When I first heard about Modern Monetary Theory (MMT), to me it just sounded like the sort of policies we see in emerging markets all the time. Turkey has been running a version of it for some time. MMT seems to endorse ever increasing government spending - something that Turkey has been doing for awhile now. Below is a log scale Turkish government spending.

In essence MMT endorses the idea of keep spending until something bad happens. In some ways it has been surprisingly effective, with Turkish GDP rising strongly in recent years, after a decade of stagnation. Note this in USD terms - so “real” growth, not just currency debasement led growth.

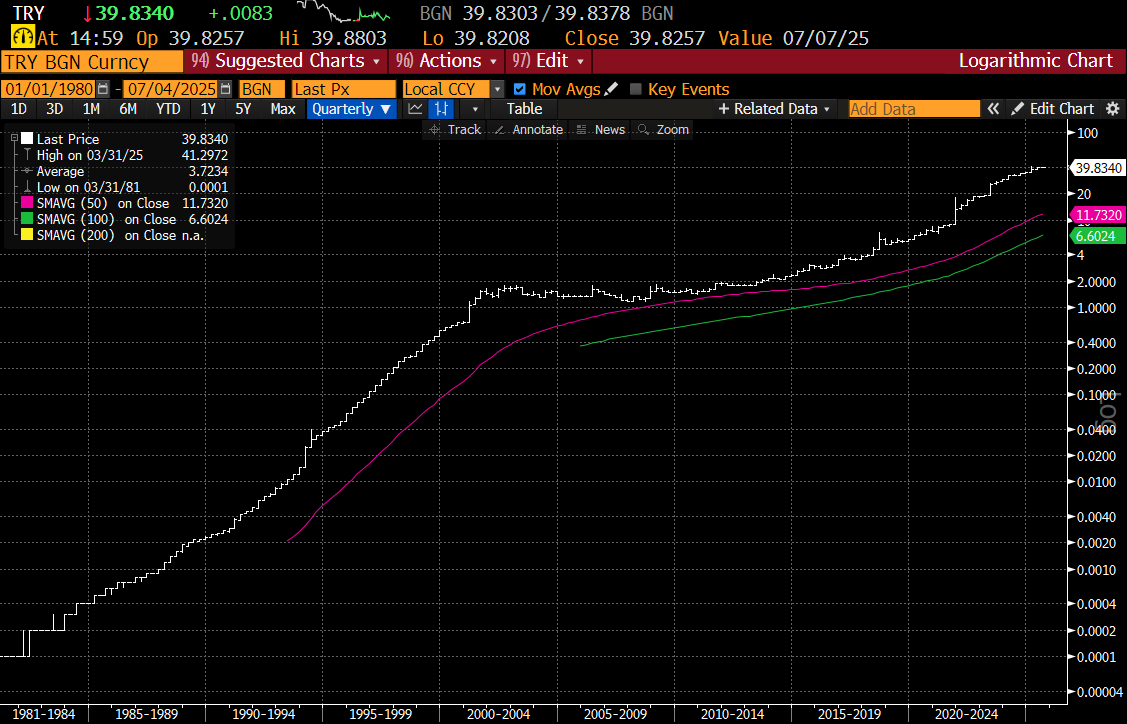

The classic monetary effect of this has been for the Turkish lira to collapse in value, again this graph is in log scale. When I first started in emerging markets in 2002, it was around 1 million Turkish Lira to the USD. There was a reform, where 6 zeros were taken off the currency to get it back to 1 Lira per USD in 2003. Lira generally loses value but from 2021, the process has accelerated, going from 8 to 40 today.

The other effect has been for 1 year interest rates to rise to over 40% in Turkish Lira terms.

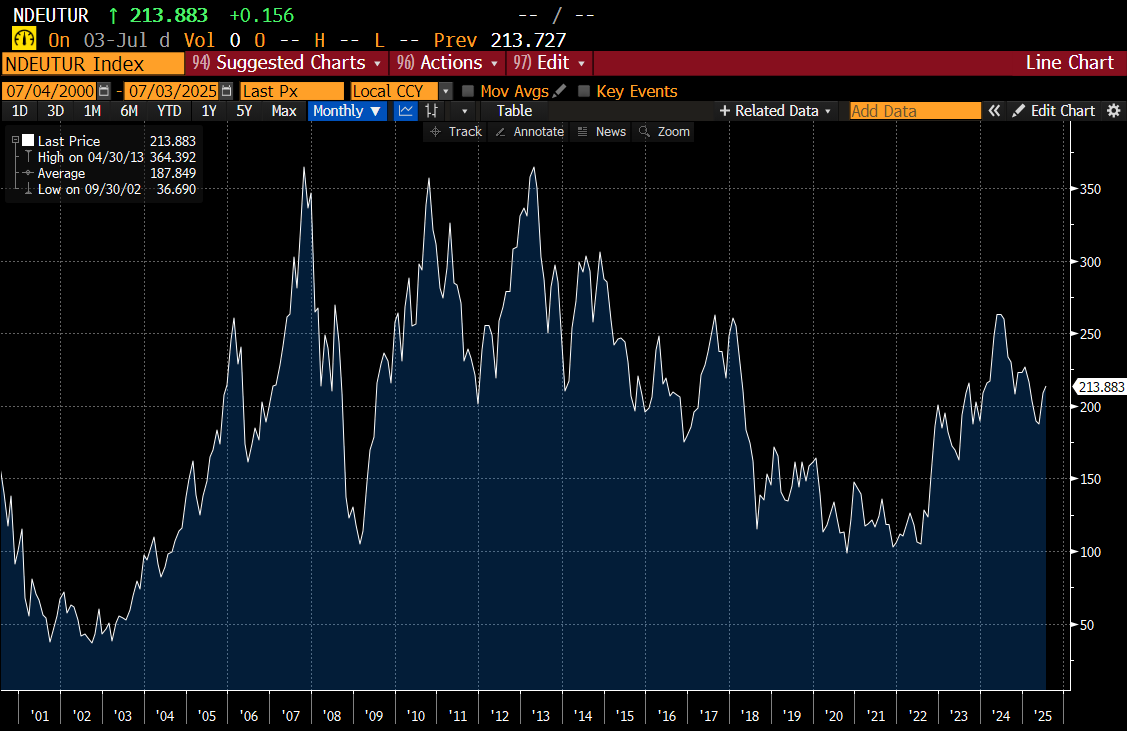

The net effect on Turkish equities of all this government spending, weak currency and high interest rates is that they have done nothing in US terms for over 20 years.

There is no surprise where MMT policies in Turkey come from. President Erdogan dominates Turkish politics and has pushed the central bank to lower interest rates constantly. For me, a weak currency, high interest rates, and poor equity returns are exactly what I would expect from modern monetary theory. And yet the US has not really followed suit. US Federal Government spending has had a step change higher as it did in the 1970s.

And much like Turkey, nominal GDP has soared - up nearly 50% from 2020.

Has the US dollar really weakened? In gold terms you could argue the last two years has seen the dollar weaken significantly.

But Fed Fund Rate has stayed at historically low levels.

And in gold terms, US equities have done fine.

So why does MMT work in America and not in Turkey? Is it purely political? Erdogan came to power in early 2000s, and took some time before he became very heterodox in economic policy and equity returns became poor. Looking at Turkish CDS - it was in 2018 when markets really started to price risk into Turkish assets. That was around 15 to 16 years after Erdogan came to power.

Trump has been the dominant force in the Republican party since 2016, so coming on 10 years, with at least another three and half years to go. Maybe that is the question. When does the market believe that MMT style policies get embedded into the US body politic? At what point does faith disappear? The best long term measure I can find is S&P 500 versus gold. It seems to inflect at critical points in American economic history - and could be inflecting now.

I think a lot of the market push for MMT came from the example of Japan, who has run large fiscal deficits for years with no effect on the bond market. This was true for decades, but is no longer true now. 30 year JGB yields have just hit a 30 year high.

To me, MMT probably does imply a non-stop bull market in gold. But I would expect equities to suffer. Perhaps it just takes time - but with JGB yields at 30 year highs, and gold at all time highs - perhaps that time is now.