I have the trade GLD/TLT as I think we are heading for a rerun of the 1970s. We are getting there. It was a trade that implied that if the US did not run serious monetary policy, then gold would soar. I guess we have our answer.

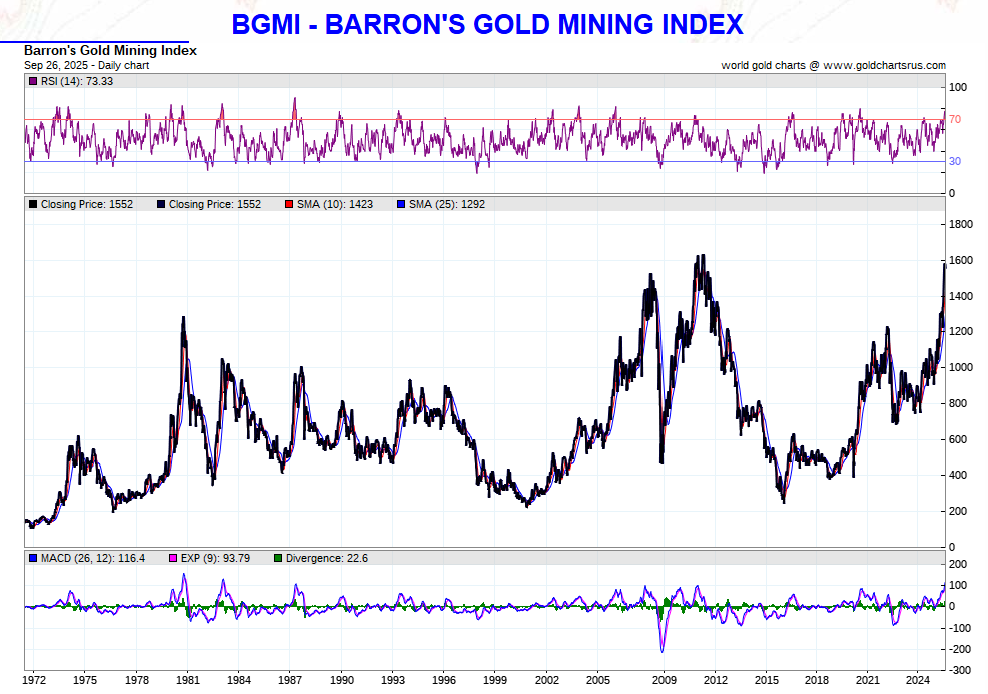

I did express a very negative view on gold miners in my last post. Mainly because in my investing experience, they have been capital destructive enterprises on an epic scale, and they tend to attract poor quality investors. But my investing time frame is based on 1990s onwards, a period when gold has been relatively poor. Trying to find a chart of long term performance, I found the Barron’s Gold Mining Index. Performance was good in the 1970s, especially on a relative basis, although the mid 1970s sell off was chunky.

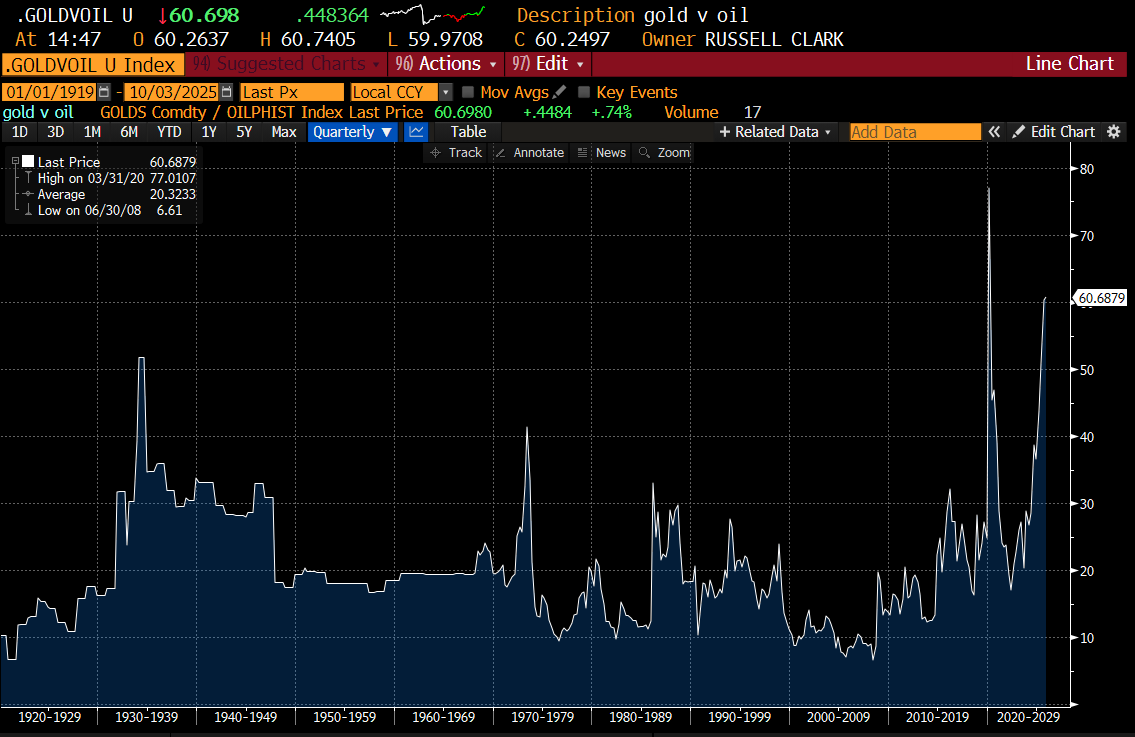

But at that time, gold was rising with rapidly rising energy prices. This time, gold is rising independently of energy prices. Gold versus oil ratio is breaking new highs, unlike the late 1970s.

If gold is being driven by the end of the treasury as a reserve asset (and it does look that way), then gold miners may well keep doing well. Semiconductor industry used to be seen as cyclical and dangerous, but has rerated as the have come to be seen as strategic assets, perhaps gold miners are the same. I will keep an open mind on gold miners.