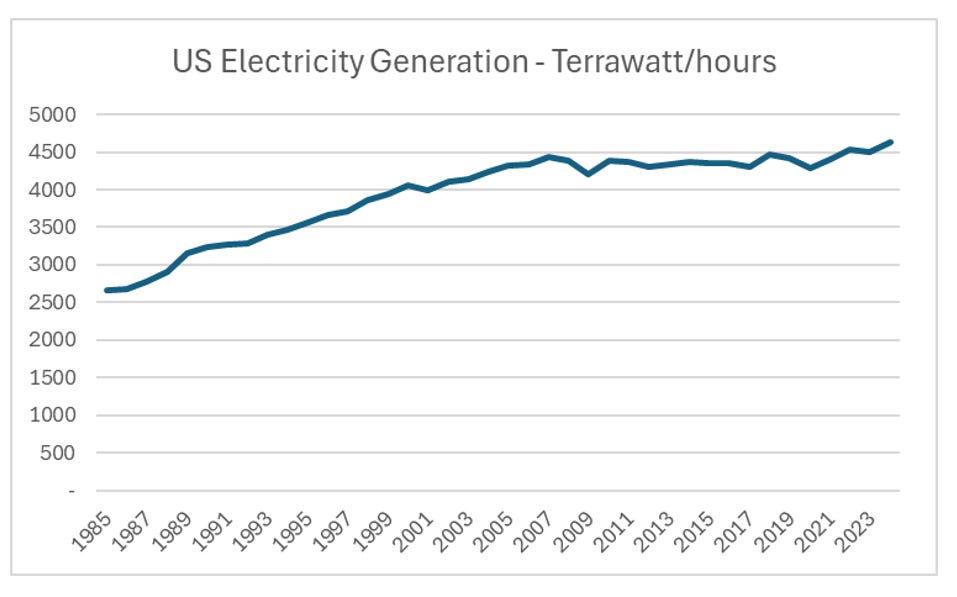

If AI is a “strategic” asset, and it is hard not to see it as such, then China is probably going to have to invest even more money into data centre builds. One knock on feature of this AI race is that the market has recognised that electricity generation which has been stagnant in the developed world is going to have to increase.

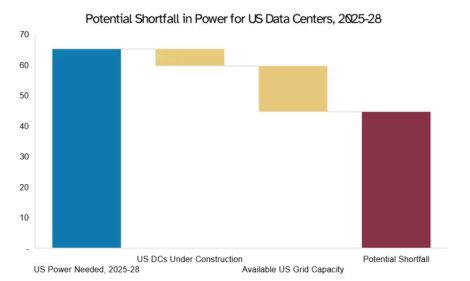

I was sceptical about this, as DeepSeek showed there were other ways to do things that were less energy hungry, but the mantra for both the hyperscalers and government is not about efficiency, but about domination. One big bottleneck in the US is generating the electricity needed.

The market has already rerated much of the sector to recognise this changed dynamic. Vertiv in the US is indicative. It now trades on 6 times EV/sales and 37 times forward P/E - reassuringly expensive.

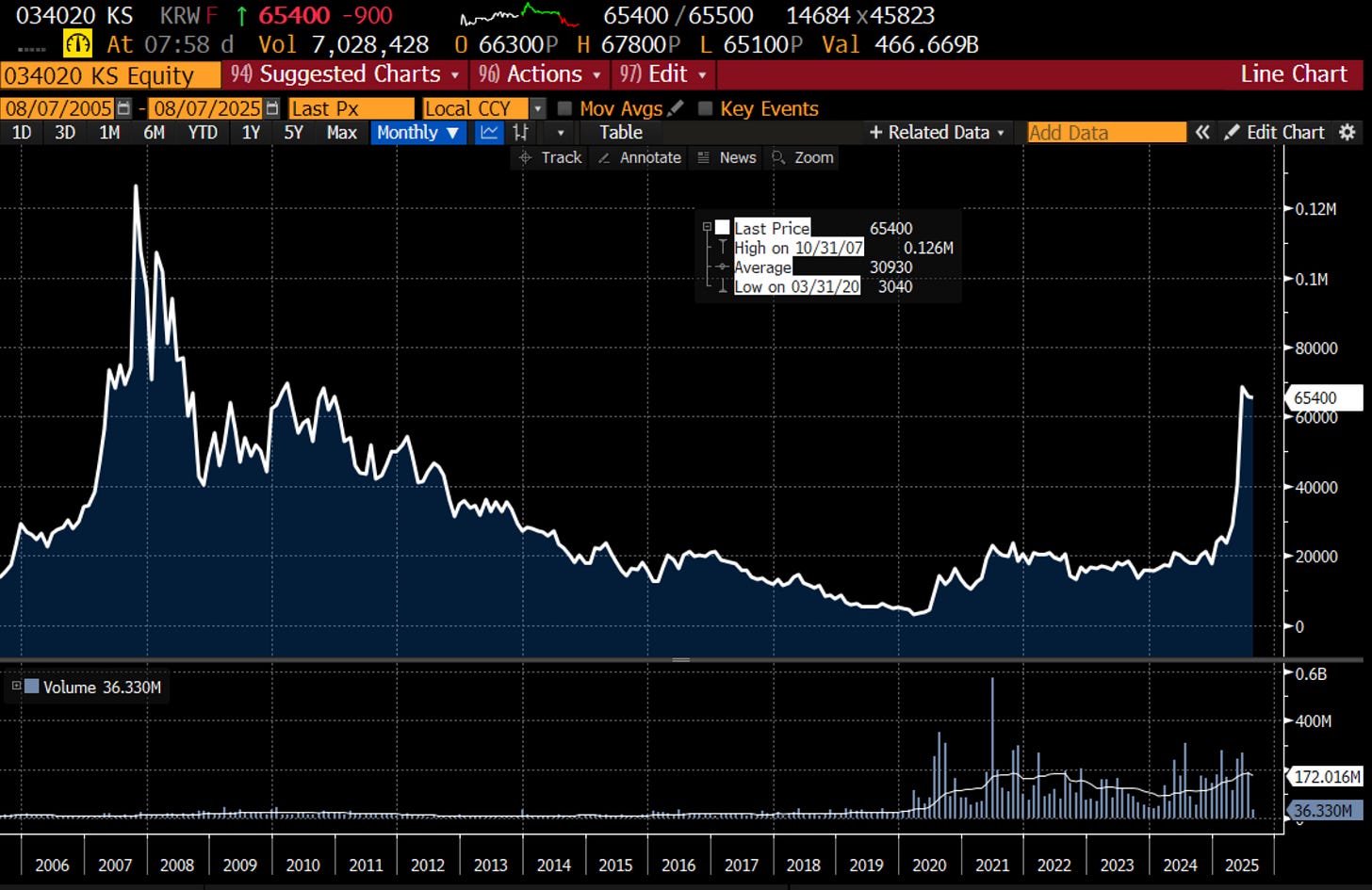

Back when I was running an emerging market fund in 2006, one of my biggest positions was a Korean company called Doosan Infracore, now renamed to Doosan Enerbility. I liked it because it specialised in renovating existing nuclear power pants to extend their life. Back then I sold it at the peak in 2007 after making 500% in it. Owning any Doosan company is a always a trade - never an investment. On an EV/Sales basis it is already above 2007 peak.

But then I started to think about China.