Capitalism, as Churchill once said, is the worst possible system except for all the others. The profit motive constant pushes capitalists to get costs as low as possible to drive profit growth, at least in theory. Unprofitable markets cause competition to leave the industry, and profitable markets attract competition, at least in theory. Capitalism should drive deflation.

The Great Depression is seen as a crisis of capitalism. But for me, it is a natural aspect of capitalism and free markets - overproduction and falling prices. Using US CPI data - which offers the advantage of consistency, and avoiding the destruction of the two World Wars which makes economic data unreliable in the rest of the world. You can see that from 1913 to 1945, price levels where virtually unchanged. This was a period that was great for bond holders, but terrible for real assets, corporates and for workers. With so few winners it is little surprise to me that the politics of the world turned viscously against free market capitalism post World War II.

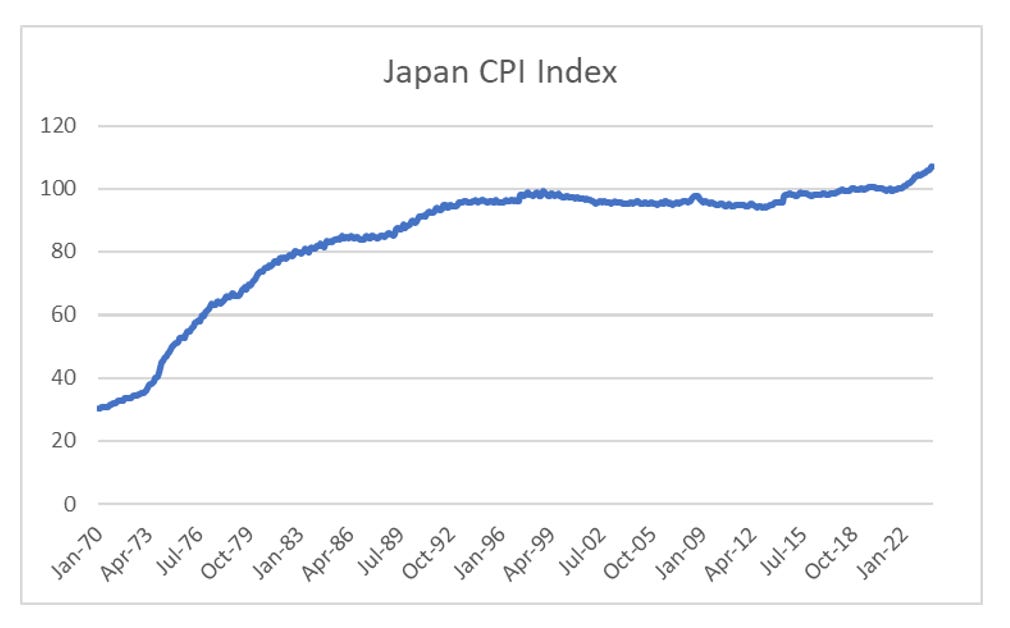

The only equivalent to the Great Depression in modern times has been the experience of Japan. Just like the Great Depression, from 1990 onwards, was great for bond owners, but terrible for asset owners, and for workers. The real mystery of Japan is how in a democratic nation, such policies did not elicit a political response. My guess it did, but hemmed in by US policies was unable to choose inflationary policy responses like massive currency devaluation or tariffs. Obviously the US no longer follows Washington consensus policies, and neither does Japan. Inflation has returned.

In response to the Great Depression politics moved to the left, or what I would call pro-labour policies. For business it was great as demand rose in line with rising wages, and prices rose. Governments spent freely and wages rose. The patsy in this market were commodity producers who saw supply controlled and prices fixed. Bond investors were also screwed over as the purchasing power of bonds collapsed. The 1970s saw the commodity producer and bond buyers rebel against their exploitation by governments, leading to the creation of OPEC and the emergence of bond vigilantes.

The greatest sign that this “post-Depression” policy mix was coming under pressure was the falling level of gold holdings in the US. That is the US government was finding it increasingly difficult to finance these pro-labour policies. In some ways, the US policy was to exploit the huge gold reserves it has built up during the two world wars.

But FDR had also introduced government controlled cartels to curb over production. The Texas Railroad Commission essentially controlled to production of crude oil. This meant that by the late 1960s, US production was beginning to fall.

Crude oil prices were fixed during the 1960s at 1.80 a barrel, while refined prices were set by the market. This was great for integrated US producers, but bad for crude oil producers, which were increasingly foreign.

To satisfy the demands of oil producers and bond markets, a new set of patsies needed to be found. In a return to the pro-capital policies, labour was to become the patsy. Full employment was no longer a political aim, and real wages could fall. Taxation favoured business over individuals and tariffs were cut.

The problem with modern free market capitalism, is that “patsies” are hard to come by. For a brief period after the dot com bust, when deflation in the US beckoned, capitalism exploited inefficiencies in credit markets. When the rating agencies mispriced mortgage backed securities and the related products, the industry grew rapidly. Markets assumed that government guarantees existed for banks, emerging markets, and mortgages that governments only honoured after the crisis. Broadly speaking the investment banks and dealers in MBS knew that the credit markets were wrong, but the limit to growth here was private sector financing of credit guarantees. AIG balance sheet growth was the limiting factor. AIG was a classic “patsy” sitting at a table with GS, MS and other investment banks selling insurance on MBS, making money while thinking they were smartest ones at the table.

Post GFC, the now virtually explicit corporate guarantees have been exploited remorseless by markets, in an era of epic consolidation and the replacement of equity with debt and intangibles. The markets have exploited the treatment of government debt as risk free, even when 5 to 6% GDP fiscal deficits have become the norm. Capitalists have exploited the disconnect between very low interest rates, even though unemployment is very low, and pro-labour polices are sweeping the world. US Federal Government spending tells you exactly who markets are treating as patsies.

Foreigners are not adding to their holdings of treasuries anymore. Of course into this gap have stepped central banks. But this can only be a sustainable model if commodity prices stay low.

The current market bares some resemblance to the 1960s. Growth is good, unemployment is low, but it requires owners of real assets and of bonds to be “patsies”. The GLD/TLT trade is based on at least one of these patsies saying they are not going to take it anymore. This is already happening.

Free market capitalism and democracy are inextricably intertwined. No one wants to be the patsy, but if you don’t have the votes, then you are the patsy. Brexit, Trump, Wilders, Meloni, Obrador, Alternative for Germany are all telling you the same thing. Western workers are no longer willing to be patsies. Bond investors look to be the new patsies to me.