Since pushing the big red button, I have started talking to allocators, and financial professionals again. I have found it invigorating. I feel like I should apologise to the financial world. It is very easy to be prejudiced against finance people - “banker wanker” is almost the universal term. But after spending the last four years talking to parents worried about the 11 plus (high school entrance exams in the UK), karting parents, and football parents, engaging with financial professionals is a breath of fresh air. I suspect the problem with parents, is that everything seems like a zero sum game - your children are all competing for the same spot. There is also a level of delusion with parents and their kids that just does not exist in finance. Probably the best thing about finance, is that we can all make money together! Its not zero sum, so conversations are much more productive and interesting. As I tell people, you can’t spell fund manager with out “fun”.

Once you start talking to investors and allocators, you get a clearer view of their thinking and needs. Allocators have to manage lots of different risks - but there are two big interrelated ones: performance risk and career risk. Basically, allocators need to outperform to survive. Passive investing involves buying a low cost fund that matches the benchmark, of which Vanguard is the best known. Morningstar estimates that Passive AUM overtook Active AUM last year some time.

The bull story for passive is two prongs - one most active managers cannot beat the market, and two that the cumulative effect of fees make active funds born losers. When I first heard the arguments for passive funds, I thought the obvious flaw was that it assumes markets always go up. Passive investing in China shares or Russian shares has not been a winner!

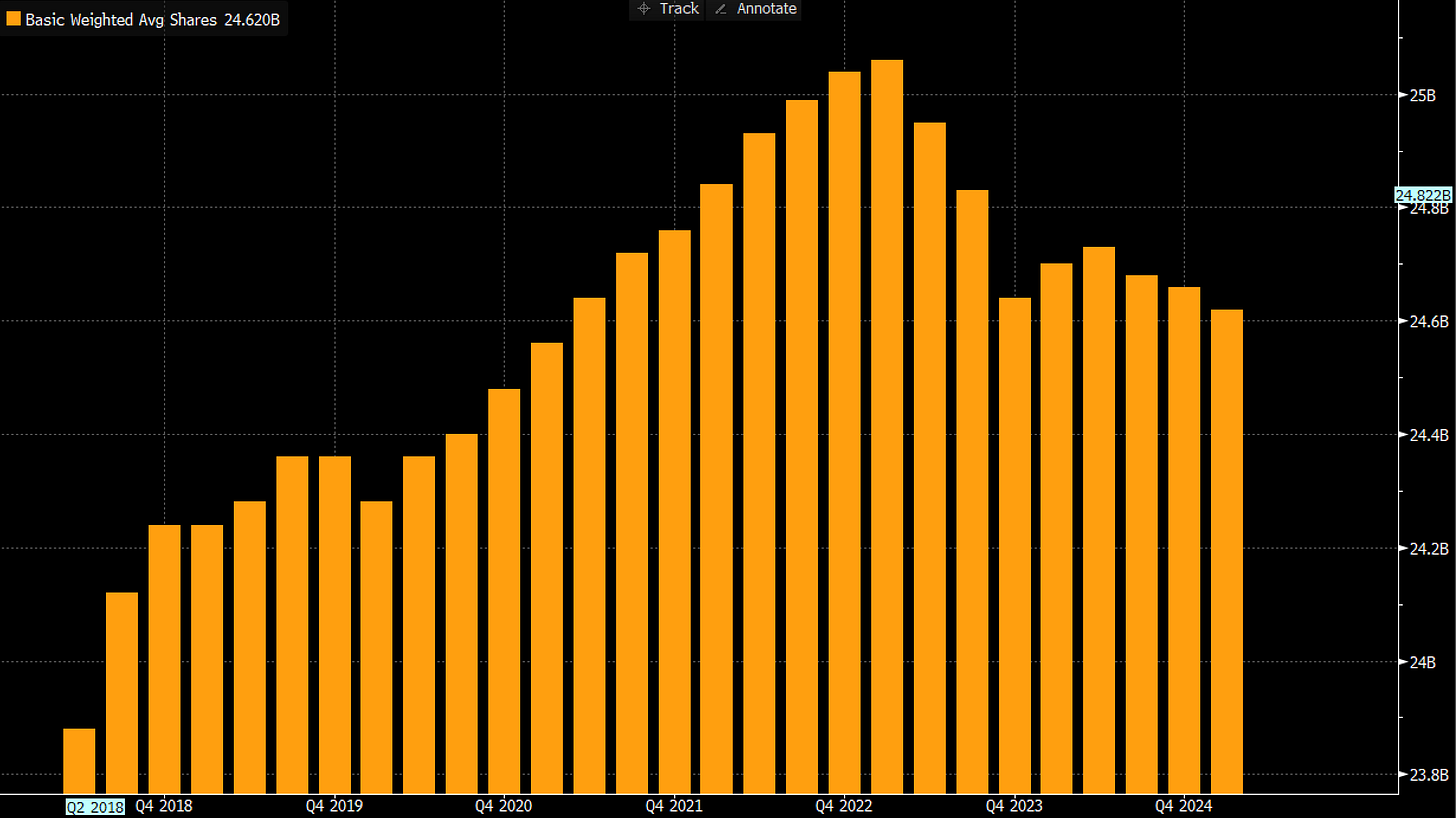

For me, in markets dominated by share buybacks, passive investing makes a lot of sense. Share buybacks got a bad name in the 1929 Crash, as they were widely blamed for inflating asset prices, and we also saw share buyback in 2006/7 before the GFC, however they have broadly continued from 2011 onwards, with a brief hiatus during Covid.

For tax reasons, investors much prefer companies buyback shares that pay cash dividends. It does make me feel strange to see Nvidia buying back shares after its share price has risen so much, but that is inline with Apple and all the other big tech companies.

One feature of share buybacks is that it means investors are increasing their stake in the company, with no further investment on their part. Assuming nothing changes, which is always a good working assumption, then over time the value of their stake will increase. This has been a core part of Warren Buffett investing style. Share buybacks mean that the areas that are booming most, are most likely to have highest valuations (faster buybacks, implies a quicker increase in equity ownership). Apple, which at Warren Buffett’s urging, began aggressively buying back shares, and has seen it EV/Sales surge from 2 times to 8 times.

As an allocator, the share buyback pose a dilemma. Share prices are no longer priced by disinterested fund managers, but by very self interested CEOs. A booming business is never “priced in” anymore, as share buybacks imply its share price will keep rising in value. Of course the risk is that its business model is broken, it will collapse in value, but that was true when it was lowly priced as well. In a world where pricing has moved from third party to self interested, passive investing is the smart move. I think most forward thinking allocators know that something is amiss, but with timing uncertain, staying long via passive makes sense. It minimises career risk, if not investing risk.

What is the problem with share buybacks? Well ultimately it is concentrating cashflow into fewer and fewer winners. Buybacks benefit shareholders only, where as wage increases or paying tax benefits society and creates demand. That is buybacks have been seen at tops as they are ultimately self defeating. The US has avoided this fate this time by the government raising spending. So unlike in other booming periods of stock markets like 1929, 2000 or 2007, government finances are a mess.

Politically share buybacks are a disaster. How can you ask voters to accept austerity when the rich get richer? You cannot. So allocators face a problem. Politically markets are unsustainable - but maybe lasts 10 more years? It hard to find parallels to the current situation, perhaps the British empire in the 1910s, as it found that its former ally Japan, was beginning to become a trade competitor, which forced it to move from a free trader to a supporter of tariffs. Maybe this cycle ends tomorrow no one really knows - but passive solves this problem - and everyone will fail together so mitigates career risk, if not investment risk. Obviously, the risk here is the sovereign debt market. 2022 saw markets move to favour gold over treasuries, and 2022 was a weak year for assets, but obviously markets have continued on their merry way since then.

I assumed the change in GLD/TLT marked the beginning of the end, as it suggests markets wants governments to get serious about their fiscal situation. But all time highs in markets still suggest passive over active. In a politically world, passive is probably the correct option for most allocators, even as the political world continues to tears itself apart. Safety in numbers is real.