(Housekeeping - I post about my son’s karting exploits here now : Jarrett Clark Racing please subscribe if you are interested)

One of the biggest headwinds the hedge fund and alternative industry has faced in the last few years has been the consistent outperformance of the US, and particularly large cap stocks. Who needs hedge funds, when you have FANG, or SPY? Why pay fees to an investment manager when you can buy the most liquid assets on the planet for virtually nothing? For me, my working assumption was that US stocks could go up forever, but only if the US dollar was weak. That assumption proved to be wrong. Using BIS measure, the US dollar is was very strong over this period, and remains strong.

Now the Economist has a long and illustrious career at a “contra”. A good recent example was Brazil. In November of 2009, the Economist ran this cover on Brazil.

Brazil has tended to do well, when its currency does well, and the cover of the Economist marked pretty close to a high for the Brazilian Real. It peaked at 1.5 Brazilian Real to the USD, and got close to 6 in 2020.

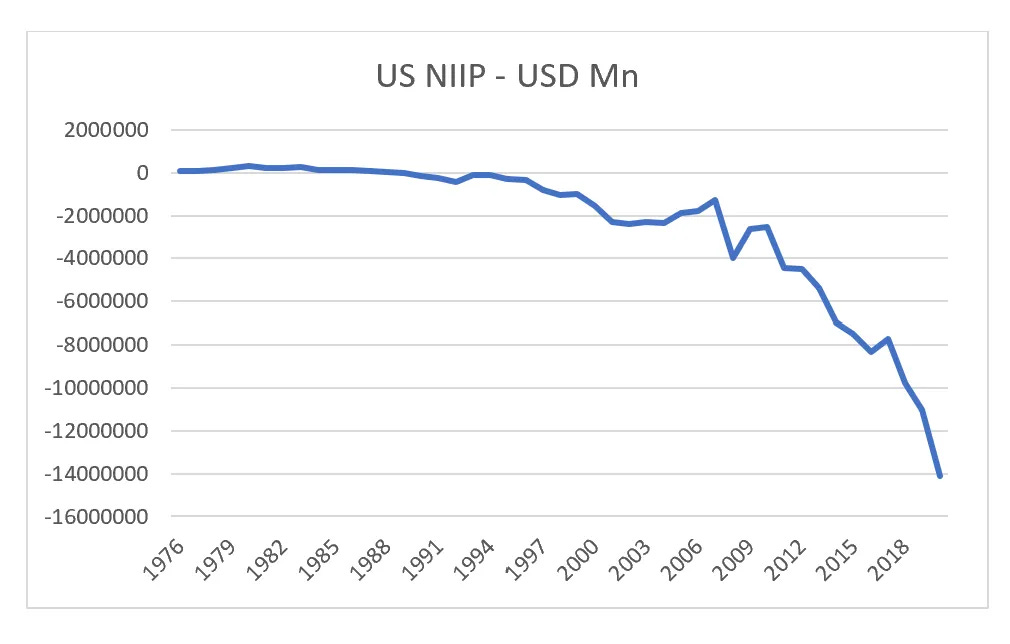

For me, there are many similarities between the US now, and Brazil then. I went to Brazil at that time for a capital raising conference, and the hotel in San Paolo was USD 500 a night and everything seemed pretty expensive. I met potential Brazilian investors, and said to them, just get your money out of Brazilian Real, and you will be fine, and the response was that the US dollar did not pay enough for them to sell Brazilian Real. One of my favourite indicators Net International Investment Position (NIIP) also flipped very negative in 2010 (and has remained negative). Typically NIIP should go positive if you devalue enough.

I have not been to the US since Covid, but most of my basketball team are North Americans and have been recently, and come back with stories of hotel rates of USD 1000 a night in Miami and New York. From a purely macro position, I have been a fan of NIIP and this has been screaming sell the US Dollar since 2016. As I am travelling, I will be using old charts from a previous post, but recent data has not changed too much - with the most recent number being USD16.7 trillion. For context, I have never seen another country get past USD 4 trillion before getting into trouble.

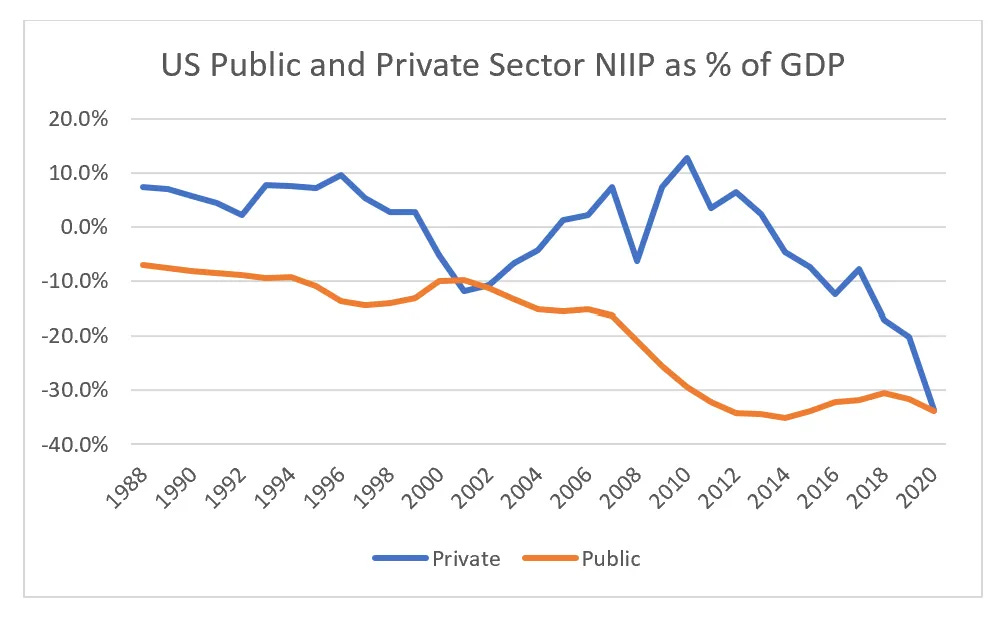

The US is not like other countries, so I also look at it in terms of its own history. Here I strip out the treasury holdings of other countries - to try and look at “Private Sector” alone, and then divided by GDP, to try and make a comparison over time. The Dot Com bust happened at 10% of private sector NIIP to GDP, while in 2020 we got to 40%. I personally went bearish on USD in 2016 on the back of this analysis, and was wrong.

What has changed to make US NIIP get so extreme? Well the US bulls have been right in a way, it’s the best of a bad bunch. China has capital controls, and both Japan and Europe until recently ran negative interest rate policies, with almost explicit policy objective of keeping the currency weak. This was one reason I have focused so much on food inflation, as this seemed to me the one type of inflation that could prompt real change from central banks. If Europe and Japan raised rates to strengthen their currencies, could this lead to capital outflow from the US? I don’t know - but the Economist cover could prove a top again. And in hindsight it would be easy to say it was obvious.