After I published a note yesterday, I got a long email basically saying, “No it is a bubble”. As I read the note, I found that I agreed with most of the points. In simple terms it made the following points:

OPEN AI and Anthropic are burning cash

Corporate take up is lower than expected

No one is willing to pay for it

Many of the key customers seem to have a vendor financing relationship - meaning the whole thing is a house of cards.

The really wild thing is that I agree with all of these points! Which is why I thought when DeepSeek came along, the whole thing was going to fall apart, but it obviously has not.

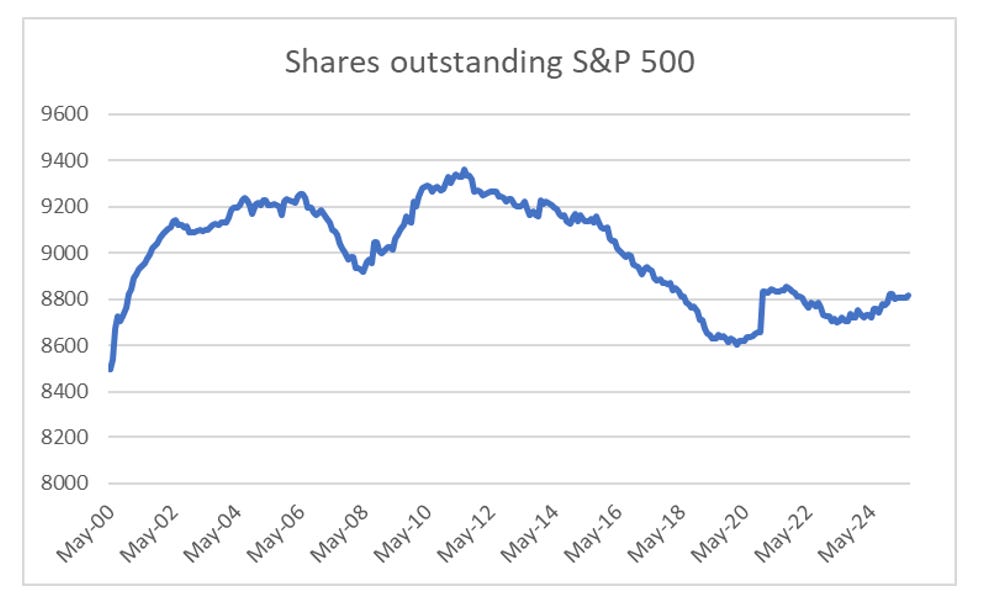

So the question to ask is why has it not fallen apart? What is different about today than back in 2000? I see three big differences. First of all, back in 2000 the dot com investment binge was fed by IPOs and share sales. The shares outstanding of the S&P 500 grew rapidly in that era, as new companies with no cash flow desperately raised capital. This always raises the risk of dilution, and eventually scares off buyers of shares - which is one reason the dot com bubble topped out in my view. Share sales are not surging today.

The other big difference between today and 2000, is that most of the hyperscalers are investing out of cashflow. This changes the dynamics greatly. Back then, the Zuckerbergs, Bezos and Sons of the world had to convince sceptical finance types to back them. These days, they have the cash flow and the corporate control to do whatever they want. And as they often built businesses before there was an established business model, I think it very likely that they look at the current unprofitability of AI and look through that. The limit on investing is not the profitability or non-profitability of AI. The limit is the profitability of their own businesses. So if we have a recession, then AI is in trouble, but then so is everything else.

I have also learnt the hard way, is that you should never short a dream. I read many many bearish notes on Tesla, how it would never make money, and was a scam of sorts. And for years it had the highest short interest in the market (see middle chart). But when the dream came true - the short sellers were taken out back and shot.

What is even more incredible about Tesla is that now that its a reality, it earnings are poor, and the stock still holds up. Usually stocks follow earnings, but not with Tesla anymore. The bulls will tell you that Robotaxi and self driving cars will be the next leg of the bull market in Tesla. Could be. Buy my rule of never shorting dreams still holds true. And in the case of AI, or AGI - this a dream I do not want to short.

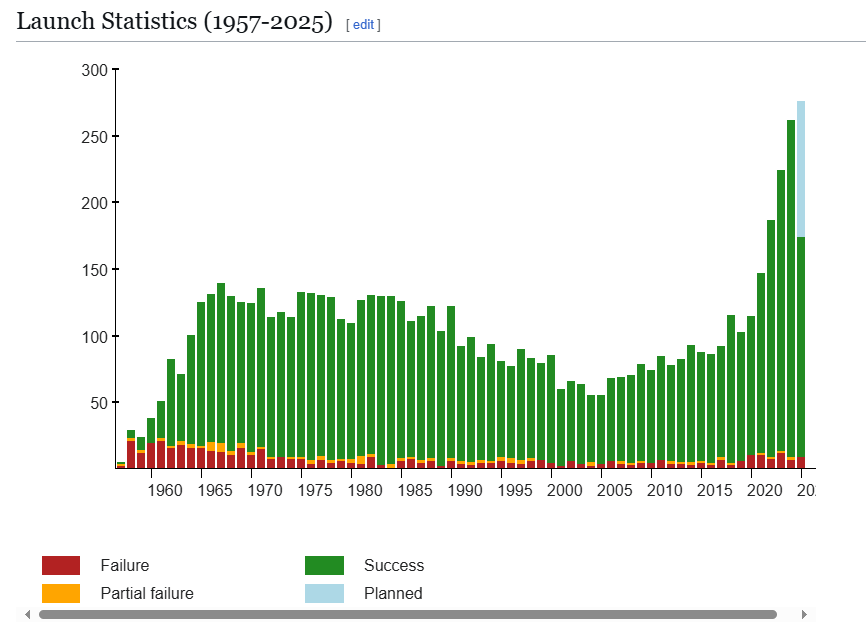

The final point I am going to make about AI, is that it has become a strategic industry in the competition between China and the USA. The space race was the defining competition between USSR and the USA. This led to huge uneconomic investments in sending astronauts to the moon. The Apollo program cost USD 300bn in today’s money. And when money became tight in 1970s, the program was cut. On balance, the US government see AI as a new space race in my view. That means questions of economics and returns are unlikely to be asked in the foreseeable future.

In short, I agree that the financials are indeed a bubble. But I don’t see how or why any of the major players cut their investments as yet. All of them have been involved with loss making visionary businesses - and the strategic value of AI will make it unlikely that they back away from their investments, even if they are loss making for the foreseeable future.

I have only had one period of success in shorting technology stocks - which is when the Chinese government told me to short their technology stocks in 2021.

Back in 2000, the US government sued Microsoft over antitrust, which was a good reason to short. Bit like the experience of China in 2021. But outside of these special cases, it never works to short expensive tech. One lesson I have always had to teach new hires about short selling, which they really struggle with, is that you will make far more money shorting stocks with low PEs than stocks with high PEs. The problem with shorting AI is that these are high PE’s stocks - and unfortunately, that is a bit like Stella Artois - reassuringly expensive.

I understand the bearish arguments - but I don’t see who is the investor who is going to suddenly pull out. Or governments suddenly not being supportive. What is more likely is that there is a technological breakthrough that upends the AI race - I thought DeepSeek was it - but it looks like I was wrong. Time to be patient I think.