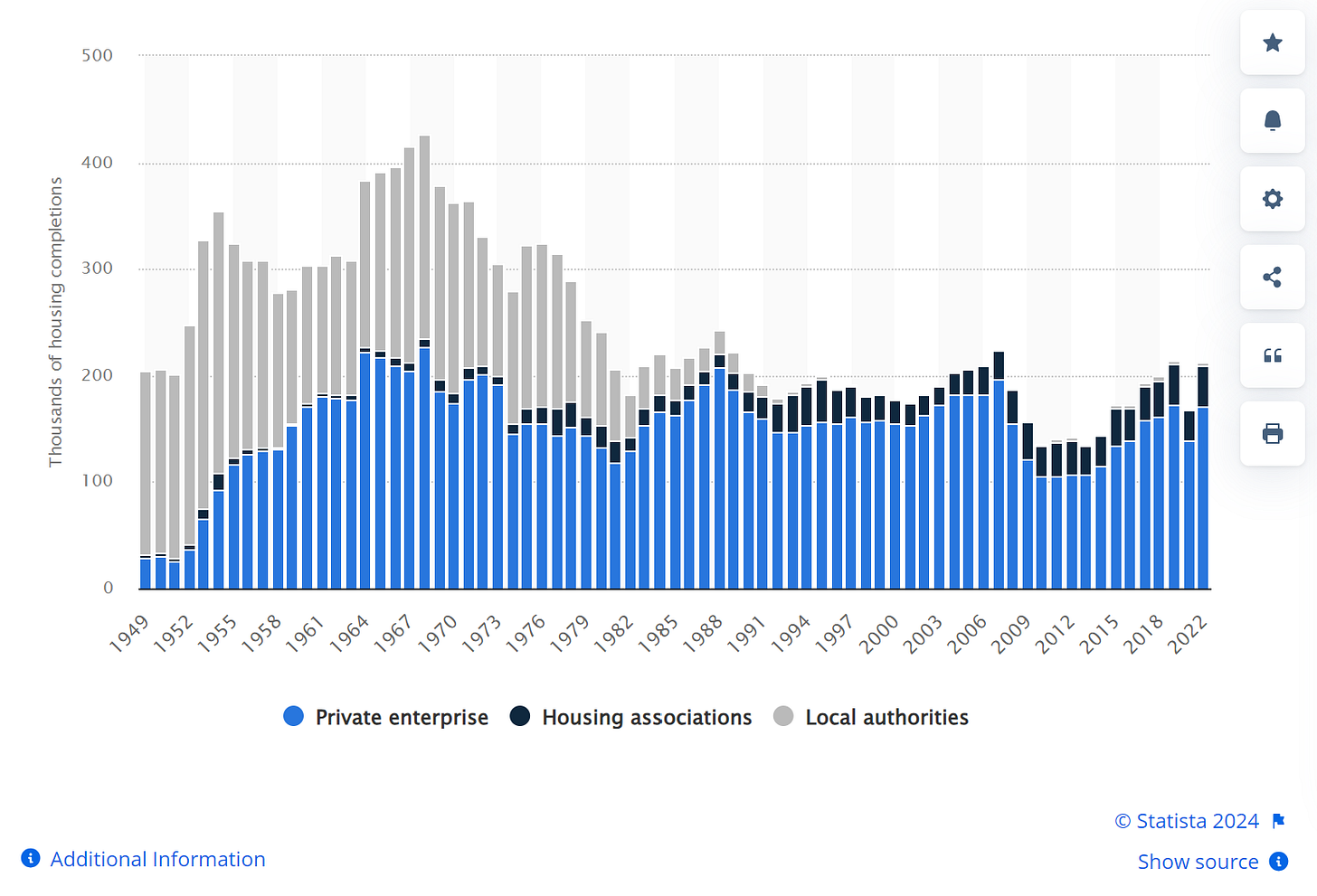

Many days I still feel like a young man, with much to learn. But then other times, when I muse on the changes that I have seen and lived through, I realise I am more likely the adult in the room. One thing I love about the UK is that its politics is so open and competitive, but also winner takes all. If you capture the House of Commons, you can pretty much do whatever you want (see Boris Johnson). Looking at announced Labour Policies, it plans to rejuvenate the NHS (largest employer in the UK), build 1.5m homes (a chunky number in a country of 28m households), raising corporation tax and a number of other policies. The home building one I find intriguing. The cost of buying a home in 1970s was very low, I usually thought because interest rates were so high, but as usual, strong supply was probably a more important reason.

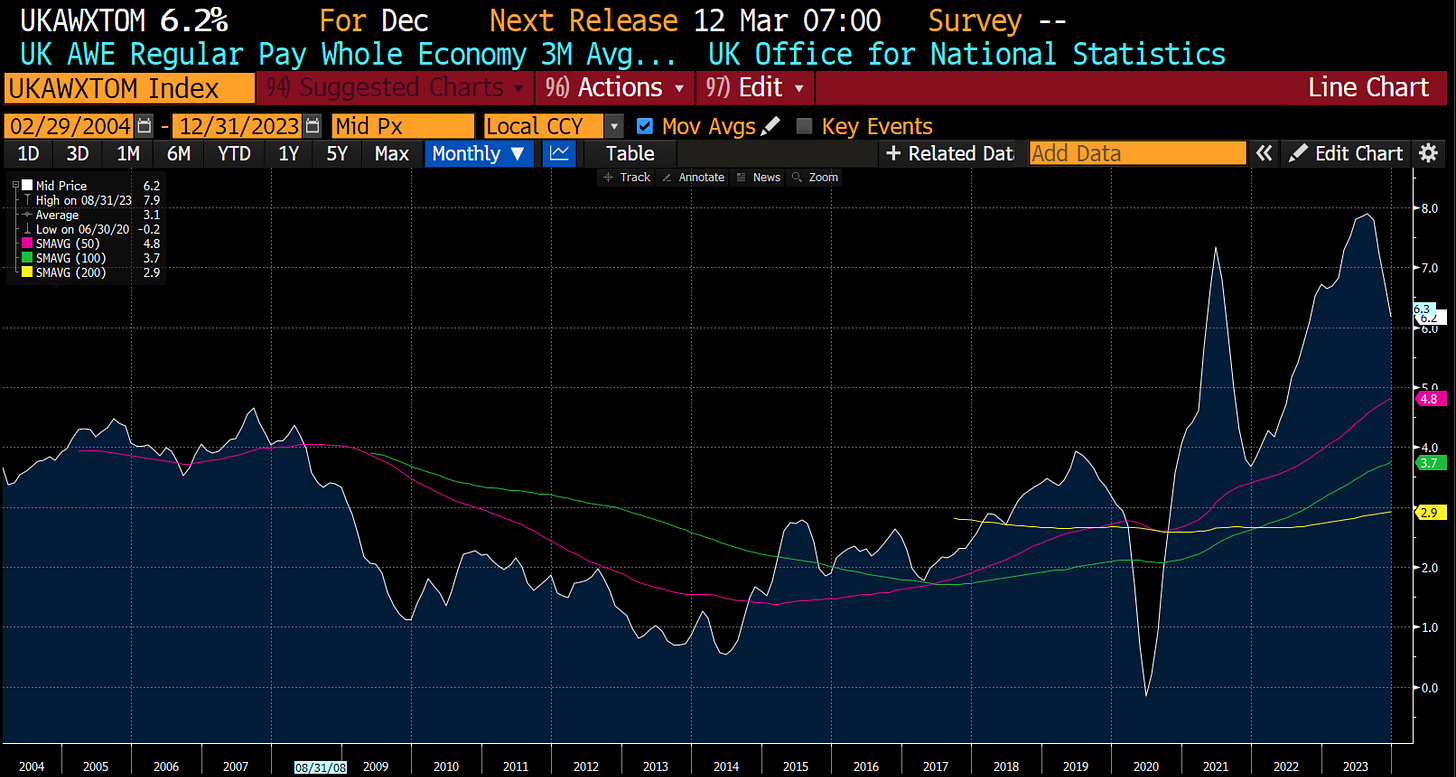

Increasing home building seems like a great policy, and in line with the needs of Labour’s core voters, the young. I just wonder where the workers are going to come from? Unemployment in the UK is already at levels seen when the UK was building 300k homes a year as the future labour government is proposing. With mass immigration a no-go policy, it seems a distinctly “wage inflationary” policy.

BOE boss, Andrew Bailey made it clear that rising wages was a key cause for inflation. But wages in the UK are well below that of the US, and for tradesmen below that in Australia. Labour policy looks like to put upward pressure on wages. The BOE certainly seems to have noticed. They are proposing selling their entire bond portfolio

The BOE has often left me dumbfounded. Sterling has fallen from 2 USD to 1 GBP to 1.2 USD to 1 GBP since the GFC, something I would consider inflationary.

Likewise, soaring house prices to income I would also consider inflationary.

Given the weak pound, and rising house prices relative to incomes, the burden on workers became too much, and wages began to rise.

Rising wages were eventually seen as a reason to raise interest rates. Of course, if BOE had raised rates earlier to keep sterling strong, and house price in check, then current increase would have been unnecessary (policies that China enacted - and has not had inflation or interest rate increases).

In economist speak, the BOE has a revealed preference of high asset prices and weak wages. In realpolitik speak, I think their is an entrenched bias to try and restrain the success of left wing parties through tight monetary policy. Or in other words, central banks try to engineer recessions to keep the supply of labour loose. Giving the political liability that has become the Conservative Party, I think we can expect 10 years of pro-labour policy so buying 10 year UK gilts at 4.2% strikes me as very foolhardy indeed. 10% looks more likely to me.

War is politics by other means. So is monetary policy.