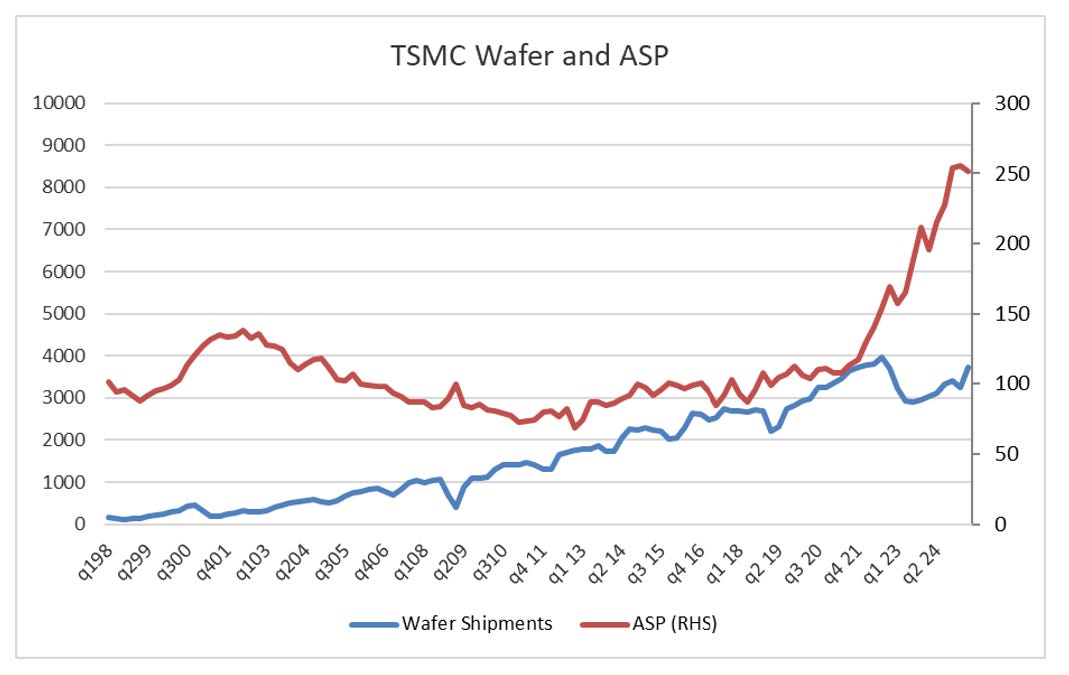

Bobby Molavi from GS reckons that 56% of the S&P 500 is now tech or tech related. I have no reason to disbelieve him. For me, the dot com boom, and now the AI boom are all about pricing. The closest thing I have to clear pricing trends is TSMC presentations on ASP, which are still rising as far as I can tell.

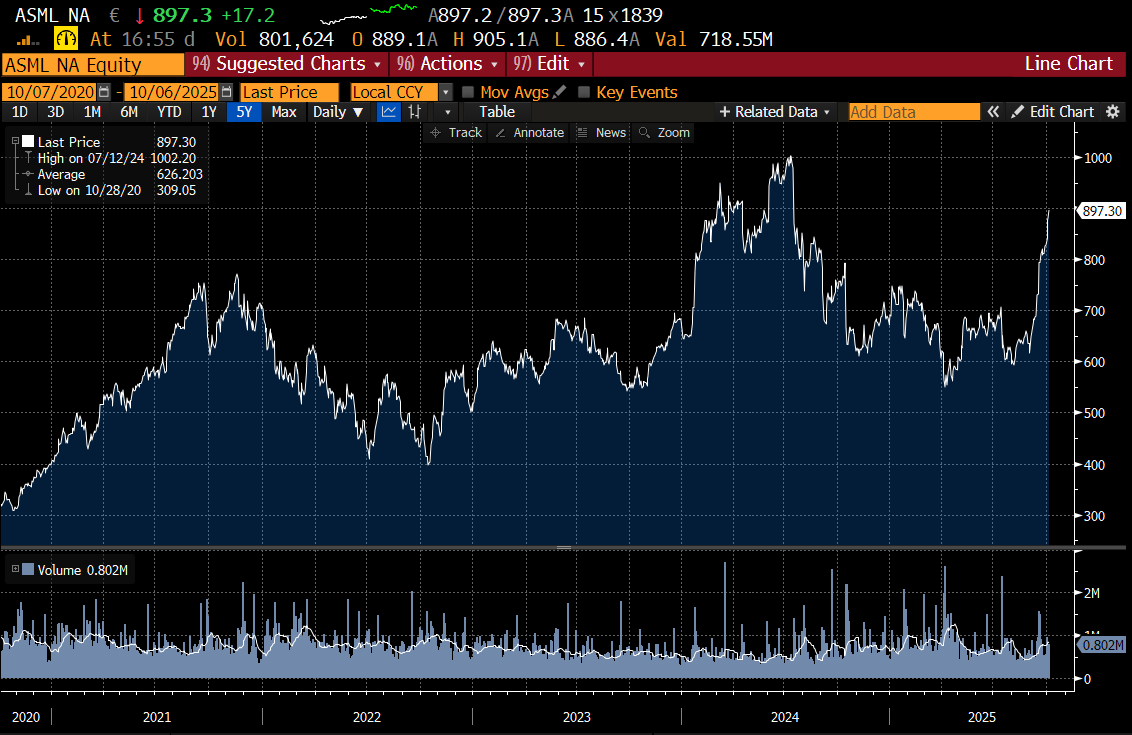

Bearish minded people will say that it will revert to weaker pricing, just as it did in 2001. I thought this was possible, as ASML, which is the key maker of equipment for TSMC, was lagging the market badly - a bearish sign I thought. But like many tech stocks this month, it has blasted higher on OpenAI deals.

I have always been cautious on tech stocks as it seemed to me technological changes can wipe out a company pretty quickly, but the market seems convinced todays winners will be tomorrow winners as well. To be fair Microsoft has been around for well over 40 years now, so maybe they are right. That being said, the share prices of quantum computing stocks are implying we are on the threshold of a technological advance. Logically this makes sense - as higher prices for semiconductor chips should motivate research in new areas. Rigetti is popular quantum stock.