One of the first things you learn in finance is that VIX is a fear index. When VIX is going up, then markets should be going down. But a combination of AI and autocallables is turning the market on its head. The KOSPI 200 has surged recently, with the AI boom driving both SK Hynix and Samsung Electronics higher - both big constituents of the KOSPI 200.

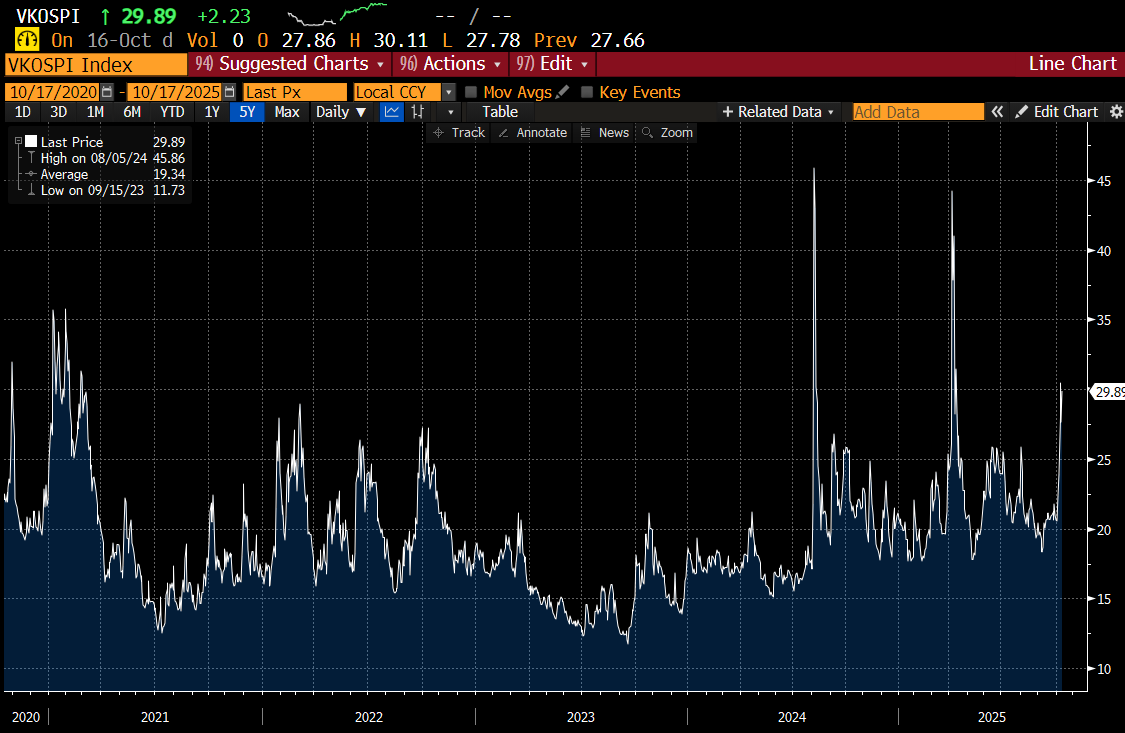

But we have also seen the KOSPI VIX surge in recent days, with values only seen recently during large sell offs.

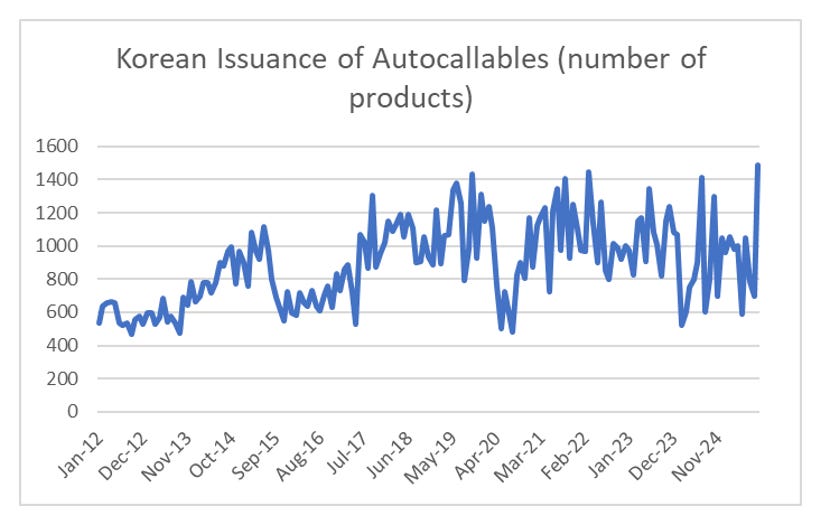

What gives? Well Koreans love autocallables, and last month saw record issuance. As a reminder, an autocallable is selling volatility to generate yield. A large issuance, should depress VIX.

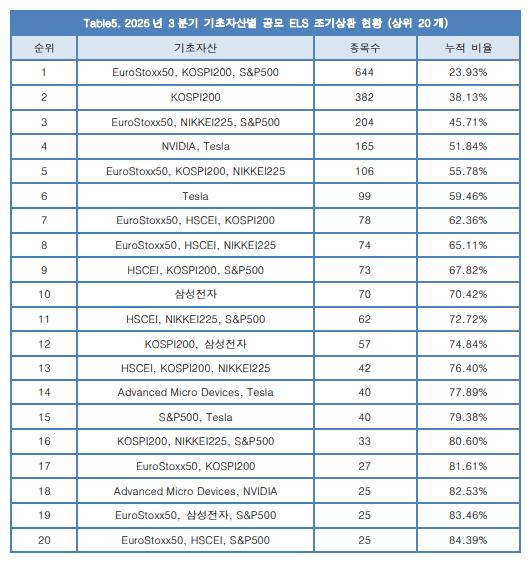

KOSPI 200 as are the Euro Stoxx, the Nikkei, S&P 500, Tesla and Nvidia are all popular products. The higher the implied volatility, the higher the yield. A full list of popular underlying is below. The Korean below is for Samsung Electronics.

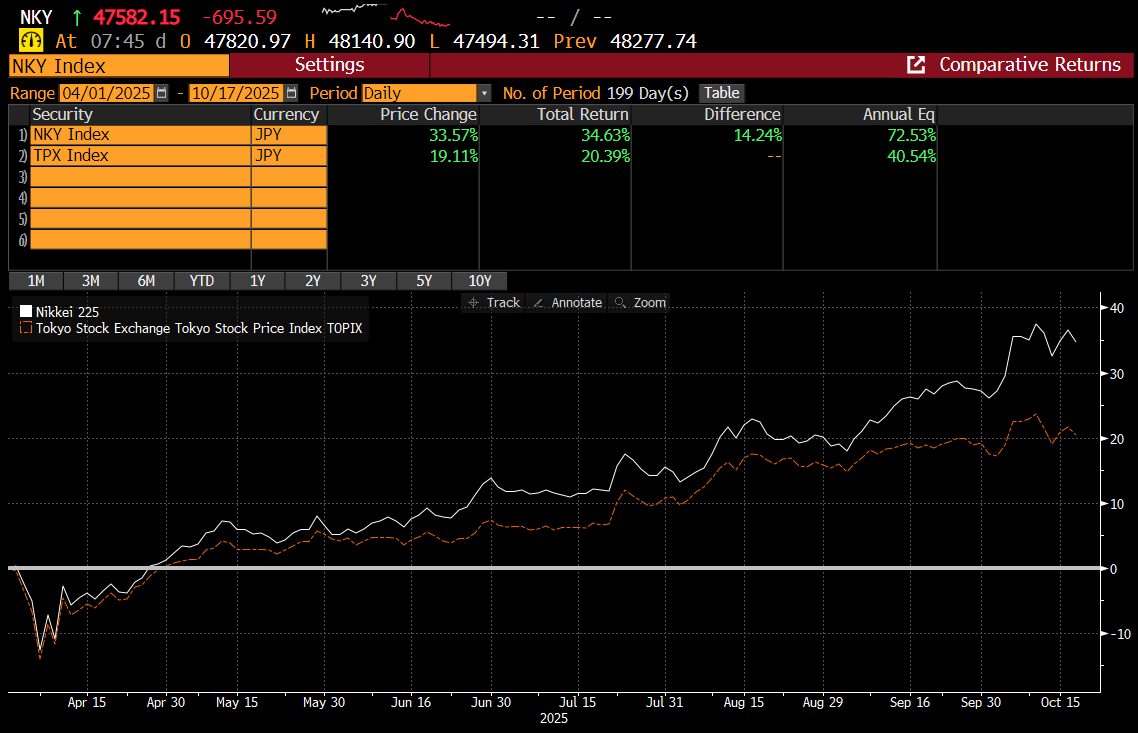

Autocallables have knock in and knock out levels. My guess is that the Kospi 200 has breached a popular knock out level of 500, which has meant that all the autocallables have been unwound and hence the structural selling of volatility has collapsed and hence the spike in KOSPI VIX. We see a similar thing with the Nikkei, even though it is at new all time highs.

The Nikkei in particular has been driven by AI related stocks - particular Advantest - to outperform the Topix by nearly 15% since the April low.

What does it mean? Well it all depends. If you think the move in AI is sustainable, then the rise in VKOSPI and VNKY is a selling opportunity, and markets will move higher. However, if you think AI is a bubble, then you are likely to see a whole bunch of autocallables get restruck at very high levels, just as the market is about to tank. We have one example of this from 2015, when autocallables got in to trouble after the Chinese market rallied then crashed.

I made money in the 2015 HSCEI autocallable sell off. One sign that things were going wrong was that the dividend futures (needed to structure autocallables) moved the opposite way to markets. I see this with HSCEI Dividend futures again.

And Kospi Dividend Futures.

Who knows, but the spike in VIX in a rising market is sign that the autocallable market is unsettled, and a negative surprise, like the apparent fraud at US regional banks, could drive much lower markets. A Korean, Chinese centred volmaggedon beckons.