Back in the early 2000s, Berkshire Hathaway had a large stake in Chinese oil major, Petrochina. Selling out of the position in 2007, they made 7 times there money in a relatively short period of time.

As so often, he was selling when he could at pretty close to the top. The oil price has been rangebound ever since.

My impression of the time that Buffett was a excellent commodity investor. When I heard the news that Buffett was taking stakes in Japanese trading houses in 2020, I took this as a view that the commodity cycle had decisively turned. The Japanese market has relatively few resource plays, and trading houses were seen as commodity plays. And as the above chart on PetroChina, oil stocks have been “ok” places to put money. But the chart of Itochu, is very different to PetroChina.

Itochu has significant food related assets, an area that I was quite excited by. I thought the Buffett investment was an endorsement of the idea of structural inflation in food. As the VanEck Agribusiness ETF shows, agriculture related stocks have not been a good place to invest.

Even in Japan, agribusiness stocks have disappointed. Kubota, which has a significant tractor business in the US has been disappointing even in yen terms.

For long time Japanese investors, and myself, I found the investments into the trading houses a bit of a surprise. The businesses tend to be complicated, with many subsidiaries. They also have tended to have large amount of debts both at the parent level and at the subsidiary level, and have also been very cyclical assets. So why the interest? Well share counts have of course been falling due to buy backs. Mitsui & Co has seen shares outstanding fall from 1.8bn to 1.5bn. But other commodity producers like Shell have been even more aggressive in buying back shares.

However what does make Japanese trading houses very special indeed is that due to BOJ QQE policies. The BOJ through ETF purchases is estimated to be a large owner of Japanese stocks than the GPIF. Looking at Mitsui shareholder register, this would mean that taking the GPIF, BOJ and Berkshire holdings together, you probably have 25% of the float locked up.

BOJ QQE program also means that yields on Japanese corporate debt is very low by global standards. Mitsui bonds due in 2039, still only yields 1.8%. By comparison Euro denominated Shell PLC bonds of a similar tenor would have double the yield.

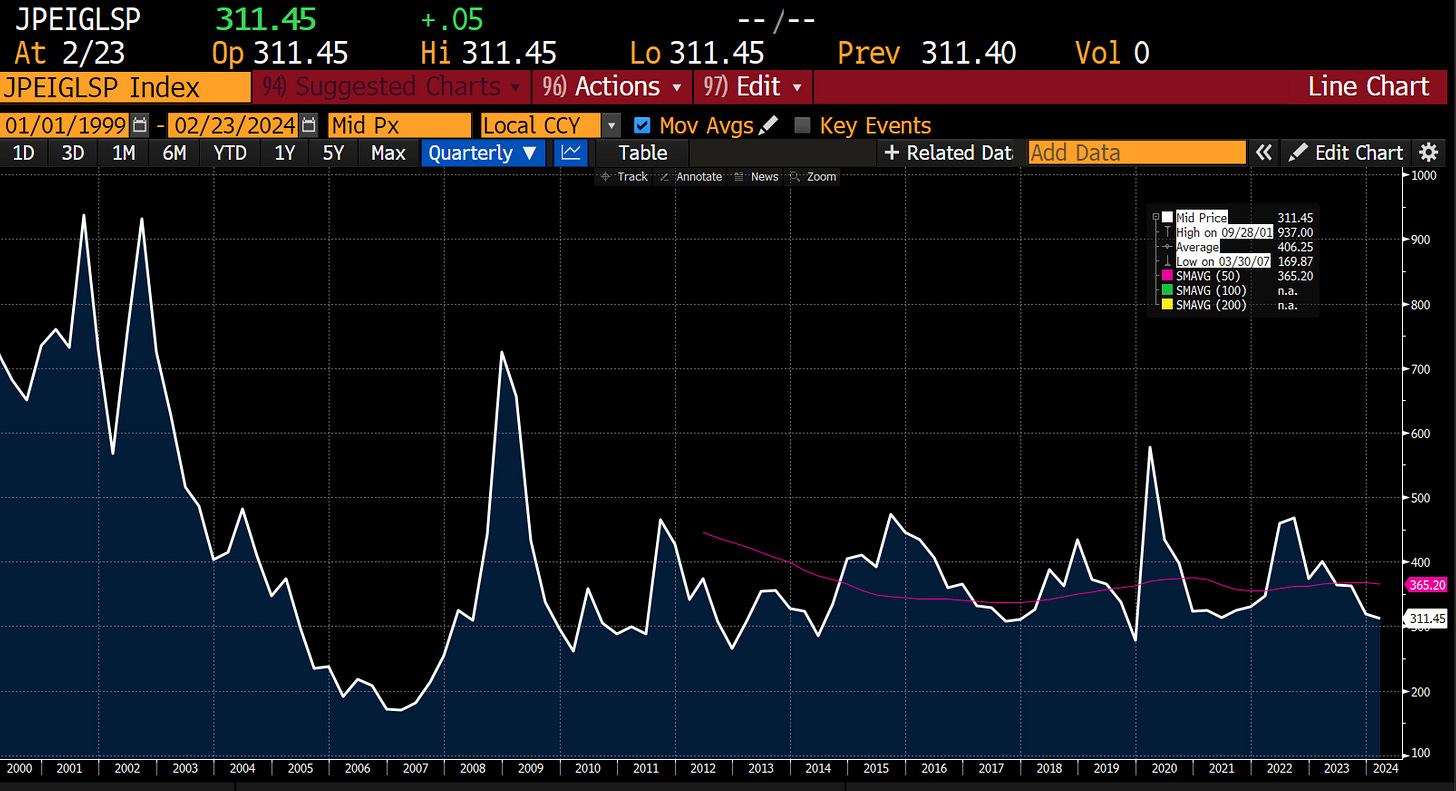

One thing this made me consider was whether Buffett’s PetroChina investment was also a similar bond yield to earning yield calculation? Finding an accurate measure of Chinese credit spreads in the early 2000s is a bit difficult, but we do have the JP Morgan EMBI bond spread. In the early 2000s, after the Asian Financial Crisis, Dot Com Bust, and the Argentinian Devaluation of 2001 saw emerging market borrowing costs through the roof. But from 2002 onwards, this spread collapsed.

The thing is that PetroChina represented both a great macro story, as China developed, and transitioned from energy exporter to importer, and a political story, as it joined WTO, saw a surge in investment and had a generally business supportive government. A good earning story, combined with falling emerging market bond yields created a great investment climate, but I can see now it was also following the political winds of the time. This makes sense to me, and helps explain Buffett’s other long term Chinese investment BYD. Not only did it have an attractive valuation when he first invested into it, it was also a key beneficiary of supportive government policy.

It has certainly been true that the Japanese have been extremely “pro-capital” in policy making. And Buffett to his credit has made this work well for Berkshire. What makes this intriguing for me is that rather than seeing as a excellent commodity investor, I have to look at Berkshire is playing the same private equitization game as the rest of the market. Historically I would have bracketed Buffett with Soros, but I think we need to bracket Buffett with Kravis, Schwarzman and other private equity titans. Certainly their respective investment vehicle share prices are highly correlated. I suspect all of them hope the BOJ never tightens monetary policy.