The crappy bank trade has been pretty good for investors. I like it as well as it fits in with my view of a world that is turning pro-labour. This should push up the cost of capital, and benefit banks with large deposit franchises. Generally speaking crappy banks have been centred in countries with weak property markets, and low interest rates, Japan and Germany are probably the stand out markets here. Some banks have been crappy for so long, they attract nicknames. German lender, Commerzbank, has long been known as Comedybank. In the long deflationary funk after the Eurocrisis, I went back to the well many times to short Comedybank, but since 2020, it is up 1000%.

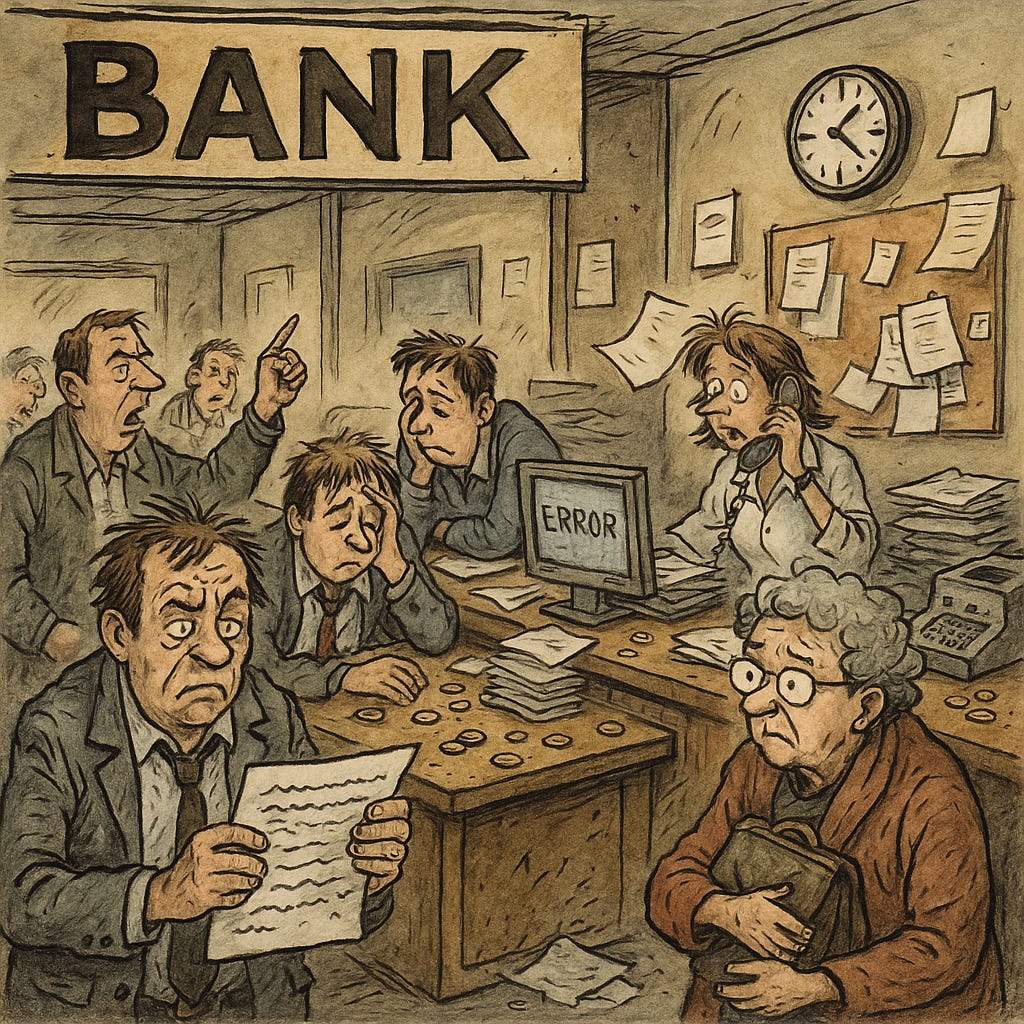

The macro problems with German and Japanese banks was that yields on government debt fell so much after the GFC, it was hard to make money. Movements in 30 year German bunds have pretty much decided where crappy banks like Comedy Bank will trade.

Japanese banks were also a byword for crappy banks, but have also been good places to be in recent years.

Like Comedybank, I would need to see lower JGB yields to be convinced the crappy bank trade is over.

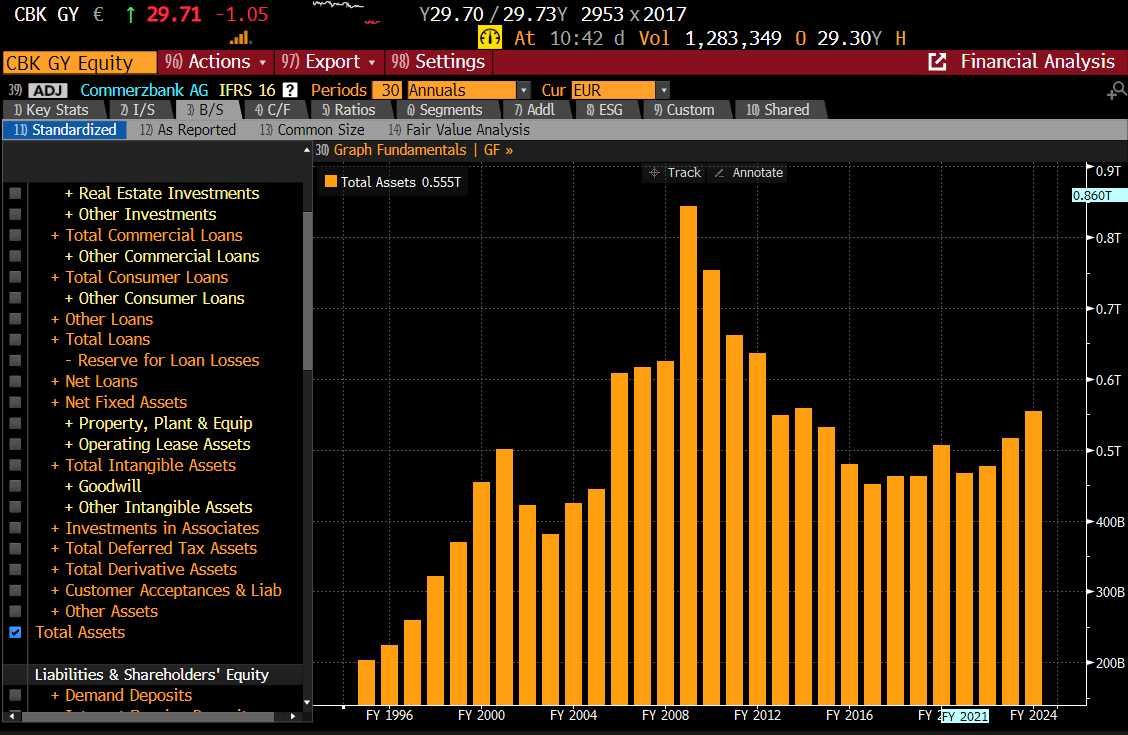

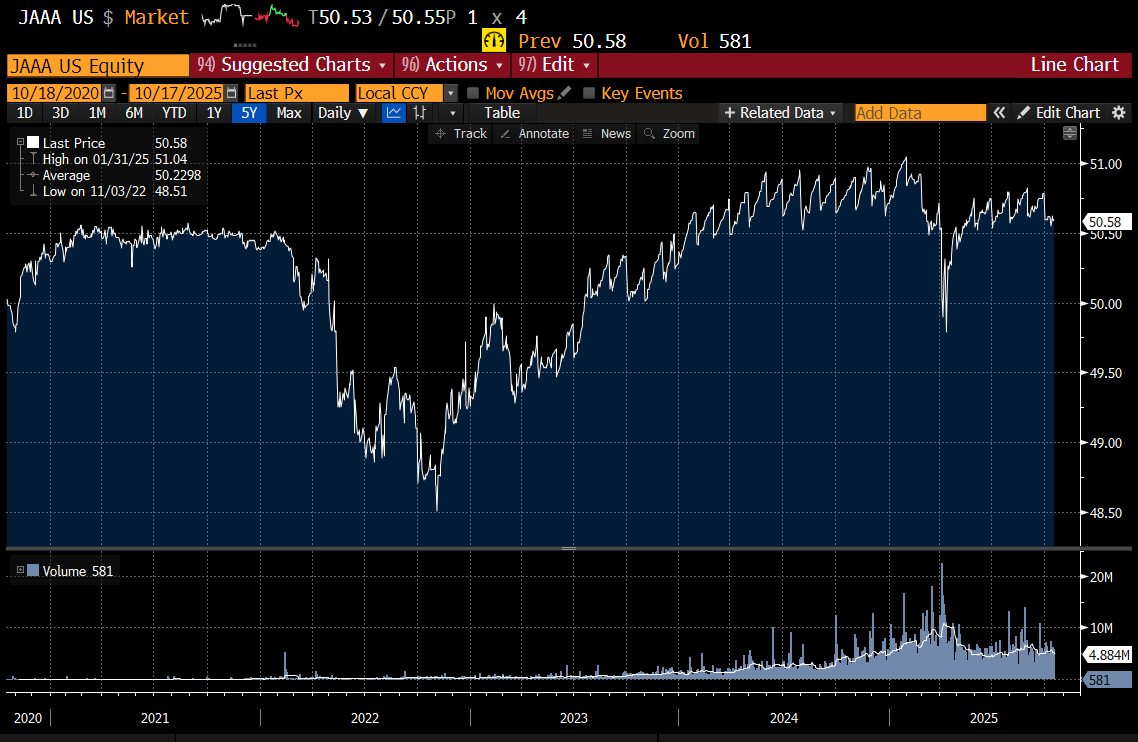

What is spooking the market is signs of fraud in the commercial lending market. If I had to guess, the collateralised loan market, and the private credit market has grown a lot recently, and we are starting to see the fruits of lack of discipline on the lending side come through. The Janus Henderson BBB CLO ETF does not look a happy place.

As someone who has shorted a lot of banks, when a lending cycle goes wrong, it is the banks that grew the balance sheet the most that are going to see the most problems. Comedybank is not a great bank, but they have not been growing their balance sheet that much.

Where the problems are going to be are far more likely in private equity/private credit space. AUM in these areas are up 1000% from the GFC.

As far as I can see, there is a question mark over CLOs and Private Credit, which should impact this area, and it should give cover to central banks like the Federal Reserve to cut interest rates. But will turn into a full blown credit crisis? If oil prices were spiking, then I would be worried, but with oil at new lows, I reckon things will be okay.

The big issue is whether these cases are isolated frauds, or huge systemic issues. By systemic, I would mean the AAA tranches of CLOs were also zeros. So far that is not seemingly the case. The Janus Henderson AAA CLO ETF has held up well so far.

I can see markets selling off from here, as they have had a fantastic run. But an end to an inflation cycle? And the end of the pro-labour cycle? Seems unlikely to me. More likely interest rate cuts embolden politicians to spend. The (voting) public are not ready for an austerity cycle again.