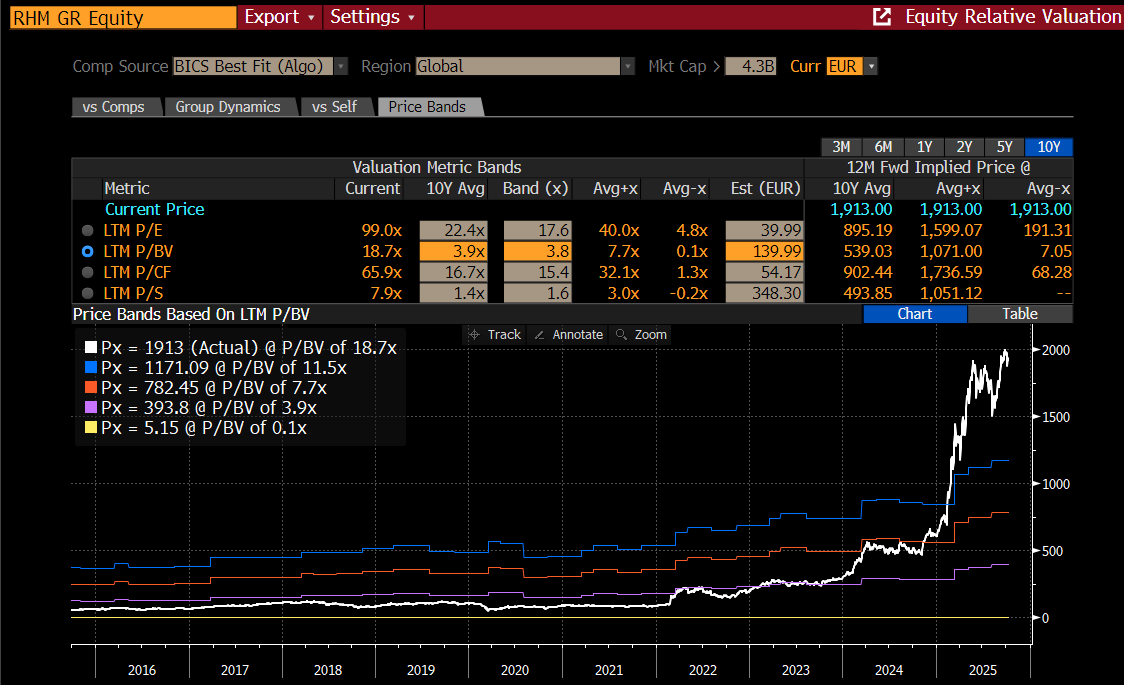

About 5 years ago, I bought shares in Rheinmetall AG, as it was trading at or around book. At the time I told my colleagues, it was extremely rare to find a defence stock trading so cheaply. Its cheapness was due to is defence business being unprofitable, and its auto business really struggling. I think we doubled our money, before selling the shares when I closed down the fund. The Russian invasion of Ukraine has radically changed Rheinmetall’s fortunes. It now at 19 times book, and up 3000% from when I first bought shares.

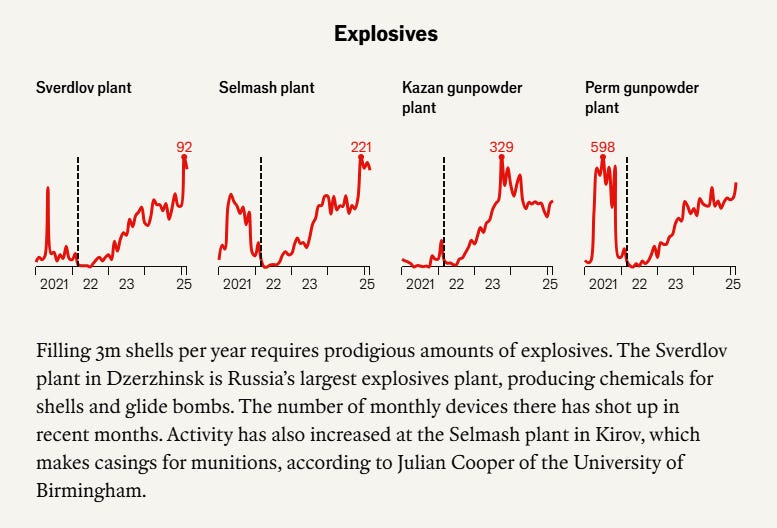

It is not hard to understand why it has rerated. When I look at every part of defence that I like the look of, anti drone defence systems, tanks, ammunition, Rheinmetall is already there and rapidly growing capacity. It also has a CEO who is not afraid of publicity, which in modern markets also helps stocks. Its been a great trade - but are we near peak war I wonder? Without question, Western Europe needs to match Russian output. As a recent Economist article highlighted, Russia has been boosting capacity and can now manufacture around 3m shells.

From an investing point of view, I like explosives as it would generally be hard for greenfield expansion - far more likely that existing areas, and existing producers get contracts for expansion. There are two ways that we could be “Peak War” - the first is that Western European Expansion has already brought parity to Russia, and secondly, the War in Ukraine could be coming to some sort of end. We will look at both of these issues in turn.

In the same article from the Economist it quotes Chris Cavoli, the top NATO Commander as saying Russia would produce 250,000 shells per month, putting it “on track to build a stockpile three times greater than the United States and Europe combined”. One of the problems with defence investing is that companies tend to be tight lipped about their plans - for obvious reasons. But a recent acquisition by Czech listed Colt Group of a producer of a key chemical, Energetic Nitocellulose (eNC), used in munition production gives us some numbers to play with.

Using the numbers above, 250,000 shells a month, gives 3m shells a year. At 6 kg of eNC a shell, this gives 18,000 tonnes of eNC. Russia apparently had access to 13,000 tonnes (mainly from China) last year, so these number don’t match up exactly, but are close enough for me. But the Colt Group lists European capacity of nearly 20,000 tonnes.

It would seem to me that perhaps Western Europe has sufficient capacity, at least at the chemical level. There could be more to do on shell casings etc, but on this metric, perhaps we are peak war. These numbers would suggest at least for ammunition perhaps the investment for peak war is there, even if the production is lagging.

The other risk is that perhaps we are near some end game for Ukraine and Russia? Typically financial markets rally when the worst possible outcome is taken off the table. The Ukrainian Hryvnia is no longer in freefall.

Likewise the Russian Ruble is not as weak as you would expect for a country at war, and the oil price in the US 60 range.

Austrian based, Raiffeisen Bank, which has/had significant assets in Russia and Ukraine has rallied back to pre war highs.

Emotionally, it feels like military spending will keep rising as we are in a multipolar world. And with Russia having a number of incursions into Western Europe, it would seem spending can only increase. But hard numbers seem to be suggesting we are near peak war in Europe at least. Of course a Chinese blockade of Taiwan, or Russia invading another country would change this calculation, but European defence (or at least munitions) does not seem the riskless trade that it was. In my mind there is now potential for over capacity or reduction in fighting. In equity terms, we may be near peak war.