In 1987 film Lethal Weapon, Donald Glover uttered the immortal line “I’m too old for this shit”. Born in 1946, he would have been 41 when playing Murtargh to Mel Gibson’s Riggs. 13 at the time, I thought “Yeah! He is too old for that shit!” At the grand old age of 49, and thinking of getting back into fund management, I keep thinking that I’m both too old for this shit and too young for this shit. Currently the no-brainer easiest trade in the world is to basically buy the Nasdaq 100.

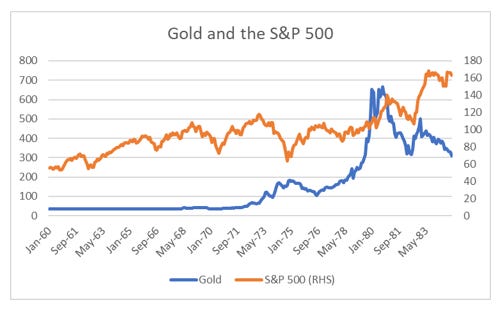

The problem with no-brainer trades is that I have seen so many go wrong. Buying gold in 1970s, which then turned into 20 year bear market from 1980 onwards. Many gold bulls like to pretend the period from 1980 to 2000 and from 2011 to 2019 didn’t exist, but they did and wiped out many investors in gold mining companies. In hindsight, politics was turning against inflation in 1970s, and this was going to catalyse a 20 year bear market in gold.

In the 1980s, Japan was the no-brainer trade, but again by the mid 80s, politics was turning against Japan, as the US started negotiations for various free trade agreements with other nations, and the Yen was forced higher to make Japanese manufacturers less competitive.

More recently, in 2011 emerging markets and China in particular were seen as no-brainer trades. But 10 years later, you are sitting on 60% loss. I don’t need to tell you how politics has changed in relation to China.

So my problem, and why I am too old for this shit, is that the politics for US large cap tech has also turned negative, and did so quite some time ago. Lina Khan head of the FTC basically made her name by calling out Amazon for its anticompetitive behaviour. Biden went out of his way to try and increase market competition in the US, and yet the biggest and best stocks, the ones most at risk have continued to climb. And that is because the biggest companies are the biggest buyers of their own shares, regardless of valuation.

If I had to explain the bull market of the the last ten years to some distant future young analyst, I would say it was a bull market driven by the tolerance of extremely pro-capital policies. Rather than try and let market forces work their magic, governments stepped in early and often to maintain friendly market conditions. Corporates were allowed, and even encouraged, to seek tax friendly policies. Corporates have benefited from government largesse and reduced taxes. This has led to the strange situation in the US net worth being 600% of GDP, and US Federal Debt to GDP being over 100%, and life expectancy actually falling. How can a country be rich, broke and dying at the same time? What is clear to me is that pro-labour policies are very effective at reducing debt to GDP levels. Rising nominal GDP with high inflation and high interest rates is the incentive structure needed to reduce debt - and importantly in my view, win elections here.

The problem is that political change can only change markets with a significant lag. For example, I see devaluation of the currency as a pro-capital policy (it reduces real wages). With this understanding, you wanted to buy stocks when Nixon abandoned the gold standard, but US stocks did not take off for another 8 years. If you bought stocks at the 1974 low, you did buy a generational low, but only from the 1980s onwards did stocks really outperform. Perhaps it was the confirmation of pro-capital policies with the landslide election of Reagan that markets needed.

The Plaza Accord of 1985 led to a surge in the value of the Yen, and was a clear sign that the mercantilist policies of Japan had reached a natural political end. And yet the Nikkei quadrupled over that period before entering a prolonged bear market. These days, a strong yen and weak Nikkei is almost axiomatic - but back then people rationalised it away.

So coming back to today, for me the 40 year bull market in bonds is done. And for me its a clear market signal.

So I think we are heading back to a long period of gold outperforming treasuries. Below is the a long term chart of gold versus treasuries. For me, we are still in the foothills of this trade.

My problem is that while I am too old to play along with the “no-brainer” trade of Nasdaq 100, I am too young to just sit around buying gold and selling treasuries while waiting for it to happen. I still have the fire in the belly to go out and short businesses that will struggle in the world we are going to. So strangely, I feel both too old for this shit, and too young for this shit.