I have thought the world is moving to a 1970s style stagnation. What this means is rising wages would create inflation and higher interest rates. This would lead to asset markets stagnating. I thought the best way to trade this was long GLD short TLT. It has been a good trade - even with the reversal this week.

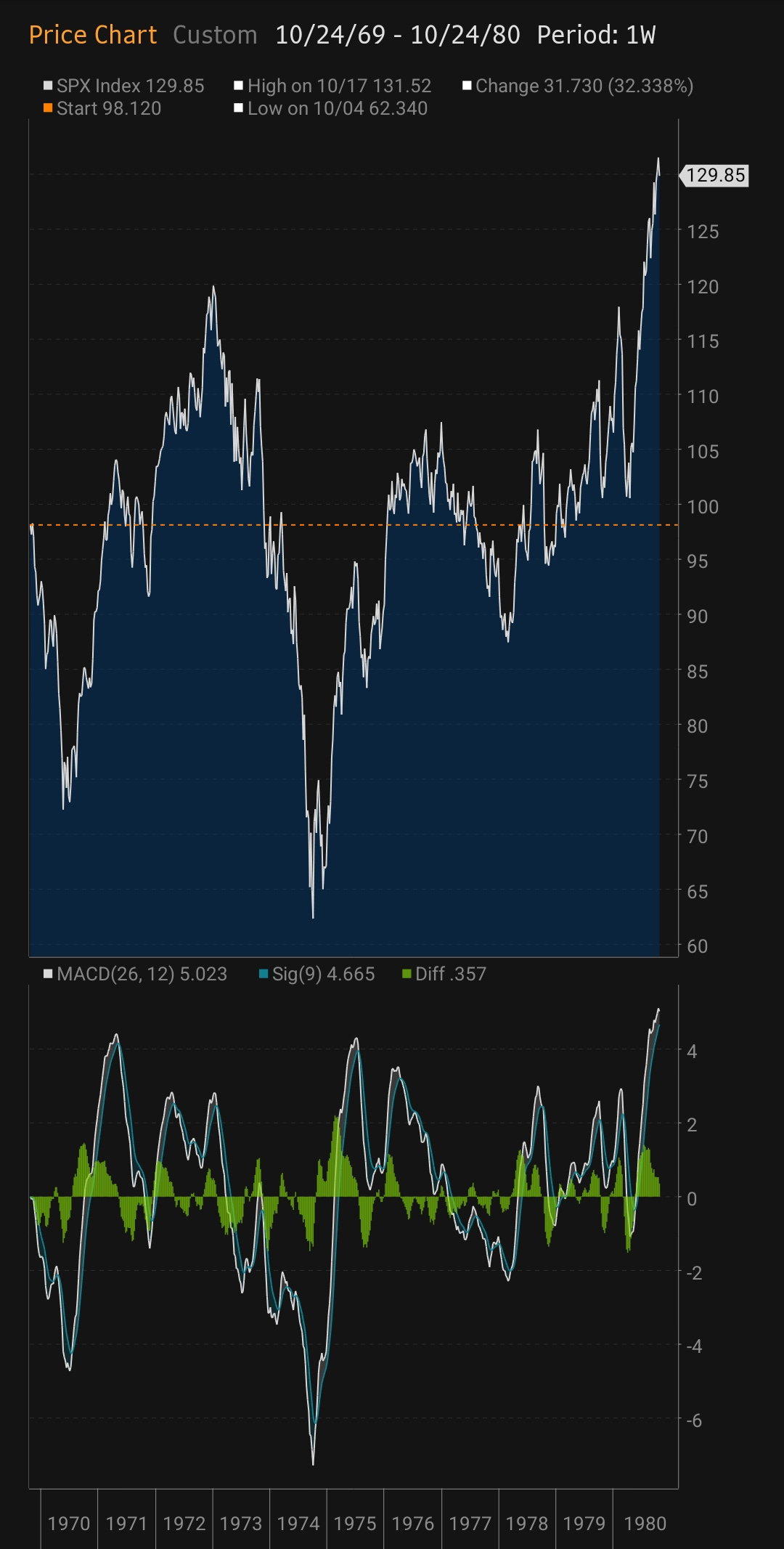

I also thought equities, and particularly the S&P 500 would be a big flat nothing, with swings up and down like the 1970s.

That has not been the case. I just got an 11 hour flight to San Francisco which has given me time to think. The problem for markets in the 1970s was the repricing higher of a key input- namely oil. And the emergence of OPEC as a price setter. Today, we see the repricing of a key input - semiconductors. If Aramco was listed in 70s - then its share price would have looked like Nvidia - and ever fund would be forced to own it.

I resisted the idea of semis as the new oil for two very good reasons. Unlike oil wells, semiconductor productivity increases over time so supply is always growing. And secondly, there is no real reason why semiconductors cannot be built anywhere - its just a matter of capital and effort. Japan has a semiconductor driven boom in the 1980s that turned to bust. And Asia had the same in the 1990s. But both of these busts were driven by free trade. US developed semiconductors first, then Japan, then Asia. And I assumed China would follow suit. Obviously efforts to slow China has worked and the SOX index has been like owning oil in the 1970s.

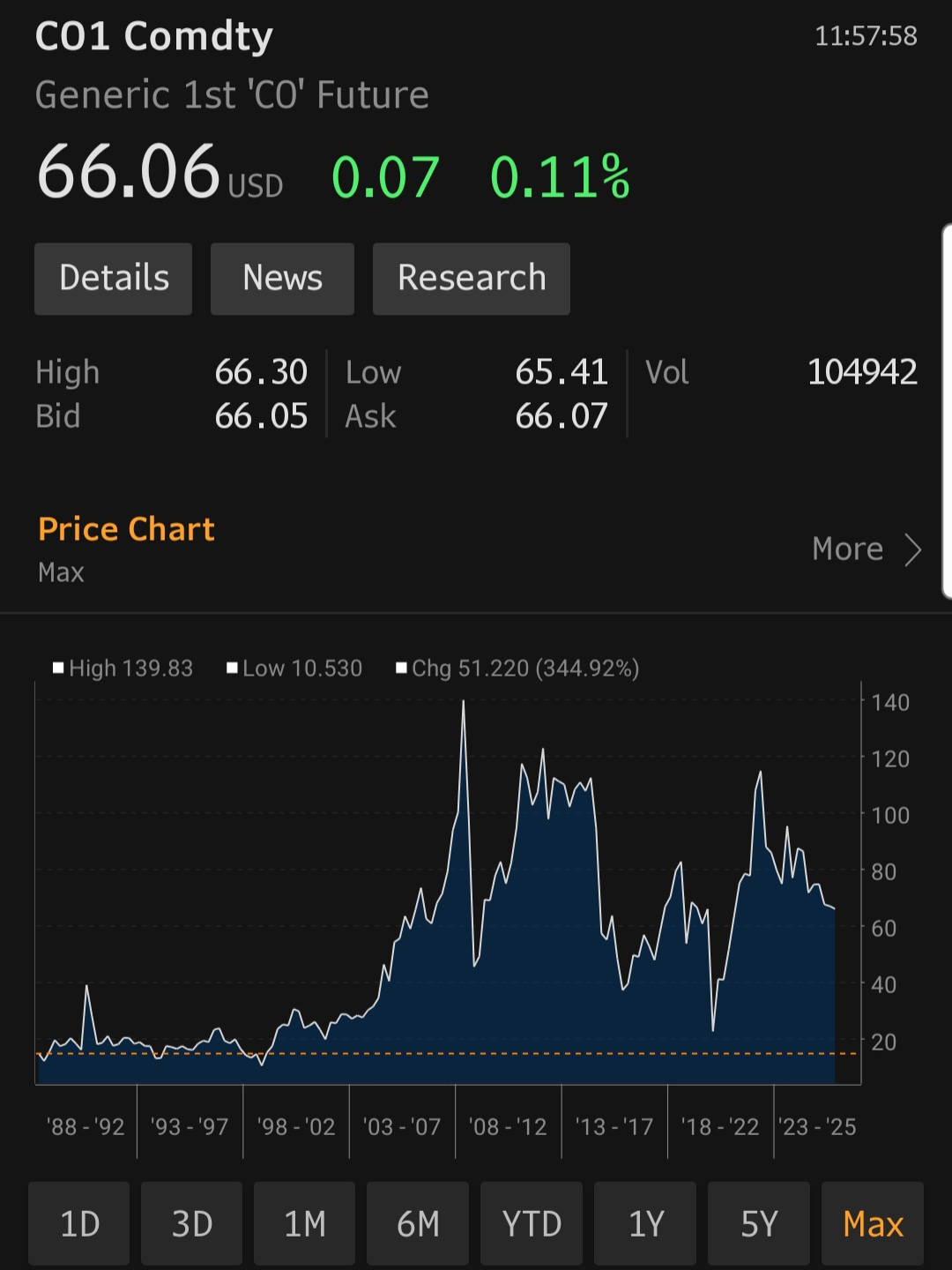

I will file this under “the market is always right”. So for me the interesting question is why is gold and precious metals doing so well? Oil prices are still in the dumps, so they are not moving with energy inflation.

I think the simple reason is that semiconductor and tech inflation is taking over from oil as the driver of inflation. Electricity CPI is NOT being driven by energy prices - but by AI capex.

Even though I have been sceptical of AI, many of my “non-tech” stock picks have been influenced by the rise and rise of semiconductor and computing as the driving force of growth. When I think.back to the commodity super cycle from 2000 to 2010 - this was driven by China catching up to the old oil centric economic model, something the western world did in 1960s to 80s. The China boom was like a big franchise sequel - made mainly for old people (industries) and totally derivative. China car sales are a good example. The US and Japan were ex-growth auto markets in the 1980s.

Lack of semiconductor supply is driven by politics and economics, just as lack of oil supply in the 1970s was driven by politics and economics. When I think about the world in this way - you can still see that GLD/TLT will do well. Unless central banks tighten - AI growth will drive more inflation. The other option would be allow China to bring on semiconductor supply - but that is a political non-starter at the moment. This means equities continue to outperform bonds - a changed relationship that really caught me out a few years ago.

The dot com bust ended as Asian supply came online, China was accepted into trading markets and fiscal and monetary policy was tight. This time China supply is rejected and fiscal and monetary policy is loose. The trillion dollar question is when does politics move decisively against inflation as it did in the late 70s? Here it gets tricky. China tends to be reticent about its semiconductor developments, and companies like Google and Microsoft are aware of their dependency on Nvidia so are spending heavy on R&D. I would be lying if I said I had inside knowledge of what is happening in China and in US big tech (and so would anyone else). What I will say is that gold/SPX is hinting at change, just as it did at the beginning of the 70s and the end of 70s.

I wonder if this well be another episode of “the market is always right “?