I have dabbled in Bitcoin. When Donald Trump was reelected, I purchase some IBIT, which did okay, but I was a bit late to the trade as my custodian made me wait a day or two. Compared to both equities and gold, Bitcoin has disappointed this year.

Why is this? I used to have theory that you should watch Tether market cap to see if liquidity was coming into or out of the crypto space to drive bullishness of bearishness on crypto. Tether market cap continues to surge.

I have been surprised by this surge to be honest. Tether pays no interest, nor does it offer capital appreciation. Why leave your money in Tether when interest rates are not zero? Perhaps its capital controls, or perhaps people leave money in tether when bearish on crypto? I don’t know, but I find it odd. As we can see from gold and silver, people are happy so speculate on zero yielding assets, so what is wrong with Bitcoin? Well I saw an interesting article in the FT postulating that Bitcoin treasury companies like Strategy (aka Microstrategy), were actually incentivise to issue stock to buy Bitcoin, as their market caps traded above NAV. Generally speaking, Strategy Market Capitalisation has been above it NAV, until recently.

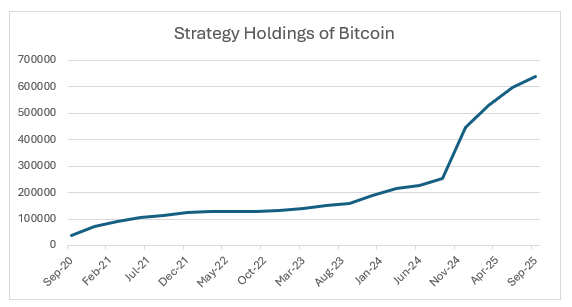

And it has been increasing its stash of Bitcoin dramatically.

And we have seen a huge increase in the issue of shares from Strategy.

If you are mindlessly bullish, there is no problem here. You would think the market was rewarding the vision of Michael Saylor with a superior market cap, and he took full advantage. Personally, I think its a variation of the CDO trade we saw from the Big Short. Big hedge fund wanted to short CDOs, so CDOs needed to be created to be shorted. Bearishness created its own demand. Investors were bearish on Strategy, so short interest as share of outstanding surged from 2021 to 2024. I do not short popular shorts, because when a hedge fund shorts a stock, it is locking up those shares. They can not be sold, until they are bought back. Bearishness on Strategy, probably drove its premium to NAV, which in turn drove its purchases of Bitcoin - market circularity at its fineness.

There are a number of Bitcoin treasury companies - one of the most interesting is Japanese listed Metaplanet Inc. It apparently holds 30,000 Bitcoin.

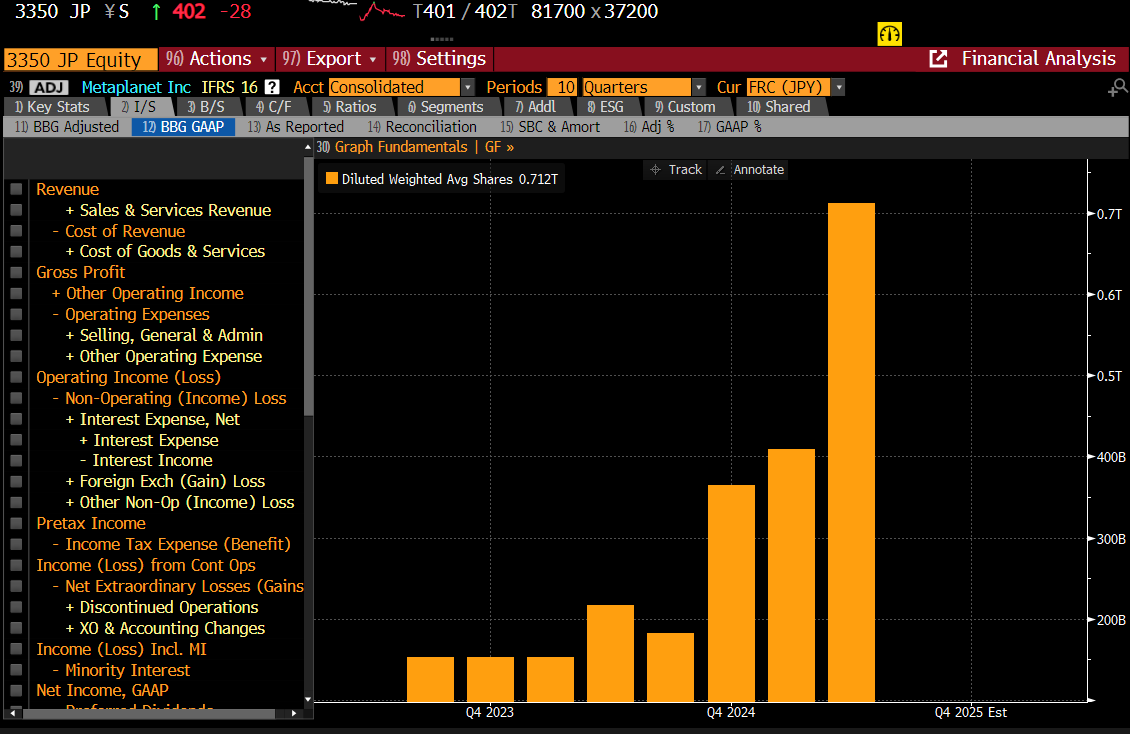

Like Strategy it was keen on issuing equity.

It currently has an EV of 3.2bn USD, which matches its NAV of its Bitcoin holding. That is the market is not incentivising buying of Bitcoin anymore, at least not through the issuing of equity at least.

The other negative for Bitcoin has been the success of the Ishares Bitcoin ETF. Shares outstanding have surged. It would have similar holding of Bitcoin to Strategy.

The problem with ETFs, is that unlike Strategy or MetaPlanet, they can also see redemptions that make them sell Bitcoin. I have always been a bit cautious of ETFs with surging shares outstanding. Even if the underlying story is good, you are at risk of profit taking, which can then spiral into a much large sell off.

So what is wrong with Bitcoin? Positioning has become long, as has positioning in Bitcoin treasury stocks. There is no “structural” buying be central banks either (not yet anyway). As mentioned in other posts, China’s surging trade surplus probably drives gold buying, just at Strategy premium to NAV drove Bitcoin buying. Weirdly, Bitcoin needs the market to get bearish again before it can move.