When Russia invaded Ukraine in 2021, we also saw Russian natural gas flows to Europe become curtailed, and sanctions placed on Russian oil producers. There was a huge shock to the energy system, which saw European natural gas prices surge 6000% from 2020 lows.

But since the highs of 2022, energy markets have been very weak, even as the Ukraine/Russian was has dragged on. The oil market has been particularly weak.

So much so that gold is approaching all time highs relative to oil.

Usually a surging gold to oil ratio suggest an economic crisis of some sort - oil falling with reduced activity, and gold surging as fear drives inflows. However, other economical sensitive commodities are breaking out. Copper is at all time highs.

As is silver.

The problems for oil come from supply side. With the shale revolution, US oil production use to fall with lower prices. But this time, we have record production.

Saudi oil production is also at close to peak levels.

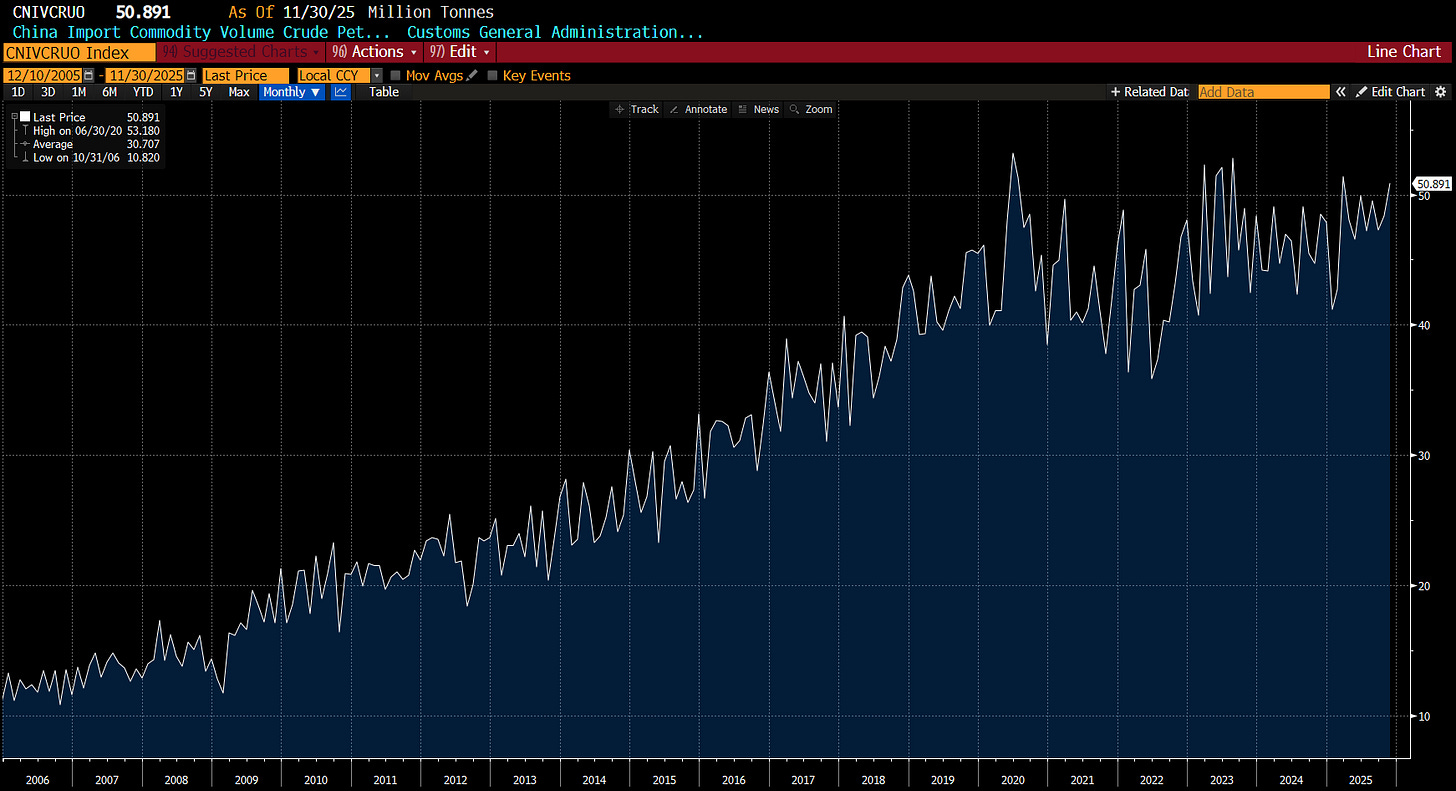

Politically, I can see both the US producers and Saudi government being asked to help keep oil prices low to put pressure on the Russian government. And given the nature of the Trump administration, it would seem wise for them to follow along. But should we get a deal between Russia and Ukraine, would higher oil price necessarily follow? There is a political logic I could see making this happen. Saudis could easily cut production again within the OPEC set up, and perhaps the Trump administration reduces energy exports - perhaps with a tax on exports. This would force up international prices, but keep domestic prices low. But why would they want to do that? Well China is now the biggest importer of oil, and higher oil prices would hurt China, just as high oil prices hurt the US in 1970s. Chinese crude imports are at close to all time highs.

That is Trump could try and pry Russia from China’s orbit by agreeing a deal on Ukraine, and helping push up international oil prices. It makes sense to me, and it certainly seems possible. But the big issue is getting a deal between Ukraine and Russia. But I think I will take a look in capturing upside in non-US oil prices.