It has been axiomatic that problems in the middle east would cause problems for the world, mainly through spikes in the oil price. Stagflationary 1970s was driven by the two oil price shocks, driven mainly by OPEC embargo on selling oil to the US. Over this period oil rose from USD 1.70 a barrel to USD35 a barrel driving rampant inflation. Believe it or not, this is before my time.

I am old enough to remember when Iraq invaded Kuwait. Oil prices spiked from USD 20 a barrel to USD 40 a barrel, and led to a brutal recession in Australia.

Unemployment in Australia surged to 11%, the highest level since the great depression. Getting a job was very hard, and remained so for quite some time.

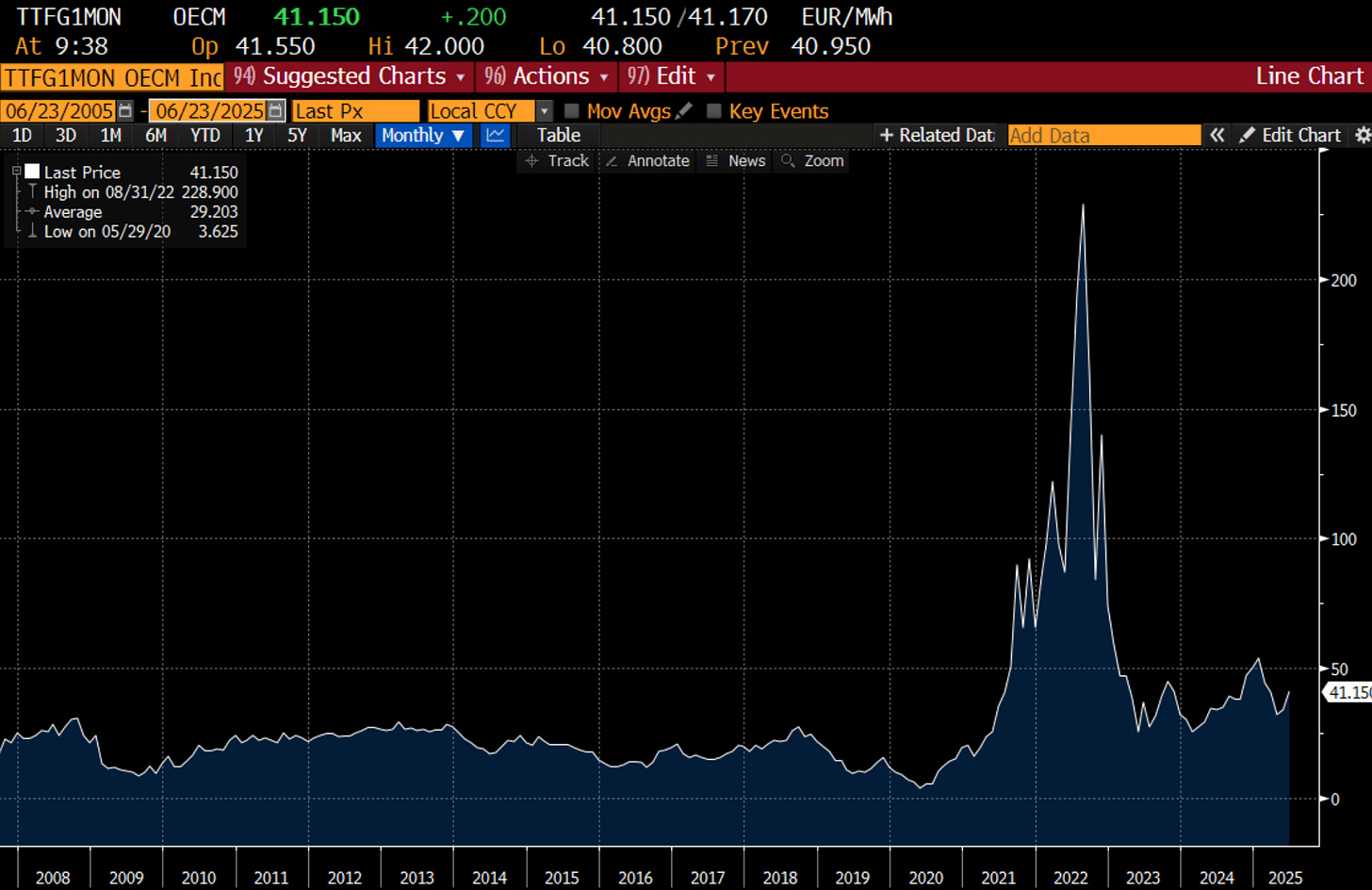

So there is a muscle memory that energy price spikes are diabolical. Certainty markets were poor during the Russia induced spike in European natural gas prices.

But even the most heavily dependent nation on Russian gas, Germany, never saw a meaningful jump in unemployment.

So first of all, plainly energy prices do not flow into unemployment as readily as they used to. The rise of service economy versus a manufacturing economy is probably the main explanation. But there is a political explanation too. During the 1970s, OPEC AND the entire Soviet Block including China were net exporters of oil. Given that the communist block was not a market based economy, as long as they had oil supply economic growth would be fine - it was only market pricing economies that would suffer - hence OPEC could threaten the US with oil price surge, while not hurting its ally, the Soviet Union. China at the time was also an exporter. But obviously this is not true anymore.

China is now much more reliant on oil imports than the US. Does it make sense for Iran to hurt the one economy that has the military might to worry the US? Not really. Even more problematically for Iran is that Saudi’s have shown a willingness to raise production. They probably have another 2m barrels a day they could bring on line - given they are producing 9m barrels a day versus a peak of 11m barrels.

With Iran at about 3.3m barrels a day, even if that was shut down, the world could probably cope if the Saudis played ball - and there is every reason to think they would. There is also the question of does Iran even have enough money to live with out oil revenue for a prolonged period of time?

Of course, the risk is that Iran realises all this, and then begins to lash out at Saudi and the rest of the Middle East, and try and disrupt all oil production. This is possible, but would probably lead to greater intervention by the US, and would NOT be supported by China - as explained above. Markets have worked all this out I think - which is why oil prices are basically flat on the year.

From my perspective, if US bombing Iran had caused JGB yields to fall, then I might have to have a rethink about markets - but JGB yields still remain in a bear market.

Iran doesn’t matter - and yet the cost of capital continues to rise. Interesting.