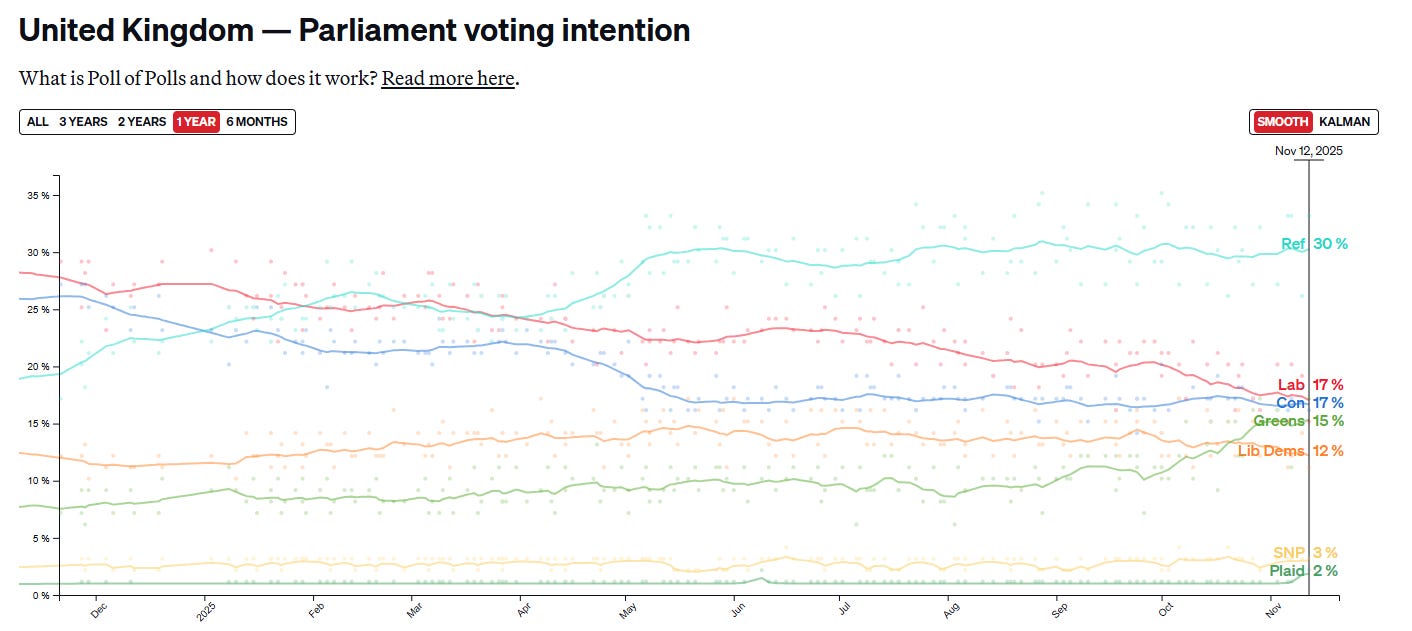

Long time readers will know that I have become more closely focuses on politics - as that is where I think markets are constantly getting surprised. For me, politics is relentless shifting to the left. In the UK, Nigel Farage’s Reform party is outpolling Margaret Thatcher’s Conservatives (and outpolling the Labour party as well)

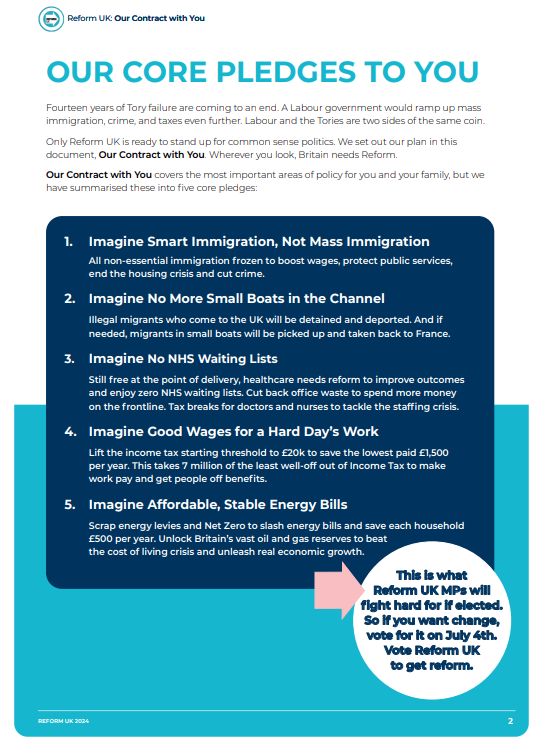

I see their core pledges in the most recent manifesto as pro labour - but then again all politicians make promises to help everyone.

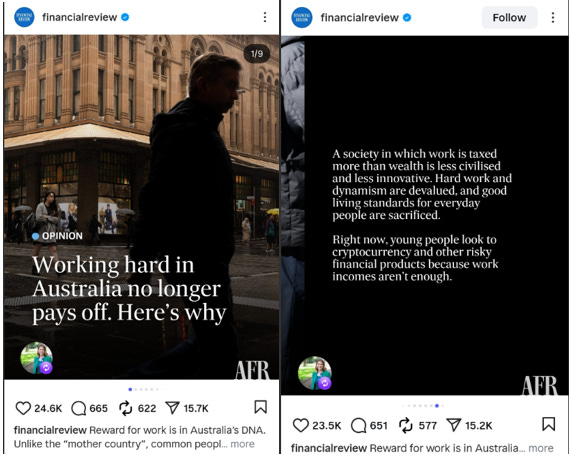

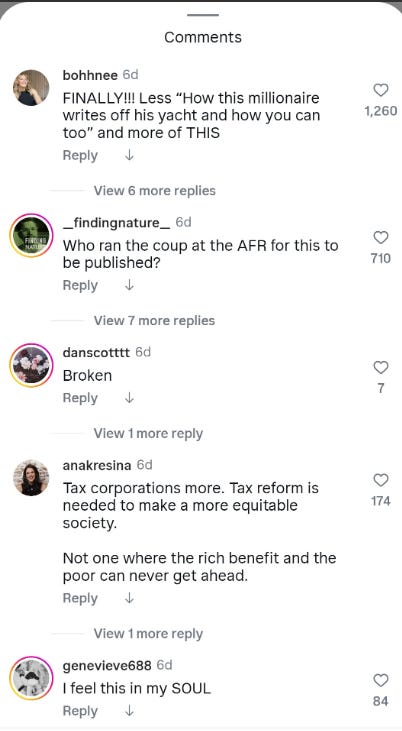

But I was scrolling Instagram the other day, and was shocked to see these posts from the Australian Financial Review (AFR), which is the Australian version of the Financial Times or the Wall Street Journal. Its commentary could have been lifted directly from the New Socialist.

I was so surprised, I wondered if it was a scam, but as far as I can tell its legitimate, and also by far the most viewed post I can see from them. The comments are as you would expect were expressing agreement and surprise this was published.

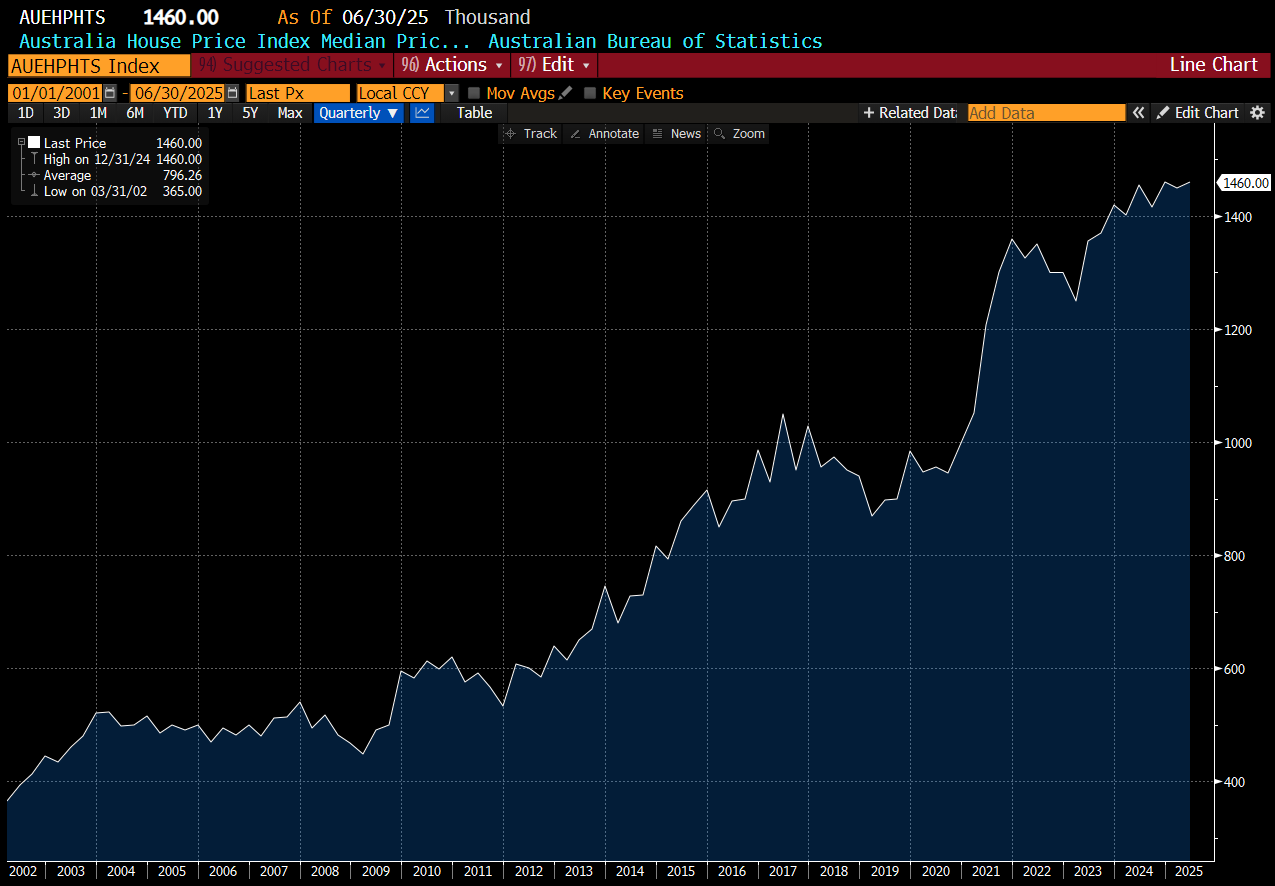

Where politics has gone wrong, is that they have focused on raising nominal wages, but not real wages, or at least not yet. Raising real wages would require asset owners and companies to accept below inflation increases. This has happened in some parts of the markets, but not yet, and particularly in housing. Sydney house prices remain extremely elevated.

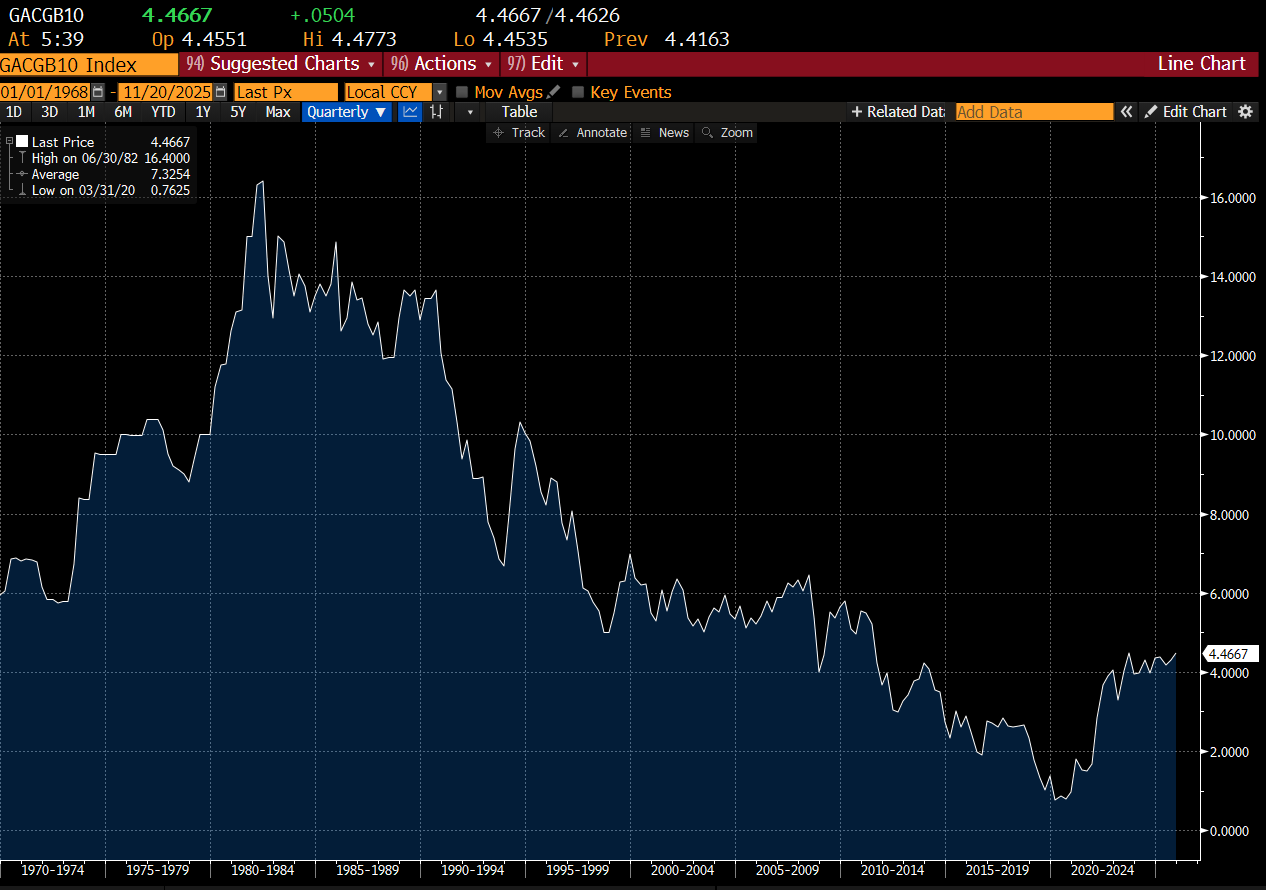

Higher taxation and higher interest rates should help with this. Australian 10 year bonds have much more to rise in my view.

Also like in the UK, in Australia an anti-immigration party, One Nation, is also surging in the polls. Many of its policies are similar to Reform UK. The question all voters are asking, how can we have record asset prices, but no money to fund the NHS, or better wages? The answer is that politically parties are afraid to take on corporations and asset owners, as they fear they will move away, or cut investment or a number of other things. But what voters want, voters get. I still expect much higher bond yields.