As I write this, markets have gone for a good old growth scare. It has also happened at a time when the BOJ is beginning to tighten policy. We are getting big moves. Yen has rallied substantially.

Markets are pricing in much more rate cutting from the Federal Reserve. The two year yield has fallen substantially.

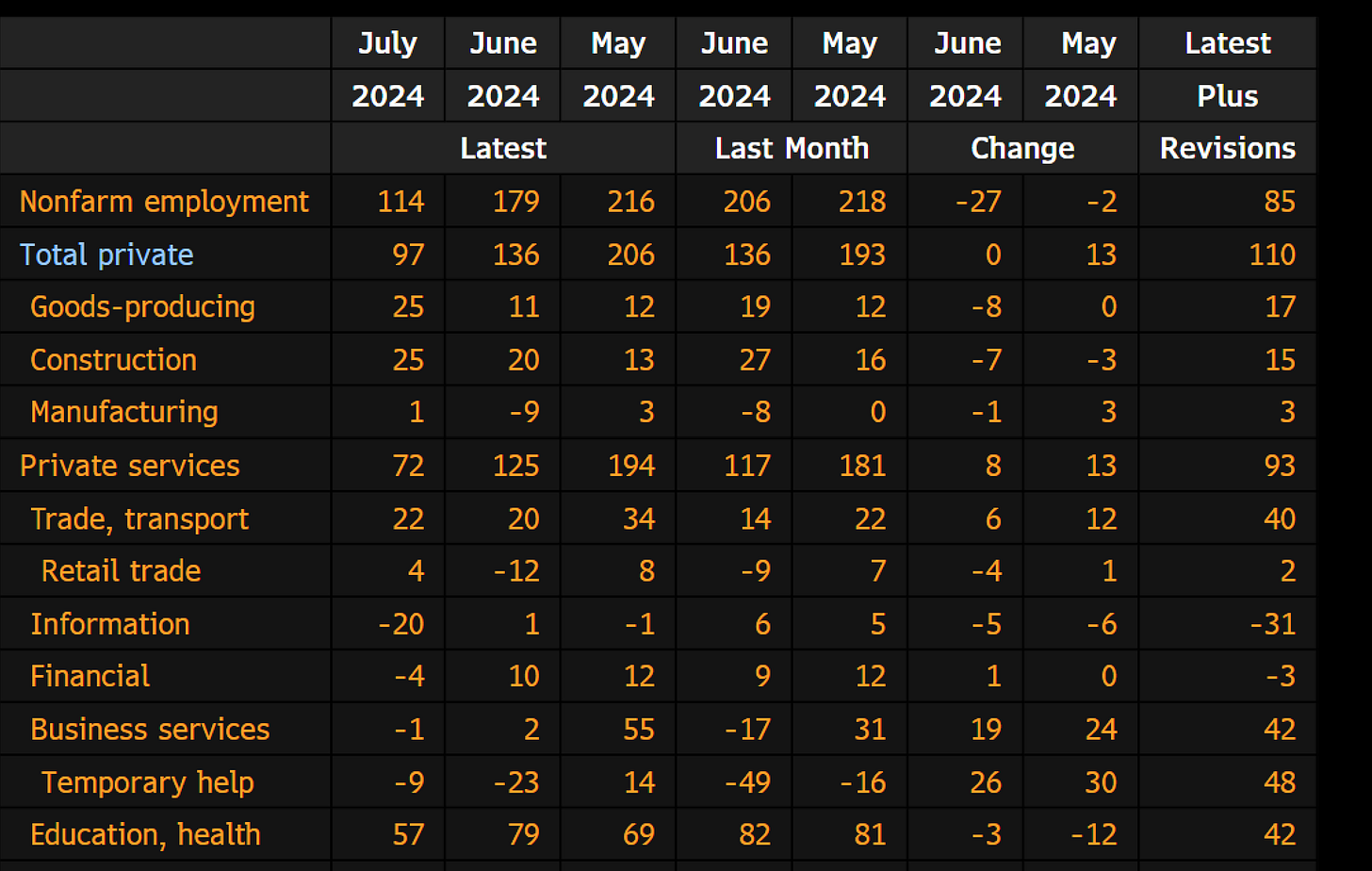

While the market had been pricing in a BOJ tightening, the real surprise has been weaker employment numbers out of the US. Non Farm Payrolls was surprisingly weak. Weak is 114k - which is actually sort of in line what he have seen since the GFC, but was weaker than expected..

More spooky was the underemployment number, which came in at 7.8%, and has seemingly inflected higher.

What is surprising about this number is that usually rising underemployment is easy to forecast. In 2000 internet stocks were going to the wall. In 2006 it was home builders and then finance people, and in 2020 it was Covid. Where is the unemployment coming from today? Higher interest rates has had no noticeable effect on property markets. The difference between Toll Brothers today and 2005/6 is night and day.

Even auto sales are holding up.

Going through the non-farm numbers, the weakness in employment is in information and business services. Traditional cyclical businesses such as manufacturing and construction seem fine.

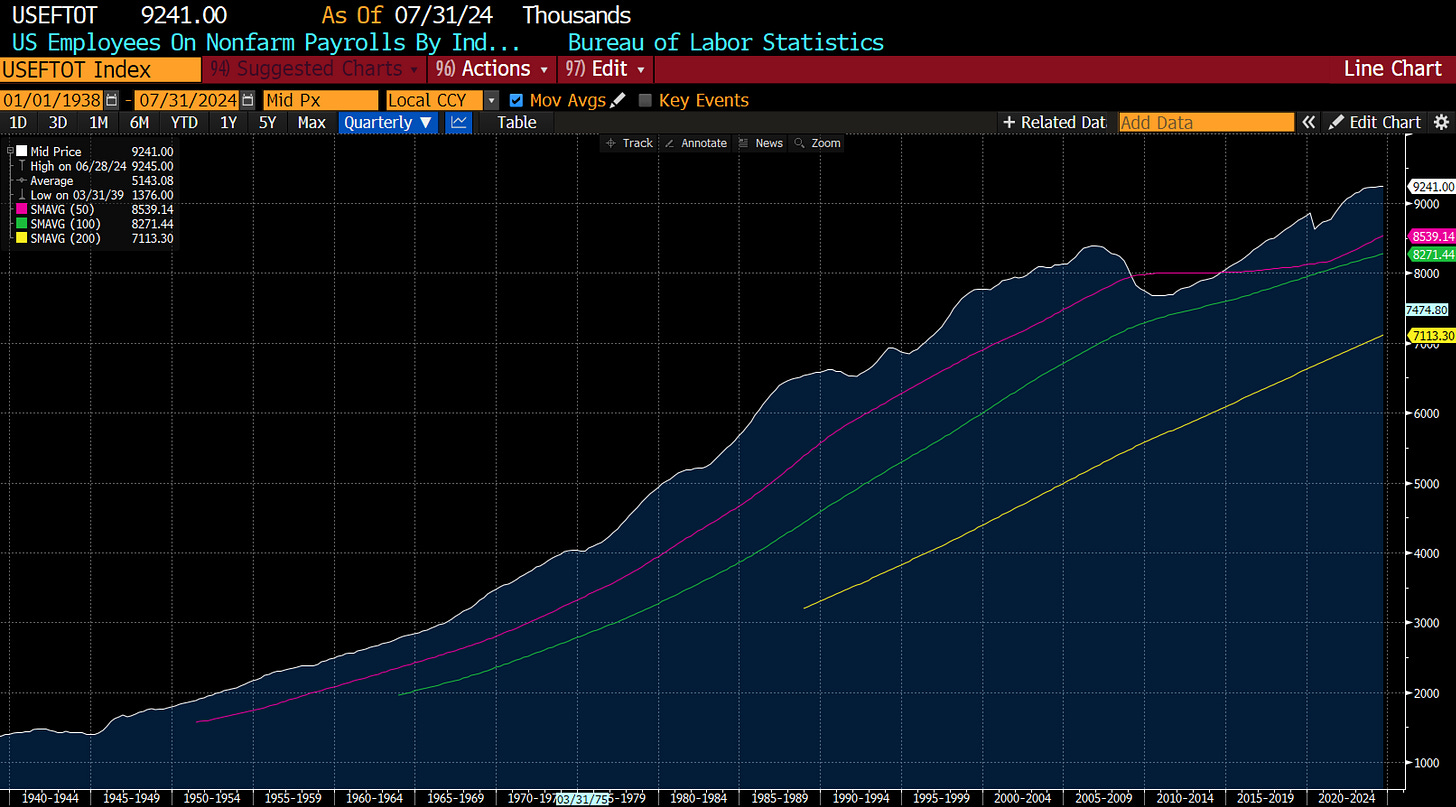

Looking at total employment over time for information sector, I don’t really see a bubble unwinding, at least nothing like the dot com bust.

Finance employment could be elevated but also look okay to me.

The biggest shock I was worried about was a China devaluation. Weak dollar has made that seem less of a worry.

The employment number is a surprise, but both Political parties have placed emphasis on blue collar over white collar, and these numbers are in line with these policies. But with oil now down on the year, the US dollar weakening, and long dated yields lower, all should be stimulatory on what still looks a decent labour market. My guess is that the curve steepens from here.