One of the effects of a pro-labour world would be that governments would come under pressure to lift real wages - which means avoiding currency devaluation. In Japan, this has meant falling foreign exchange reserves.

The overriding investing theme for me is “pro-labour” politics and the rising cost of capital. The lodestar for this theme has been the inflection of JGB yields higher.

Rising yields has meant for me an inflection in the relative performance of Japanese banks. This has also happened.

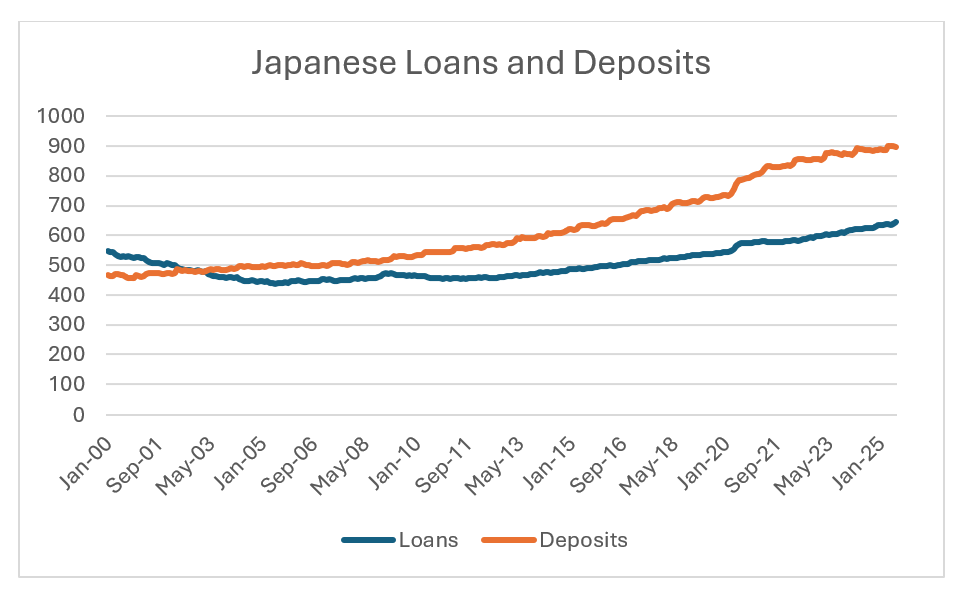

One thing about a pro-labour inflationary world that I have been also looking for is reluctance by households to hold deposits, and increasing demand for loans. If this happens, then there should be less liquidity in the banking system, and government bond yields have to rise. There are some signs of this. After years of deposit growth being faster than loan growth, we are starting to see an inflection in Japan.

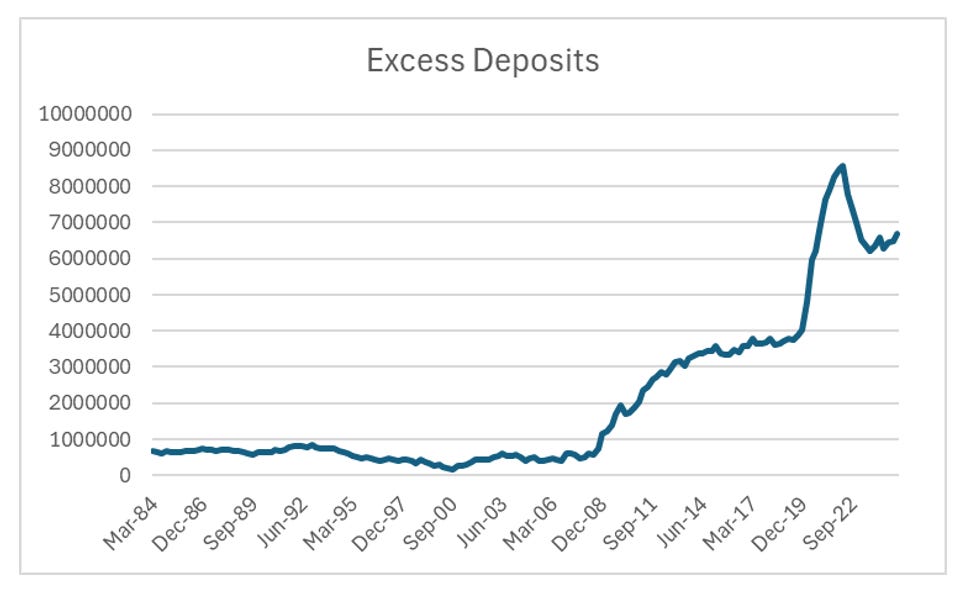

If we take deposits less loans, we can see the (possible) inflection more clearly.

What about the US and treasuries? Do we see a similar dynamic? Well after the GFC, we can see a clear dynamic of higher deposit growth, and slower loan growth.

Taking deposits less loans, we can see that Covid stimulus pumped a great deal of deposits into the system. When we can see how similar the GFC and the Japanese bank crises were for both Japan and the US. Both caused a huge build up of deposits in the bank system.

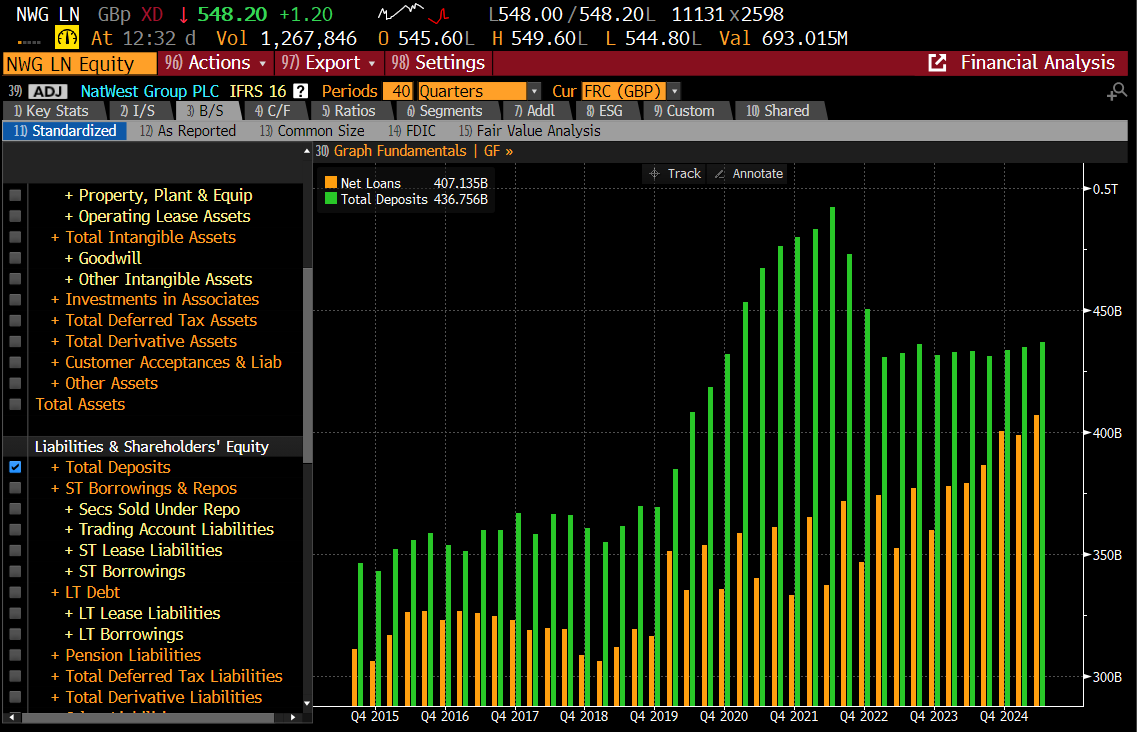

What about the UK? It has seen its long term bond yields surge even more than the US.

The BOE data made little sense to me, so I have looked at UK focused lender Natwest. What we can see is that there was a surge of deposits during Covid, which has now fallen back as loan growth has picked up. I can also confirm that the UK has seen significant wage and price inflation.

All of this confirms something that is almost self explanatory. Lower long term yields require government spending to be cut, and higher interest rates. Not to balance the budget - but to encourage households to save. And as I have argued - I think this is a political decision - not an economic decision. And with the rise of populist parties globally - no government (maybe other than the Swiss and the Chinese) will look to be causing a recession with austerity policies. It does look to me like the savings glut is over.