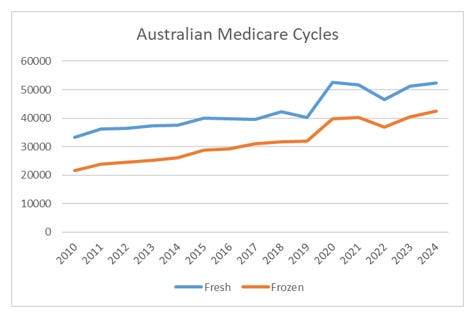

One of my pet topics, and related to my “pro-labour” views on politics, was that I expected fertility rates to rise. I know that there a number of readers who follow this, and have sent me various articles on this. For new readers, the argument for an imminent baby boom centres to two observations. Firstly, rising wages and steady employment and more opportunities to work from home should all act as a boost to baby making. Secondly, improvements in Assisted Reproductive Technology (ART) should allow women to become mothers at an older age, and during this transition from young mothers to older mothers, we see fertility rates drop, and then rise. In countries like Australia, treatments for ART have certainly increased.

Despite this, Australian fertility rates are still dropping.

Even more negative for this theory is that Denmark, which has by far the most progressive rules on ART, saw bump in births when laws were deregulated in 2015, has now seen births fall back to pre deregulation levels.

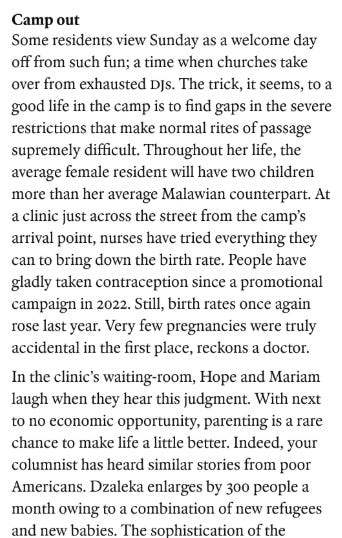

I have been sent articles pushing the idea of increased government spending leads to higher fertility rates - but the evidence has been mixed. My last post on this came to the conclusion that society has to want higher fertility rates, then anything is possible as Israel has shown. But I was struck by this article in the Economist. It was talking about a UN Refugee Camp in Malawi, where there is no work, and everyone has to get by on USD 9 a month. Despite authorities best efforts, fertility rates are fully two children higher in the camp than out of it.

This fits in with my observation of Eastern Europe, which saw birth rates plummet with the collapse of Communism. Below is Polish total fertility rates. Socialism, apparently, is good for fertility.

The conclusion is that pro-labour policies are good for fertility - but I suspect for most people, a move back to Socialism would be a price too high. Perhaps in a Trumpian America, where workers are protected by high tariffs, a fertility turn around can occur. Or perhaps a more comprehensive program to make housing cheap and affordable? Time will tell.

CLEARINGHOUSES

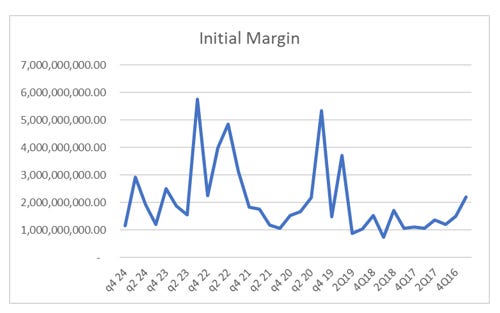

I have yet to see any political movement to reform clearinghouses. They continue to create the odd market conditions where no risk is priced in, and then all risk is priced in. They were no doubt also at the centre of the recent sell off in treasuries (if this is a new topic for you - please see my tab). Its been a few years now, so whenever you get unexplained sell off in mildly important markets - like US treasuries, or currencies - you can expect the braindead clearinghouses to be involved. They have no ability to price risk on a forward basis - almost everything they do is reactive. Looking at LCH - which is the most important interest rate derivative clearinghouse - margin breaches had fallen back to low levels in the most recent reported quarter (q4 2024)

This meant that initial margins has also fallen back to lows, even though President Trump was reelected with a mandate for change in Q4 2024. This led to reported initial markets being low was as well. Perfect conditions for a bond market panic.

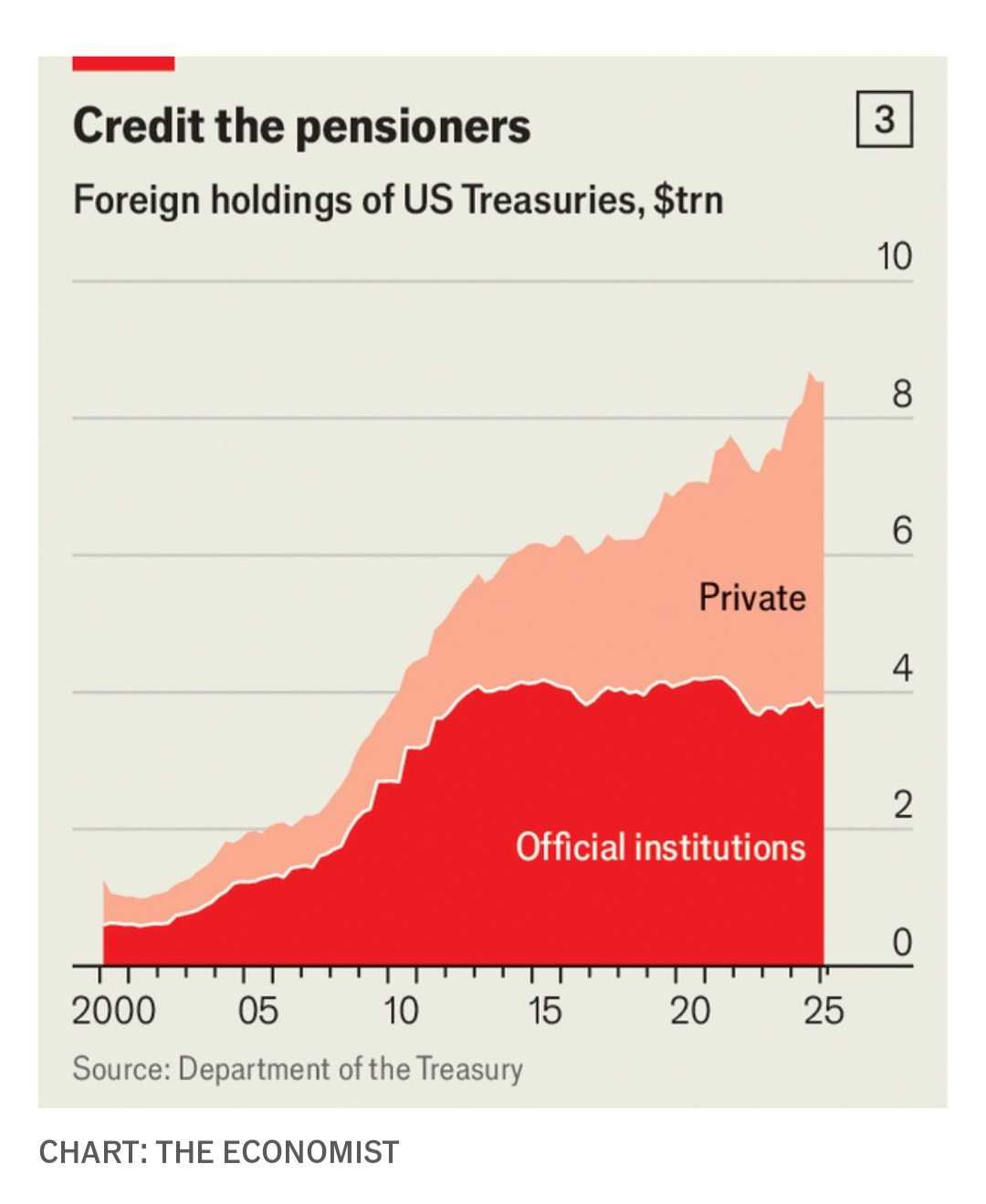

Even though clearinghouses have clear problems in managing risk, there is no political appetite for reform. I suspect that the size of the US treasury market now requires the clearinghouses poor risk management. The basis trade, where hedge funds buy treasuries and then sell futures against them has grown massively as clearinghouses have moved to the centre of financial system. Banks would never lend in the size that hedge fund needed - but clearinghouses have no qualms. This has allowed the private sector to become the biggest foreign owner of treasuries.

Its a financially unstable setup - but politically stable as the US government de facto backstops clearinghouses, who then provide hedge funds the leverage to participate in basis trades. Just expect the treasury market to go no bid from time to time.

VOLATILITY

Korean issuance of autocallable was strong into April, and the weekly numbers I have seen for April show a buy the dip mentality. That is no change in below trends.

Popular products remain S&P 500, Eurostoxx50 and Tesla. While all have been volatile, I don’t see any of them getting close to knock in levels - which means that we should still see heavy volatility selling from all this products.

Kospi 200, which probably has the most influence from autocallables has seen volatility return to 20ish. This is despite South Korea being a main trading partner to China and the US, and also seeing 25% tariffs being imposed on Liberation day.

From what I can see, autocallables look still in place, meaning a spike in volatility still remains very possible. Despite the spike in volatility in April, there does not seem to be any reduction in volatility selling - which is unusual.

Please do drop me any questions - or have a look at my other posts if any of the above is interesting.