We have had quite the precious metal frenzy in recent weeks, but with some chunky weakness today. First of all, even though gold has had quite the move, it is only double from its previous peak in 2011, still nothing compared to equities.

That being said, on my very long term chart of gold versus treasuries, it has now had a fairly serious move. Still far from the extremes reached in the 1970s - but the pace of the move recently is substantial.

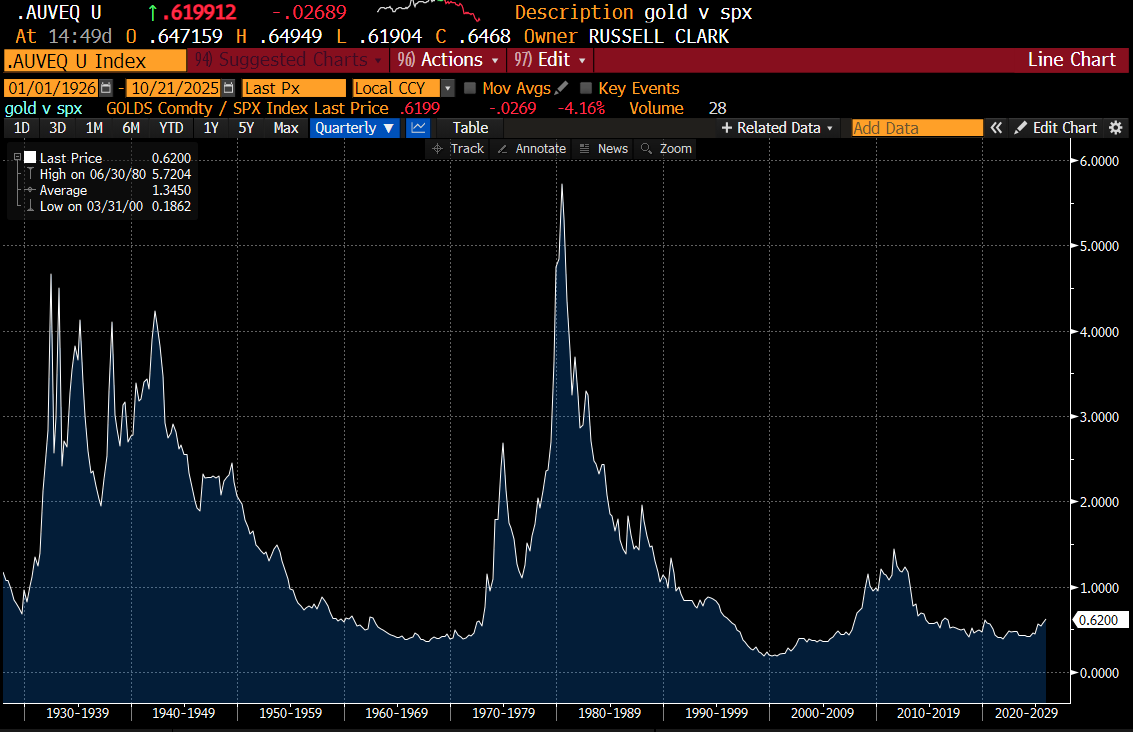

But in terms of gold versus the S&P 500, we are only just beginning to move.

Putting it all together, gold does not look cheap, but its seems cheaper than both treasuries and the S&P 500, which is exactly what I have been thinking for awhile now. On a shorter time frame, gold/SPX could correct a bit. The 200MDA looks like a good technical support, and was where we got a bounce after the surge earlier this year. We are 11% away from that, but with a rapidly rising 200MDA ( assuming no crash in S&P 500)

GLD/TLT which has been following the 100MDA would also suggest a quick 12% sell off is also possible.

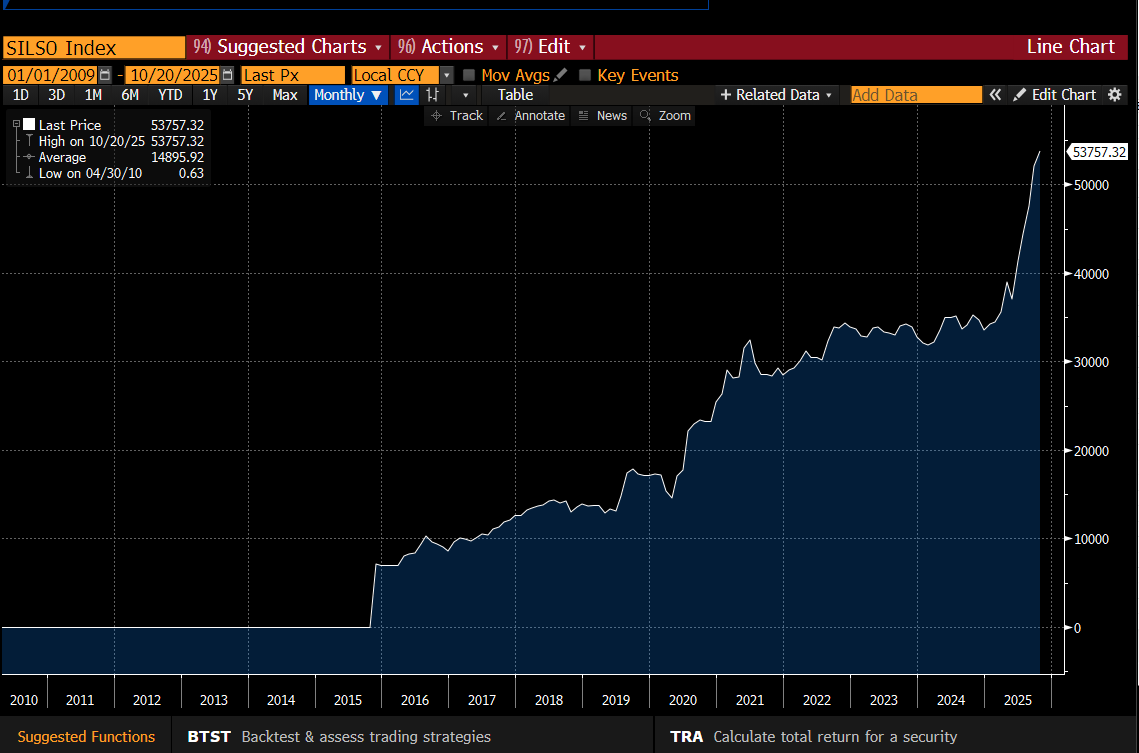

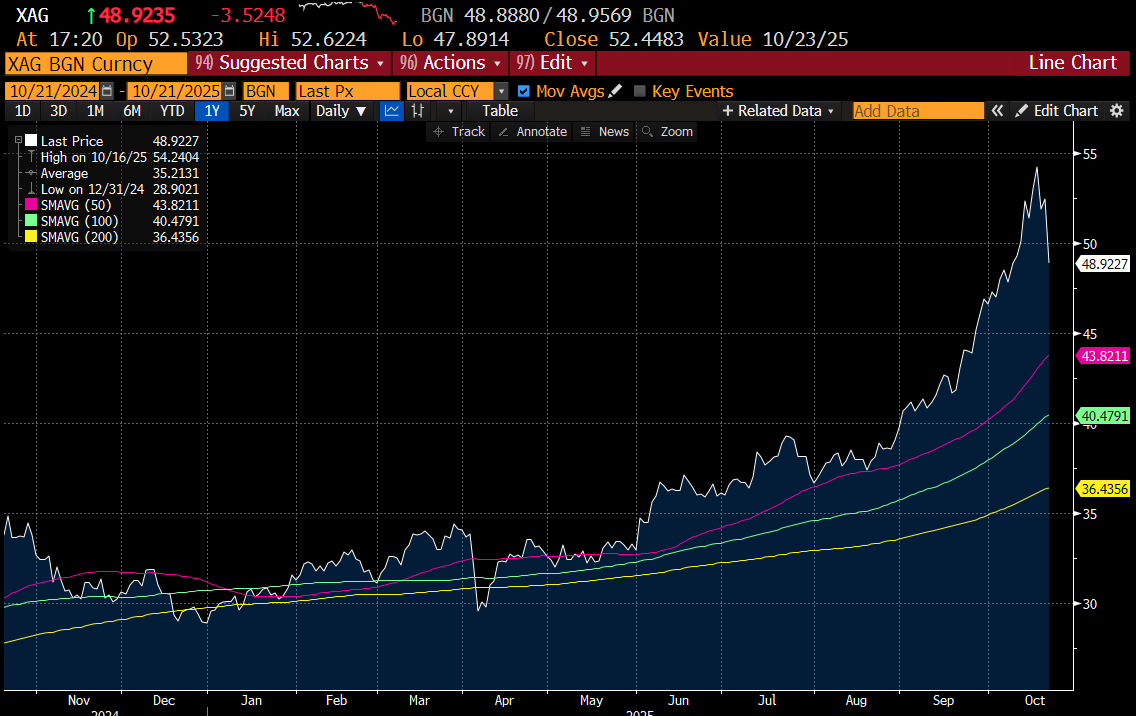

That being said, I suspect a sell off in other precious metals is probably likely here. Precious metal mining stocks have been on a tear. SIL US, Global X Silver Miners ETF has surged. But as the long term graph should suggest, silver miners (like gold miners) are terrible businesses.

Shares outstanding in SIL tends to surge whenever the silver price surges, and then a new generation learns that precious metal mining is a terrible business.

I find it easy to see silver falling back to its 200MDA of 36 USD for me, which should lead to heavy falls in silver miners.

Surely a weak silver price is bad for gold? I think that relationship ended a long time ago. As I put in a recent post, as long as the US runs a current account deficit, then Asian Central Banks will be forced to put money into something other than treasuries - and gold seems the most likely beneficiary. And the only thing that I think causes the US to balance its current account is much higher interest rates. As far as I know, central banks do not stockpile silver. So what do I see? Silver could get hammered, but gold looks like a corrective to me. Politics is still way to supportive of gold.