my perspective, what has really changed in share buy backs. Back in the 2000s, when stocks were expensive, corporates were incentivised to sell shares, and did so with abandon. But over the last 15 years or so, the share count of the S&P 500 has fallen, even as the market has become expensive.

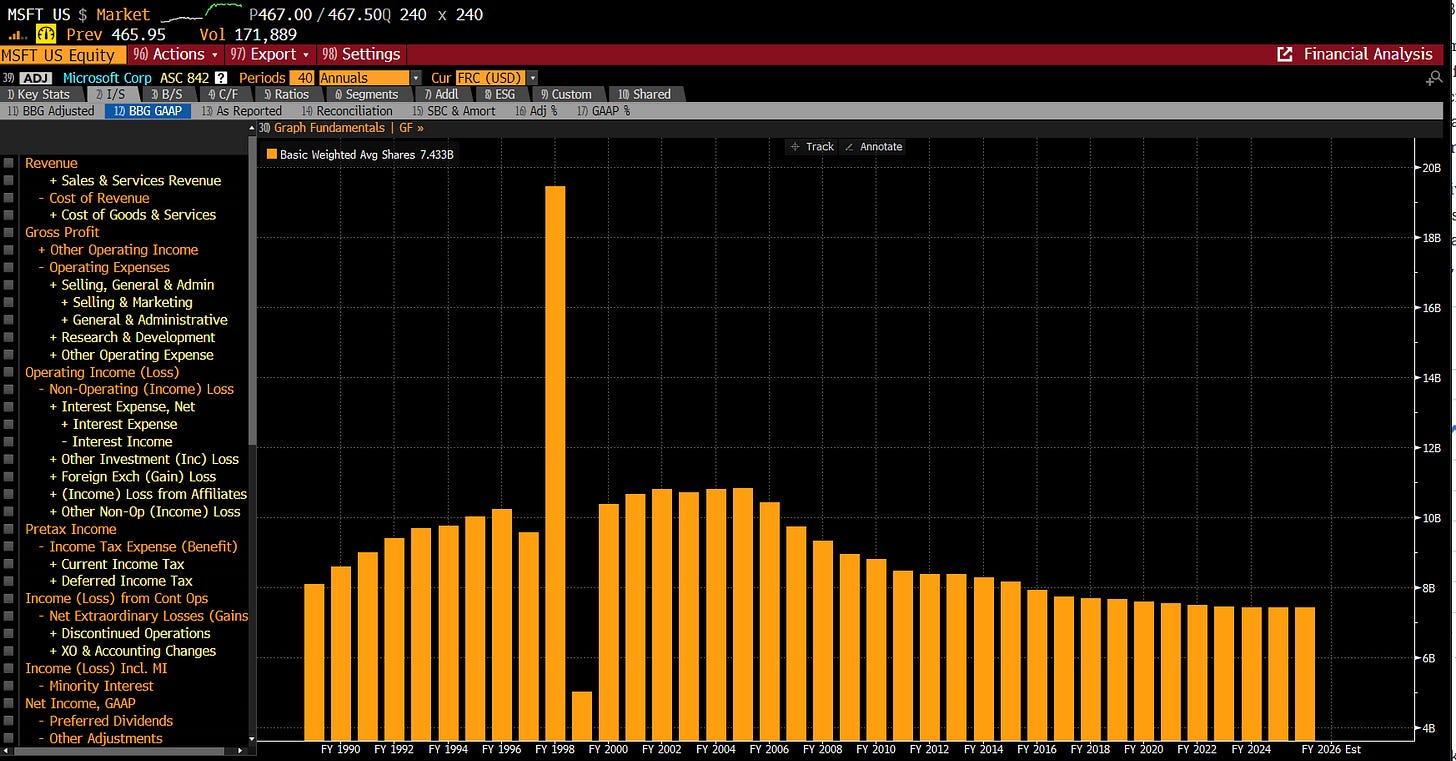

A good single stock example is Microsoft. A leading stock in the dot com bubble, and a leading stock today. If we look at shares outstanding (ignore the volatility in 1998/9) the trend is clear - issuing shares until 2007, and buying them back since.

Using EV/Sales, you should not be surprised to see that Microsoft’s valuation has moved higher in recent years.

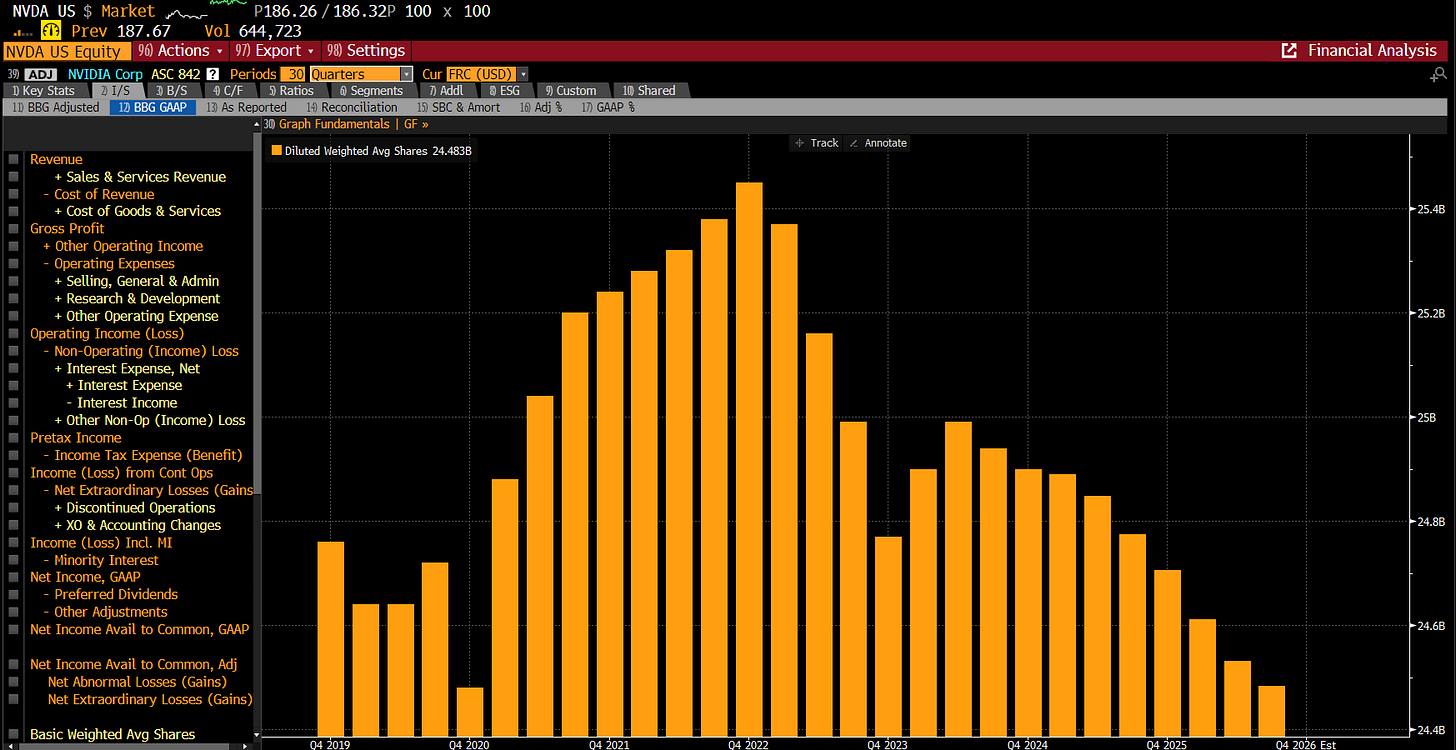

Nvidia also buys back shares

What I am saying is the reaction function of corporates has changed, and so have valuations. If Microsoft and Nvidia as willing to buy back share at valuations of 10 times EV/Sales or more, then until there is some event that destroys the cashflow to these businesses, why would they rerate lower? In my view, the rise of passive is due to passive naturally remaining fully invested in the biggest and best businesses, something most active managers struggle to do (active implies activity). The risk to passive is the same risk that all investors face, a shock like the GFC or Covid destroying cashflow, and forcing share buybacks to turn into share issuance. But in a world of fiscal dominance, how likely is that? The bigger risk to passive investors is a change in regulations or taxation. We saw this in China with its tech companies, and the stocks derated massively.

For me, in the world we have lived in for the last few years, passive has been a very effective investing strategy. If you believe that politics, industry policy and tax policy won’t change, then passive will remain effective. My view is that all of these things will change - but passive investing is not the bad guy here.