I have very MIXED feelings about June. So the core trade of GLD/TLT finished the month on lows. So even though this trade still looks good to me, it was a headwind in June.

I also think long gold/short SPX makes sense here, but again this finished the month near lows, so was another headwind.

I also think the cost of capital should be rising for US corporate in particular. One proxy for this is HYG. During the month it traded to a new high - so was a real headwind for the short book.

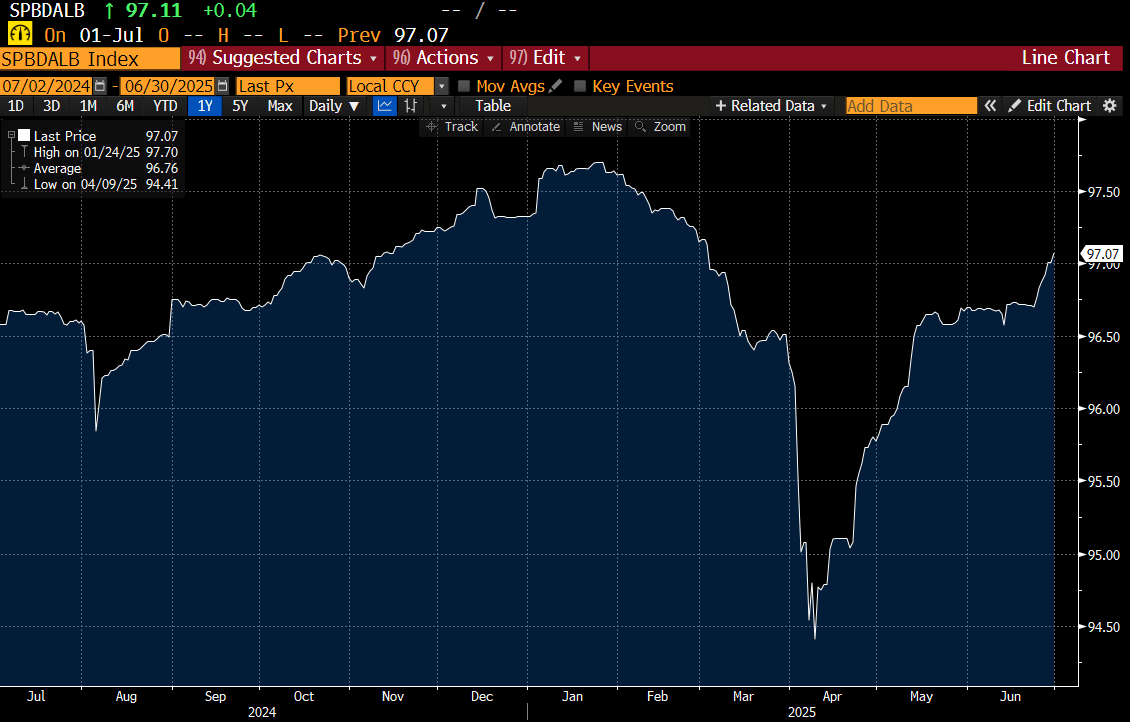

Leveraged loan index also traded up in June.

If you told me this was how the month of June was going to be for GLD/TLT, HYG and leveraged loans at the beginning of the month, I would guesstimate a loss of 2 to 3% for the fund. That we ended flat is good sign. But with core macro trading this way, I am always a bit worried. And that is why I have mixed feelings.

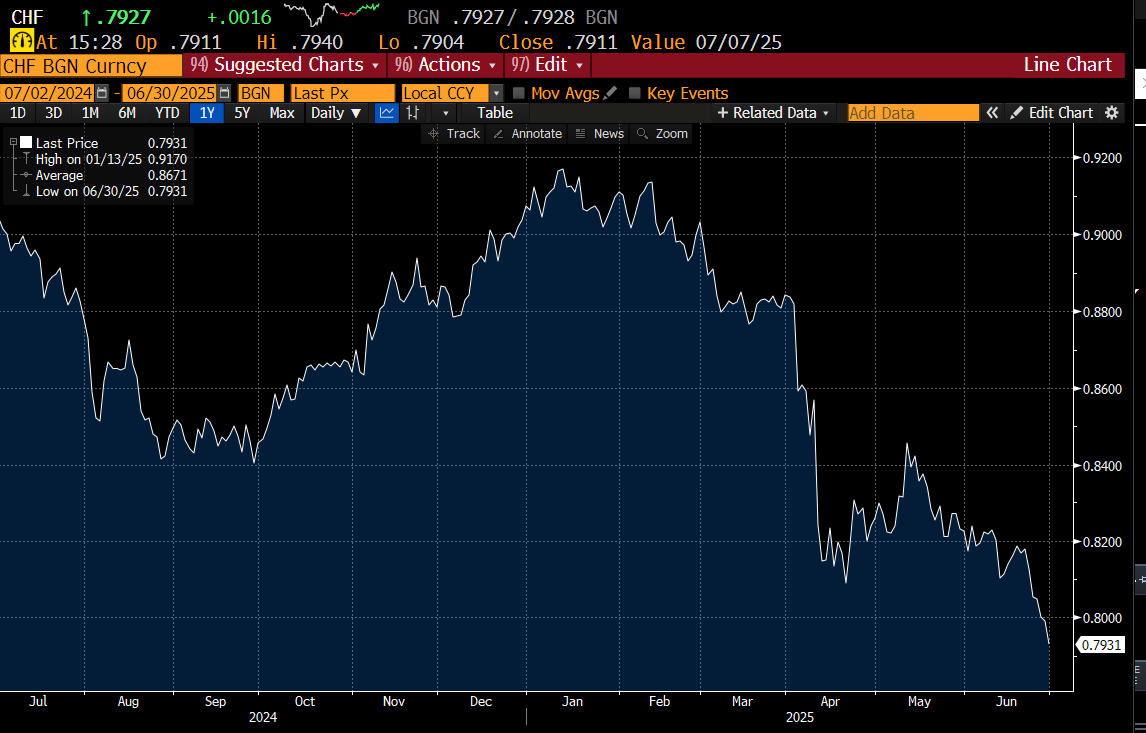

So what did work? In a month that had a decidedly “risk on” feel to it - the Swiss Franc hit new cycle highs. As a broader dollar weakening trade this makes sense to a degree - but I feel a rising Swiss Franc is a bearish signal.

On the stock side, we had some good success with some longs and surprisingly with some shorts!