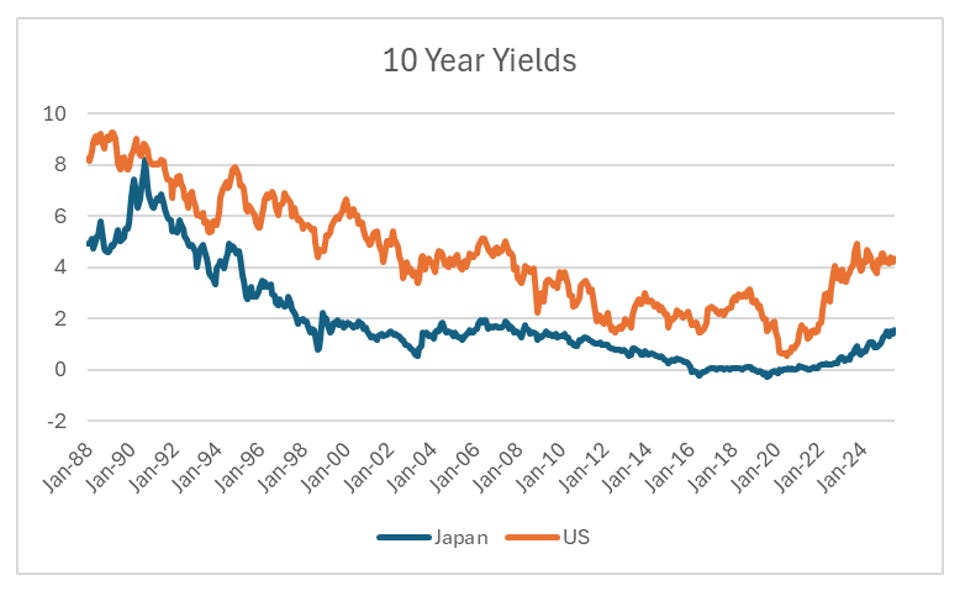

It is pretty safe to assume that the Federal Reserve will be run by a dovish Chairman in the foreseeable future who will be looking to cut interest rates. Does that make long bonds a buy? If I look at the trend on the US 10 year yield, we have not had a break out in yields since 2023.

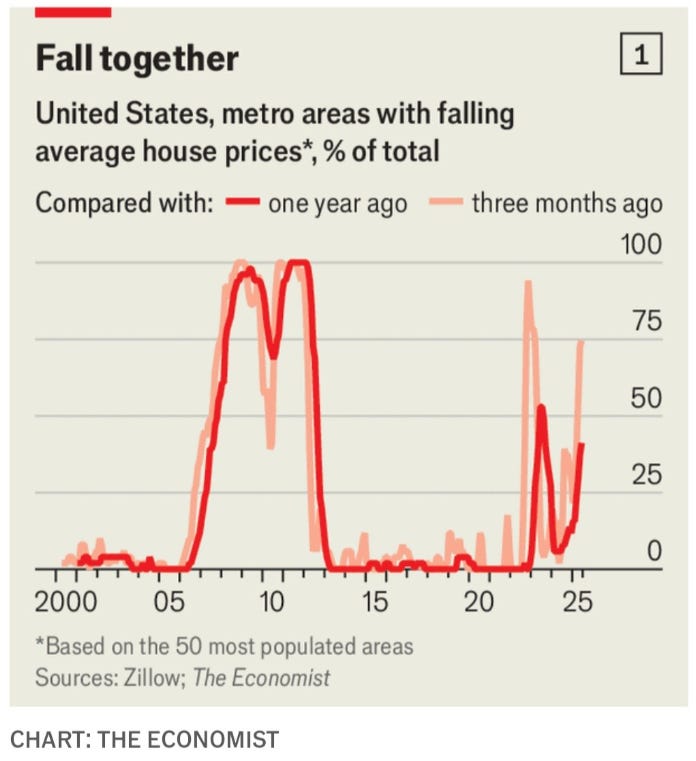

Certainly for most of my investment career, if we started to see signs of a weakening US housing market, I would be a buyer of bonds.

And we are currently living through the longest period of equity outperformance versus bonds. The implication would be to favour bonds over equities is you thought this would change.

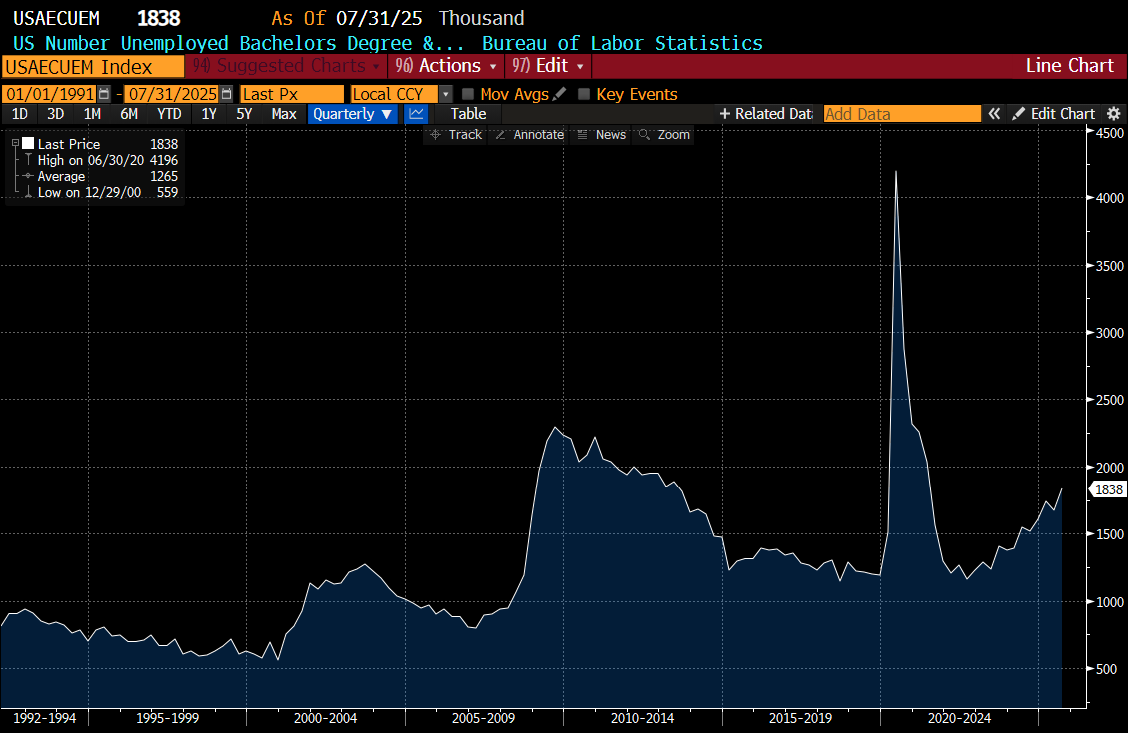

The final cherry on top would be the rising unemployment rate of university graduates. This has been a bond buying signal historically.

There was a time in my career when the above four charts would be enough for me to go all in on treasuries. But we live in new and uncertain times. For most of my investing career, JGB yields gave you a good tell on where US yields were going to go. Why do JGBs offer a tell? I could be that Japanese corporates tend to be more manufacturing heavy, or Japanese investors were big buyers of bonds. I don’t know the reason, but either way JGBs tended to move before treasuries. This time JGB yields are still in a rising trend.

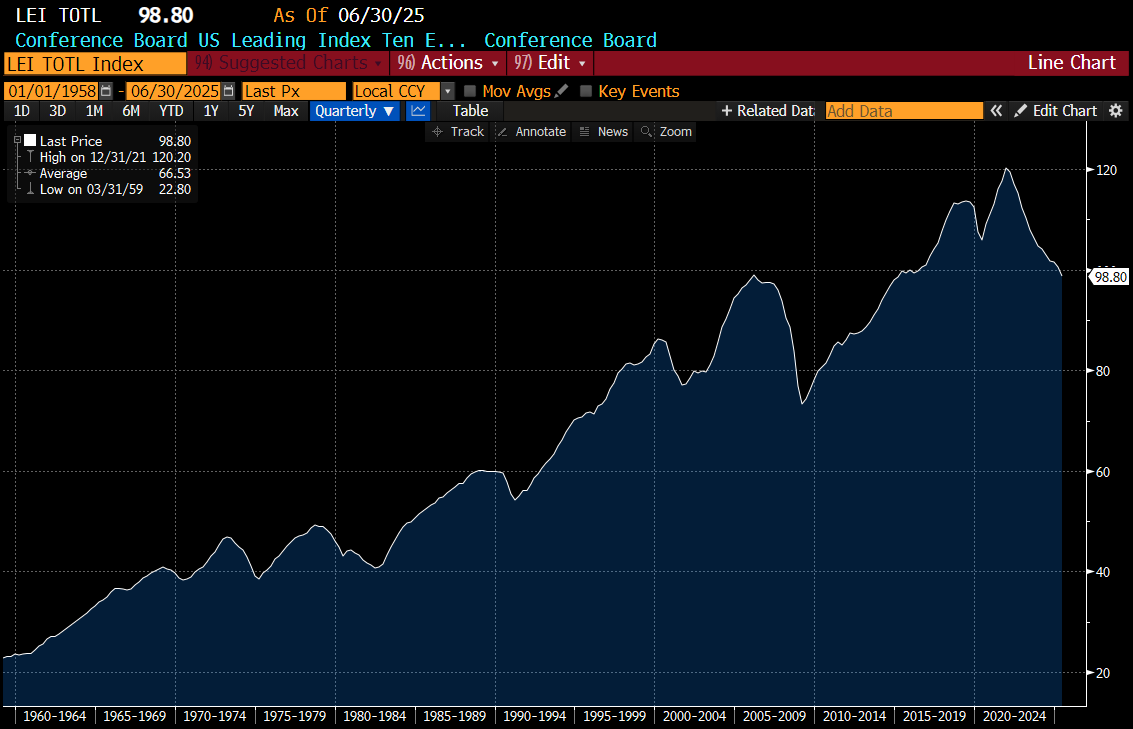

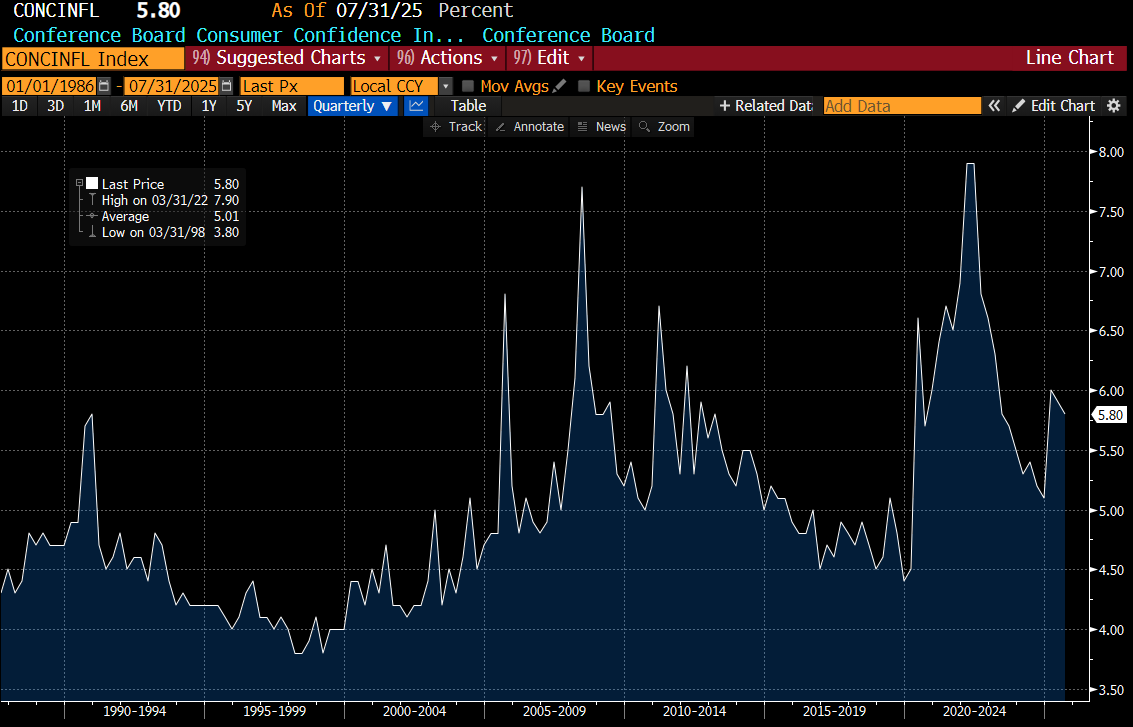

Probably the biggest problem for buying treasuries here, is that Conference Board Leading Indicator has been screaming buy for treasuries for 2 years already.

The problem with buying treasuries is that we have learnt during Covid that the US government will spend whatever it takes to stop a recession. There is no real reason to think President Trump would be any different. Firing the BLS Secretary seems to send a strong signal that he will act to counter any recession. Conference board inflation expectations are still at very high levels.

My base analysis of “Trump Economics” was that he and his supporters have tired of the US model where its buys other countries goods, and they in turn but US treasuries. The reaction to this would be that former exporting nations would be forced to stimulate, and this would lead to capital scarcity. JGBs show this trend, and so do German bonds.

There was also the knock on effect that governments would seek to diversify away from treasuries to gold. For me, it felt like the 1970s all over again. Which means either gold has to go much higher, or treasuries much lower.

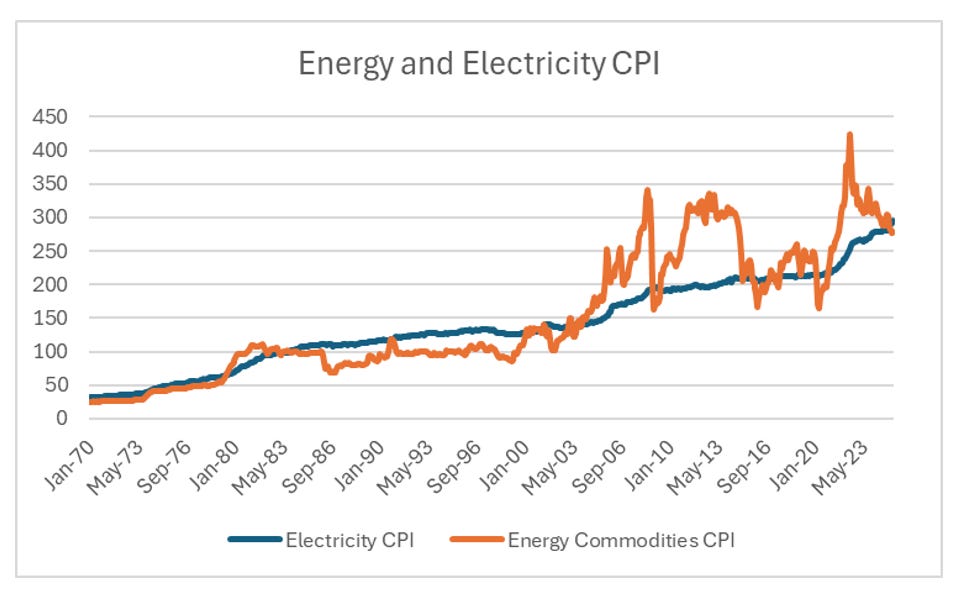

I could see treasuries getting a bid if the capex story from the hyperscalers broke down - but there is no sign of that. One of my theories about the “pro-labour” era is that trend inflation was higher, but it would look “ok” during periods of commodity price weakness. A good example now is US Electricity CPI and Energy Commodity CPI. Energy Commodities are the same price as 20 years ago - but electricity CPI is up 40% and rising.

My best guess is that a new Federal Reserve Chairman might cut rates - but we end up with a steepening curve. The curve is not that steep at that moment, but I could easily see 1% cut at the front end leading to 2% rise at the back end, pushing the curve back to 4% like we saw in 2010.

I struggle to see how a curve steepening like that would be good for housing or unemployed graduates. But then again, maybe that is not the point.