Old men and women are always obsessed with the past. When I first started working in finance in 2000, the oldies in my office would go on about the 1970s. There was a lady working in the cash management department who had started with the company in 1960s as a secretary, and kept telling me about 1974 crash. She said it was like a light switch was turned off. The managing partners came in and basically looked at the office and said everyone sitting to the left of the central aisle is fired and that was it. At the time, I thought, well that was 25 years ago when people thought flares were a good idea, nothing to do with me. Of course, within 6 months, the dot com bubble burst, and once again half the office was fired.

So here we are 25 years later, and an oldie is talking about a bubble bursting 25 years ago, and if you are in your 20s, you are probably thinking why is he talking about 2000, you guys were going to Blockbuster and thought Nokias were cool. I would calm yourself now, as this particular oldie is not going to talk about AI being a bubble - but I am going to look into other oldies claims that we could be a AI bubble. The FT Alphaville is conjuring up comparisons to the telecommunications bust that was part of the dot com bust.

Most of the note is based of Morgan Stanley research - a tech bullish broker. First of all they forecast USD 2.9 trillion of capex from 2025 to 2028 - which is a very big number in a very short period of time.

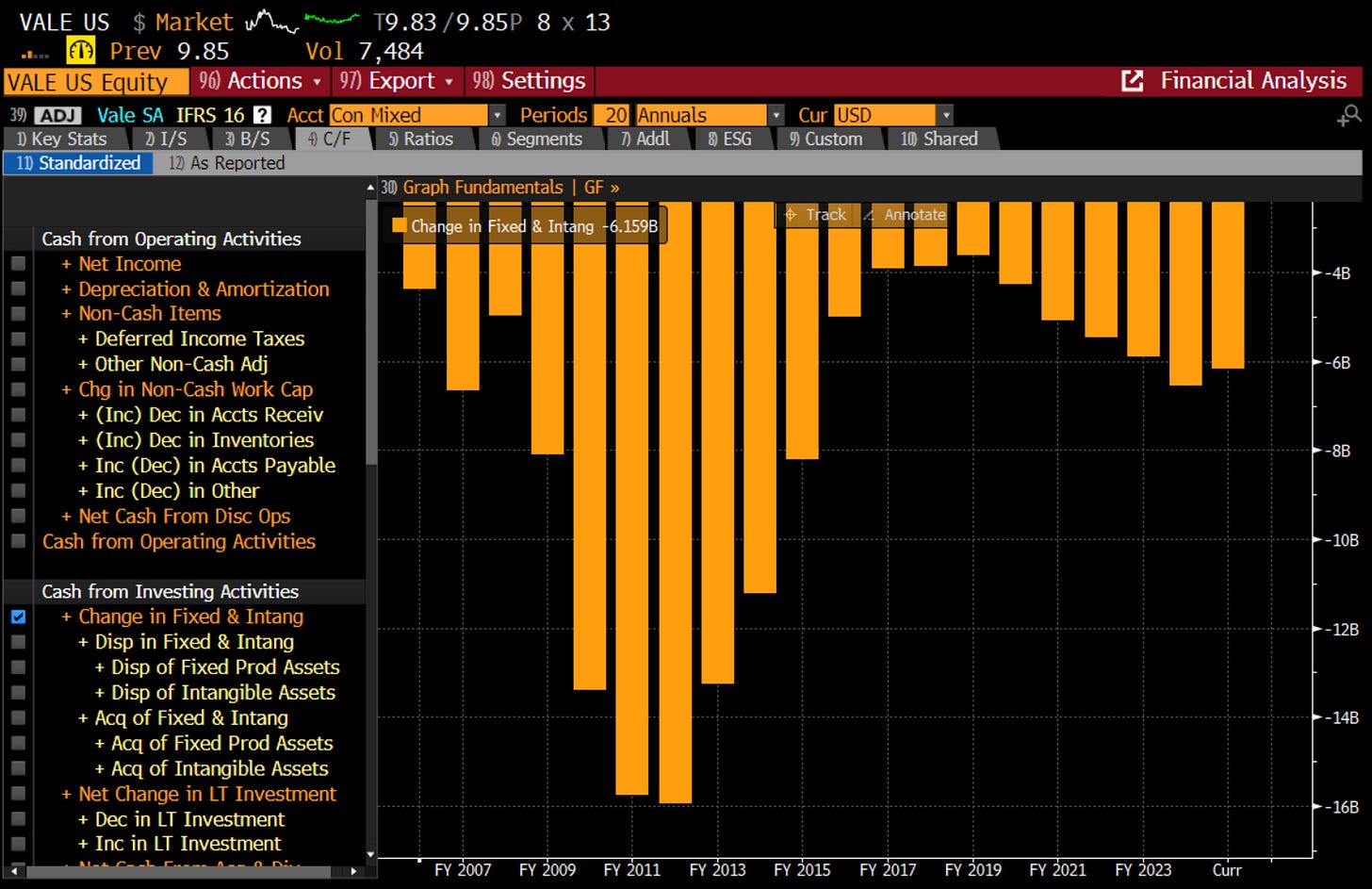

A big increase in capex IS a bearish signal. One of my best short were iron ore miners, who massively increased capex in from 2007 to 2011. Vale in Brazil was a poster child for this excess. The peak in capex then led to a 90% fall in the share price.

As both the FT and MS acknowledge, the hyperscalers have the cashflow to fund their investments, so they spend their times looking at the other USD1.4 trillion of investment that is coming from private markets. In my view, if the hyperscalers are spending, then the other markets will deliver the cash as well, so there is no need to think too much about credit markets.

For me, excess capex is a necessary, but not sufficient condition for thinking about a “bubble” (lets take bubble to mean excess investment that leads to collapsing prices and write-downs). Back in the dot com bubble era, there were two separate type of company that got into trouble at the same time. The first were a whole bunch of internet stocks that listed, but had no real path to profitability. If you were to talk about a bubble, this was it. Companies like Web Van or Boo.Com. Once the market turned on them, there was no way back. The modern day equivalent of these would be some SPAC companies and “shitcoins”. Generally speaking, these highly speculative companies got destroyed in the 2022 sell off. And we saw a corresponding sell off in Nvidia at that time.

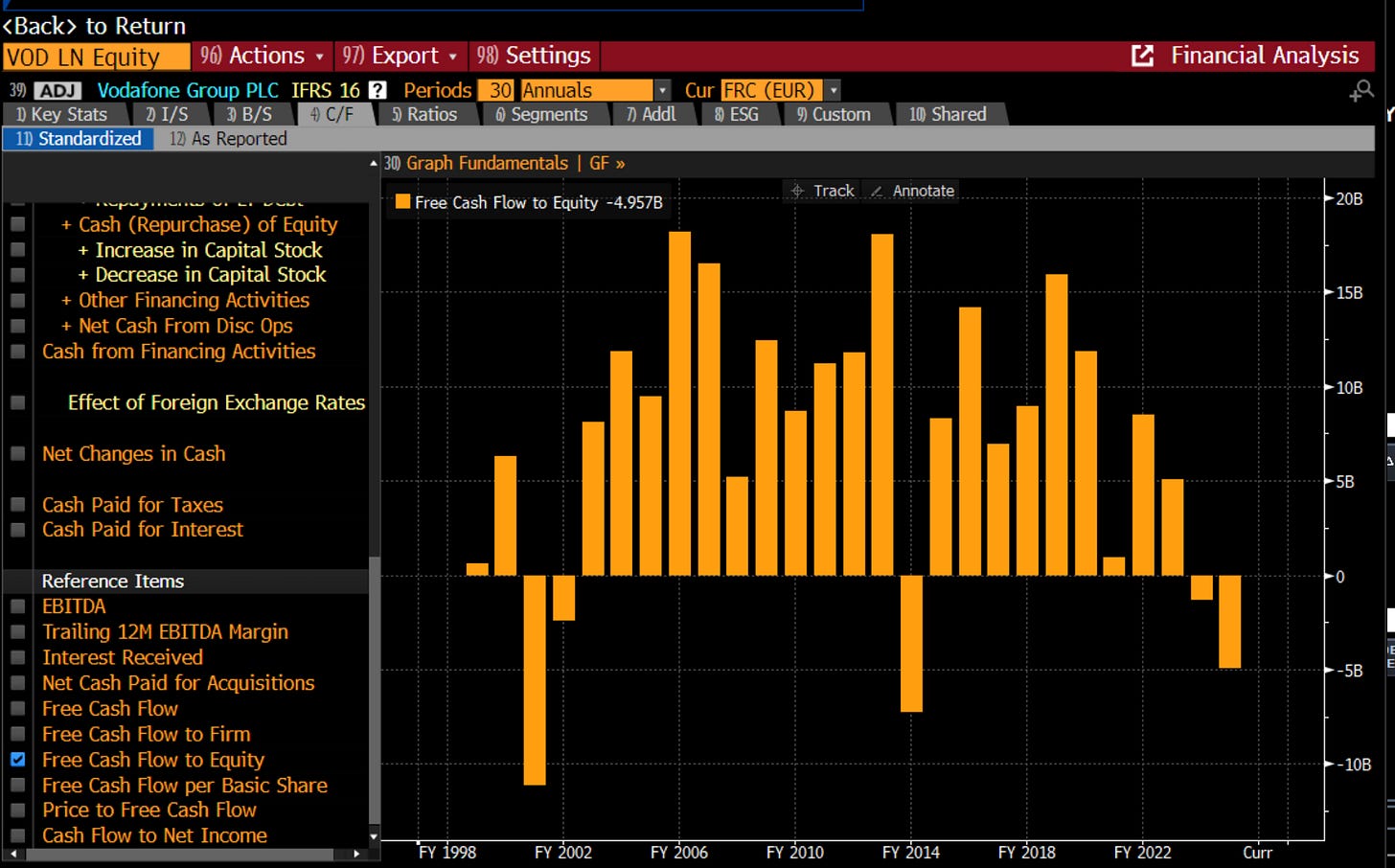

You might want to argue that OpenAI, or DeepSeek are similar crappy companies, but as I use both their products I find that a stretch. There is obvious real demand for what they do. The other type of company that got in trouble in the dot com bust was telecommunications companies that massive overpaid for 4G licences. Vodafone, which both over paid for Mannesmann and licences is a posterchild for this excess.

It was falling free cash to equity that really did Vodafone in back in 2000.

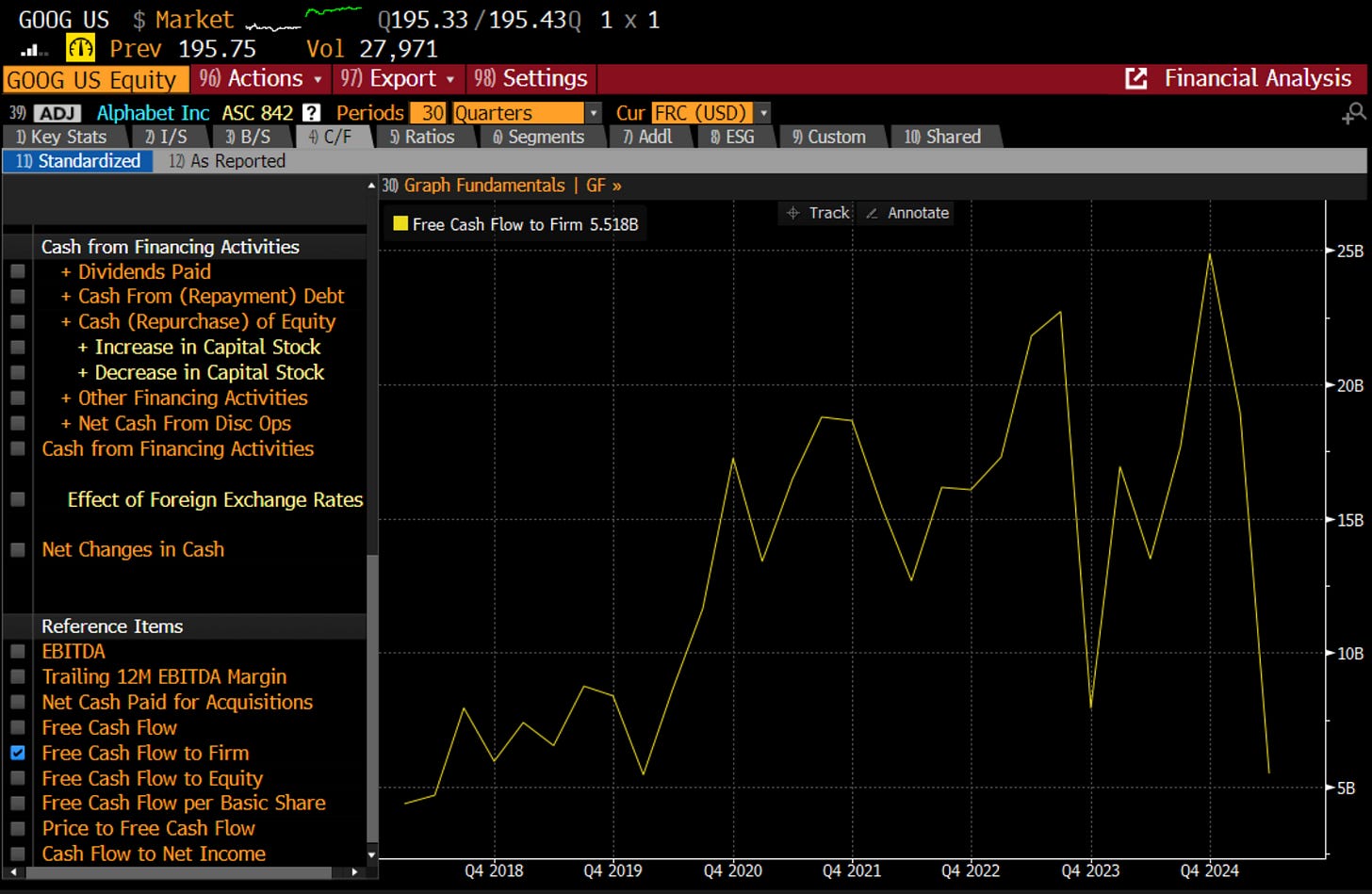

So could the market punished the hyperscalers like it punished Vodafone? Generally speaking of the “hyperscalers” only Alphabet is potentially running a risk here. But they really have no option but to spend big. Chat GPT is threatening their cash cow search business, and need to spend big.

What I find most interesting is that the market is recognising the threat that AI causes to business built around intellectual property in the software space are coming under threat. Shutterstock with its store of images has seen its share price tank. Adobe with its Photoshop products also suffering, as IT outsourcers with their IT integration business (Accenture, Infosys etc). Rather than being a bubble, the market seems to be implying that legacy IT businesses are heading for decline.

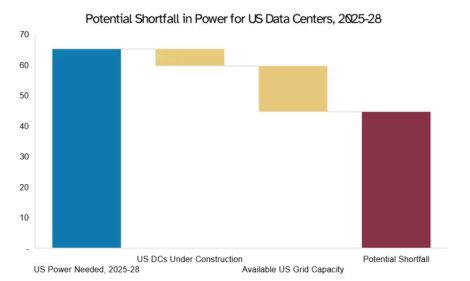

From a market perspective, outside of a recession, the hyperscalers, and the AI spend seem fine. There is one potential cause of a recession from AI I can see. It is putting extreme pressure on the grid, which could cause power prices to spike. Again from MS via the FT, they are forecasting a shortfall of 10% of current US capacity.

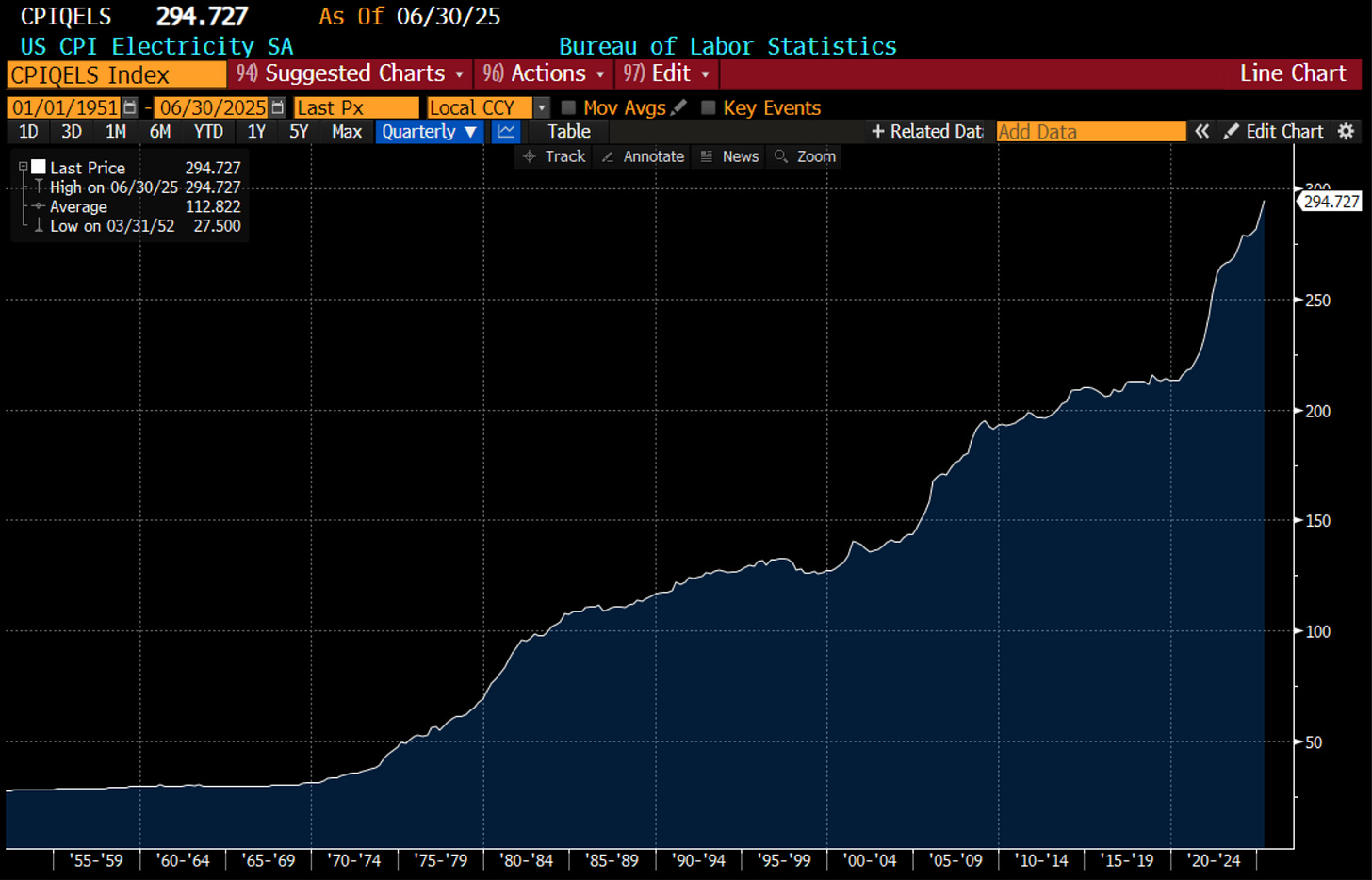

When I look at US CPI Electricity is has the type of movement that I would normally associate with a recession. Businesses and consumers hate rising electricity costs.

AI is not a bubble, but the demands it is placing on the US economy seem to be mounting. In a different political climate where some Schumpeterian style creative destruction would be seen as a wise choice of action. AI seems real to me, but inflation also seems real to me too. This seems like one of those times when a recession would be good for the US. But as Bureau of Labor Statistics Commissioner Erika McEntarfer discovered anything but awesome is not allowed. Given that rising electricity prices are good for gold, and bad for treasuries, is GLD/TLT working less because the US is a bad credit, and more because politically speaking recessions are no longer allowed?

Strange, I don’t see an AI bubble, but I think a recession would probably be good for the AI hyperscalers long term. They would be able to build out without pushing up costs for everyone else. The rising electricity price also makes Trump’s vision of bringing manufacturing back to the US harder. The current administration will probably focus more heavily on increasing energy supply, as they have done with OPEC and the EPA. But that will take time, and tariffs are going into effect now. My guess is that we are heading to an AI boom, and stagflation for the rest of the USA. Which is what Jerome Powell and Erika McEntarfer were trying to tell Trump. There was a good reason economic decisions were moved away from politicians - looks like we need to learn those reasons all over again.