Long time readers will know that I “despise” the clearinghouse model. Despise is a strong word - but justified in this case. The move to central clearing was means to make the system more robust, and remove “too big to fail” moral hazard from the financial system. The opposite has occurred, which the system more prone to failure, and requiring almost constant bail outs, with profits largely accruing to hedge funds. I have a long series of diatribes notes on clearinghouses here.

Due to regulatory change, central clearing has spread its ugly little model to almost everywhere in finance. I first worked out how dumb this model when reading this note from BIS on how a Nordic Clearinghouse run by Nasdaq went bust. Essentially clearinghouses have no pricing ability, and no need to risk capital, so just price risk as if today will be like yesterday. They are also incentivised to maximise profits, so then have tendency to be “optimistic” on pricing. What happens is they basically try and offer as much leverage as possible to buyers of risk. The problem is that when there is a shock, everyone then become a forced seller. We recently saw that with US treasury market in April, when treasuries fell even as the stock market was weak.

Why does this happen? The profit maximising efforts of clearinghouse means that eventually markets will become bifurcated between natural buyers and natural sellers.

So who are natural buyers of treasuries? Well until recently Central Banks would buy treasuries as foreign exchange reserves - but they have wised up to the foolishness of that in a Trump America.

These days hedge funds are natural buyers of physical treasuries. Off the run (treasuries that have been issued for a few months) have a higher yield than futures. So a classic basis trade is to buy physical bonds, and then repo them aggressively to make a “risk free” return. Data from DTCC shows this has been surging.

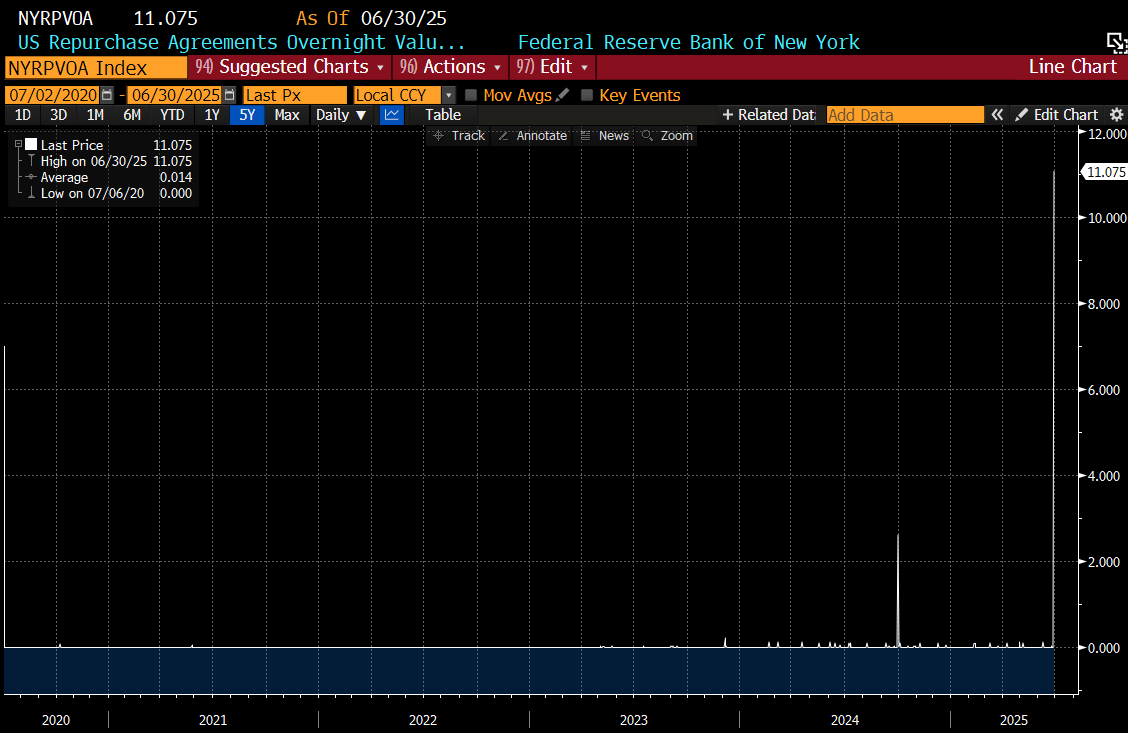

Now what happens when banks have repoed as much as they can to satisfy hedge fund demands? They will start to rely on Central Banks. For the end of June (which is the first quarterly end date since the April sell off in treasuries) we see a big increase in repo agreements with the Fed.

To put this in context, the Fed made changes to dissuade banks from using this facility during Covid - but it is interesting it has made a return recently.

Likewise, the Fed is adding cash to the system again. In essence public money injection to keep hedge funds and banks profitable and credit worthy.

Why do I care about this? Well for me, the obvious mispricing in market remains US treasuries - which are the cornerstone of modern finance. I have been quite clear that I think long dated US treasuries will end up with a 10% yield.

The bear market case for markets is a simple one. When does the Federal Reserve react to buy back credibility? 5 year treasuries have been steady at 4% now for a few years. I also think this goes to 10% at some point.

So clearinghouses, by creating hedge fund demand for treasuries are the weak link in the markets. Clearinghouses are the equivalent of AIG in the lead up to the GFC - the braindead lenders keeping the whole party going. The problem with the bearish clearinghouse view is that they essentially tie the entire financial system together into a single balance sheet - which essentially means when clearinghouses get in trouble, all banks get in trouble, and the US government will bail everyone out. And this is the reason I also like gold.