In my previous post, I lamented how momentum investing has become the most successful style of investing in the last 10 years, after having a decidedly mixed outcome from 2000 to at least 2012.

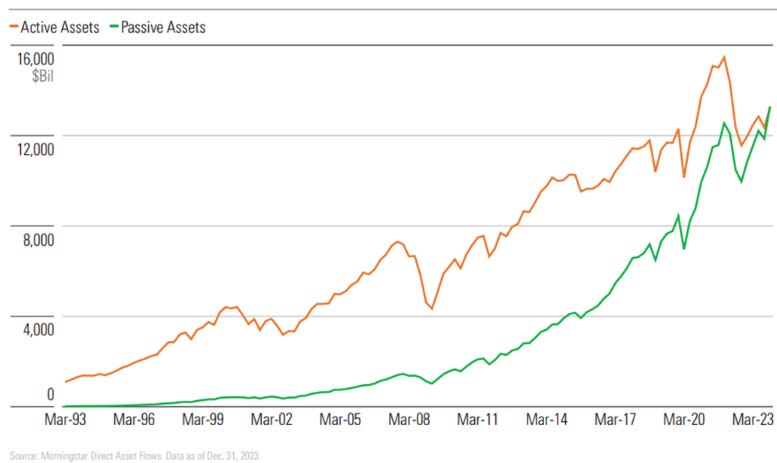

Michael Green (who writes the “Yes, I give a FIG” substack) emailed me to say basically its a bubble driven by passive flows. He attached a link to this report, “Ponzi Funds”. I have know Michael for over ten years, and been reading his thoughts for longer. I won’t lie - some of Michael’s ideas and language makes my brain hurt, which I guess is a good thing - but I always worry I may have misunderstood something. With that disclosure, when Michael and the Ponzi Fund authors finger passive investing for the continued success of momentum investing, what they are saying is that passive flows push up prices, which attracts more money, which pushes up prices, and attracts more money and so on so forth. In essence we are in the middle of huge, decades long pump and dump. At the corner stone of this view has been the rise of passive investing at the expense of active investing.

The problem I have with this analysis is that correlation does not imply causation. Yes, the rise of momentum investing has coincided with the outperformance of momentum investing, but from my perspective you could argue that investors have seen how poorly active fund management has performed relative to passive, and decided to follow performance. I know for my self that outperforming in a bull market it tough - but outperforming in a bear market is relatively easy for me. The problem is that I was assuming a bear market would come every 7 to 10 years - in line with recessions in the US. Ignoring Covid, which I think we should, we are now in year 17 of the expansion (d’oh). That being said, I think we can tease a bit more out of Michael’s analysis. So passive flows can drive prices? I think this is true. A good example was the rise of ARKK a few years ago. In 2020, there definitely seemed to be a correlation between flow and performance, and when flow stopped and slowed, ARRK underperformed. This is a definitive example of what Michael is talking about.

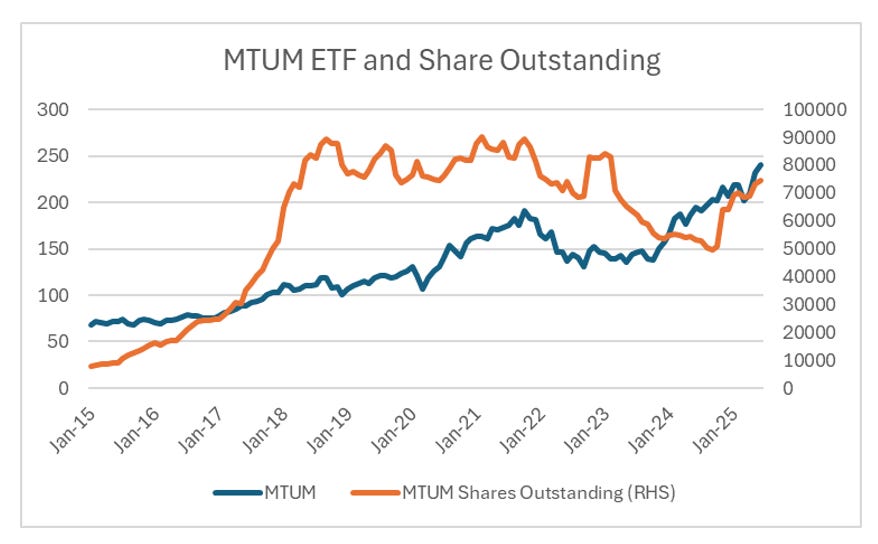

The problem here is that ARKK was more an actively managed ETF, than a true passive fund. If I look at the iShares Momentum ETF, I don’t see any correlation here either.

So part of the problem I had with the “passive is everything” argument is that the market is usually pretty good at taking advantage of crazy inflows. Remember Gamestop? That did not work out well in the end.

But I do think passive investing is working for another reason. That Michael is right for slightly different reasons.