For the best part of 20 years, commodity prices seem to ebb and flow with the vagaries of Asian economic growth. The 1990s saw the collapse of the Soviet Union, the busting of the Japanese economic bubble, and the heavy restructuring of the Chinese and Indian economies to free market policies, and then finally the Asian financial crisis. As mentioned in previous posts, I see gold as an Asian asset that happens to be traded globally. The 1990s saw falling Asian wages, and so we saw a falling gold price.

Conversely, rising Asian wages, particularly since 2000 has coincided with rising gold price. While Chinese economic growth has slowed, growth in India and other Asian nations like Vietnam have been able to keep the gold story alive. It should be noted that in 2011 onwards, when it looked like China might devalue, gold suffered, but as China has maintained a policy of keeping real wages high, gold has continued to do well.

Probably the most eye catching move has been weakness in the oil price. Given its importance in inflation and inflation expectations for the American economy was probably the key factor in the Federal Reserve cutting rates.

The reason given for oil price weakness is weaker than expected imports from China. That is demand is surprising to the downside. While that is true, IEA demand forecasts show that compared to the collapsing demand in 2008 or 2020, we are not in the massive economic weakness area.

That other economic sensitive commodity, copper is not collapsing either.

So what gives? Well for me, a pro-labour world, and world of rising Asian wages is a world where commodity demand should remain reasonably solid, but perhaps not the crazy growth in demand we saw in the 2000s. What this means is that supply, rather than demand is a much bigger issue. I think with oil, supply has surprised, rather than demand being weaker than expected. I think this is also true with agricultural products. Corn prices have round tripped.

I suspect many investors, myself included, expected Russian and Ukrainian supply of commodities to be heavily disrupted, if not by the war itself, but by the sanctions imposed on Russia. As the most recent report for the US Department for Agriculture makes clear, there has been little disruption in Coarse Grain (mainly corn) exports from either Russia or Ukraine.

Commodity markets priced in tight supply in areas where Russia and Ukraine are leading exporters - corn, natural gas, oil - and have been disappointed when supply was fine. In other areas like gold, which given the ease of transportation, no real supply disruption was expected have continued to reflect good demand.

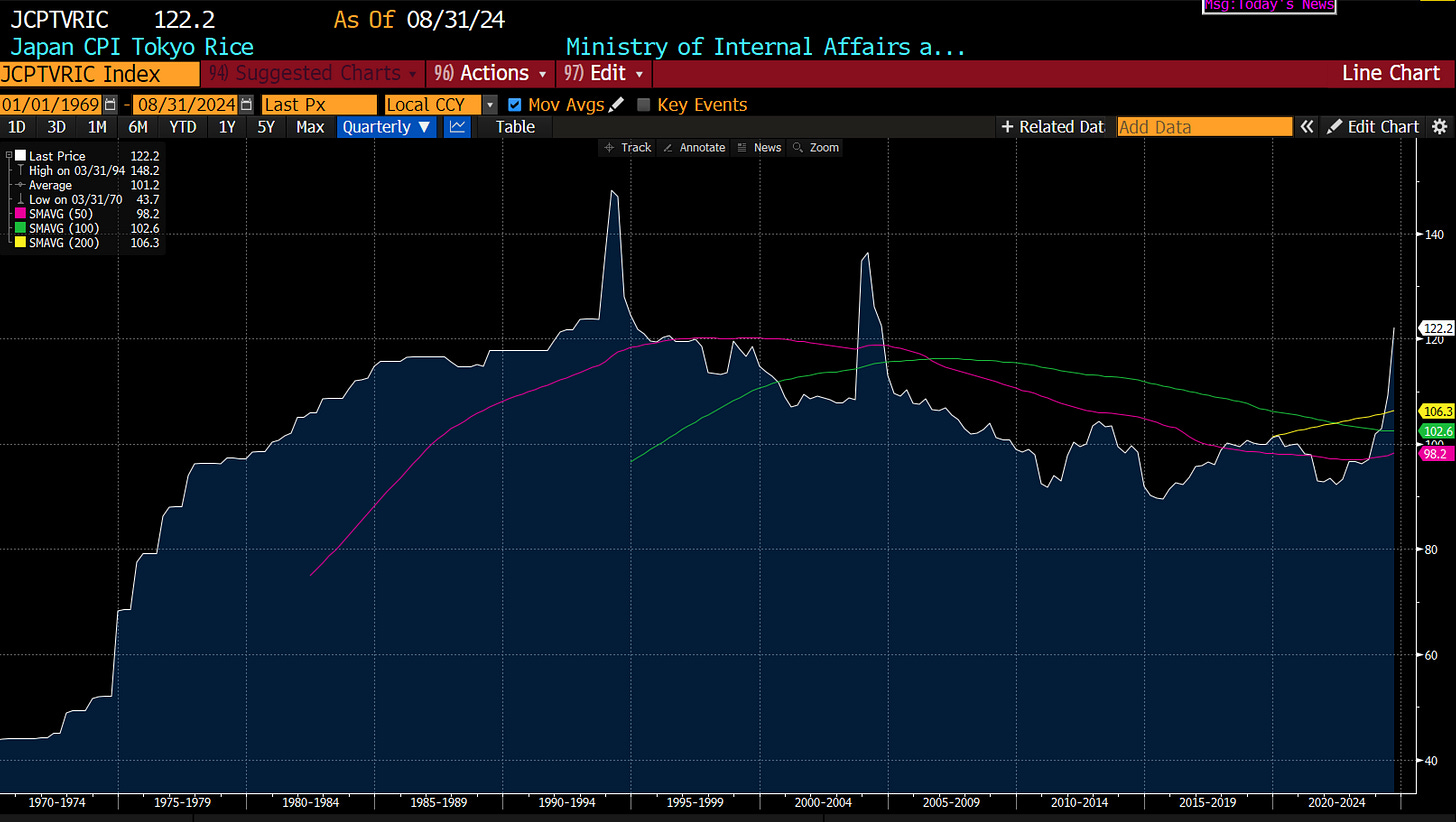

Away from Russian/Ukrainian issues, food inflation remains a big issue. In Japan rice prices are surging.

Orange juice prices are at their highest levels since the 1990s.

Coffee prices continue to surge.

Commodity prices seem to reflect changes in supply, with demand remaining robust - which is what the pro-labour theory would suggest. Certainly, when I look at the CRB Food Index, I find myself thinking that interest rates cuts here are foolhardy.

Why has GLD/TLT traded so well? Well gold supply is very difficult to grow rapidly, and or to surprise the market - not the case with agricultural or industrial commodities. It continues to reflect a pro-labour environment in my view.

Commodities that look to have supply restraints should continue to do well. So commodity markets have changed from one where demand was always better than expected, to one where supply is the driver of prices. This is breaking down correlations in my view - and making them seem “screwy”.