It is funny to hear my non-finance friends start worrying about their jobs. AI has been infecting finance for decades. Algorithmic trading, AI programs that analyse releases in an instant, and even Bloomberg Industries, that collates industry data has replace my earliest job in finance - collecting data. One thing that became apparent to me is that the rise of AI made investors very reluctant to give money to strategies that were too simple. The simplest, and always a favourite with “traders” everywhere is momentum investing. Below is the Morgan Stanley US Momentum Long Index. I started in markets in 2000, and momentum investors were taken to the wood chipper then, and then again in 2008. Around 2015, I thought momentum investing was done, and then again in 2021 - and I was wrong. I did think in April we were done with momentum investing again, but here we are, back at highs.

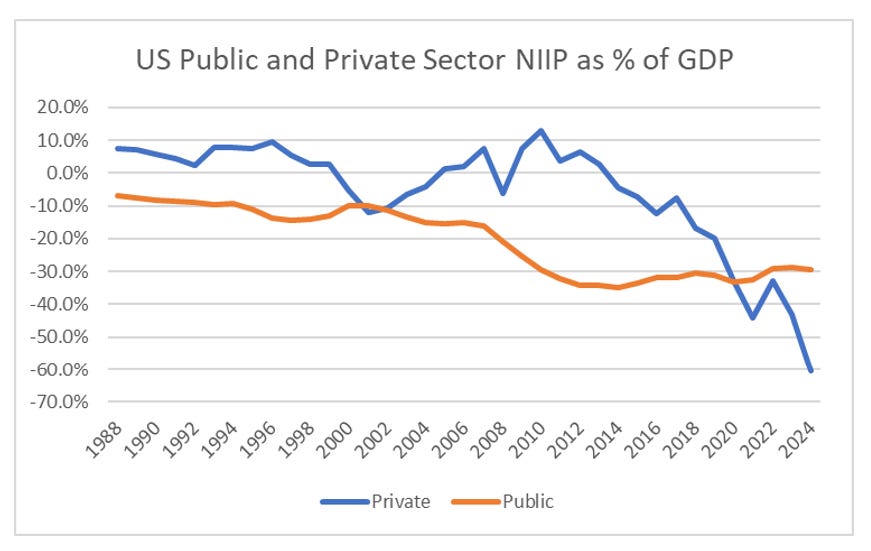

Prior to 1999 when this index started is that we would have seen at momentum investing in the Nikkei bull market over the 1970s and 1980s, and potentially Asian markets in the 1990s, and of course in 1920s. Looking at all this periods, I found that when capital flows were extreme, I assumed they would reverse at some point. NIIP was a useful way of seeing this - for example German versus Spanish NIIP became extreme just before the Eurocrisis.

Using NIIP even worked well for Korea in 1998 and again in 2007. I strip out public sector foreign exchange positions to get a cleaner position.

Applying this to the US, at the top of the dot com bubble, private sector NIIP also became extreme, at negative 10% of US GDP. This would have given you a bearish signal in 2016, and you would have been wrong.

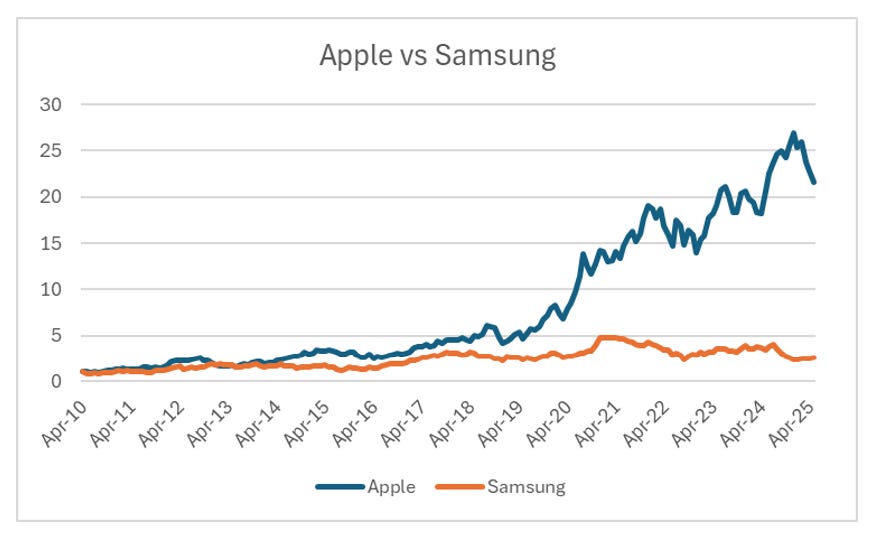

So cautious habits I learned from looking at macro when I was younger have stopped working . But as someone who tries to be through, I always looked for confirmation from the bottom up. I try to look at companies in similar industries to identify changing trends. One of my best ever short ideas was iron ore. From 2000 to 2006, Chinese steel companies and iron ore companies moved together. From from 2010, Chinese steel companies were very weak. For me, the weakness of Chinese steel companies meant that the upside to iron ore was capped. In 2008 and 2011, Vale was a momentum trader favourite. Catching this inflection in momentum investing probably made my name.

Using these same methods, I was looking at the tech space, Samsung, which is both a rival and competitor to Apple, had begun to roll over in 2021, which made me think there was downsize risk to Apple. This has not really been the case - the gap between Samsung and Apple has just gotten wider.

You seem similar disparity opening up between Nvidia and AMD for example.

Watching Disney, would have been good for shorting Netflix in 2021, but has not worked since.

All of the above is in some ways versions of Dow Theory - which is saying the best bull markets raise all boats. Or if you look at the Russell 2000, it has been going sideways for 5 years. Traditionally a bearish signal. I have also been thinking the break out gold versus the S&P 500 is bearish.

What would be ideal is if momentum investing started to fail. As in 2012, that is the chance to really make my name again. So what are momentum investors in? Fortunately there is a USD 17.5bn Momentum ETF - MTUM US - that gives us an idea. It is at all time highs having rallied 31% from April lows.

Intriguingly, when I look at it versus gold, it is right back at the 200mda - so decision time for markets. It is weird, having seen momentum investing work for so long, I fell like it momentum investing must continue on, but a dispassionate look at this graph suggests a trend change is afoot.

If you are wondering what is in it, it is pretty transparent with its holdings. The median market cap of the below is nearly USD 300bn, with a dividend yield of 1% and price to book of 6.

Part of my argument is that the move in gold is a sign that the market is beginning to notice that the US government is essentially bankrupt, and that at some point this leaches in to economic problems. I also thought the rise of cheap competitors to US in AI and EVs would put downward pressure on stocks. If I am right, then you are getting another chance to sell stocks and buy gold. If not, then who knows where this ends. Either my old habits are a trap - or I have somehow managed to survive to an ultra extreme point in markets. The markets will decide.